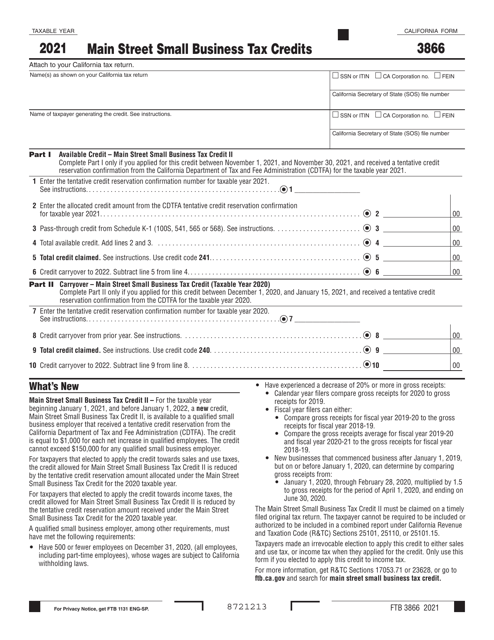

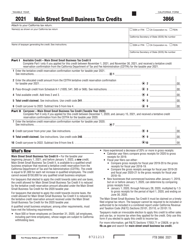

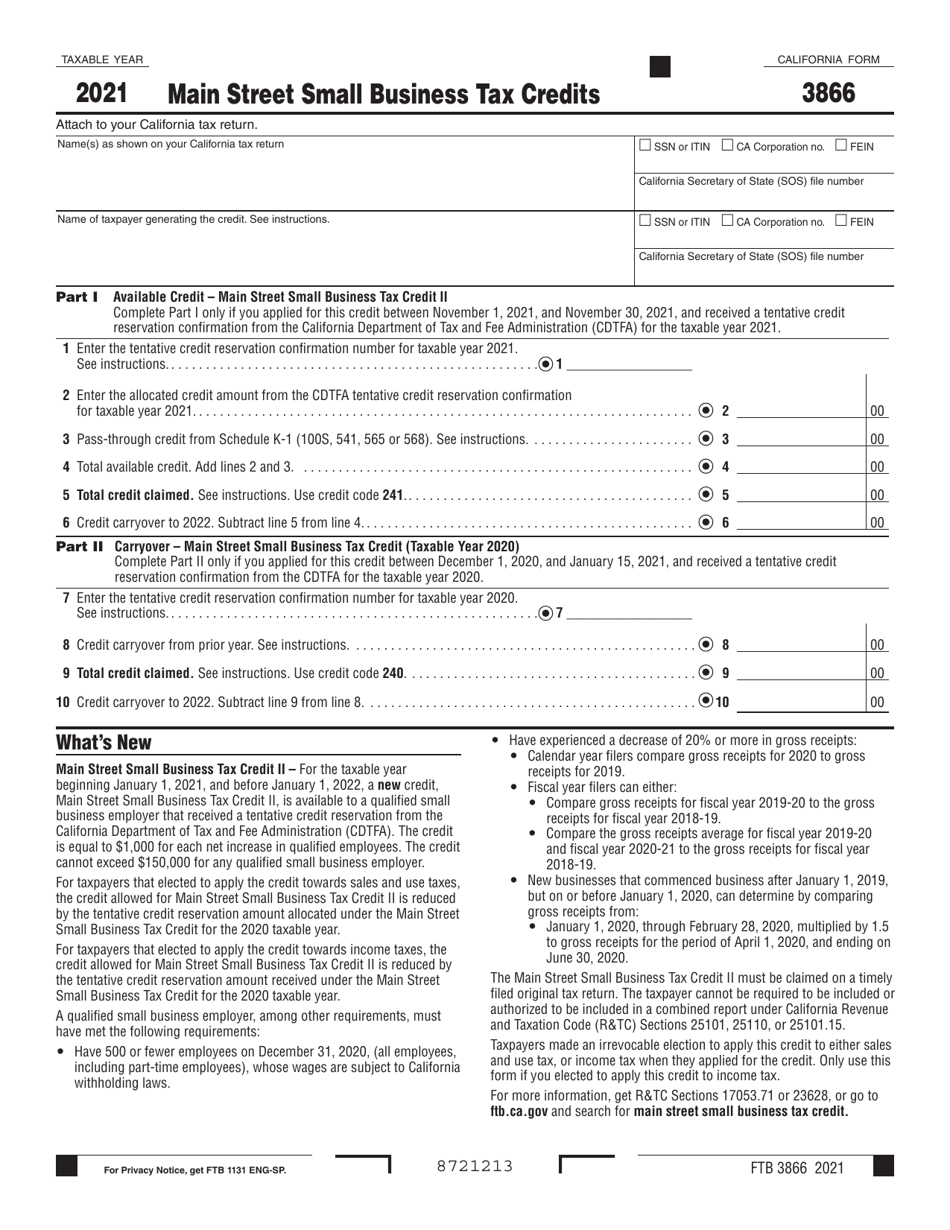

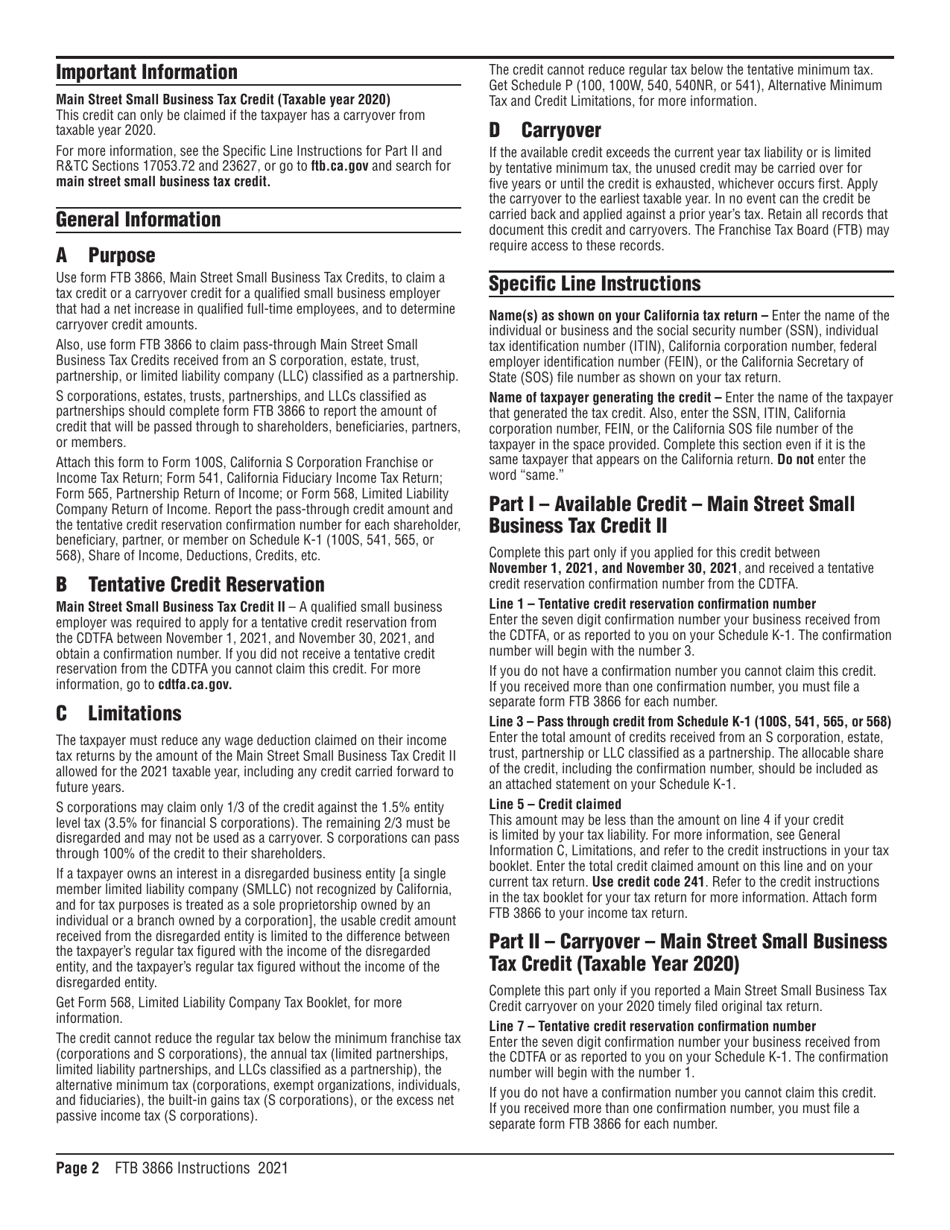

Form FTB3866 Main Street Small Business Tax Credits - California

What Is Form FTB3866?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3866?

A: Form FTB3866 is a tax form used by small businesses in California to claim various tax credits.

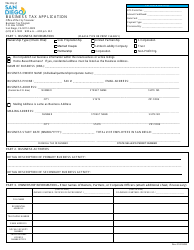

Q: Who is eligible to use Form FTB3866?

A: Small businesses in California that meet certain eligibility criteria are eligible to use Form FTB3866.

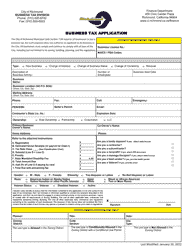

Q: What tax credits can be claimed using Form FTB3866?

A: Form FTB3866 allows small businesses to claim tax credits such as the Small Business Employee California Leave Credit, the Small Business Assistance Credit, and the New Employment Credit.

Q: When is the deadline to file Form FTB3866?

A: The deadline to file Form FTB3866 varies depending on the tax year. It is recommended to check the instructions provided with the form for the specific deadline.

Q: Do I need to attach any supporting documents with Form FTB3866?

A: Depending on the tax credits being claimed, you may need to attach supporting documents such as payroll records or proof of eligible employee leave.

Q: What should I do if I have questions or need assistance with Form FTB3866?

A: For questions or assistance regarding Form FTB3866, you can contact the California FTB directly or consult a tax professional.

Q: Is Form FTB3866 only applicable to businesses in California?

A: Yes, Form FTB3866 is specifically designed for small businesses in California to claim state tax credits.

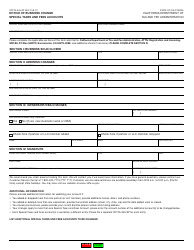

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3866 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.