This version of the form is not currently in use and is provided for reference only. Download this version of

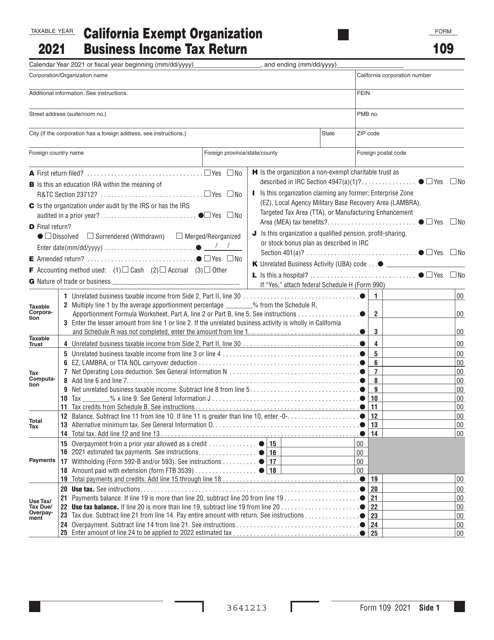

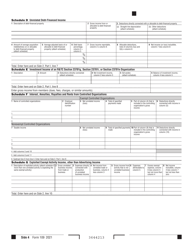

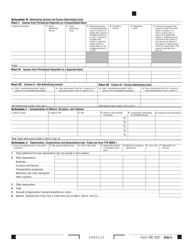

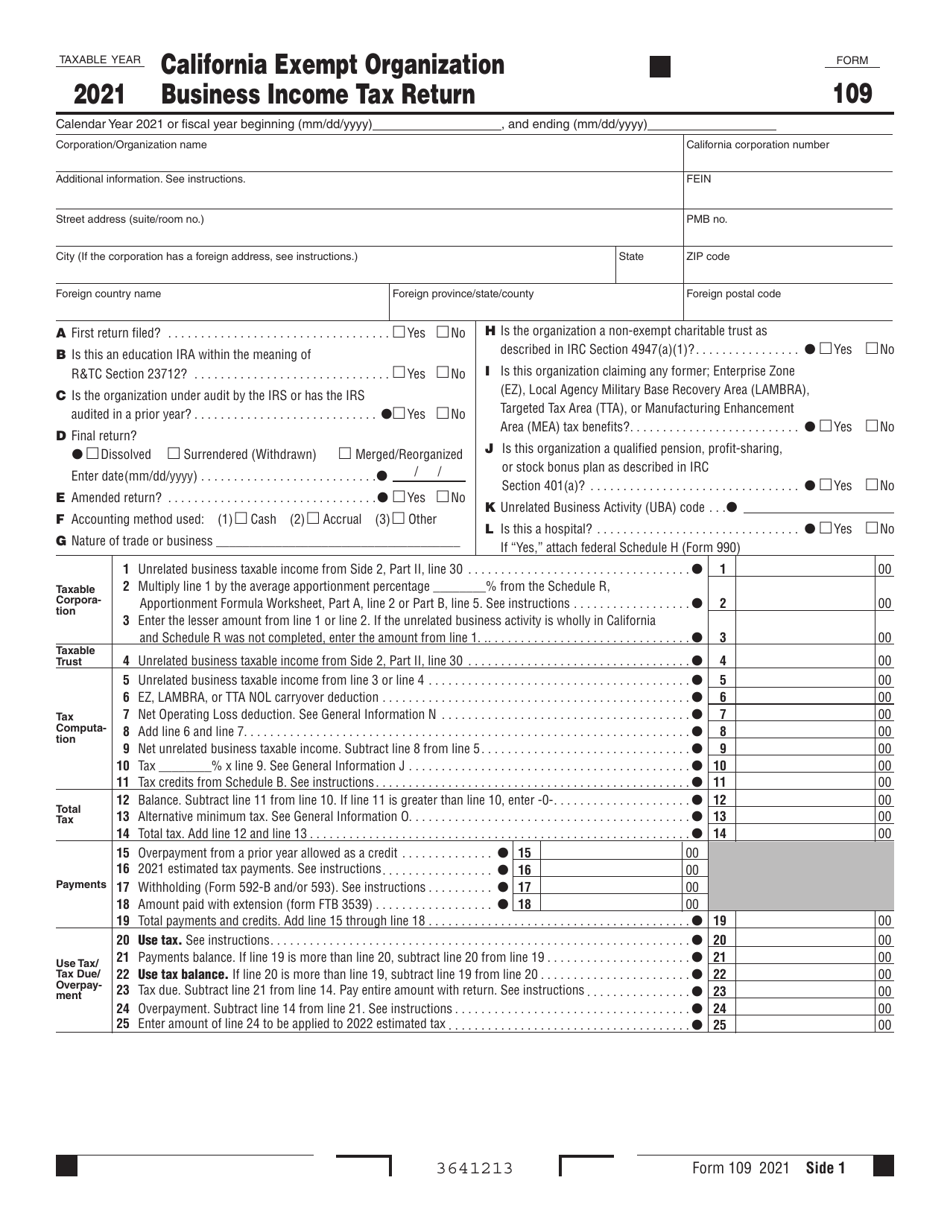

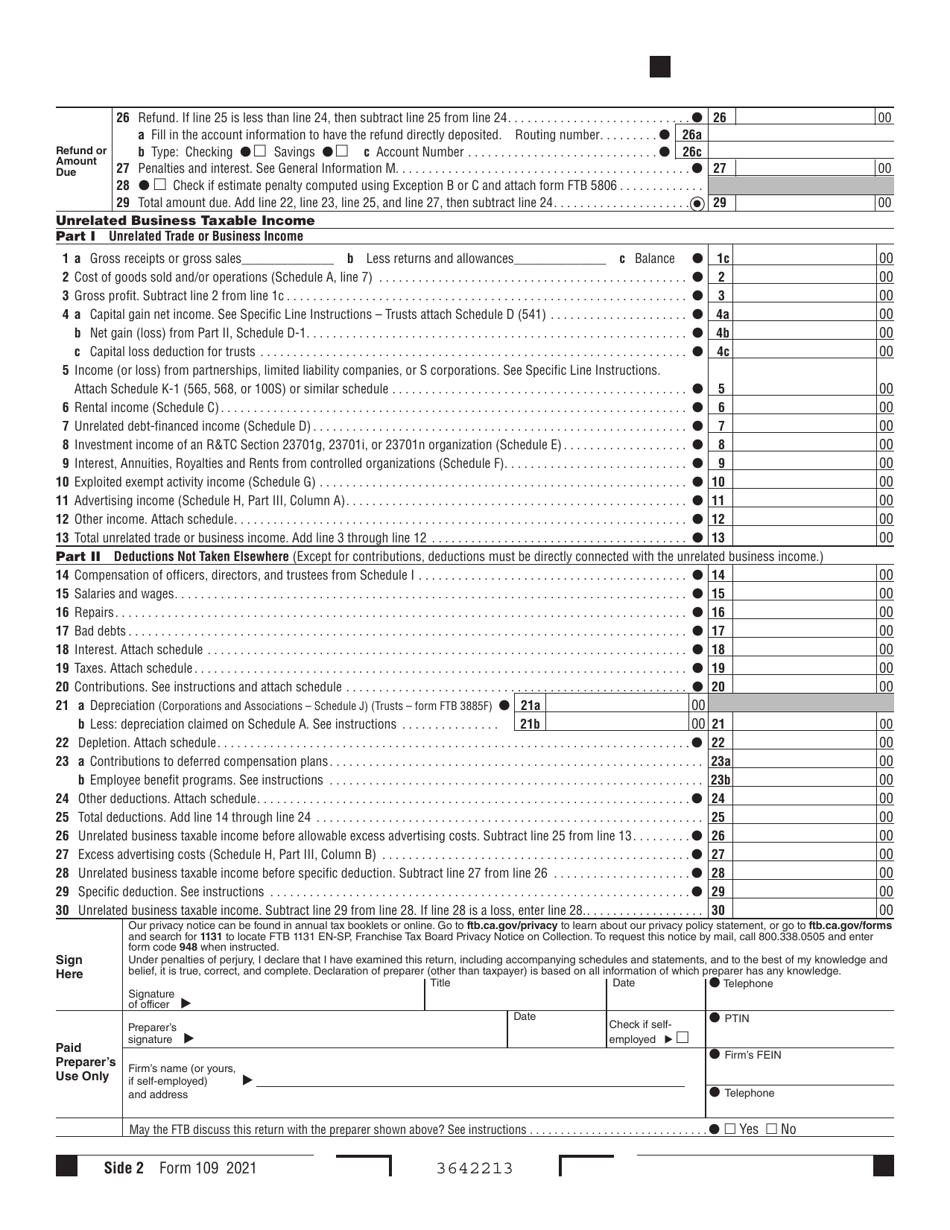

Form 109

for the current year.

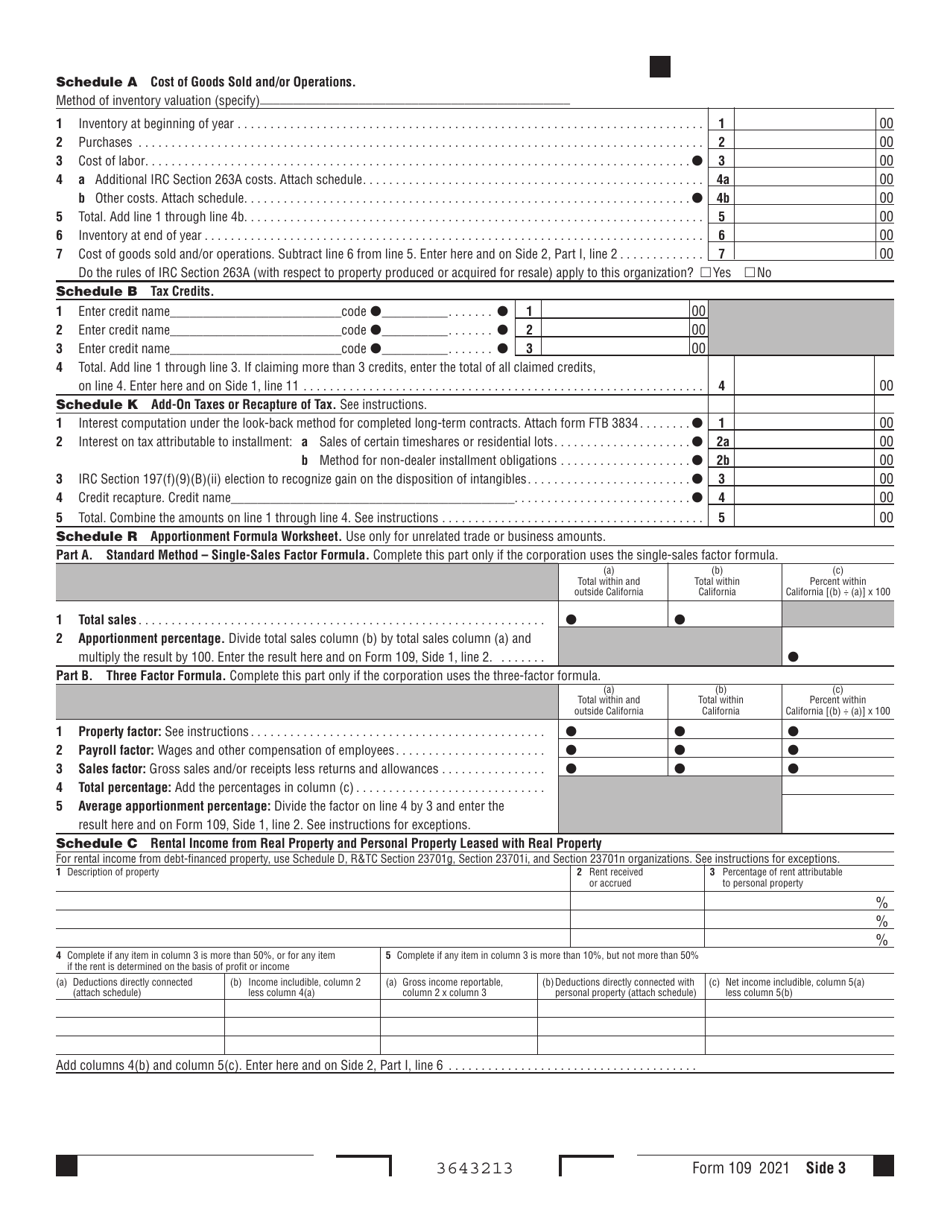

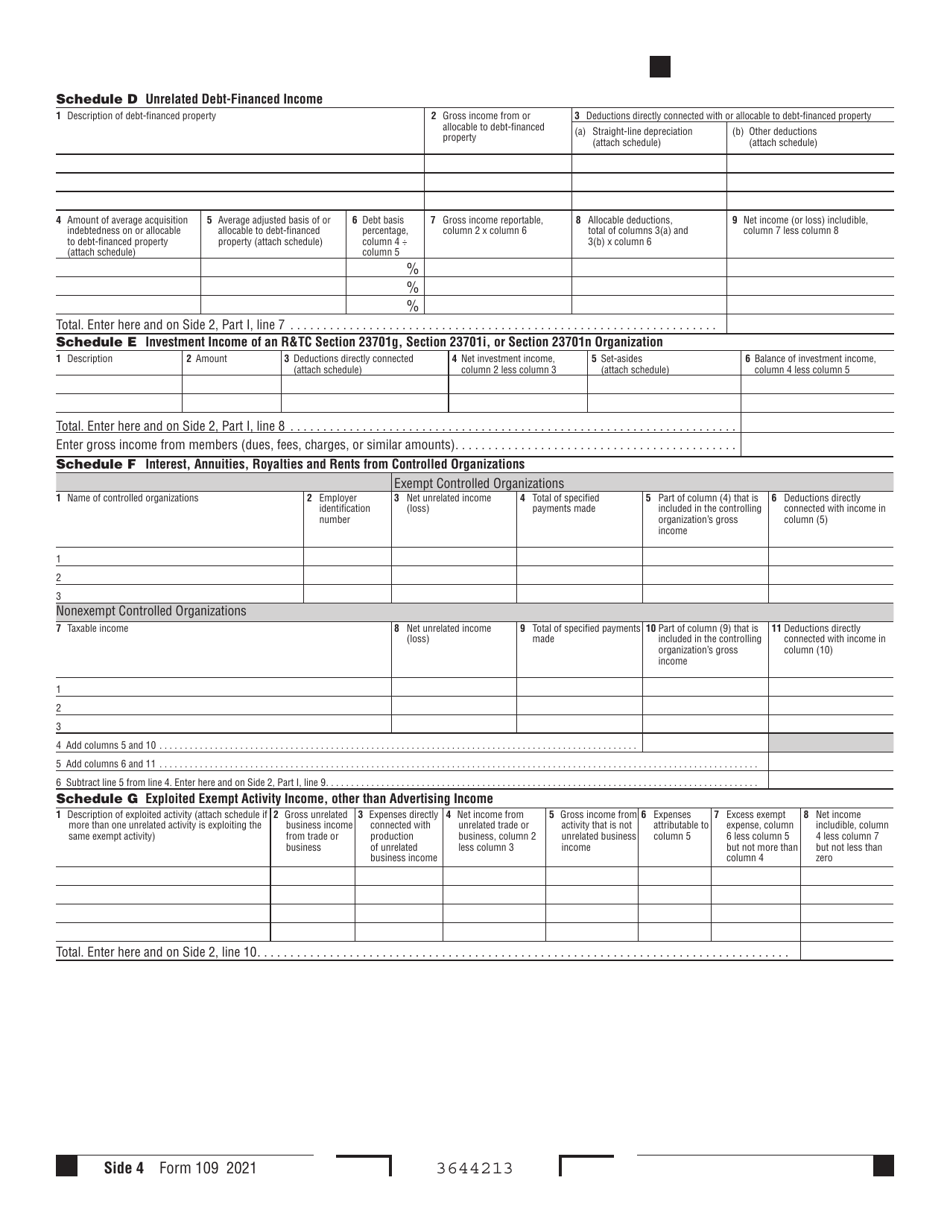

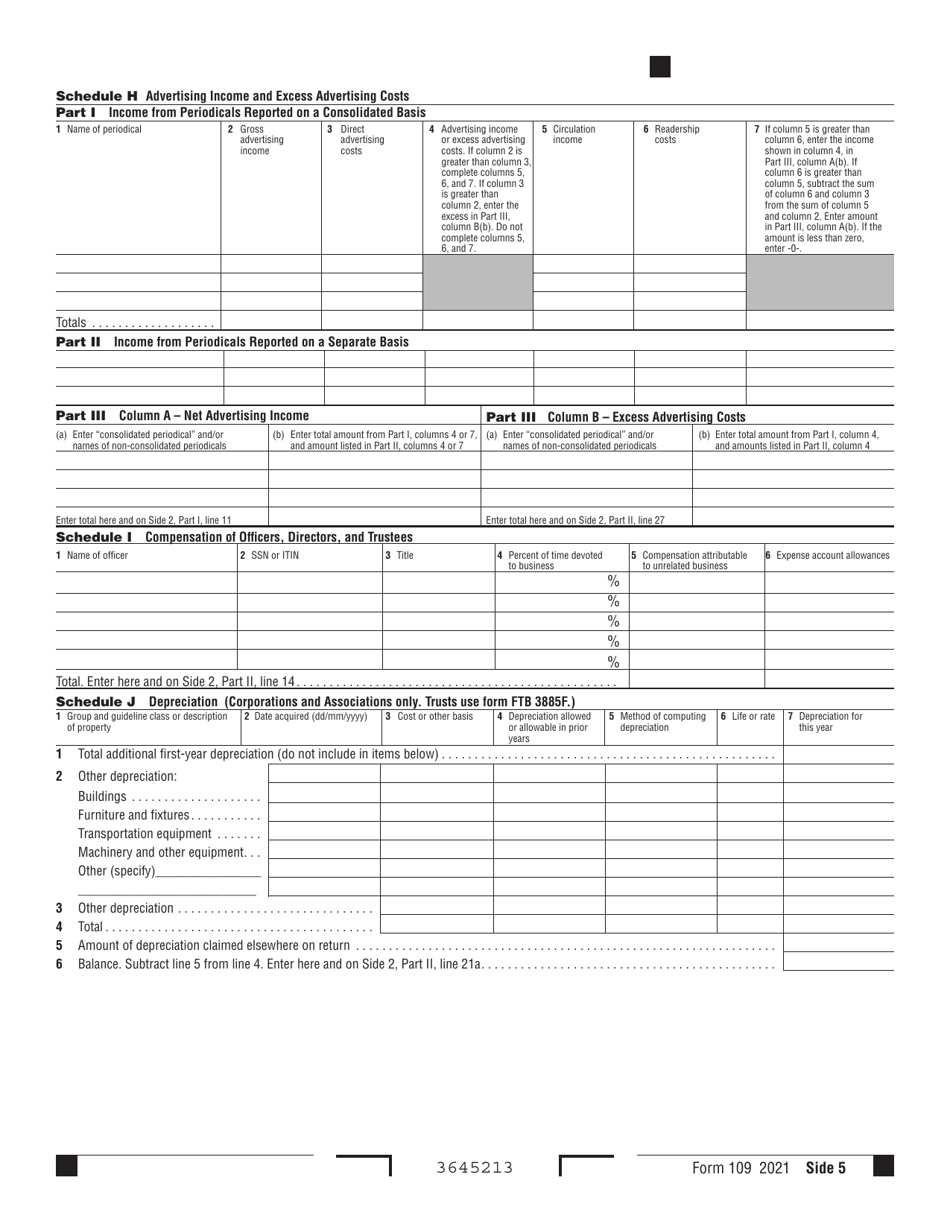

Form 109 California Exempt Organization Business Income Tax Return - California

What Is Form 109?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 109 California Exempt Organization Business Income Tax Return?

A: Form 109 California Exempt Organization Business Income Tax Return is a tax form used by exempt organizations in California to report their business income.

Q: Who needs to file Form 109?

A: Exempt organizations in California that have business income need to file Form 109.

Q: What is considered business income?

A: Business income includes income derived from regular trade or business activities, including rental income, royalty income, and income from the sale of goods or services.

Q: Are all exempt organizations in California required to file Form 109?

A: Not all exempt organizations are required to file Form 109. Only those with business income need to file this form.

Q: When is the deadline to file Form 109?

A: The deadline to file Form 109 is the same as the federal income tax deadline, which is typically April 15th, or the next business day if it falls on a weekend or holiday.

Q: Is there a fee to file Form 109?

A: There is no fee to file Form 109.

Q: Can Form 109 be filed electronically?

A: Yes, Form 109 can be filed electronically using the California Franchise Tax Board's e-file system.

Q: What are the consequences of not filing Form 109?

A: Failure to file Form 109 can result in penalties and interest charges imposed by the California Franchise Tax Board.

Q: Can a tax professional or accountant help with filing Form 109?

A: Yes, a tax professional or accountant can assist with filing Form 109 and ensure it is filled out correctly.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 109 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.