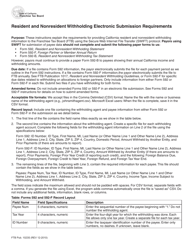

This version of the form is not currently in use and is provided for reference only. Download this version of

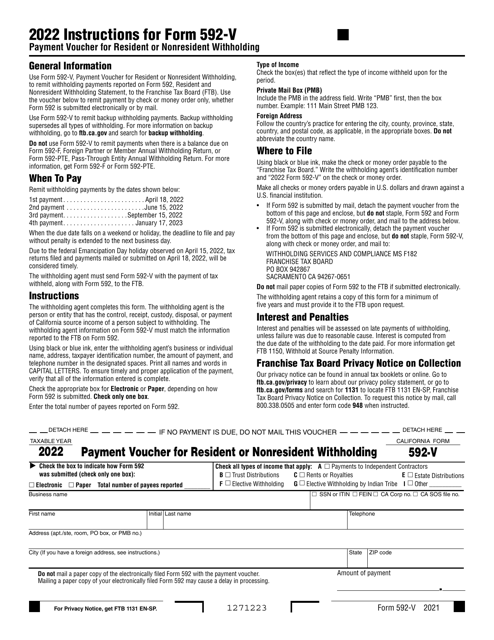

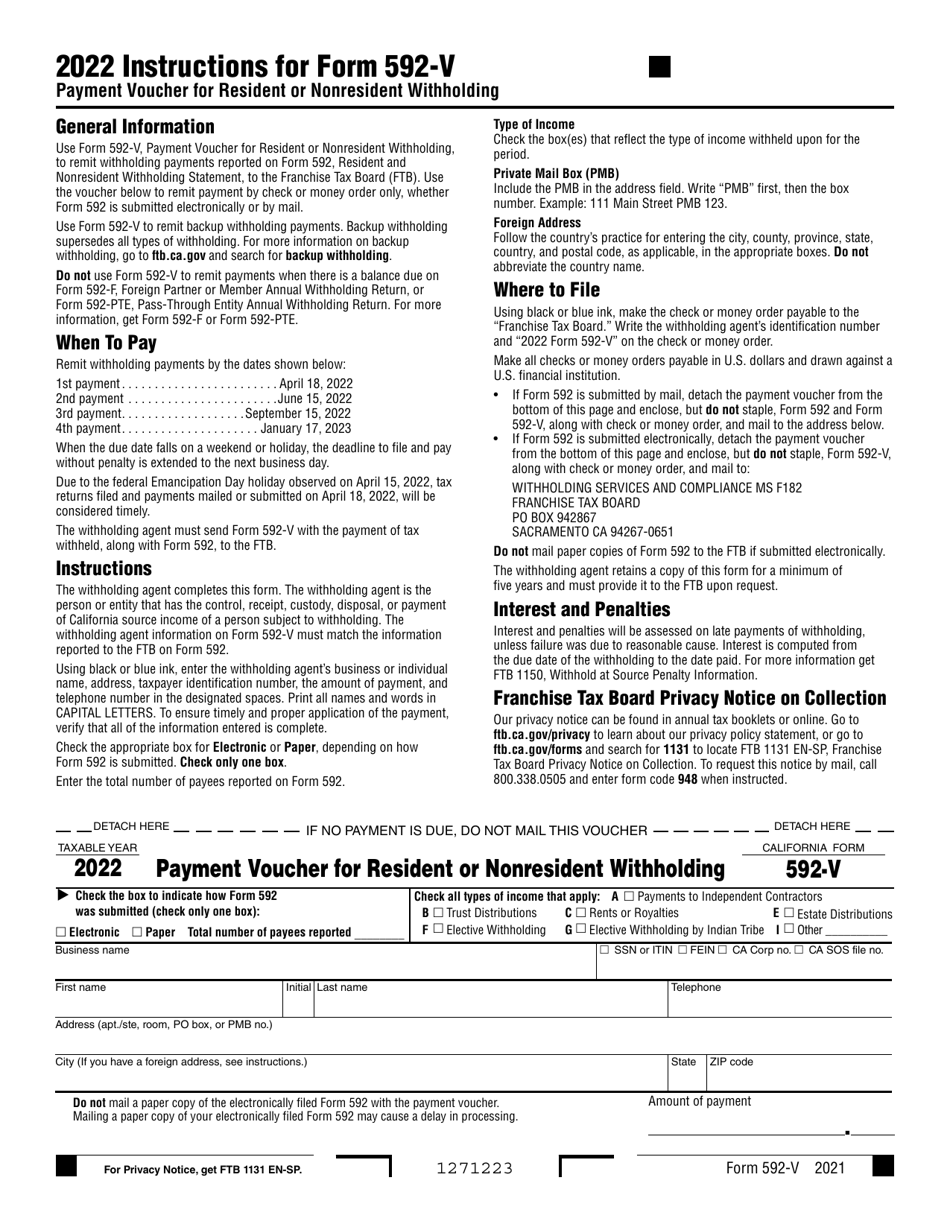

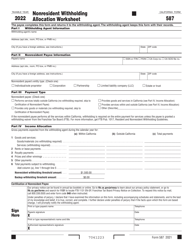

Form 592-V

for the current year.

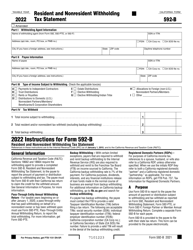

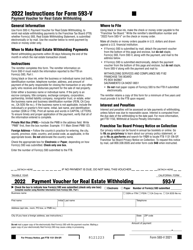

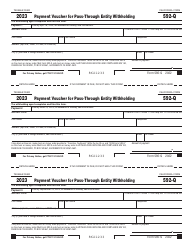

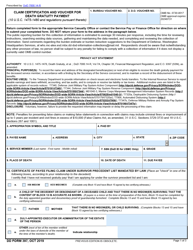

Form 592-V Payment Voucher for Resident or Nonresident Withholding - California

What Is Form 592-V?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

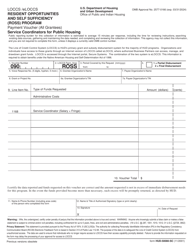

Q: What is Form 592-V?

A: Form 592-V is a payment voucher used for resident or nonresident withholding in California.

Q: Who needs to use Form 592-V?

A: Anyone who is required to withhold taxes from payments made to a resident or nonresident in California needs to use Form 592-V.

Q: What types of payments require withholding?

A: Certain types of payments, such as rental income, interest, dividends, and non-wage compensation, may require withholding.

Q: When is Form 592-V due?

A: Form 592-V must be submitted with the corresponding tax payment by the due date specified by the California Franchise Tax Board.

Q: What happens if I don't submit Form 592-V?

A: Failure to submit Form 592-V and the corresponding payment may result in penalties and interest charges.

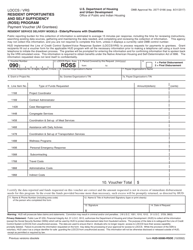

Q: Is Form 592-V only for California residents?

A: No, Form 592-V is used for both residents and nonresidents who have withholding obligations in California.

Q: Is Form 592-V the same as Form 1099?

A: No, Form 592-V is a payment voucher for withholding taxes, while Form 1099 is used to report certain types of income.

Q: What other forms might I need to submit with Form 592-V?

A: Depending on your specific circumstances, you may need to submit other forms, such as Form 592 or Form 592-B, along with Form 592-V.

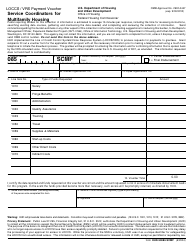

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-V by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.