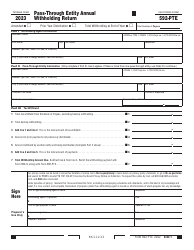

This version of the form is not currently in use and is provided for reference only. Download this version of

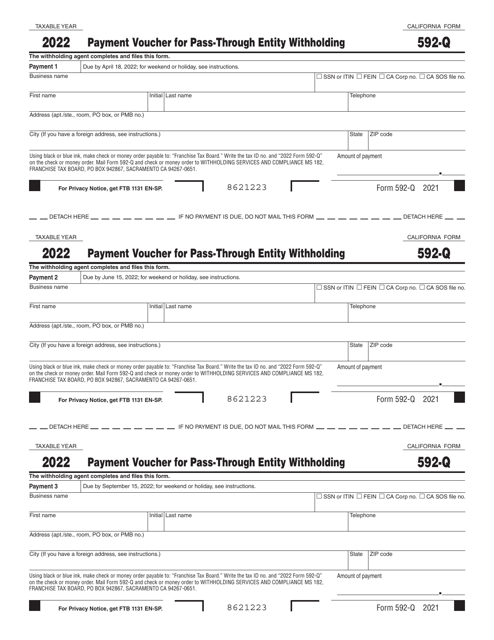

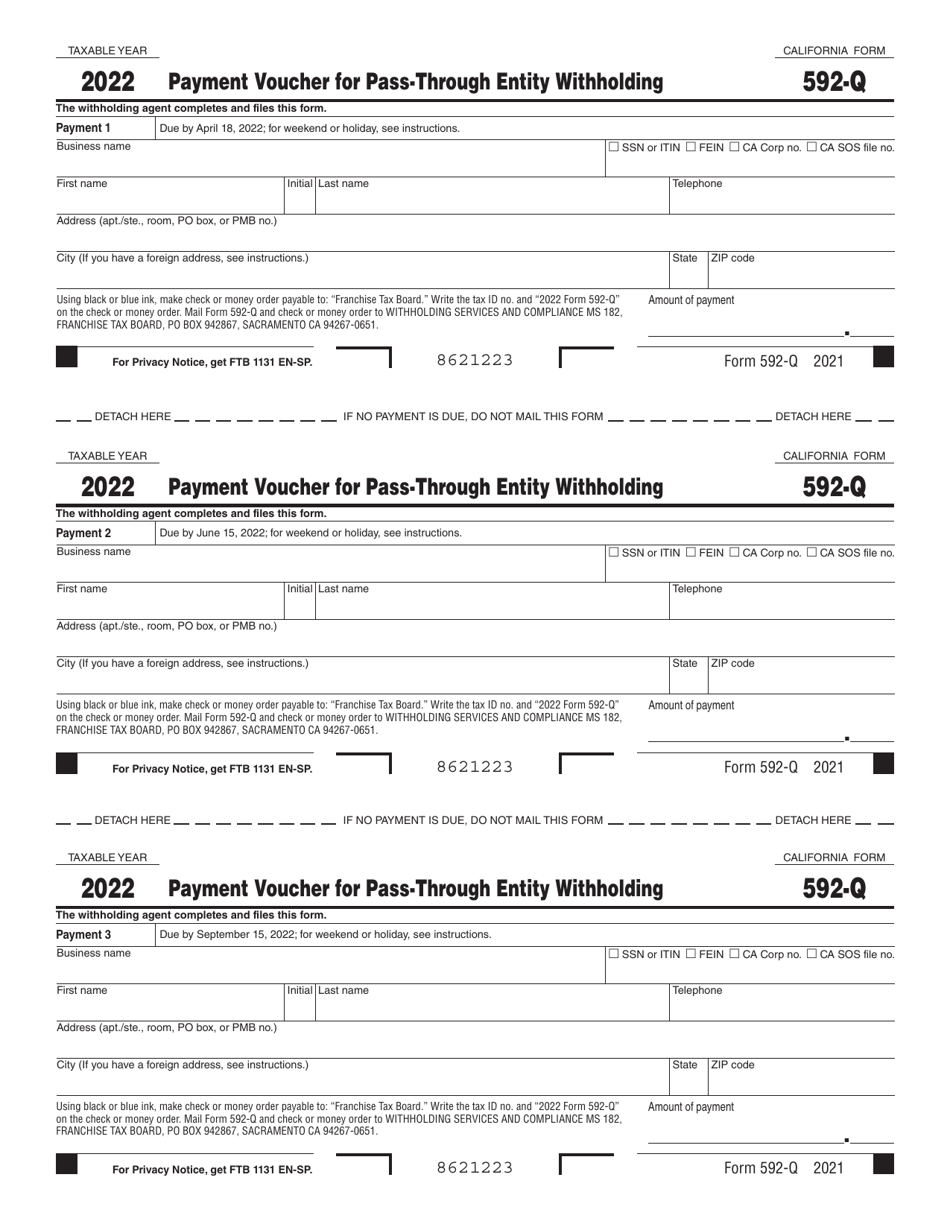

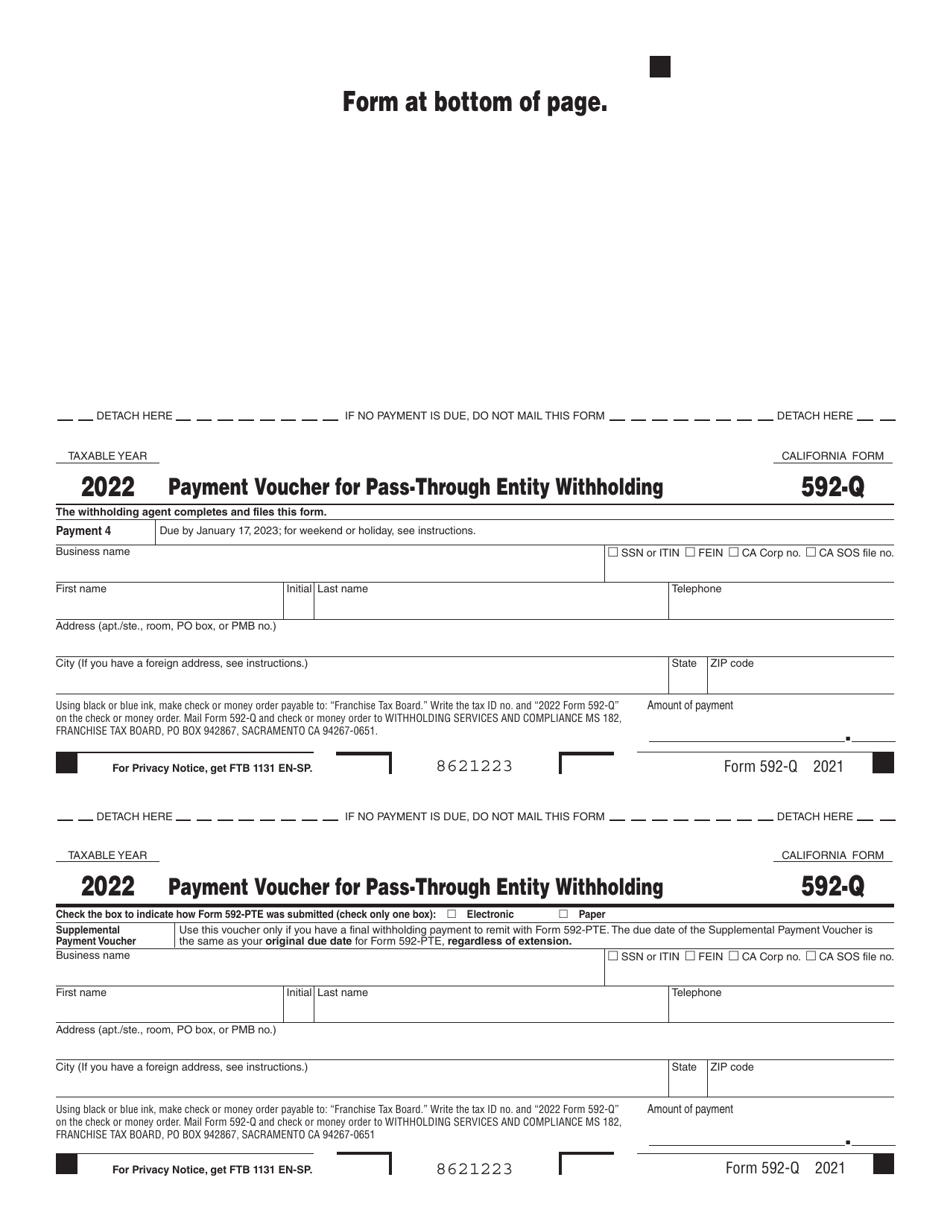

Form 592-Q

for the current year.

Form 592-Q Payment Voucher for Pass-Through Entity Withholding - California

What Is Form 592-Q?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

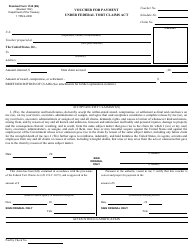

Q: What is Form 592-Q?

A: Form 592-Q is a payment voucher used for Pass-Through Entity Withholding in California.

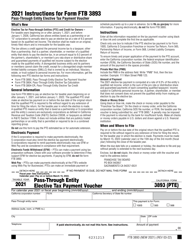

Q: Who needs to use Form 592-Q?

A: Pass-through entities that are required to withhold tax on behalf of nonresident owners or beneficiaries in California need to use Form 592-Q.

Q: What is Pass-Through Entity Withholding?

A: Pass-Through Entity Withholding is when a pass-through entity withholds tax on behalf of its nonresident owners or beneficiaries.

Q: When is Form 592-Q due?

A: Form 592-Q is generally due on the 15th day of the 4th, 6th, and 9th months of the taxable year.

Q: What should I include with Form 592-Q?

A: You should include the payment for the withholding tax amount with Form 592-Q.

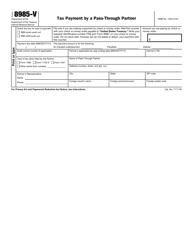

Q: What happens if I don't file Form 592-Q?

A: If you fail to file Form 592-Q or make the required withholding payment, you may be subject to penalties and interest.

Q: Do I need to send a copy of Form 592-Q to the nonresident owners or beneficiaries?

A: No, you are not required to send a copy of Form 592-Q to the nonresident owners or beneficiaries, but you should provide them with a statement of the amount withheld.

Q: Can I amend Form 592-Q?

A: Yes, you can amend Form 592-Q by filing an amended form and providing the correct information.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-Q by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.