This version of the form is not currently in use and is provided for reference only. Download this version of

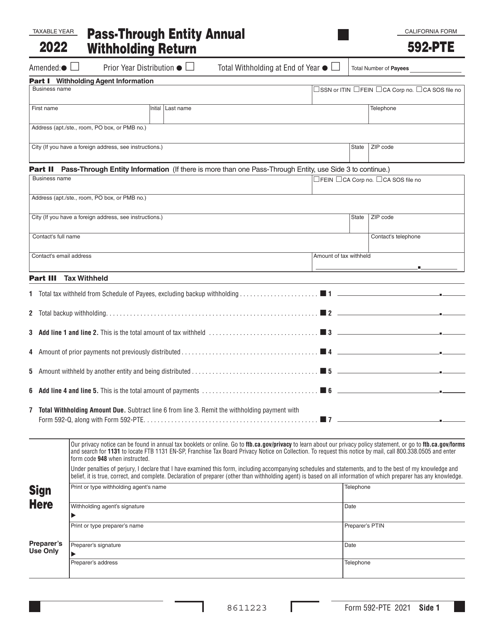

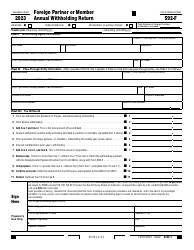

Form 592-PTE

for the current year.

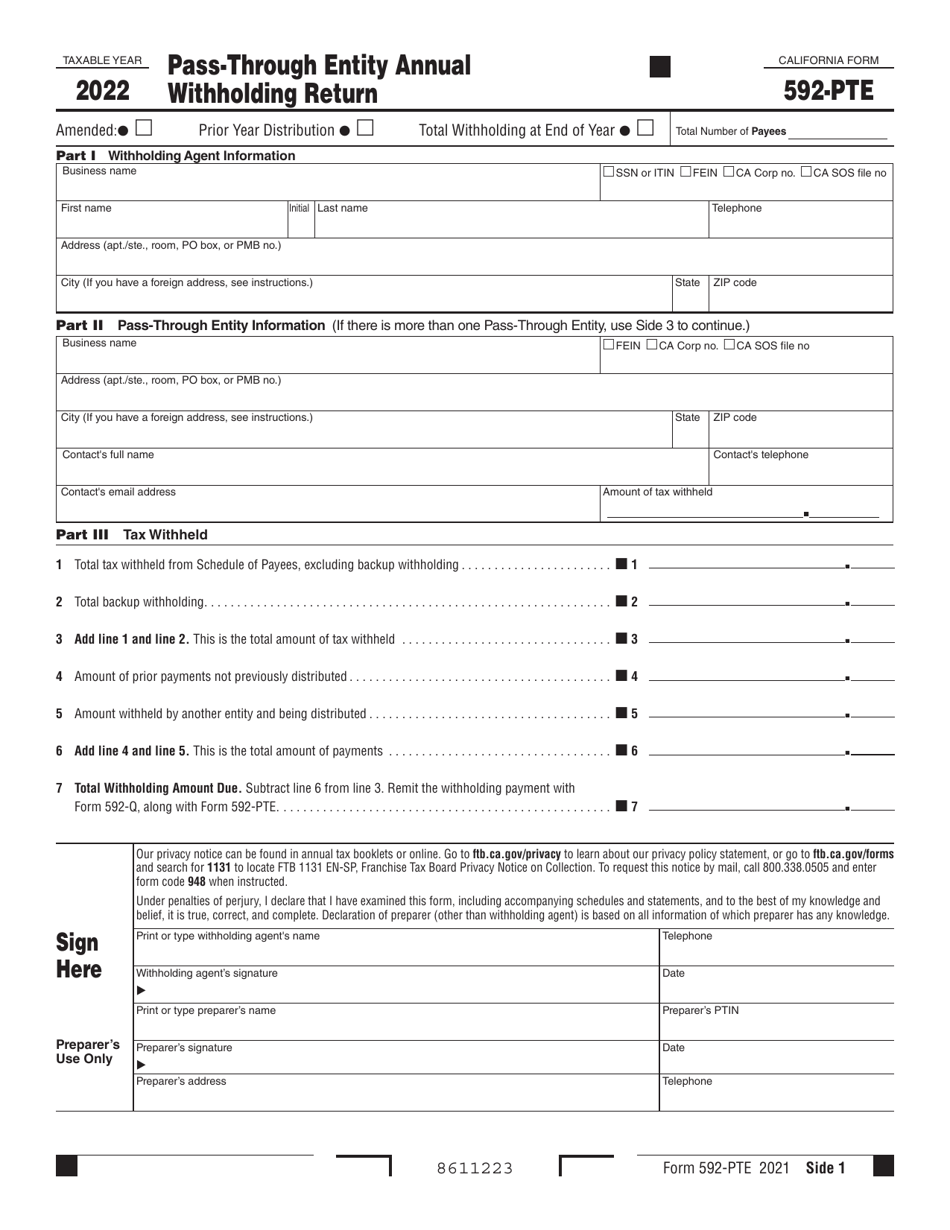

Form 592-PTE Pass-Through Entity Annual Withholding Return - California

What Is Form 592-PTE?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 592-PTE?

A: Form 592-PTE is the Pass-Through Entity Annual Withholding Return for California.

Q: Who needs to file Form 592-PTE?

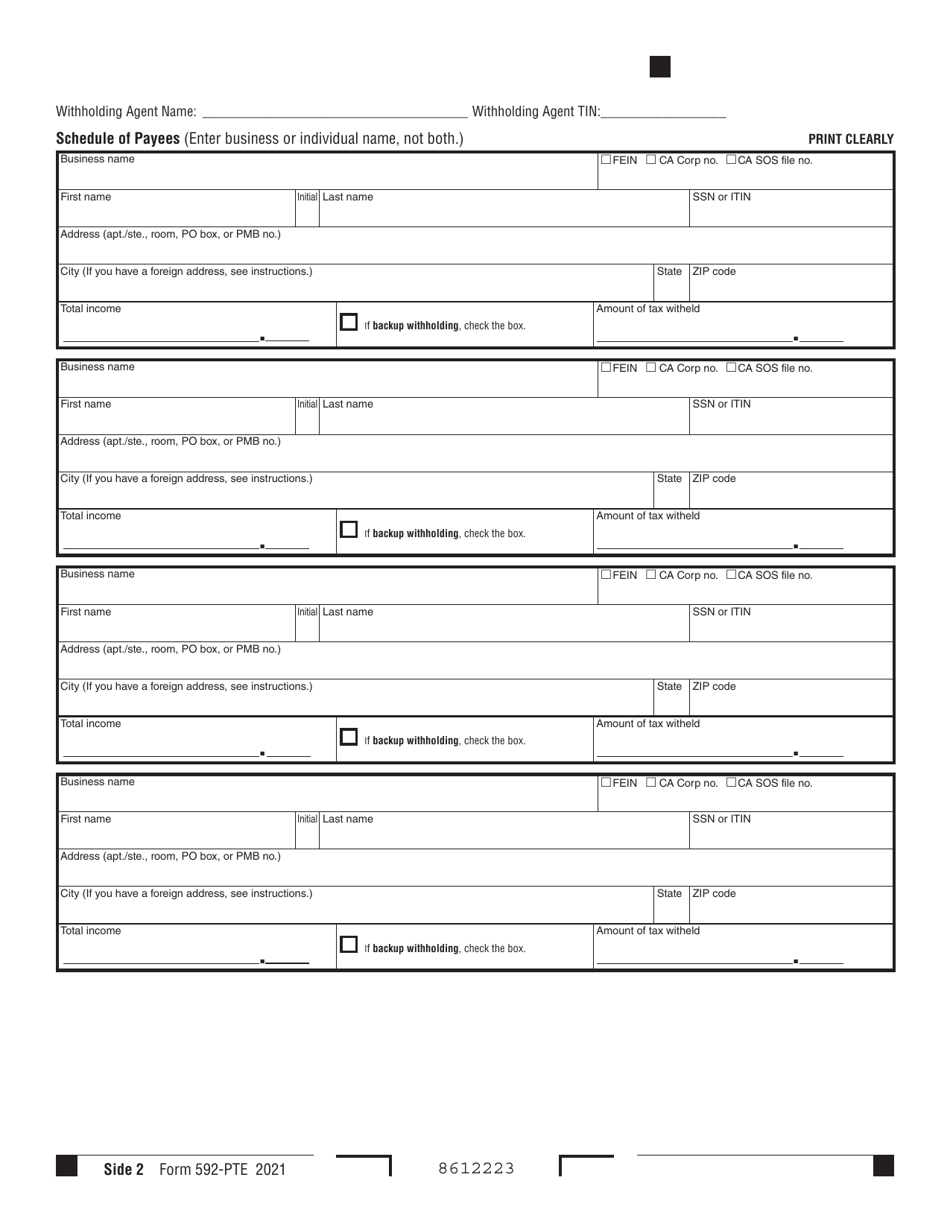

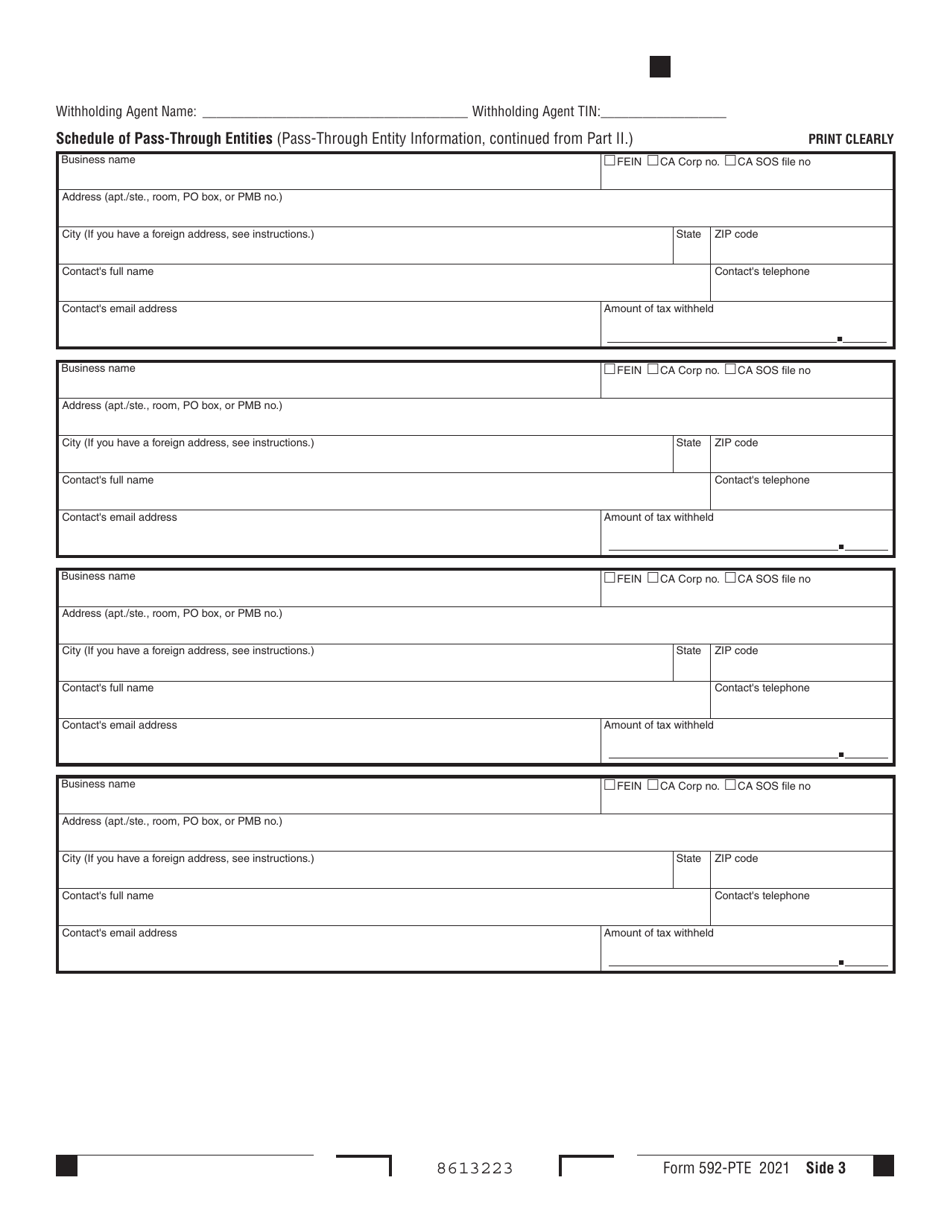

A: Pass-through entities doing business in California, such as partnerships and limited liability companies, need to file Form 592-PTE.

Q: What is the purpose of Form 592-PTE?

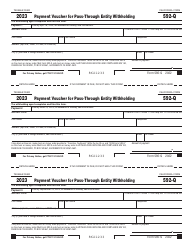

A: Form 592-PTE is used to report and remit withholding payments on behalf of nonresident owners of pass-through entities.

Q: When is Form 592-PTE due?

A: Form 592-PTE is due on or before the 15th day of the fourth month following the close of the entity's taxable year.

Q: Are there any penalties for not filing Form 592-PTE?

A: Yes, failure to file Form 592-PTE or pay the withholding tax can result in penalties and interest.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-PTE by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.