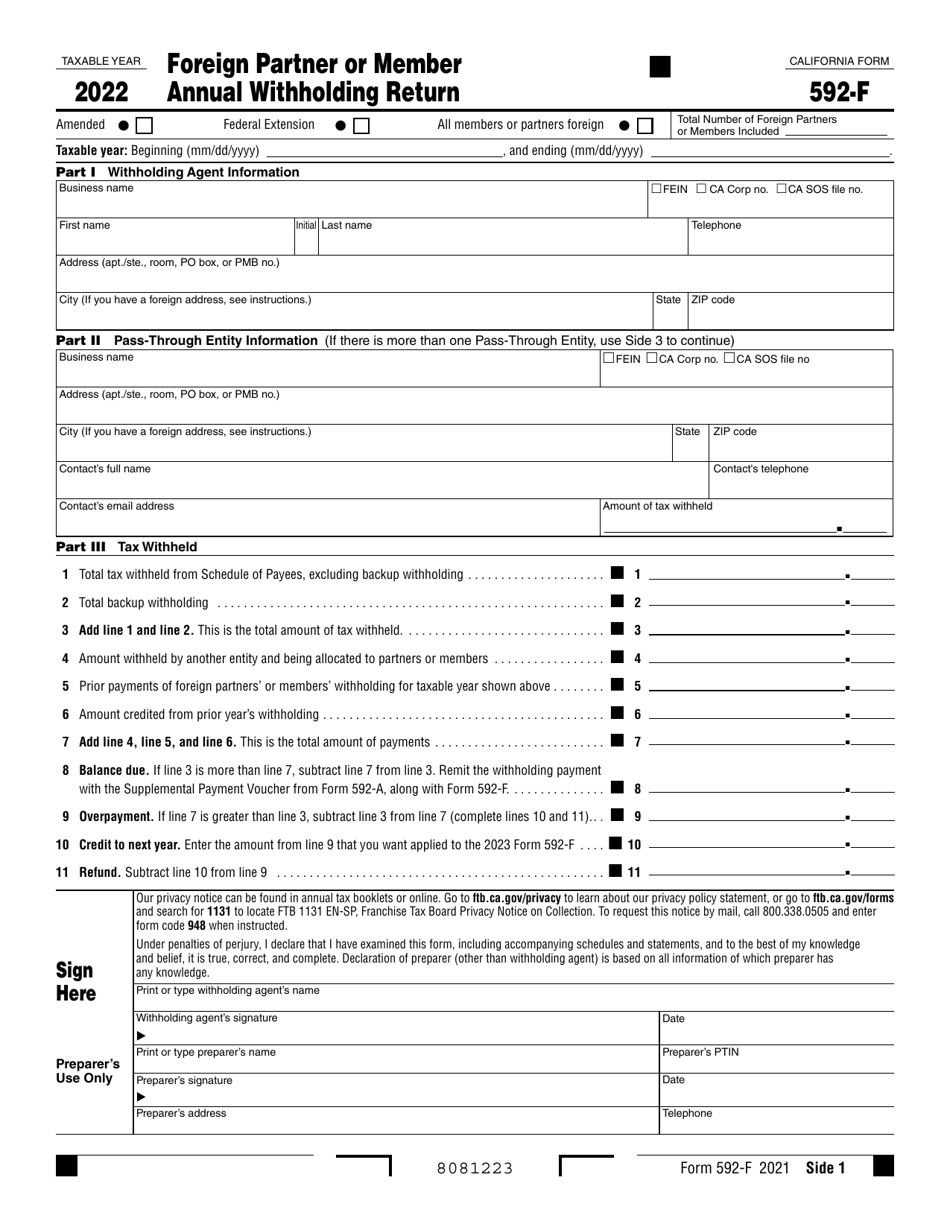

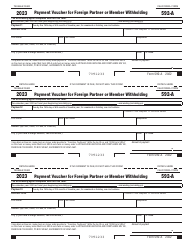

This version of the form is not currently in use and is provided for reference only. Download this version of

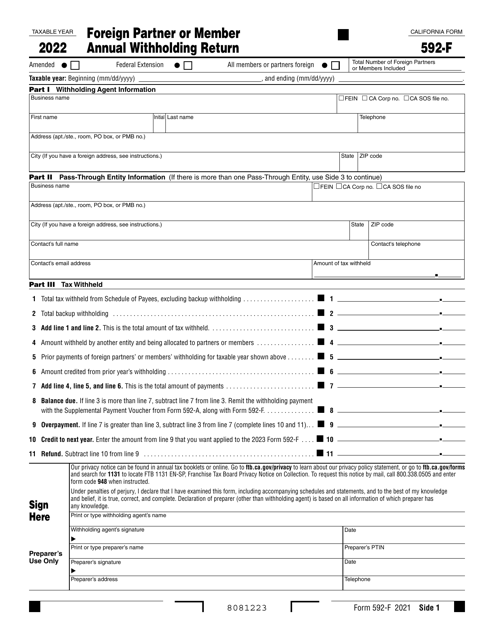

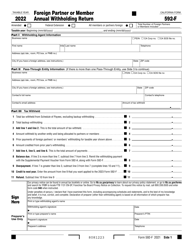

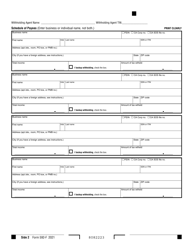

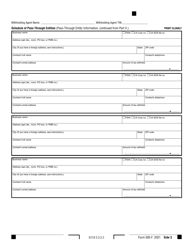

Form 592-F

for the current year.

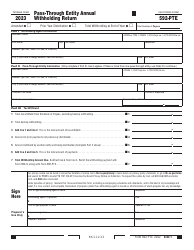

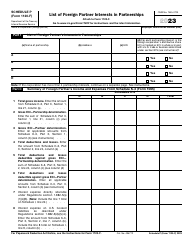

Form 592-F Foreign Partner or Member Annual Withholding Return - California

What Is Form 592-F?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form 592-F?

A: Foreign partners or members who have income from a California source.

Q: What is the purpose of Form 592-F?

A: To report and pay withholding on income from California sources.

Q: What type of income does Form 592-F cover?

A: It covers income from California sources received by foreign partners or members.

Q: Do I need to file Form 592-F if I am a U.S. resident?

A: No, the form is only for foreign partners or members.

Q: When is Form 592-F due?

A: It is due by the 15th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for not filing Form 592-F?

A: Yes, failure to file the form or pay the withholding tax may result in penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

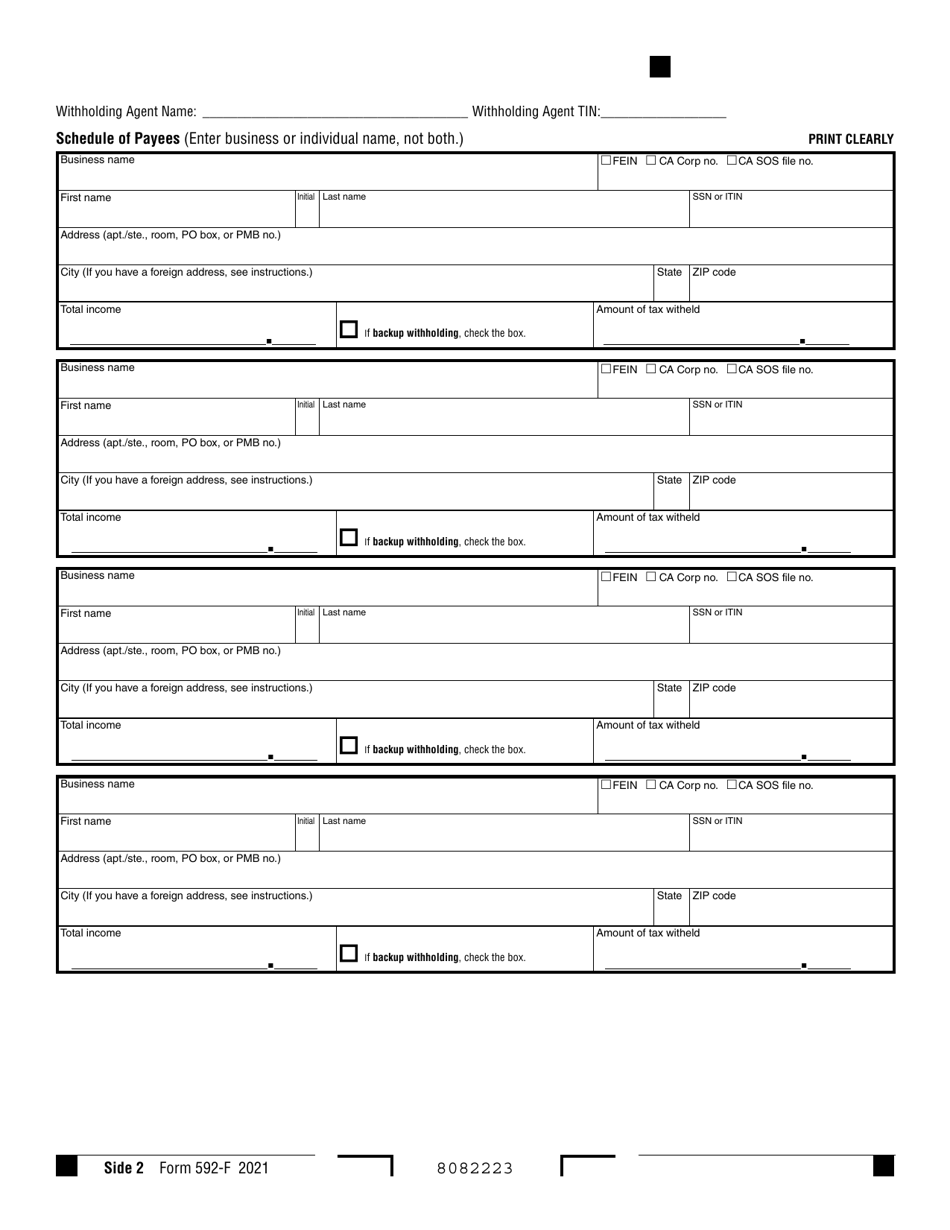

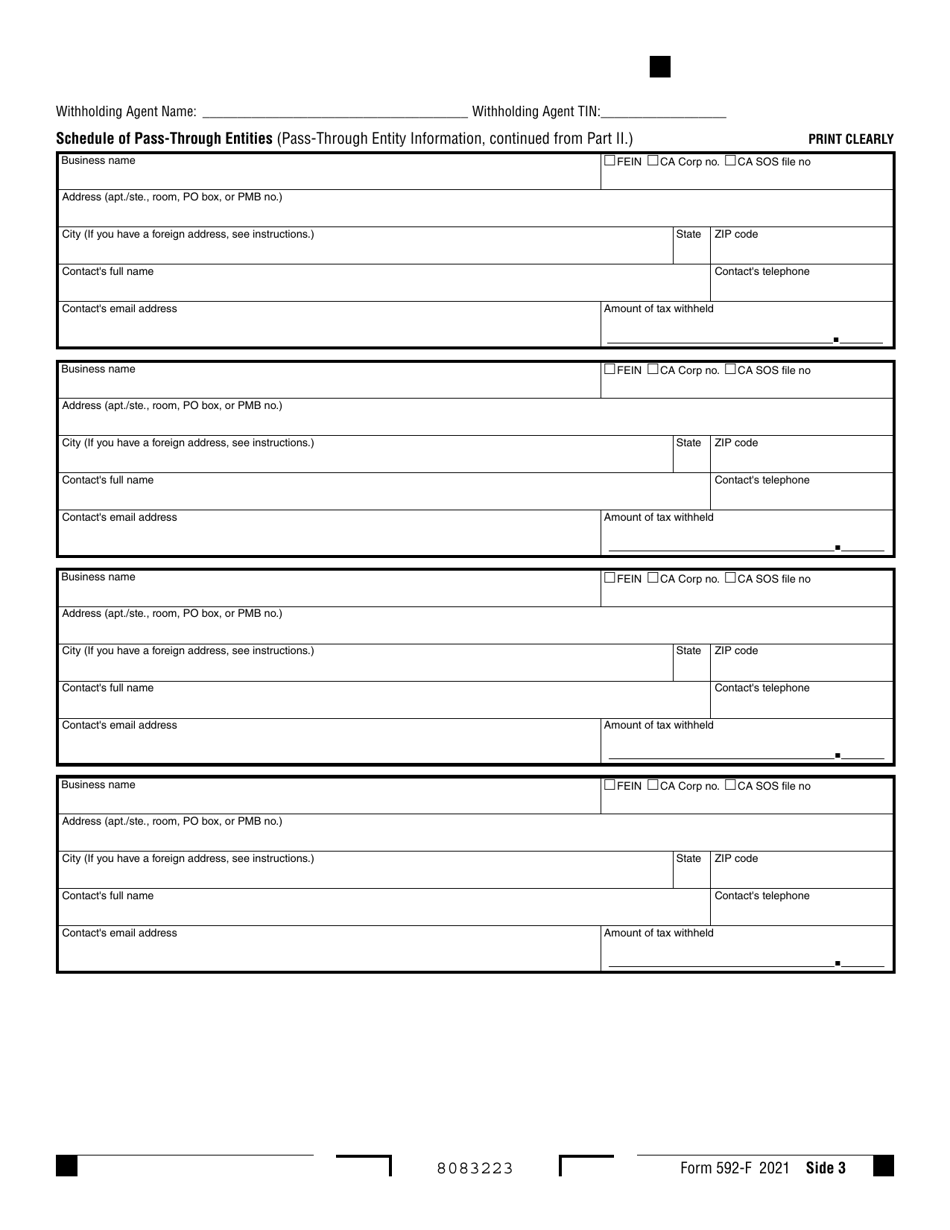

Download a fillable version of Form 592-F by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.