This version of the form is not currently in use and is provided for reference only. Download this version of

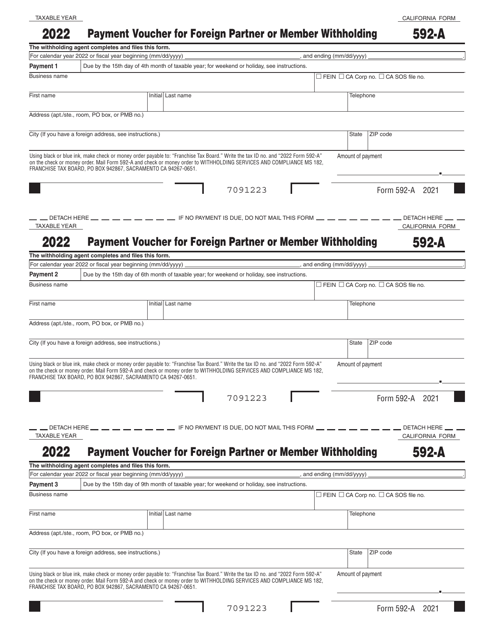

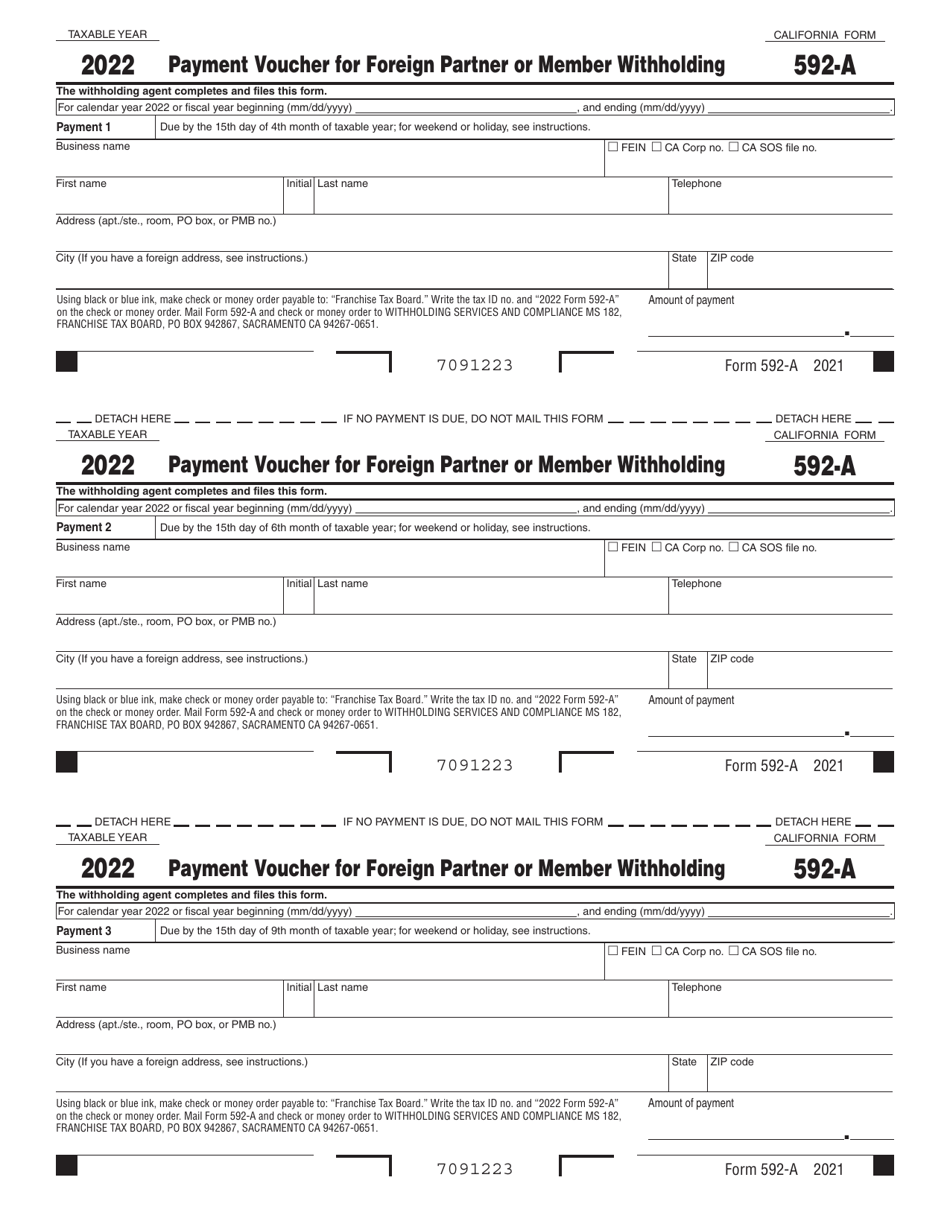

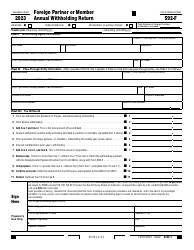

Form 592-A

for the current year.

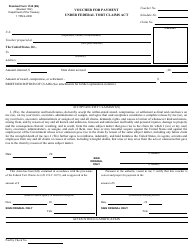

Form 592-A Payment Voucher for Foreign Partner or Member Withholding - California

What Is Form 592-A?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 592-A?

A: Form 592-A is a payment voucher used for foreign partner or member withholding in California.

Q: Who needs to use Form 592-A?

A: Form 592-A is used by payers in California who are withholding tax from payments made to foreign partners or members.

Q: What is the purpose of Form 592-A?

A: The purpose of Form 592-A is to report and remit withholding tax on payments made to foreign partners or members.

Q: When is Form 592-A due?

A: Form 592-A is due on or before January 31st of the following year, for each calendar year.

Q: How do I fill out Form 592-A?

A: You must provide your payer and withholding information, as well as the details of the foreign partner or member.

Q: Are there any penalties for not filing Form 592-A?

A: Yes, failure to file Form 592-A or pay the withholding tax can result in penalties and interest.

Q: Can Form 592-A be filed electronically?

A: Yes, you can file Form 592-A electronically if you have registered for e-filing with the California Franchise Tax Board.

Q: Is Form 592-A only for foreign partners or members?

A: Yes, Form 592-A is specifically for reporting and withholding tax on payments made to foreign partners or members.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-A by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.