This version of the form is not currently in use and is provided for reference only. Download this version of

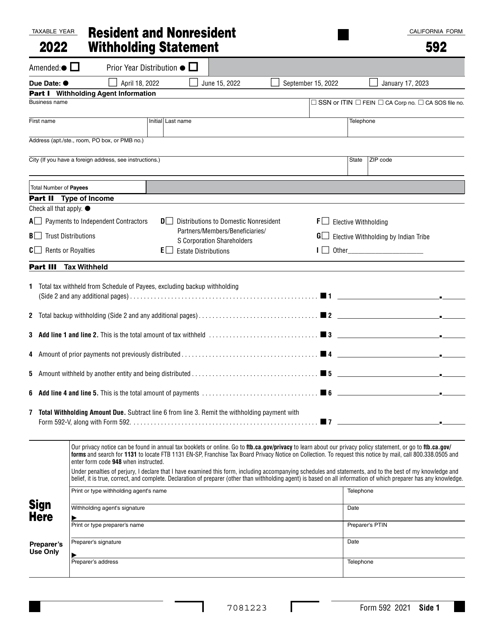

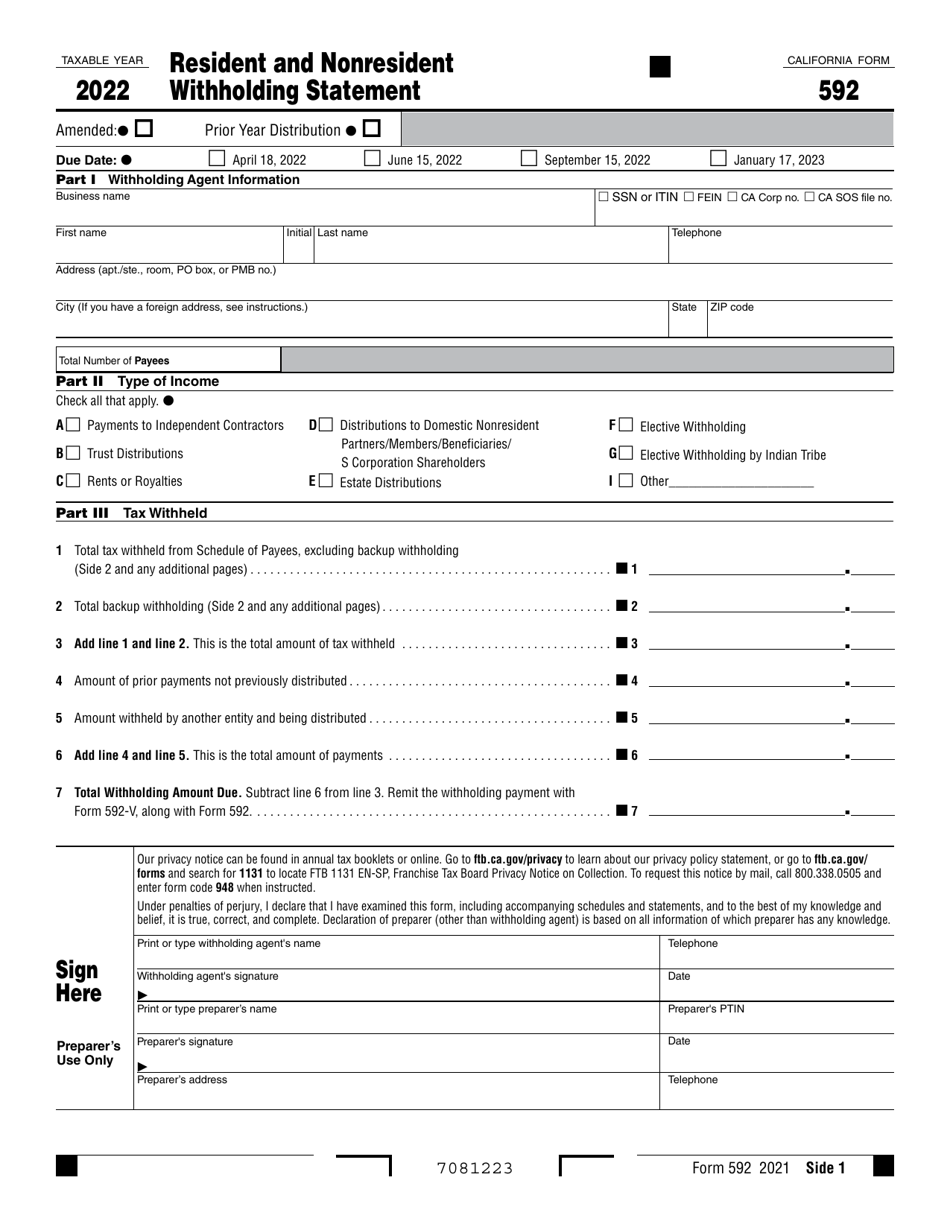

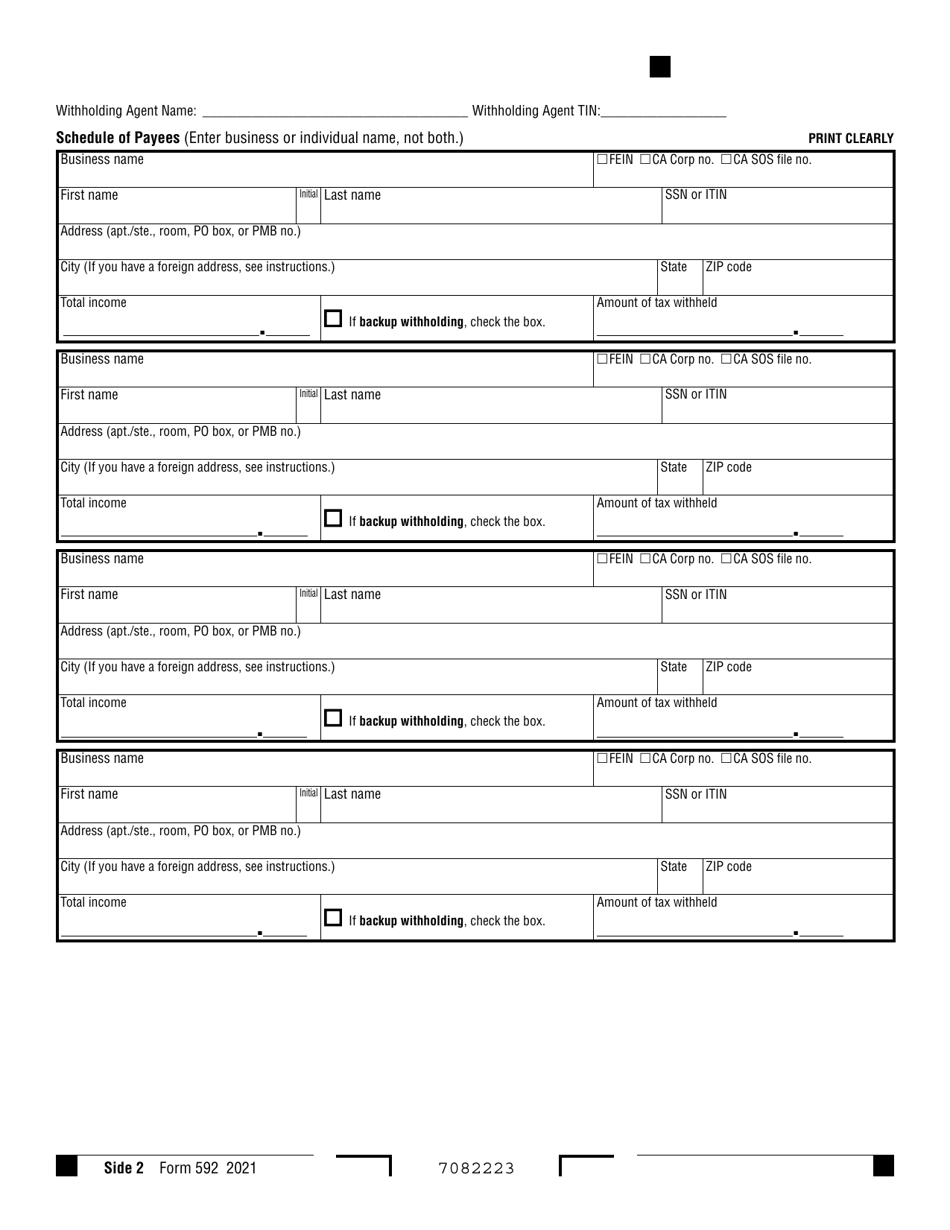

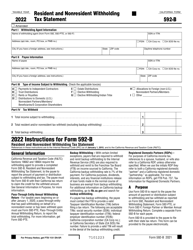

Form 592

for the current year.

Form 592 Resident and Nonresident Withholding Statement - California

What Is Form 592?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 592 Resident and Nonresident Withholding Statement?

A: Form 592 is a tax form used in California to report withholding taxes on income paid to nonresident individuals and entities.

Q: Who needs to file Form 592?

A: Anyone who is required to withhold income tax from payments made to nonresident individuals or entities in California needs to file Form 592.

Q: What income is subject to withholding and reported on Form 592?

A: Income subject to withholding and reported on Form 592 includes California source income such as rented or leased real estate, royalties, or payments to independent contractors.

Q: When is Form 592 due?

A: Form 592 is due on or before the last day of the month following the quarter in which the withholding occurred.

Q: Is Form 592 required for residents of California?

A: Form 592 is not required for residents of California. It is only required for nonresident individuals and entities.

Q: What are the penalties for late or incorrect filing of Form 592?

A: Penalties for late or incorrect filing of Form 592 can include interest charges, a penalty based on the amount of tax not withheld, or additional penalties for intentional disregard of the filing requirements.

Q: Does Form 592 apply to income earned outside of California?

A: No, Form 592 only applies to income earned from California sources.

Q: Do I need to attach Form 592 to my tax return?

A: No, Form 592 should be retained for your records and does not need to be attached to your tax return.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.