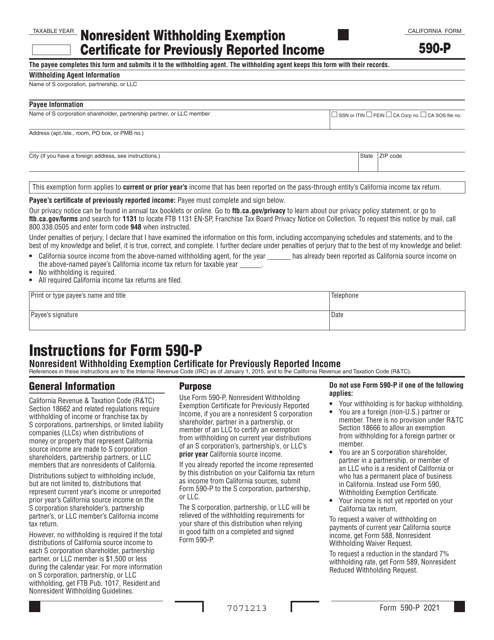

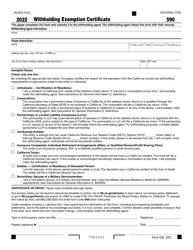

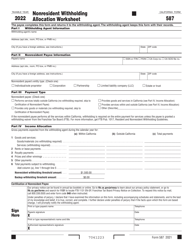

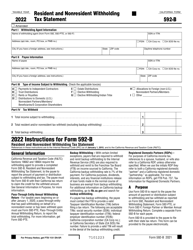

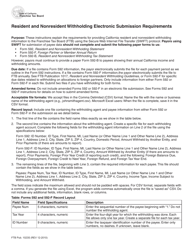

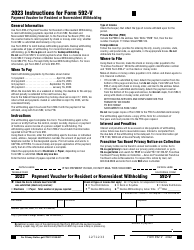

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

What Is Form 590-P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

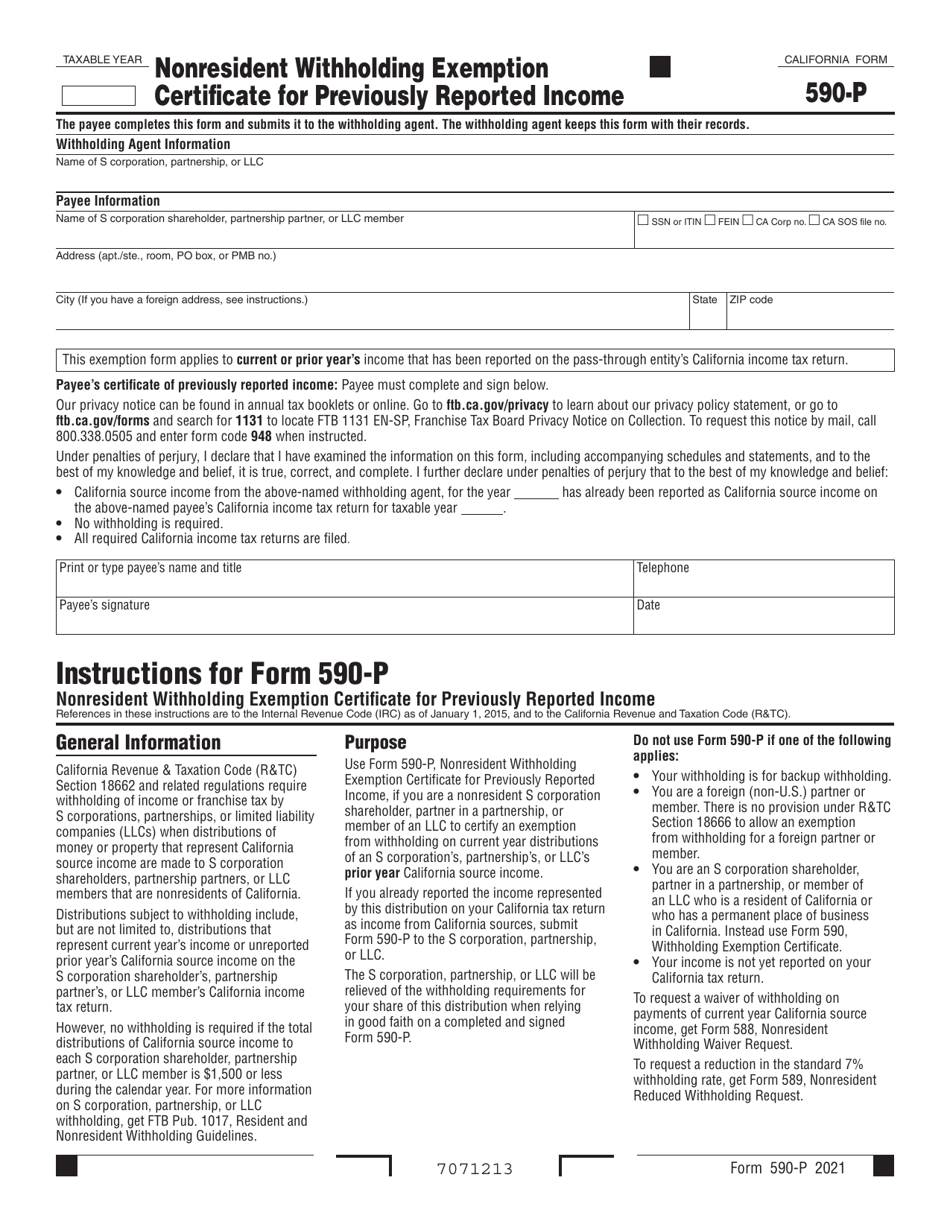

Q: What is Form 590-P?

A: Form 590-P is the Nonresident Withholding Exemption Certificate for Previously Reported Income in California.

Q: Who needs to use Form 590-P?

A: Form 590-P is for nonresident individuals or entities who previously reported California source income and now qualify for an exemption from withholding.

Q: What is the purpose of Form 590-P?

A: The purpose of Form 590-P is to certify that a taxpayer is exempt from withholding on previously reported California source income.

Q: When should Form 590-P be filed?

A: Form 590-P should be filed with the California Franchise Tax Board when a taxpayer wants to claim an exemption from withholding on previously reported income.

Q: Is there a deadline for filing Form 590-P?

A: Yes, Form 590-P must be filed on or before the due date of the associated withholding payment.

Q: Can Form 590-P be used for future payments?

A: No, Form 590-P can only be used for previously reported income and is not valid for future payments.

Q: What happens after filing Form 590-P?

A: After filing Form 590-P, the California Franchise Tax Board will review the form and determine if the taxpayer qualifies for an exemption from withholding on previously reported income.

Q: Is Form 590-P the same as Form W-9?

A: No, Form 590-P is specific to California nonresidents claiming an exemption from withholding on previously reported income, while Form W-9 is a federal tax form used to provide a taxpayer identification number to a payer.

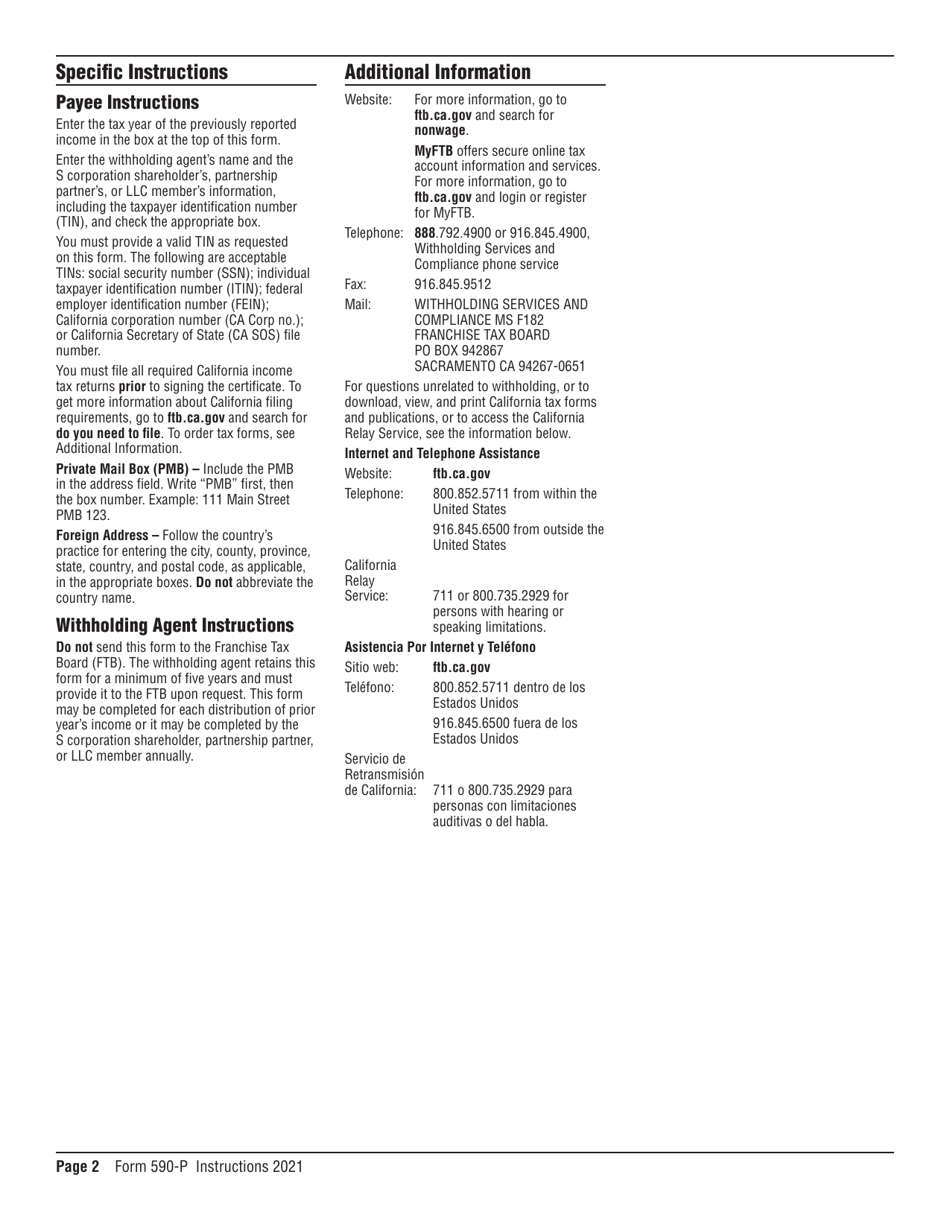

Q: Are there any other requirements for claiming an exemption from withholding?

A: Yes, in addition to filing Form 590-P, nonresidents must meet other criteria specified by the California Franchise Tax Board to qualify for an exemption from withholding.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 590-P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.