This version of the form is not currently in use and is provided for reference only. Download this version of

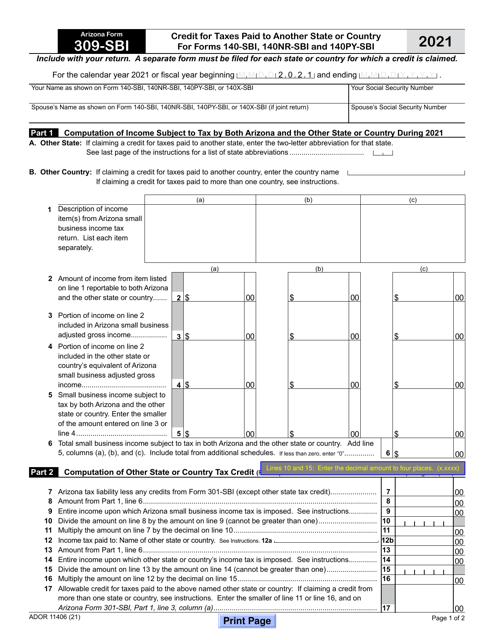

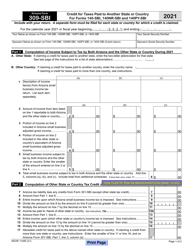

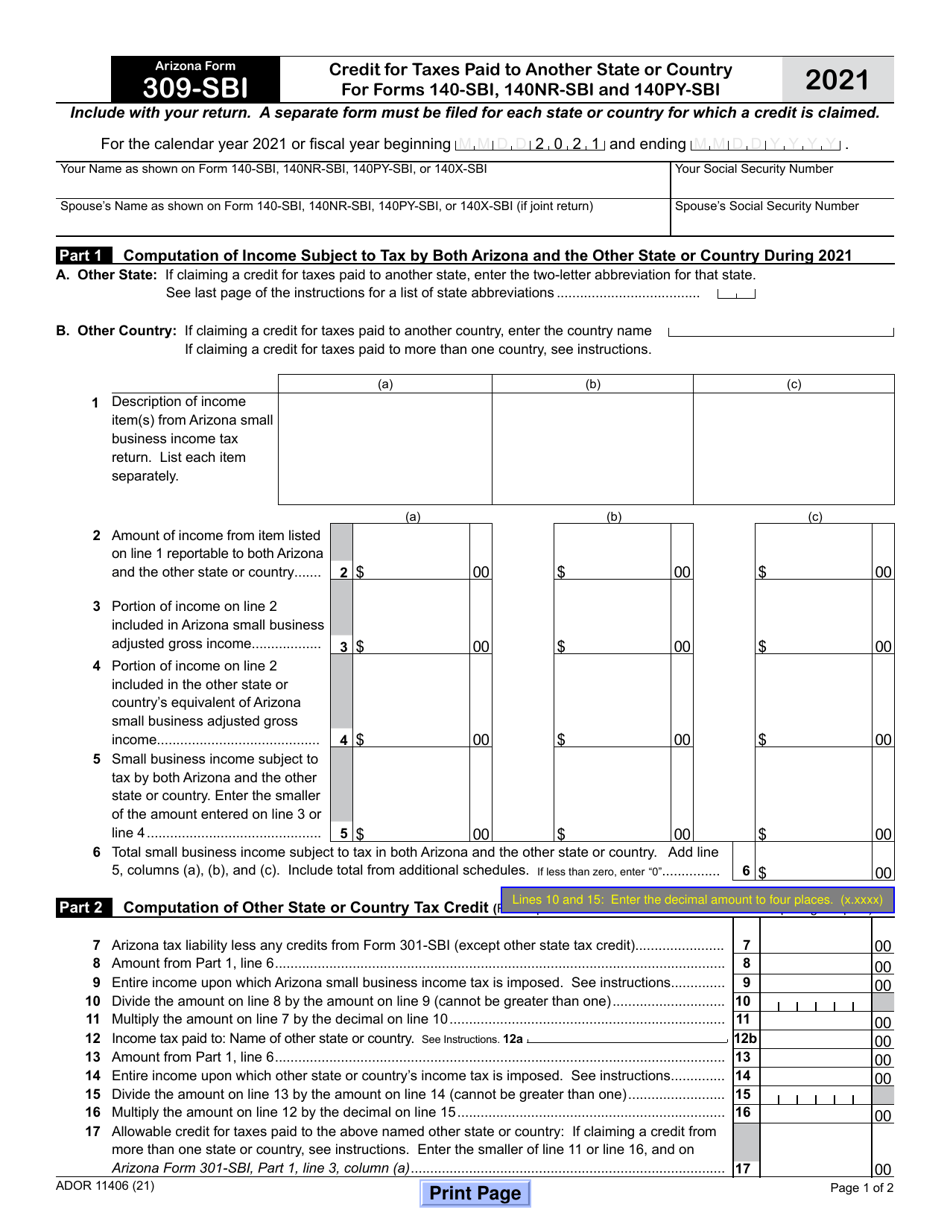

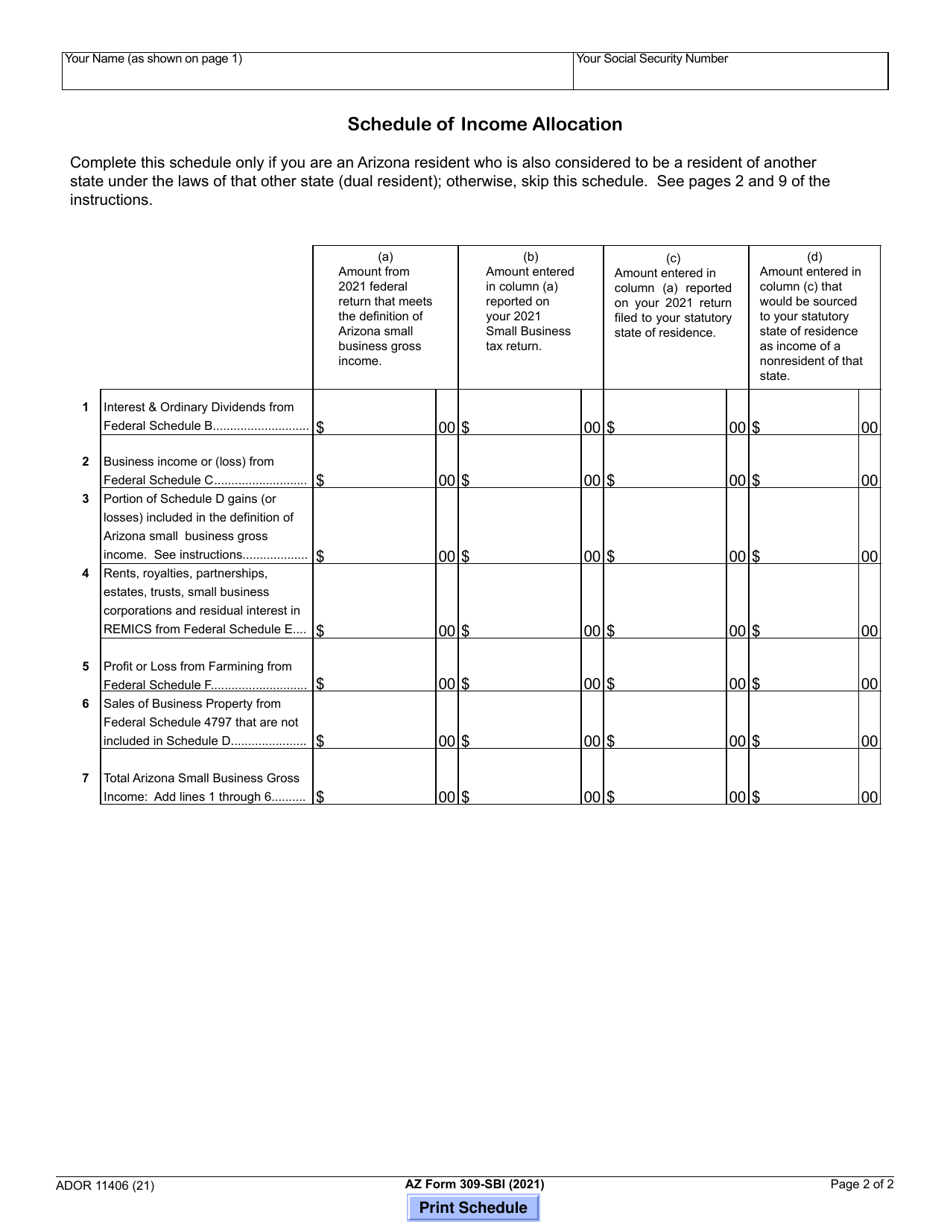

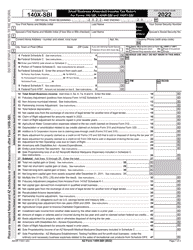

Arizona Form 309-SBI (ADOR11406)

for the current year.

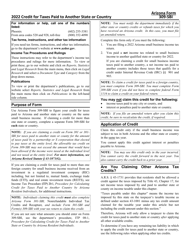

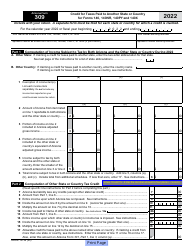

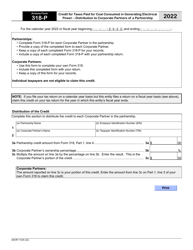

Arizona Form 309-SBI (ADOR11406) Credit for Taxes Paid to Another State or Country for Forms 140-sbi, 140nr-Sbi and 140py-Sbi - Arizona

What Is Arizona Form 309-SBI (ADOR11406)?

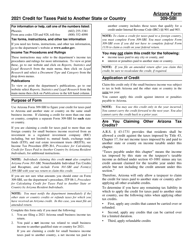

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 309-SBI?

A: Arizona Form 309-SBI is a tax form used for claiming a credit for taxes paid to another state or country.

Q: Which tax forms in Arizona require the use of Form 309-SBI?

A: Form 309-SBI is required for certain individuals filing Forms 140-SBI, 140NR-SBI, and 140PY-SBI.

Q: What is the purpose of Form 309-SBI?

A: The purpose of Form 309-SBI is to allow taxpayers to claim a credit for taxes paid to another state or country, which can help reduce their Arizona tax liability.

Q: Who can use Form 309-SBI?

A: Form 309-SBI can be used by individuals who have paid taxes to another state or country and are eligible to claim a credit for those taxes on their Arizona tax return.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 309-SBI (ADOR11406) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.