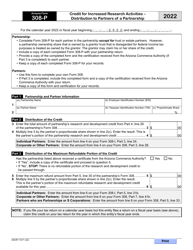

This version of the form is not currently in use and is provided for reference only. Download this version of

Arizona Form 346-S (ADOR11284)

for the current year.

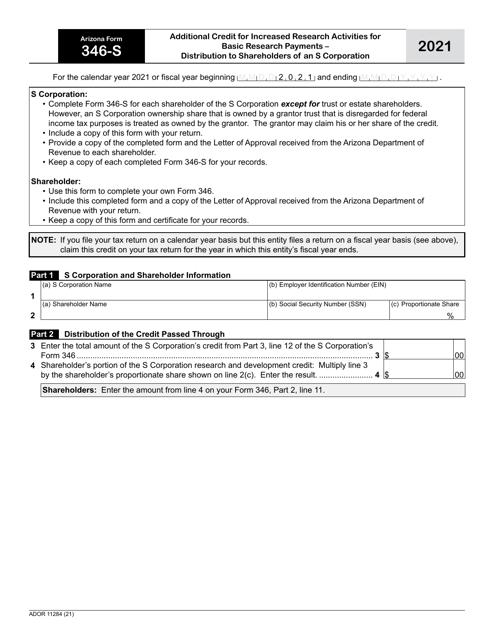

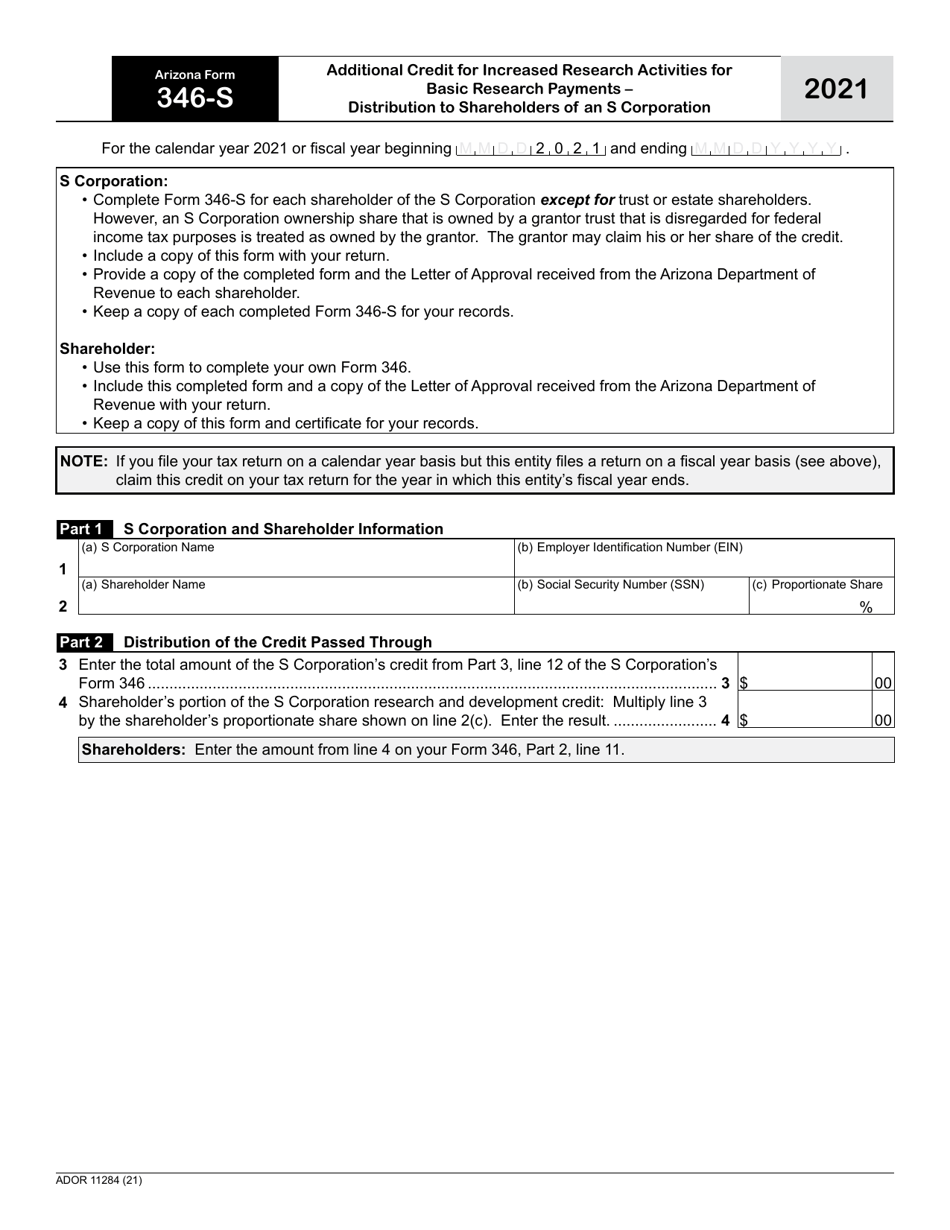

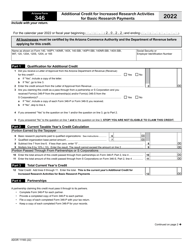

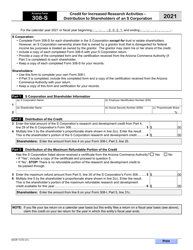

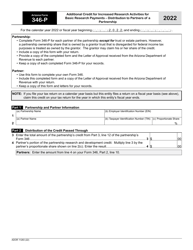

Arizona Form 346-S (ADOR11284) Additional Credit for Increased Research Activities for Basic Research Payments - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 346-S (ADOR11284)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 346-S?

A: Arizona Form 346-S is a tax form used to claim Additional Credit for Increased Research Activities for Basic Research Payments.

Q: Who can use Arizona Form 346-S?

A: Arizona Form 346-S is specifically used by shareholders of an S Corporation in Arizona.

Q: What is the purpose of Arizona Form 346-S?

A: The purpose of Arizona Form 346-S is to claim a credit for increased research activities related to basic research payments.

Q: What is the credit for increased research activities?

A: The credit for increased research activities is a tax credit that provides an incentive for businesses to conduct research and development activities in Arizona.

Q: What are basic research payments?

A: Basic research payments refer to amounts paid or incurred by a shareholder of an S Corporation that are eligible for the credit for increased research activities.

Q: What is an S Corporation?

A: An S Corporation is a type of business entity that passes income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: When is the deadline to file Arizona Form 346-S?

A: The deadline to file Arizona Form 346-S is typically April 15th of the following year.

Q: Are there any other requirements or attachments needed with Arizona Form 346-S?

A: Yes, additional forms and documentation may be required to claim the credit for increased research activities. Please refer to the instructions provided with the form for more details.

Q: Can the credit for increased research activities be carried forward or backward?

A: Yes, any unused credit can be carried forward for up to five years or carried back for one year, subject to certain limitations.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 346-S (ADOR11284) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.