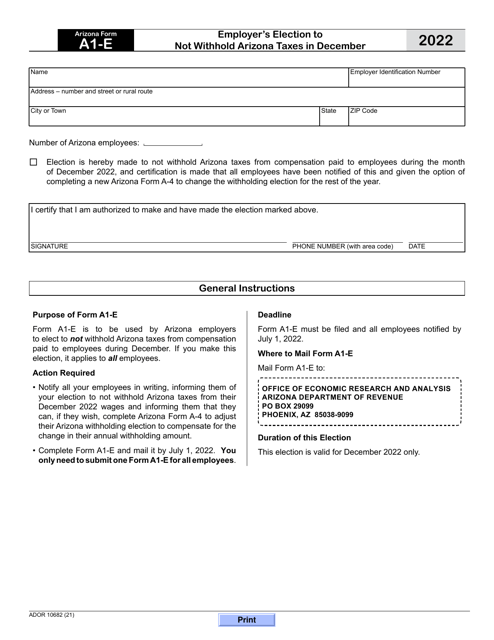

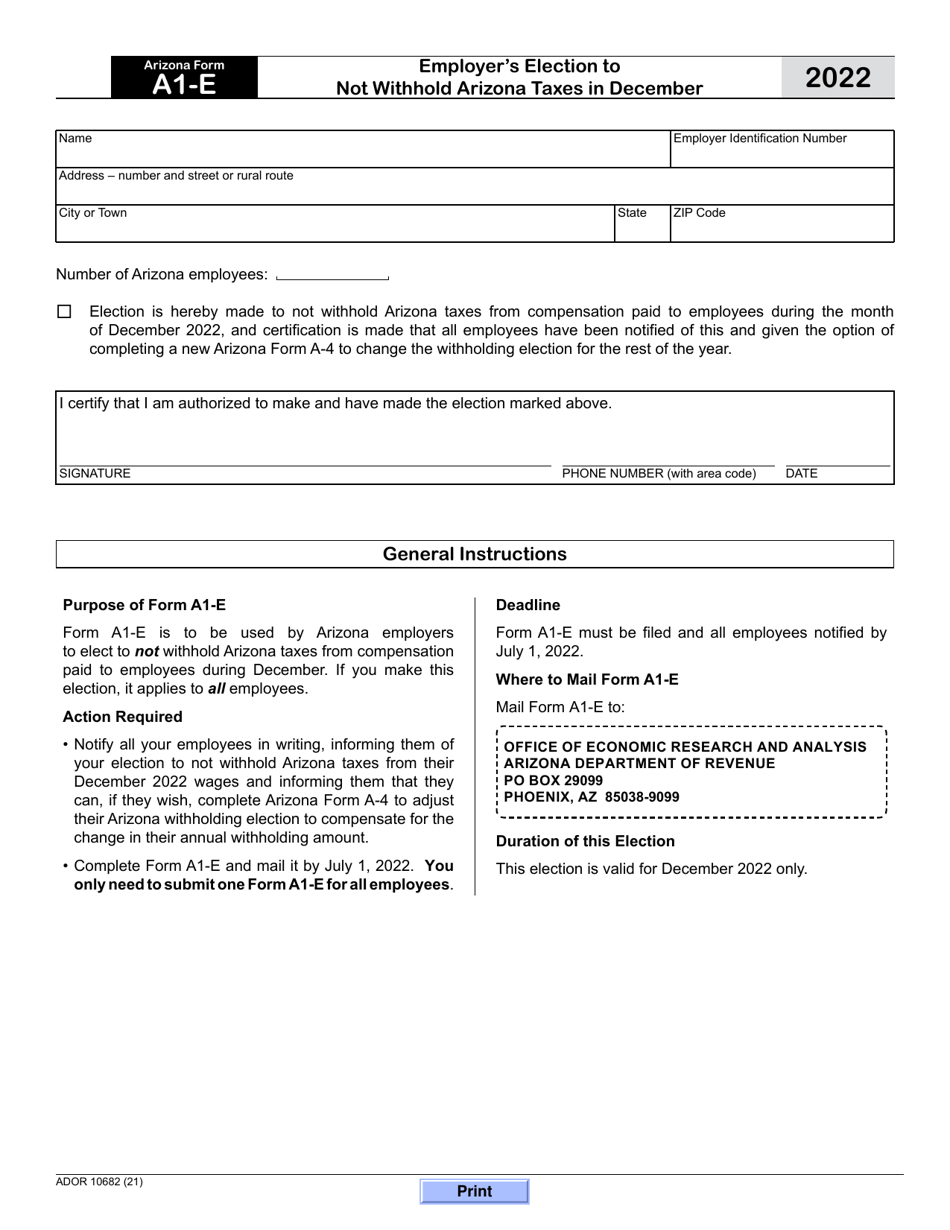

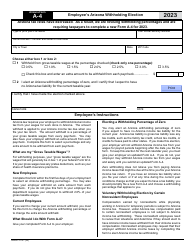

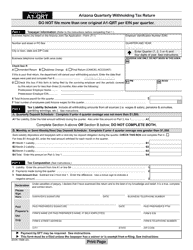

Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona

What Is Arizona Form A1-E (ADOR10682)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form A1-E?

A: Arizona Form A1-E is an Employer's Election to Not Withhold Arizona Taxes in December.

Q: What is the purpose of Arizona Form A1-E?

A: The purpose of Arizona Form A1-E is for employers to elect not to withhold Arizona taxes in December.

Q: Who needs to file Arizona Form A1-E?

A: Employers who want to elect not to withhold Arizona taxes in December need to file Arizona Form A1-E.

Q: Is Arizona Form A1-E mandatory for all employers?

A: No, Arizona Form A1-E is not mandatory for all employers. It is only for those who want to elect not to withhold Arizona taxes in December.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-E (ADOR10682) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.