This version of the form is not currently in use and is provided for reference only. Download this version of

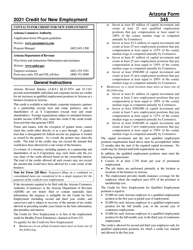

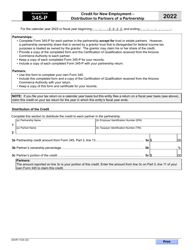

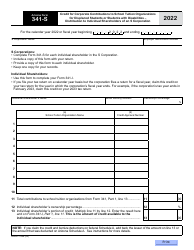

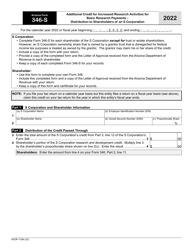

Arizona Form 345-S (ADOR11335)

for the current year.

Arizona Form 345-S (ADOR11335) Credit for New Employment - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 345-S (ADOR11335)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 345-S?

A: Arizona Form 345-S is a tax form used for claiming the Credit for New Employment for Shareholders of an S Corporation in Arizona.

Q: Who can use Arizona Form 345-S?

A: Arizona Form 345-S can be used by shareholders of an S Corporation who are eligible for the Credit for New Employment in Arizona.

Q: What is the purpose of Arizona Form 345-S?

A: The purpose of Arizona Form 345-S is to calculate and claim the Credit for New Employment for shareholders of an S Corporation in Arizona.

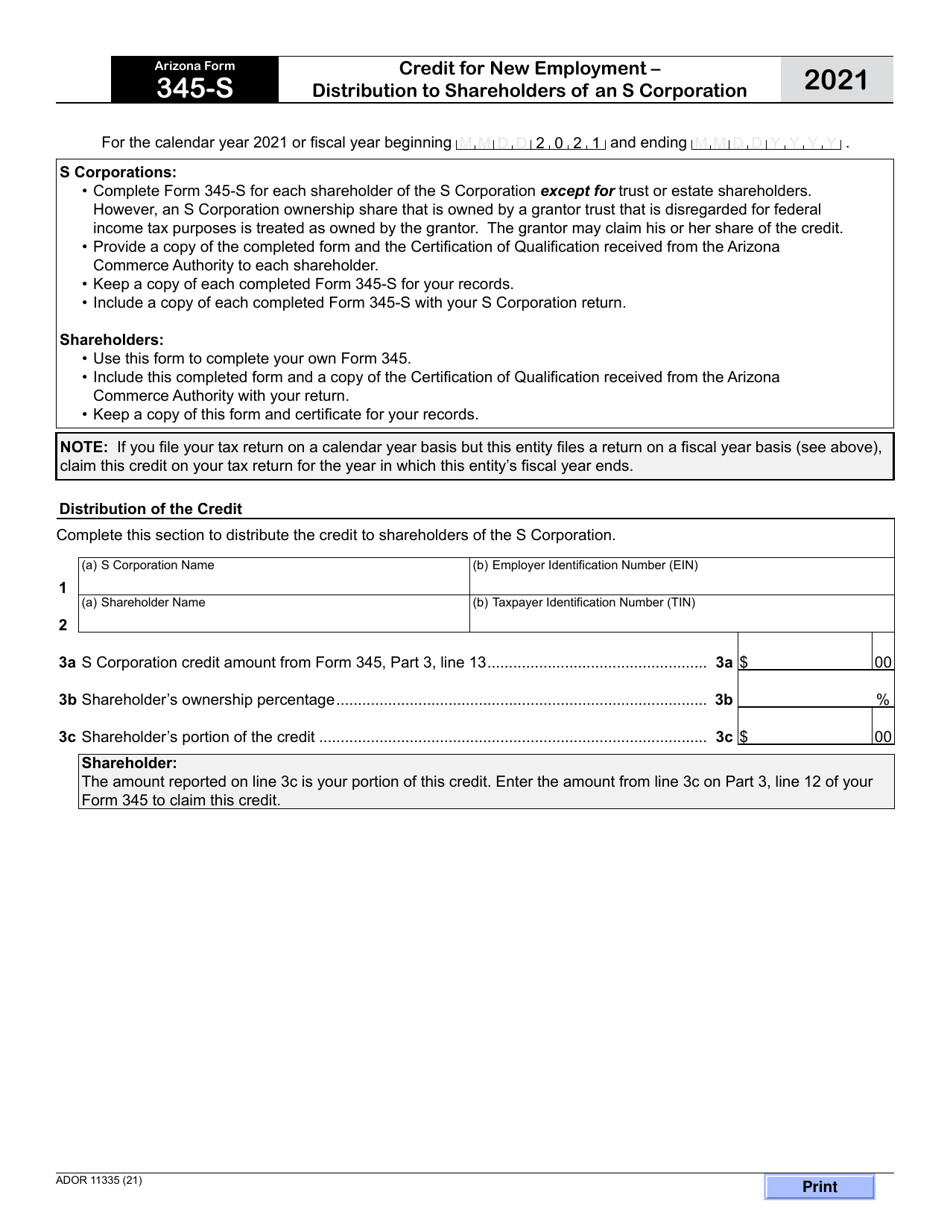

Q: What is the Credit for New Employment?

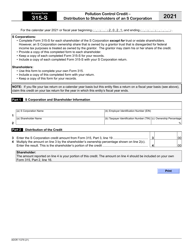

A: The Credit for New Employment is a tax credit offered by the state of Arizona to encourage job creation and economic growth.

Q: How do I qualify for the Credit for New Employment?

A: To qualify for the Credit for New Employment, you must meet certain criteria specified by the Arizona Department of Revenue. These criteria typically include creating new jobs and meeting wage requirements.

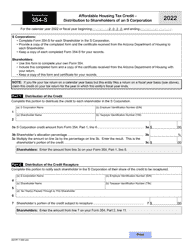

Q: Is there a deadline for filing Arizona Form 345-S?

A: Yes, Arizona Form 345-S must be filed by the due date specified by the Arizona Department of Revenue. The deadline may vary from year to year.

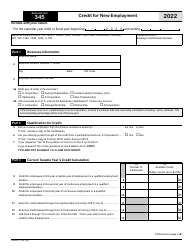

Q: Are there any other requirements or documentation needed to file Arizona Form 345-S?

A: Yes, you may need to provide supporting documentation such as payroll records and proof of new job creation when filing Arizona Form 345-S.

Q: Can I file Arizona Form 345-S electronically?

A: Yes, the Arizona Department of Revenue allows electronic filing for Arizona Form 345-S.

Q: Is the Credit for New Employment refundable?

A: Yes, if the credit exceeds your tax liability, you may be eligible for a refund.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 345-S (ADOR11335) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.