This version of the form is not currently in use and is provided for reference only. Download this version of

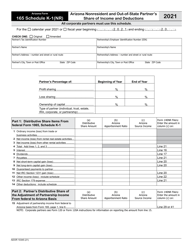

Arizona Form 165PA (ADOR11293) Schedule K-1(NR)

for the current year.

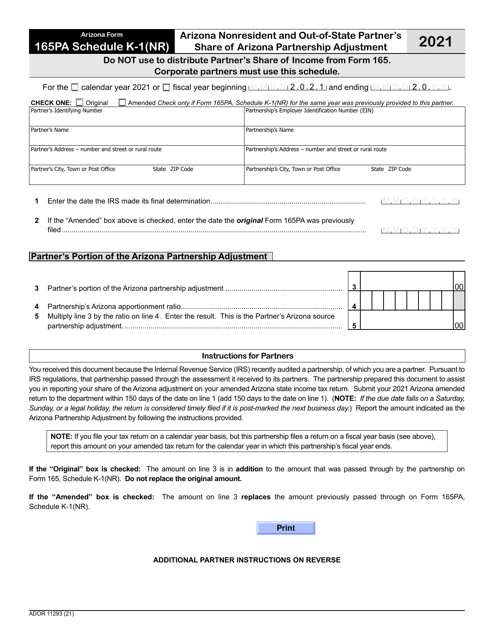

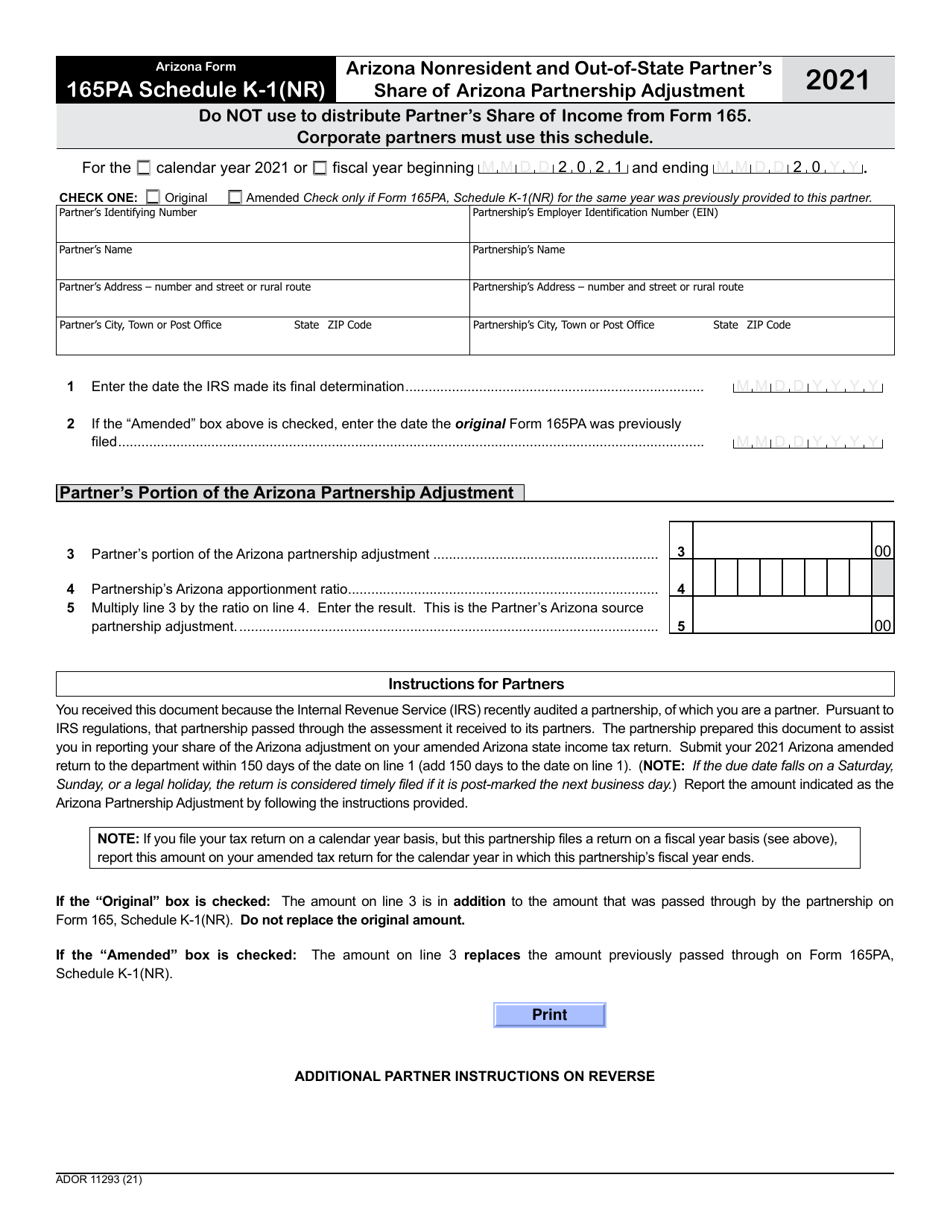

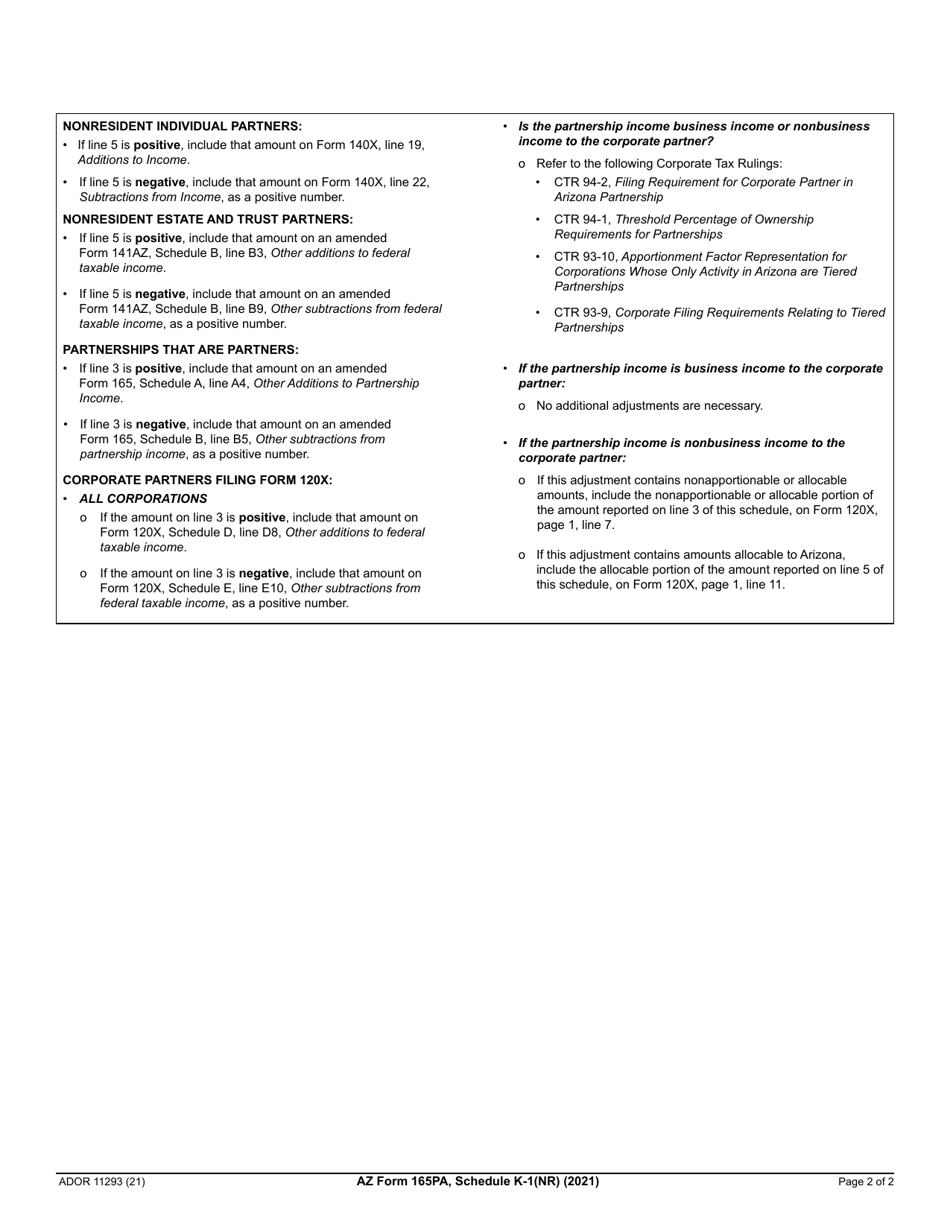

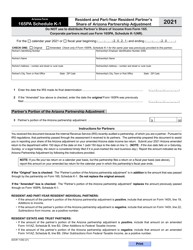

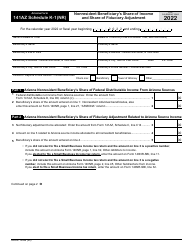

Arizona Form 165PA (ADOR11293) Schedule K-1(NR) Arizona Nonresident and Out-of-State Partner's Share of Arizona Partnership Adjustment - Arizona

What Is Arizona Form 165PA (ADOR11293) Schedule K-1(NR)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona.The document is a supplement to Arizona Form 165PA, Credit for Qualified Facilities - Distribution to Shareholders of an S Corporation. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 165PA?

A: Arizona Form 165PA is a tax form used by nonresident and out-of-state partners to report their share of Arizona Partnership Adjustment.

Q: Who needs to file Arizona Form 165PA?

A: Nonresident and out-of-state partners of an Arizona partnership need to file Arizona Form 165PA.

Q: What is Schedule K-1(NR) on Arizona Form 165PA?

A: Schedule K-1(NR) on Arizona Form 165PA is used to report the nonresident partner's share of Arizona partnership adjustment.

Q: What is Arizona Partnership Adjustment?

A: Arizona Partnership Adjustment is the difference between the partnership's federal taxable income and the partnership's Arizona taxable income.

Q: Can I use Arizona Form 165PA if I am a resident of Arizona?

A: No, Arizona Form 165PA is specifically for nonresident and out-of-state partners.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 165PA (ADOR11293) Schedule K-1(NR) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.