This version of the form is not currently in use and is provided for reference only. Download this version of

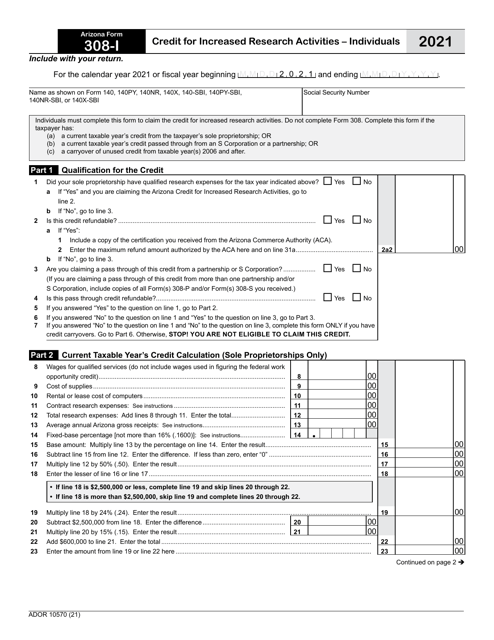

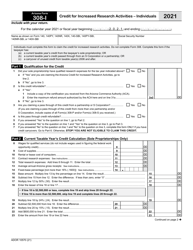

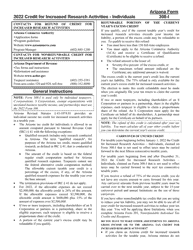

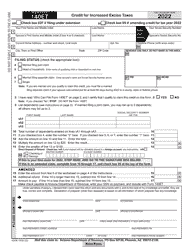

Arizona Form 308-I (ADOR10570)

for the current year.

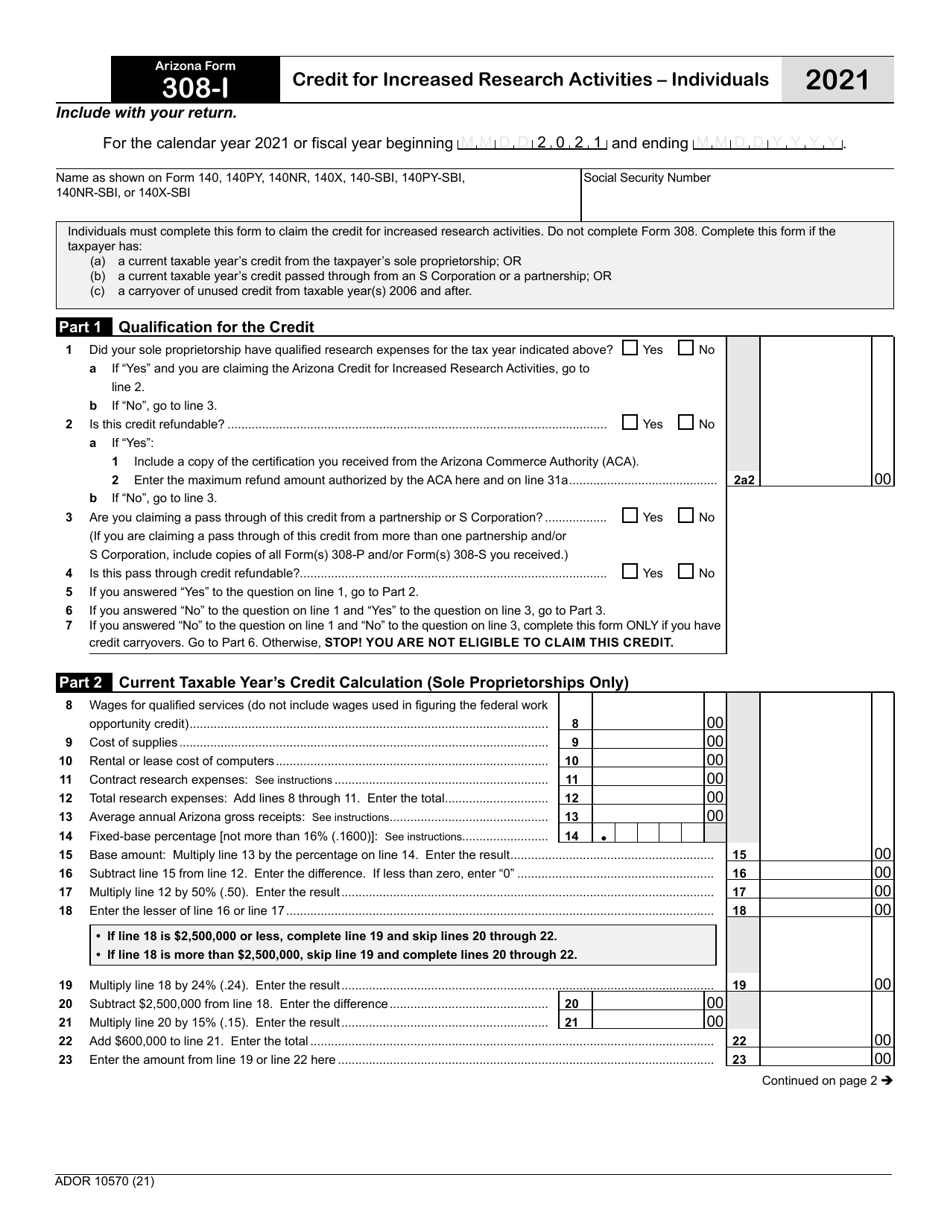

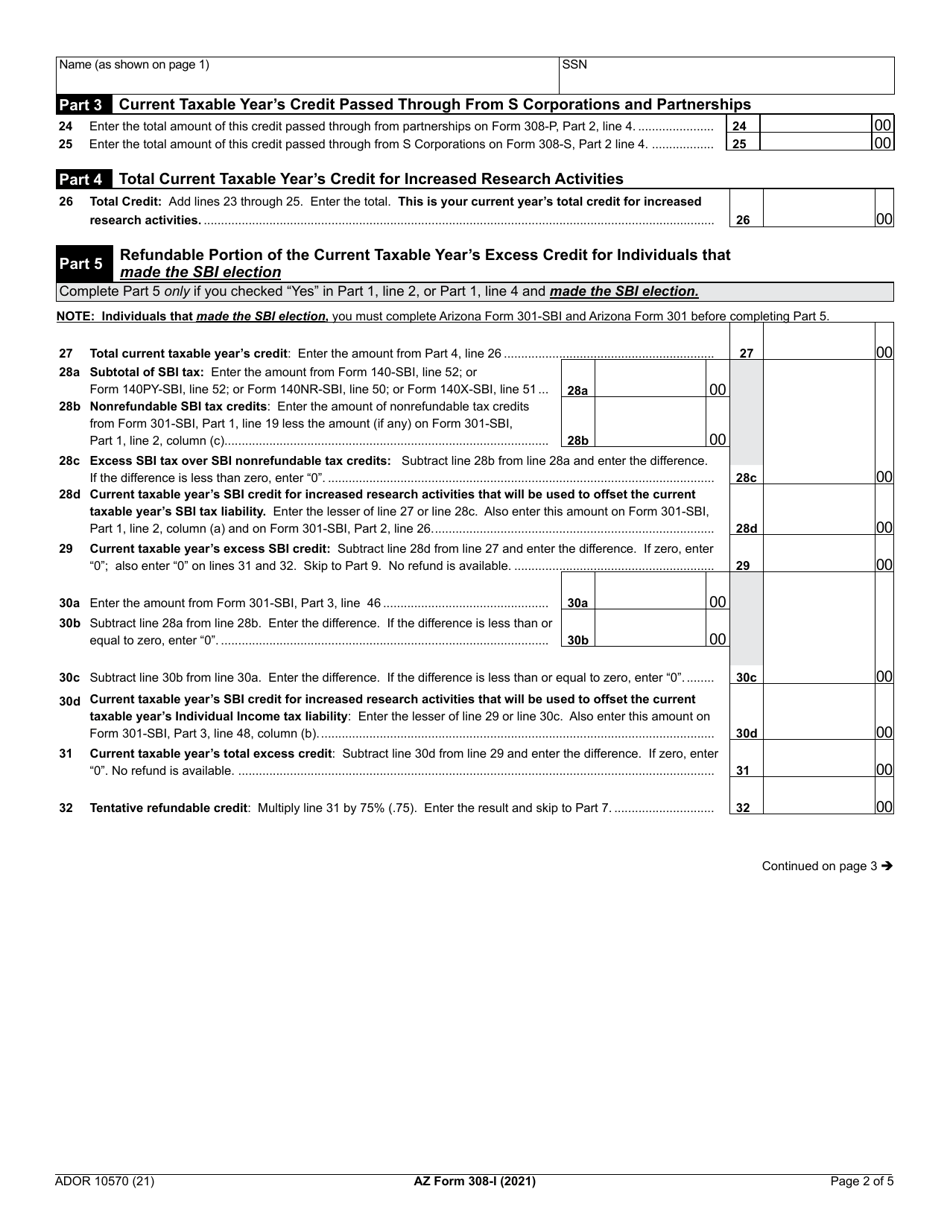

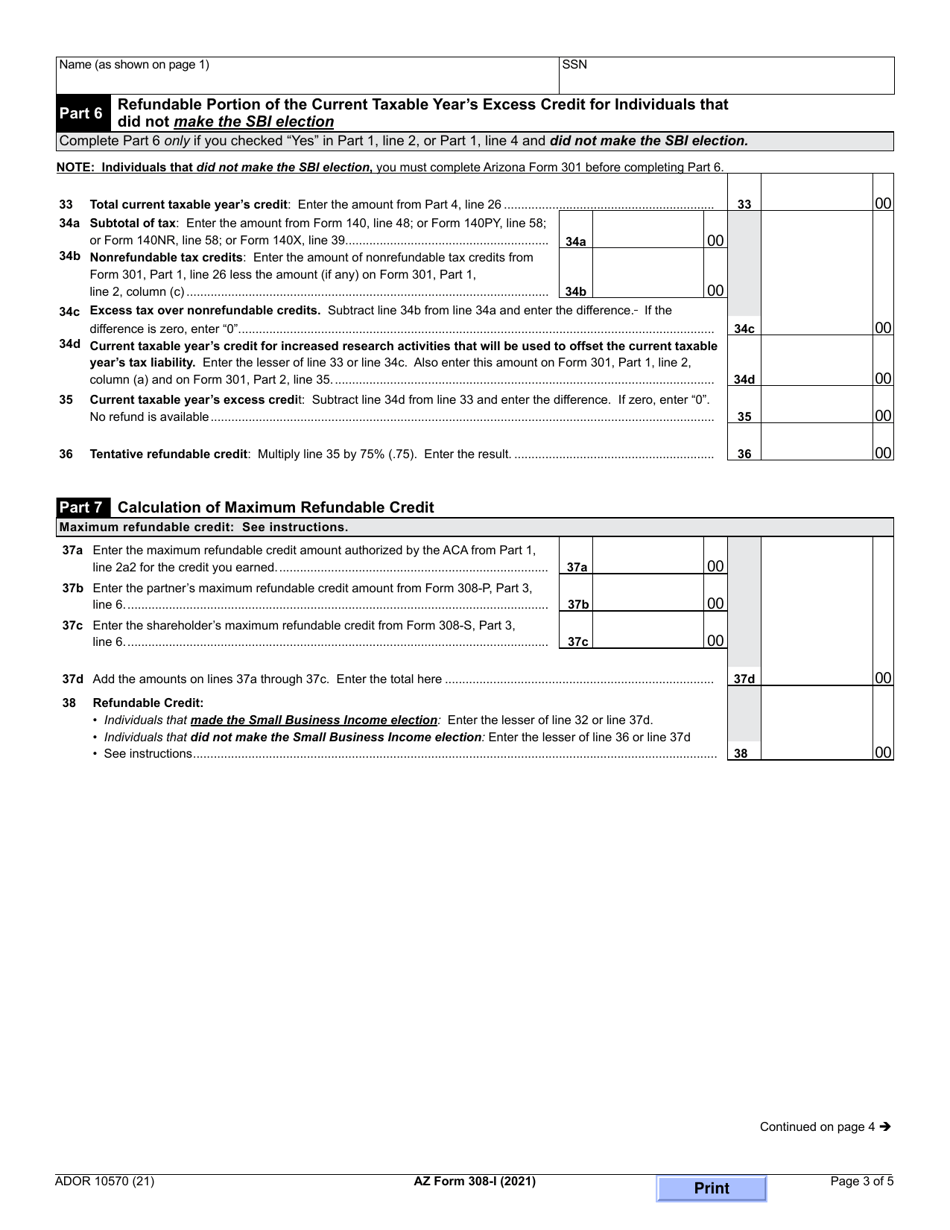

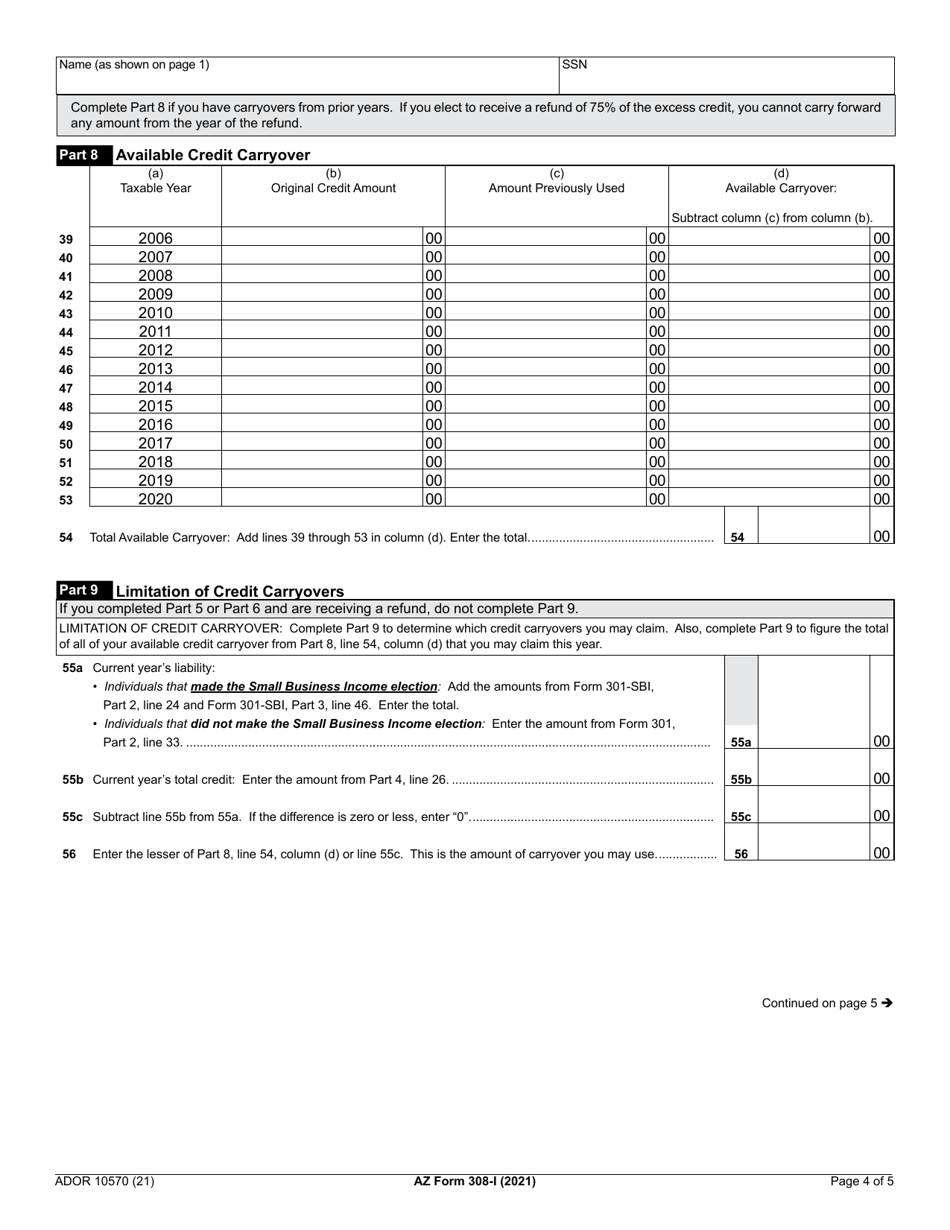

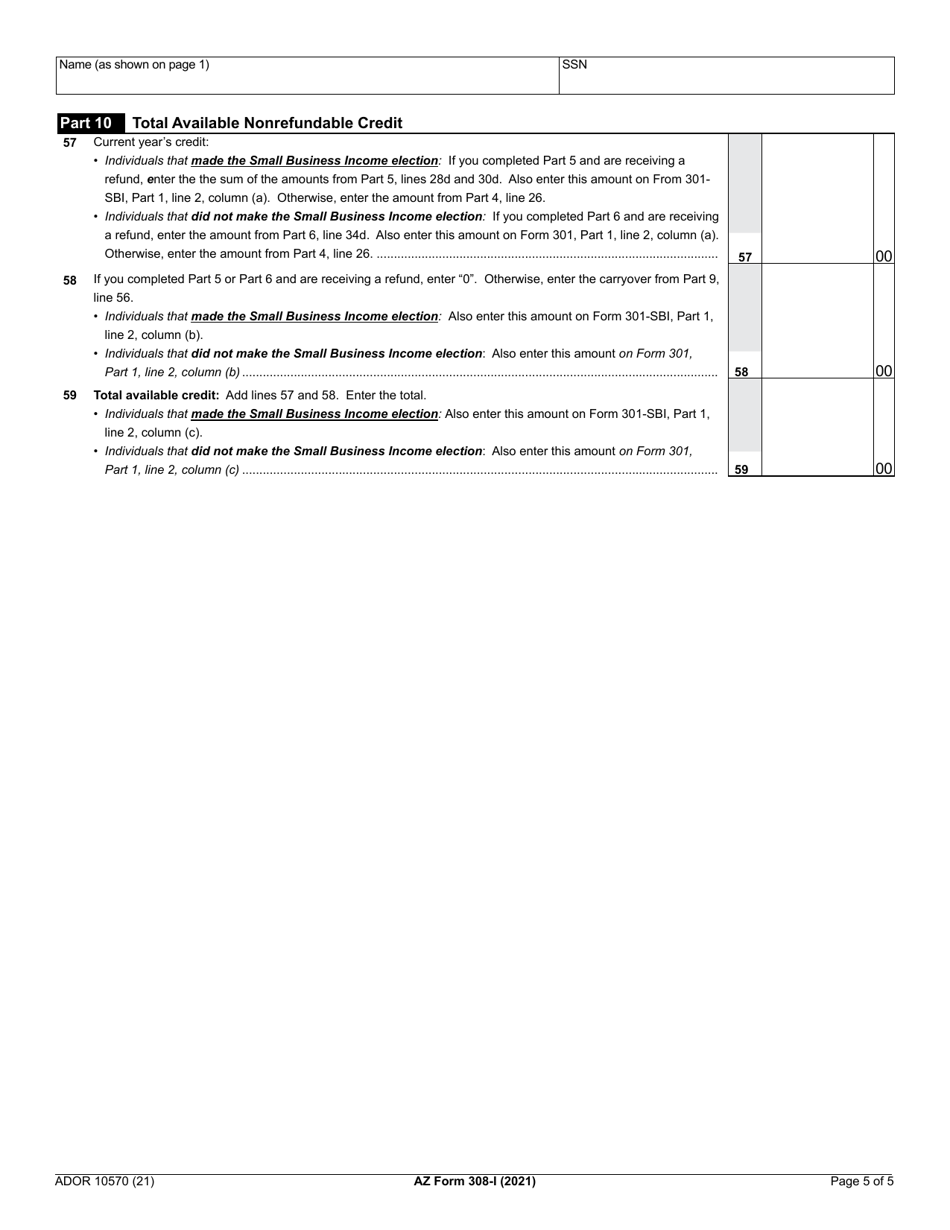

Arizona Form 308-I (ADOR10570) Credit for Increased Research Activities - Individuals - Arizona

What Is Arizona Form 308-I (ADOR10570)?

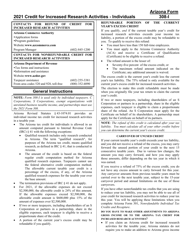

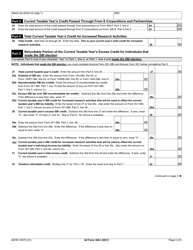

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 308-I?

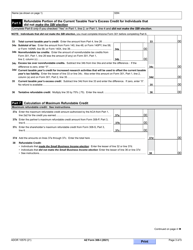

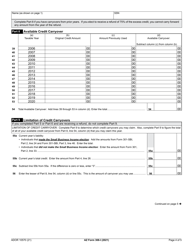

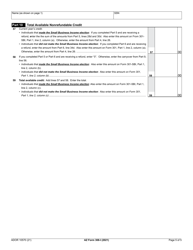

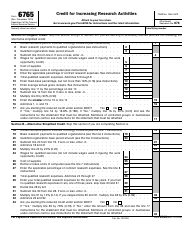

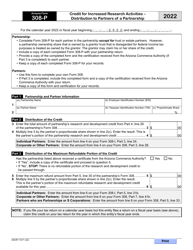

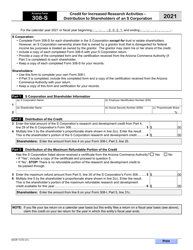

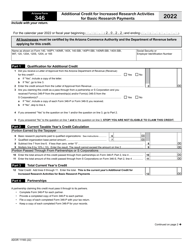

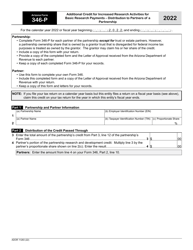

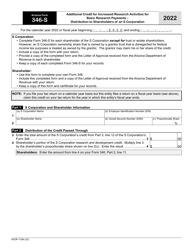

A: Arizona Form 308-I is a tax form used by individuals in Arizona to claim the Credit for Increased Research Activities.

Q: What is the Credit for Increased Research Activities?

A: The Credit for Increased Research Activities is a tax credit that allows individuals to claim a percentage of qualified research expenses they incurred in Arizona.

Q: How do I qualify for the Credit for Increased Research Activities?

A: To qualify for the Credit for Increased Research Activities, you must have incurred qualified research expenses in Arizona and meet certain criteria set by the Arizona Department of Revenue.

Q: What are qualified research expenses?

A: Qualified research expenses include expenses incurred for research and experimental activities conducted in Arizona, such as wages, supplies, and contract research costs.

Q: When is the deadline to file Arizona Form 308-I?

A: The deadline to file Arizona Form 308-I is typically the same as the deadline to file your state income tax return, which is usually April 15th.

Q: Is the Credit for Increased Research Activities available to non-residents of Arizona?

A: No, the Credit for Increased Research Activities is only available to individuals who are residents of Arizona.

Q: Can I claim the Credit for Increased Research Activities on my federal tax return?

A: No, the Credit for Increased Research Activities is a state tax credit and can only be claimed on your Arizona state tax return.

Q: Can I carry forward any unused credit to future years?

A: Yes, if the amount of the Credit for Increased Research Activities exceeds your tax liability, you can carry forward the unused credit for up to five years.

Q: Are there any other tax credits available in Arizona?

A: Yes, Arizona offers various tax credits, such as the Credit for Solar Energy Devices and the Credit for Donations Made to School Tuition Organizations.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 308-I (ADOR10570) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.