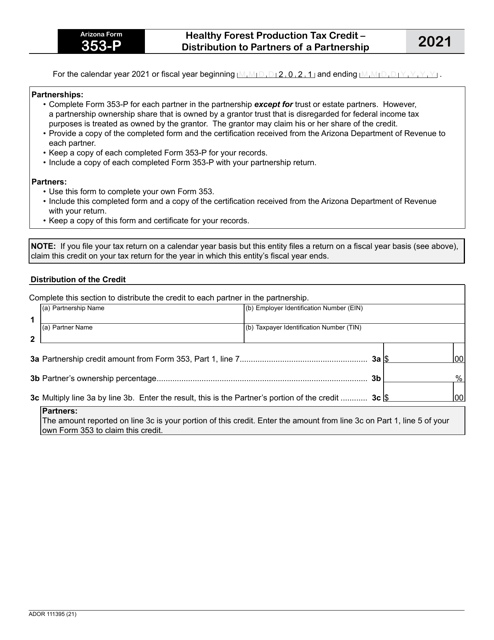

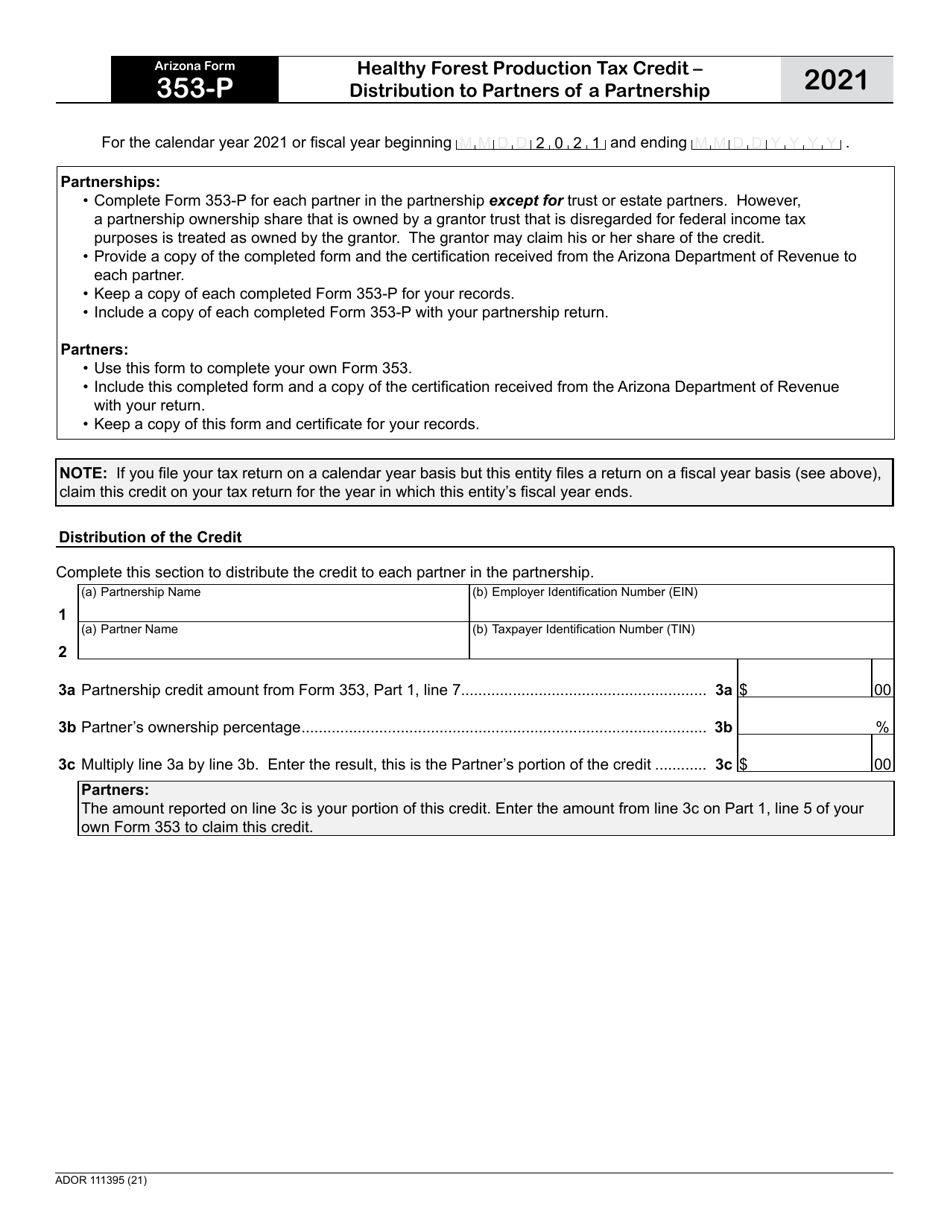

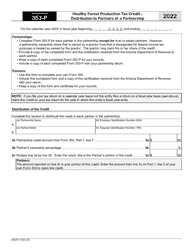

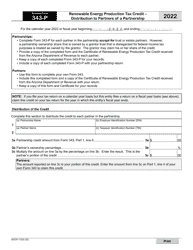

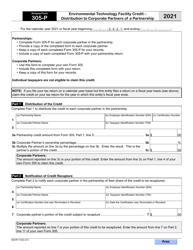

Arizona Form 335-P (ADOR111395) Healthy Forest Production Tax Credit - Distribution to Partners of a Partnership - Arizona

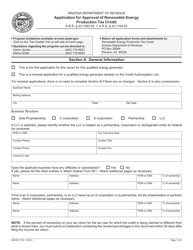

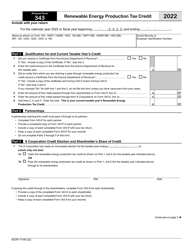

What Is Arizona Form 335-P (ADOR111395)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 335-P?

A: Arizona Form 335-P is a tax form used to claim the Healthy Forest Production Tax Credit for distribution to partners of a partnership in Arizona.

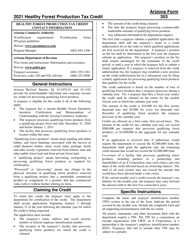

Q: What is the Healthy Forest Production Tax Credit?

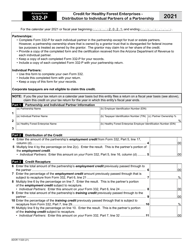

A: The Healthy Forest Production Tax Credit is a tax credit offered in Arizona to promote sustainable forest management and reduce the risk of wildfires.

Q: Who can use Arizona Form 335-P?

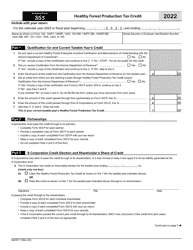

A: Partnerships in Arizona that qualify for the Healthy Forest Production Tax Credit can use Arizona Form 335-P.

Q: What is the purpose of distributing the tax credit to partners of a partnership?

A: Distributing the tax credit allows each partner in a partnership to claim their share of the Healthy Forest Production Tax Credit on their individual tax returns.

Form Details:

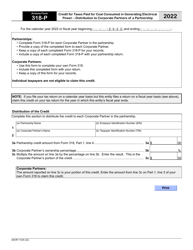

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 335-P (ADOR111395) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.