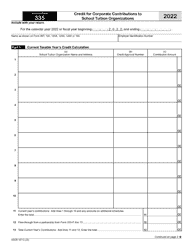

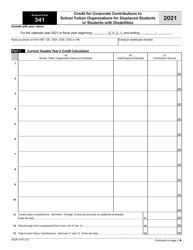

This version of the form is not currently in use and is provided for reference only. Download this version of

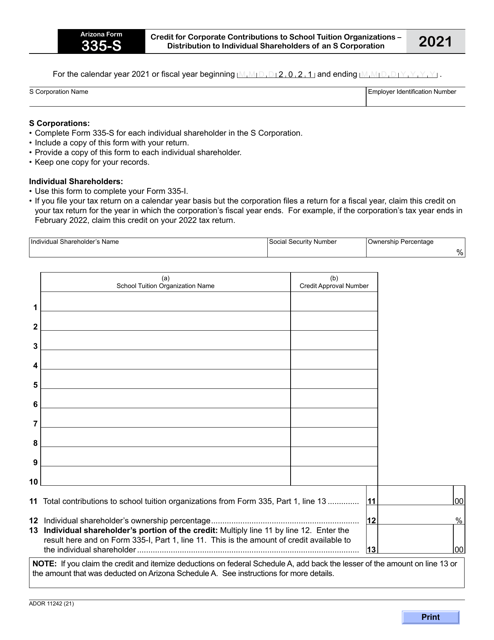

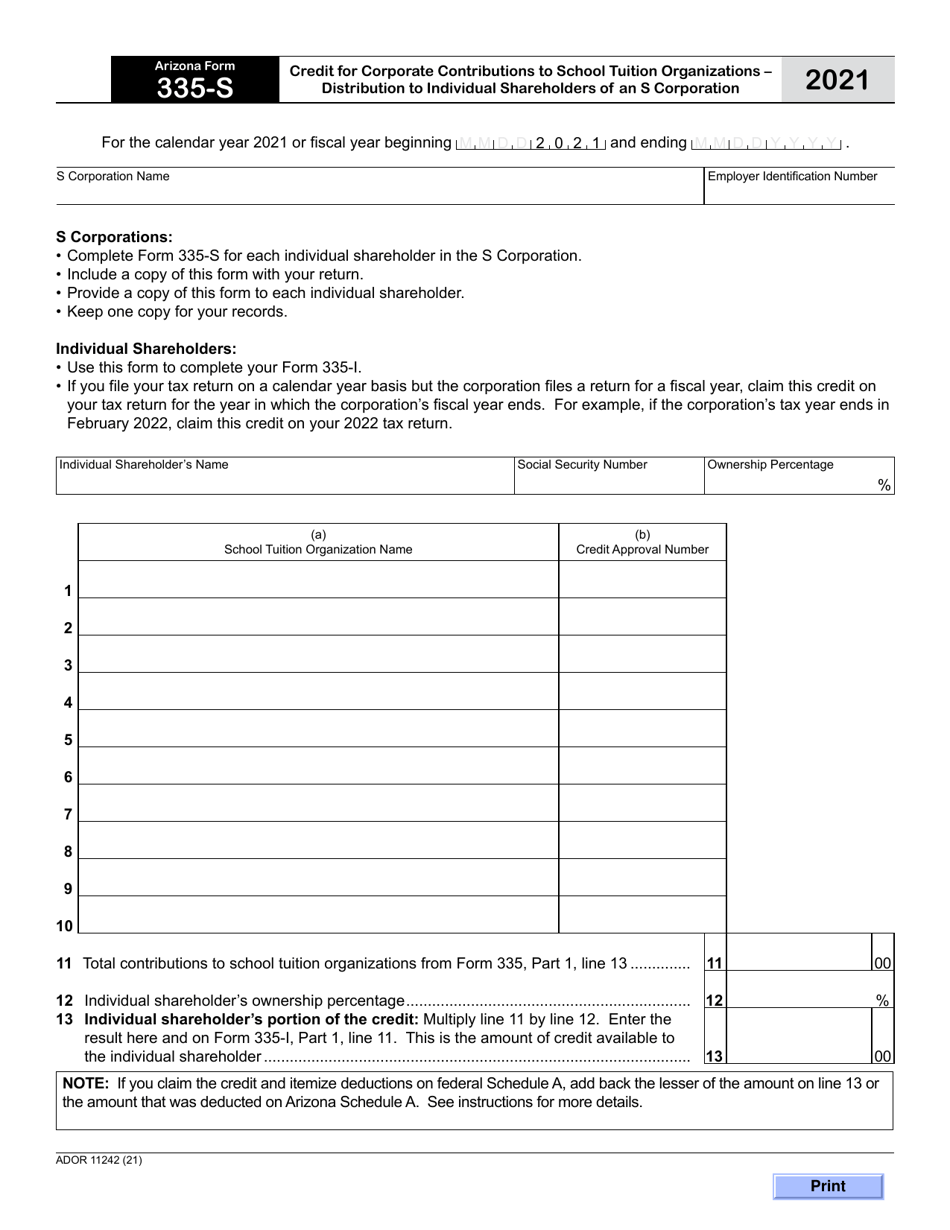

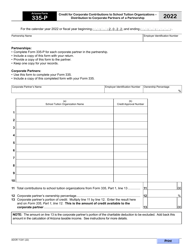

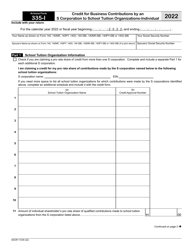

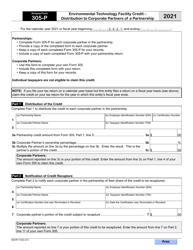

Arizona Form 335-S (ADOR11242)

for the current year.

Arizona Form 335-S (ADOR11242) Credit for Corporate Contributions to School Tuition Organizations - Distribution to Individual Shareholders of an S Corporation - Arizona

What Is Arizona Form 335-S (ADOR11242)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

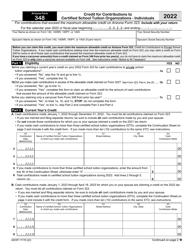

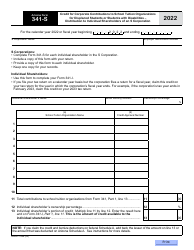

Q: What is Arizona Form 335-S?

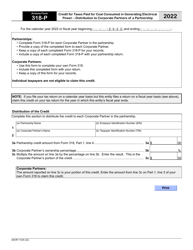

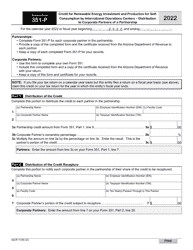

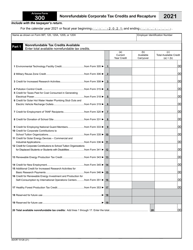

A: Arizona Form 335-S is a form used to claim the Credit for Corporate Contributions to School Tuition Organizations.

Q: Who can use Arizona Form 335-S?

A: Arizona Form 335-S is used by individuals who are shareholders of an S Corporation.

Q: What is the purpose of the form?

A: The purpose of Arizona Form 335-S is to report the distribution of corporate contributions to school tuition organizations to individual shareholders of an S Corporation.

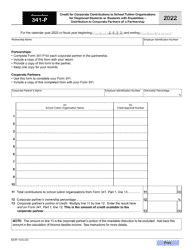

Q: What is the Credit for Corporate Contributions to School Tuition Organizations?

A: The Credit for Corporate Contributions to School Tuition Organizations is a tax credit available to individuals who receive distributions from an S Corporation as a result of the corporation's contributions to qualifying school tuition organizations.

Q: What is a School Tuition Organization?

A: A School Tuition Organization is a charitable organization that uses contributions to provide scholarships or grants to K-12 students attending qualified private schools in Arizona.

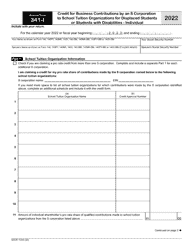

Q: Are there any eligibility requirements to claim this credit?

A: Yes, the individual shareholder must meet certain eligibility requirements to be eligible to claim the Credit for Corporate Contributions to School Tuition Organizations, as outlined by the Arizona Department of Revenue.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 335-S (ADOR11242) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.