This version of the form is not currently in use and is provided for reference only. Download this version of

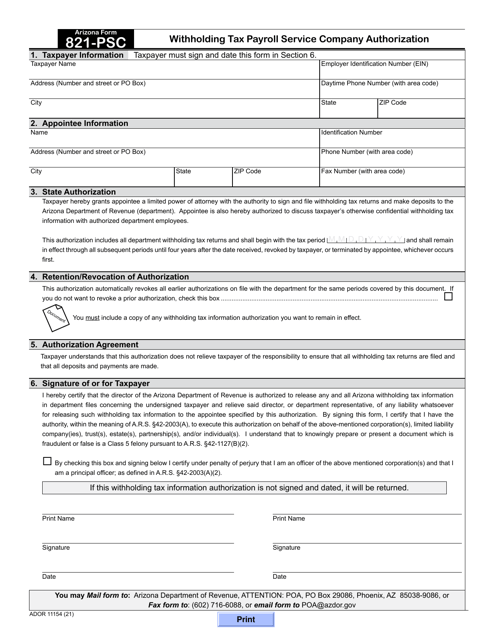

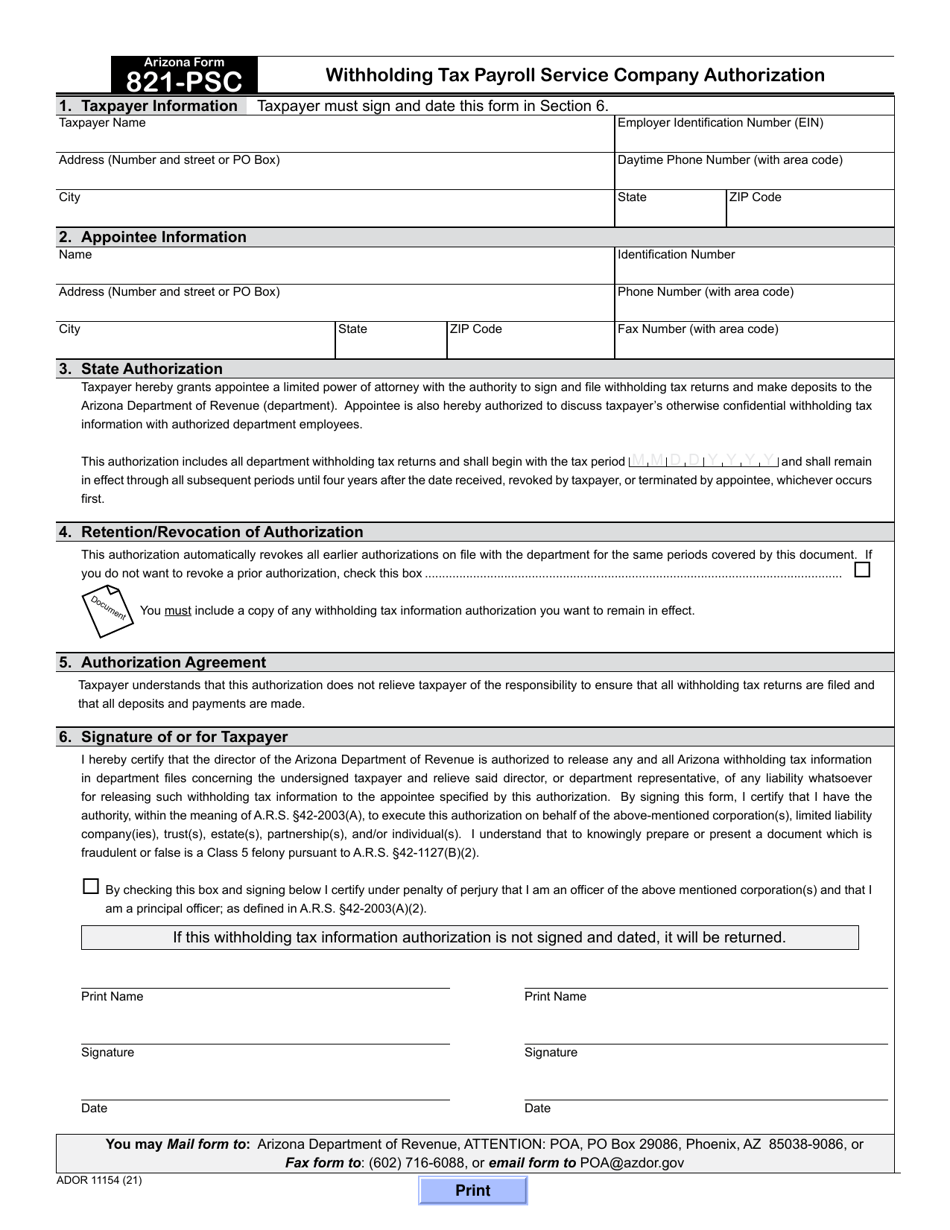

Arizona Form 821-PSC (ADOR11154)

for the current year.

Arizona Form 821-PSC (ADOR11154) Withholding Tax Payroll Service Company Authorization - Arizona

What Is Arizona Form 821-PSC (ADOR11154)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 821-PSC?

A: Arizona Form 821-PSC is a form used for Withholding TaxPayroll Service Company Authorization in Arizona.

Q: What is the purpose of Arizona Form 821-PSC?

A: The purpose of Arizona Form 821-PSC is to authorize a payroll service company to file withholding tax returns on behalf of an employer.

Q: Who needs to fill out Arizona Form 821-PSC?

A: Employers in Arizona who want to authorize a payroll service company to file withholding tax returns on their behalf need to fill out this form.

Q: Is there a deadline for filing Arizona Form 821-PSC?

A: There is no specific deadline mentioned for filing Arizona Form 821-PSC. However, it is recommended to submit the form as soon as possible.

Q: What information is required on Arizona Form 821-PSC?

A: Arizona Form 821-PSC requires information such as the employer's name, contact information, employer identification number, and the payroll service company's name and contact information.

Q: Is Arizona Form 821-PSC mandatory?

A: No, Arizona Form 821-PSC is not mandatory. It is optional for employers who want to authorize a payroll service company to file withholding tax returns on their behalf.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 821-PSC (ADOR11154) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.