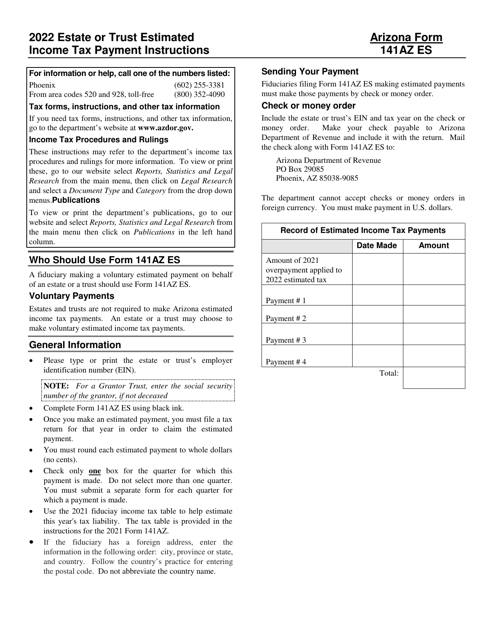

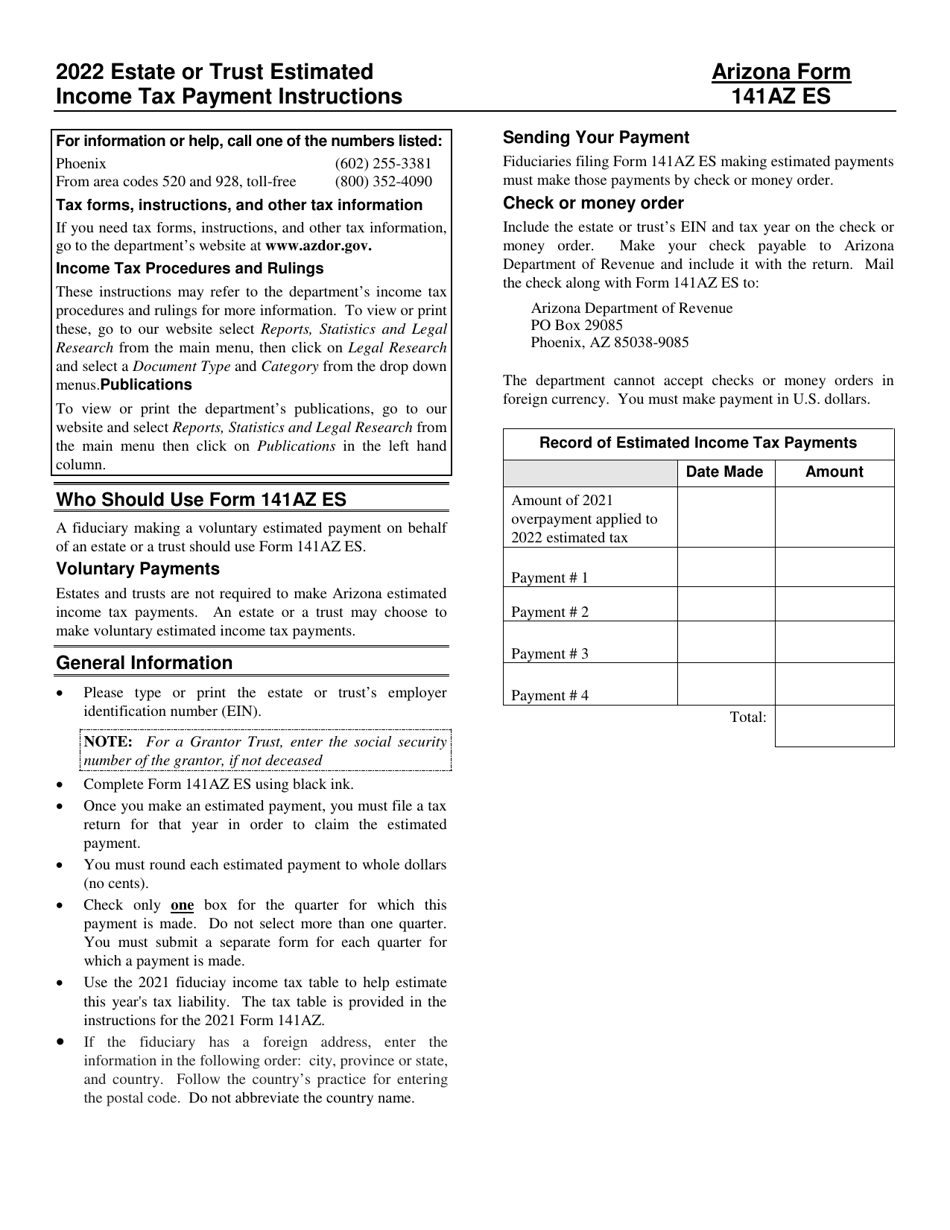

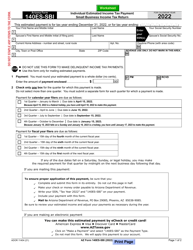

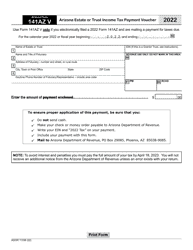

Instructions for Arizona Form 141AZ ES, ADOR11135 Estate or Trust Estimated Income Tax Payment - Arizona

This document contains official instructions for Arizona Form 141AZ ES , and Form ADOR11135 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 141AZ ES (ADOR11135) is available for download through this link.

FAQ

Q: What is Arizona Form 141AZ ES?

A: Arizona Form 141AZ ES is a tax form for making estimated income tax payments for estates or trusts in Arizona.

Q: Who needs to file Arizona Form 141AZ ES?

A: Estates or trusts that expect to owe Arizona income tax and meet certain requirements are required to file this form.

Q: What is the purpose of Arizona Form 141AZ ES?

A: The purpose of this form is to calculate and pay estimated income tax payments for estates or trusts in Arizona.

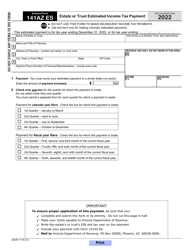

Q: What are estimated income tax payments?

A: Estimated income tax payments are quarterly payments made by estates or trusts to prepay their expected tax liability for the year.

Q: How often do I need to file Arizona Form 141AZ ES?

A: Arizona Form 141AZ ES is filed quarterly, with payment due by the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Q: Are there any penalties for not filing or paying Arizona Form 141AZ ES?

A: Yes, there are penalties for not filing or paying Arizona Form 141AZ ES on time. It is important to meet the deadlines and pay the correct amount to avoid penalties.

Q: How do I calculate the estimated income tax payment?

A: The instructions for Arizona Form 141AZ ES provide a worksheet to help you calculate the estimated income tax payment. Follow the instructions carefully to ensure you calculate the correct amount.

Q: What should I do if I have questions about Arizona Form 141AZ ES?

A: If you have questions about Arizona Form 141AZ ES or need assistance with completing the form, you can contact the Arizona Department of Revenue for guidance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.