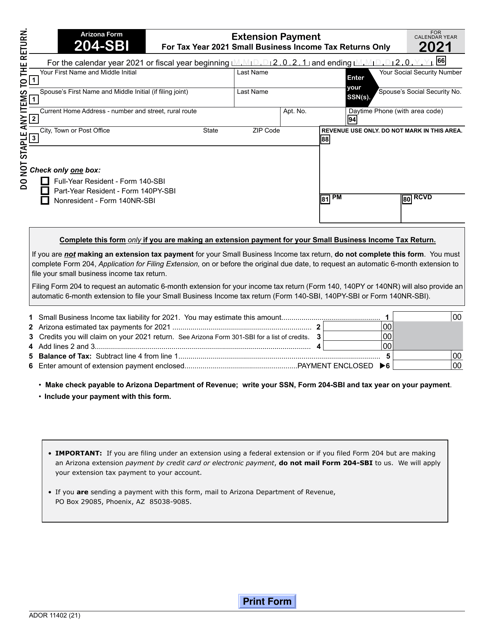

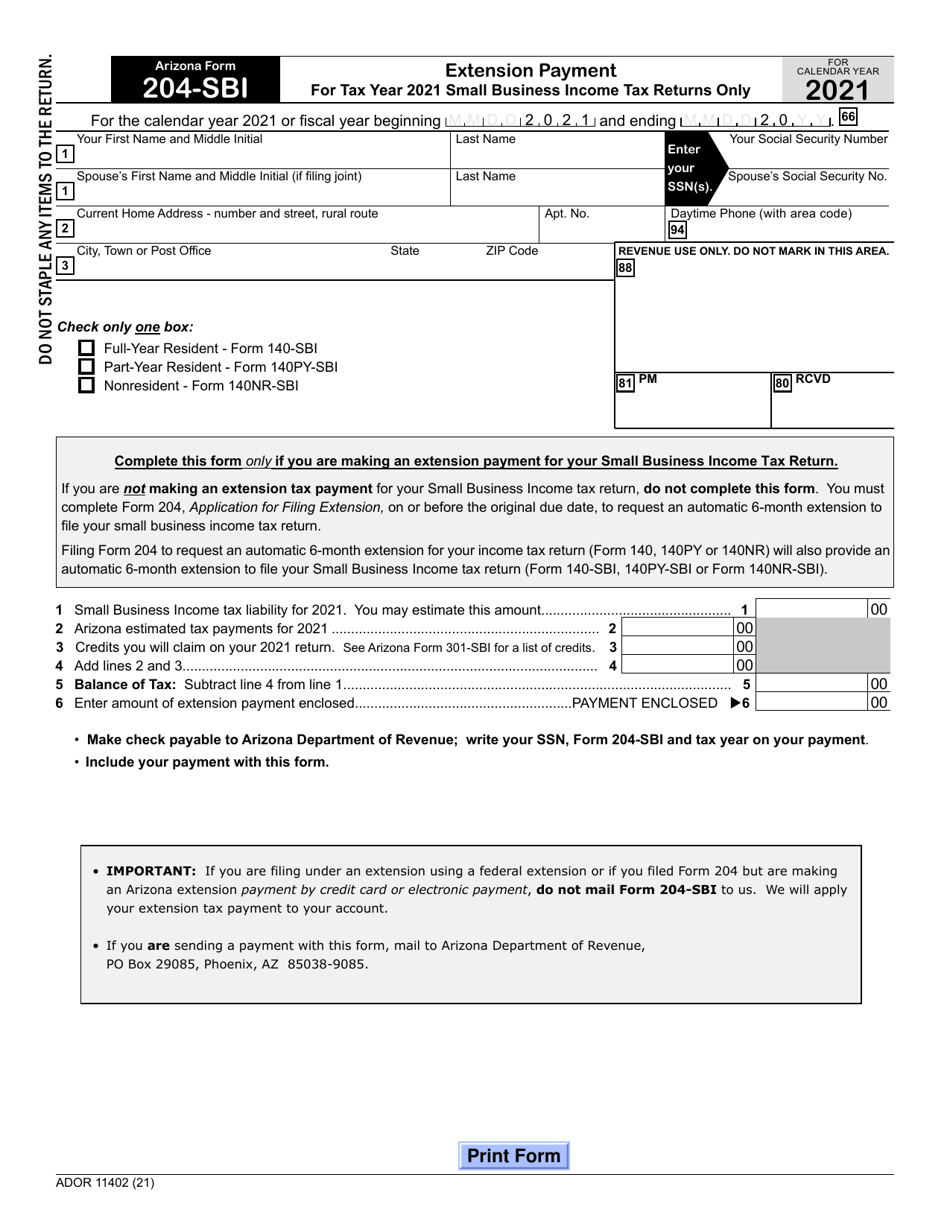

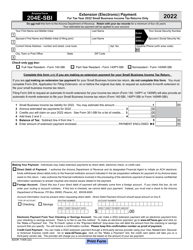

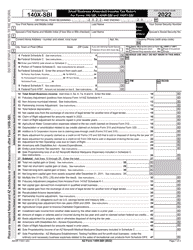

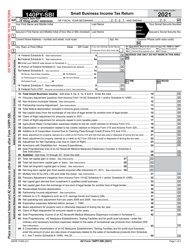

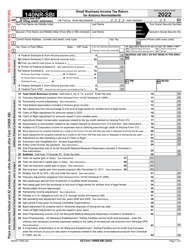

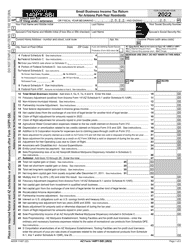

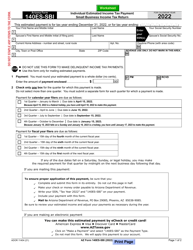

Arizona Form 204-SBI (ADOR11402) Extension Payment - Small Business Income Tax Returns Only - Arizona

What Is Arizona Form 204-SBI (ADOR11402)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 204-SBI?

A: Arizona Form 204-SBI is an extension payment form for small business income tax returns in Arizona.

Q: Who needs to use Arizona Form 204-SBI?

A: Only small business owners in Arizona who need an extension for their income tax returns should use Arizona Form 204-SBI.

Q: What is the purpose of Arizona Form 204-SBI?

A: The purpose of Arizona Form 204-SBI is to request an extension for filing small business income tax returns in Arizona.

Q: Is Arizona Form 204-SBI applicable for individuals or corporations?

A: Arizona Form 204-SBI is specifically designed for small businesses, not individuals or corporations.

Q: What should be included with Arizona Form 204-SBI?

A: When submitting Arizona Form 204-SBI, you should include the payment for the amount of tax owed.

Q: What is the deadline for filing Arizona Form 204-SBI?

A: The deadline for filing Arizona Form 204-SBI is the same as the deadline for filing the small business income tax returns in Arizona, typically April 15th.

Q: What happens if I don't file Arizona Form 204-SBI?

A: If you fail to file Arizona Form 204-SBI and do not file your small business income tax returns on time, you may face penalties and interest charges.

Q: Can I request multiple extensions using Arizona Form 204-SBI?

A: No, Arizona Form 204-SBI can only be used to request a single extension for filing small business income tax returns in Arizona.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 204-SBI (ADOR11402) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.