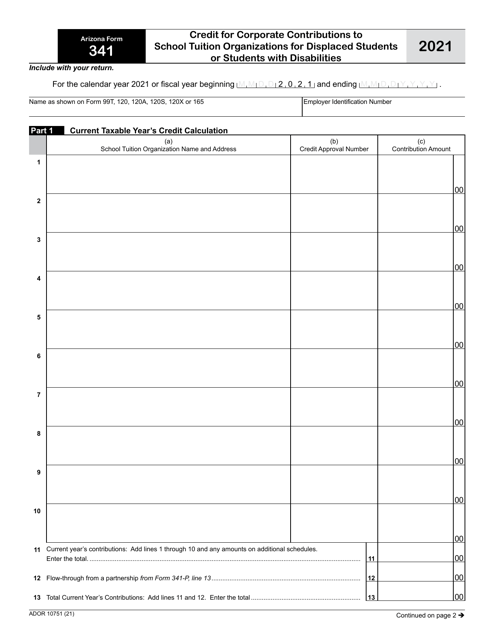

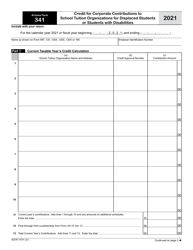

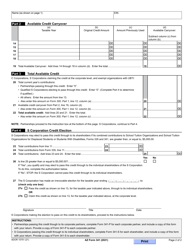

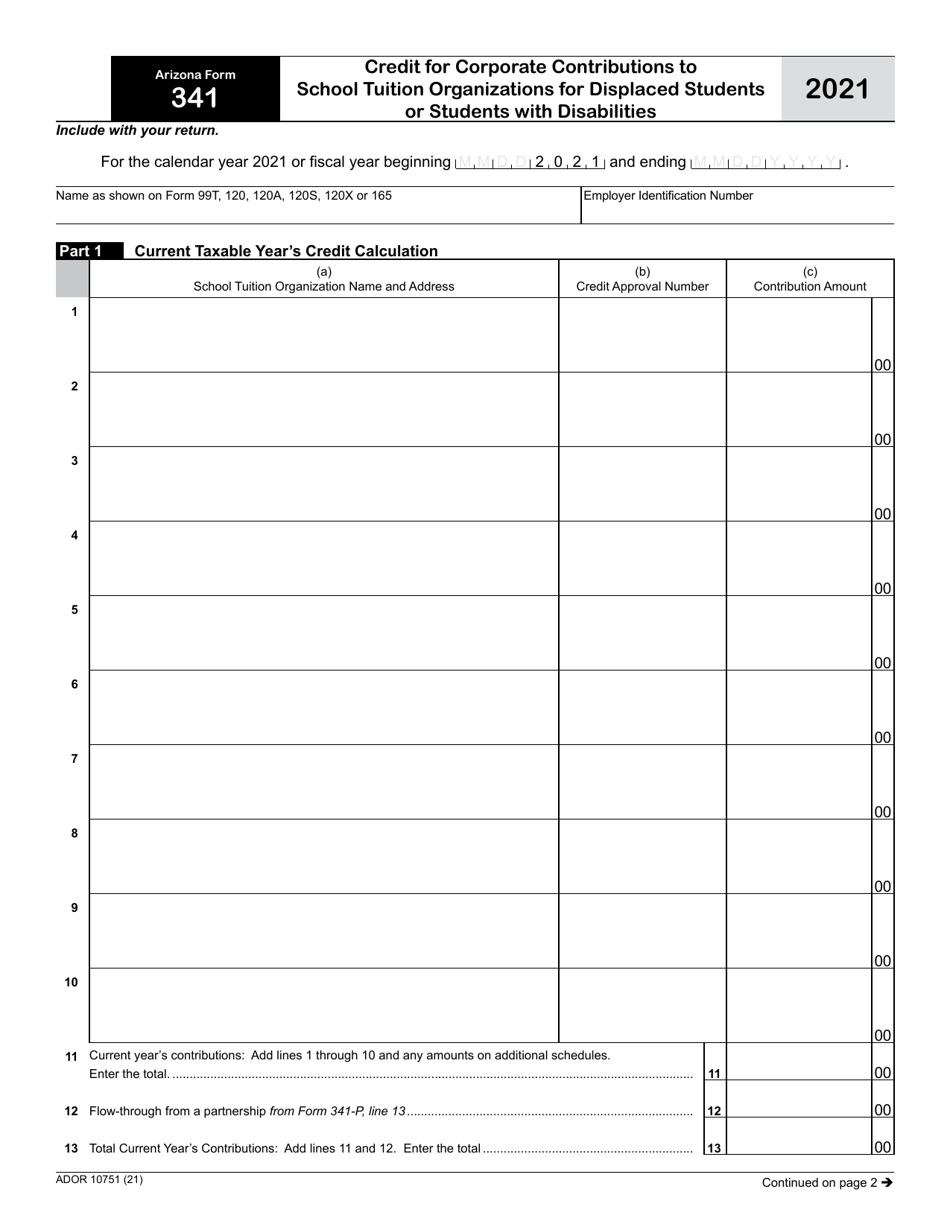

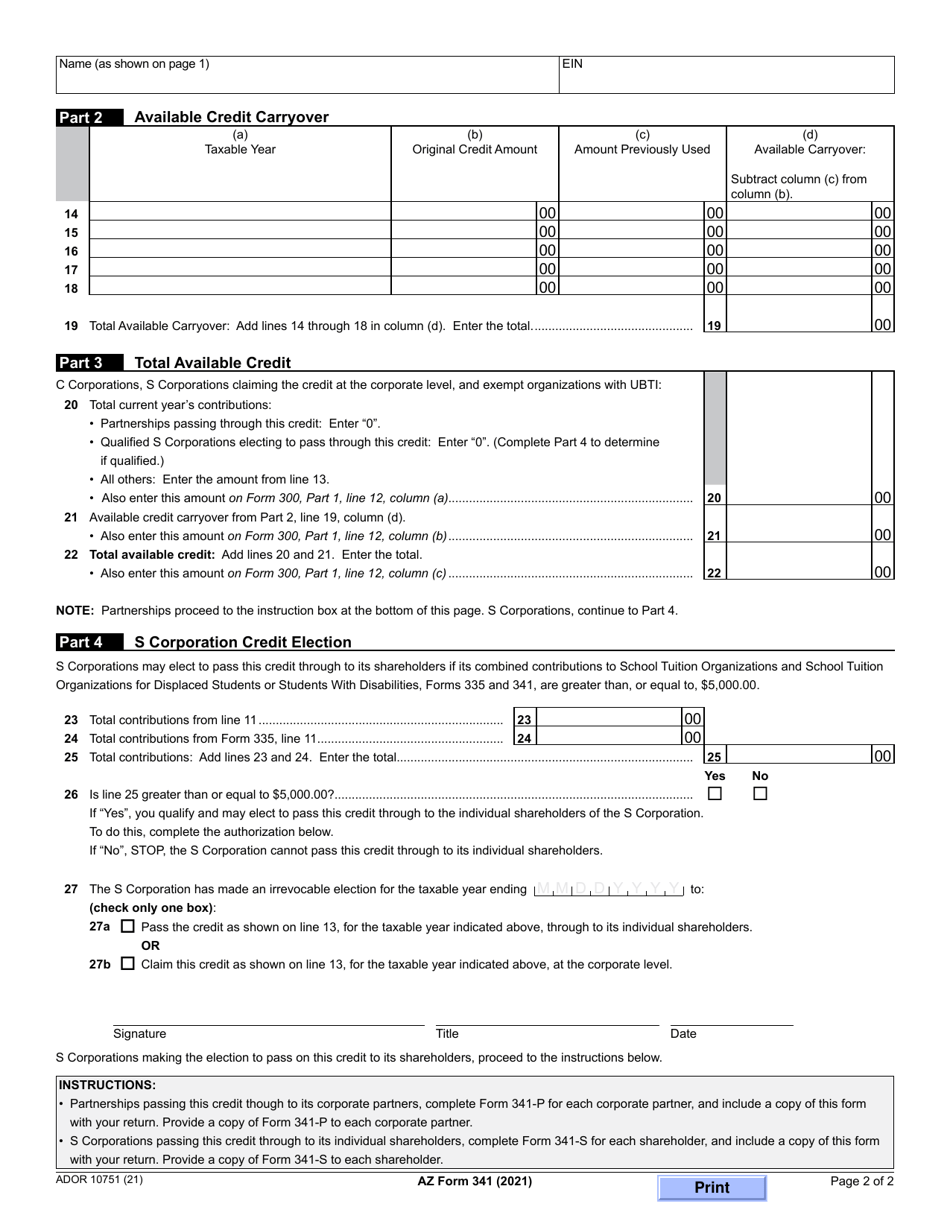

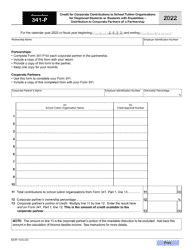

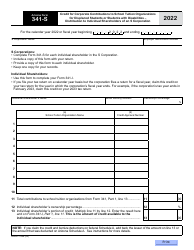

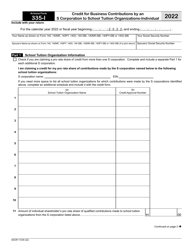

Arizona Form 341 (ADOR10751) Credit for Corporate Contributions to School Tuition Organizations for Displaced Students or Students With Disabilities - Arizona

What Is Arizona Form 341 (ADOR10751)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 341 (ADOR10751)?

A: Arizona Form 341 (ADOR10751) is a form for claiming the Credit for Corporate Contributions to School Tuition Organizations for Displaced Students or Students With Disabilities in Arizona.

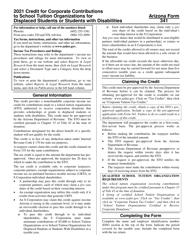

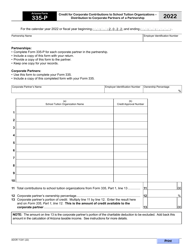

Q: Who is eligible for the Credit for Corporate Contributions to School Tuition Organizations?

A: Corporations that make contributions to School Tuition Organizations in Arizona for displaced students or students with disabilities may be eligible for this credit.

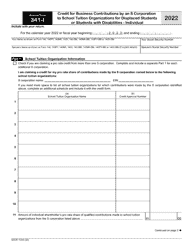

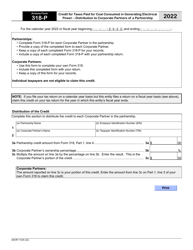

Q: What is the purpose of the Credit for Corporate Contributions to School Tuition Organizations?

A: The purpose of this credit is to provide financial support to School Tuition Organizations that help displaced students or students with disabilities.

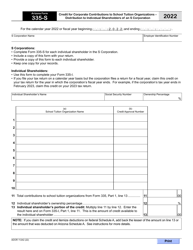

Q: What is a School Tuition Organization?

A: A School Tuition Organization is a nonprofit organization that uses contributions to provide scholarships or financial aid to students attending private schools in Arizona.

Q: How much credit can corporations claim?

A: Corporations can claim a credit equal to 100% of their contributions to School Tuition Organizations, up to the annual maximum limit set by the Arizona Department of Revenue.

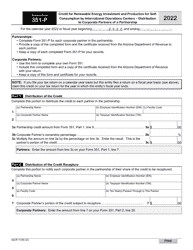

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the credit, such as the annual maximum limit and the requirement to make contributions to qualified School Tuition Organizations.

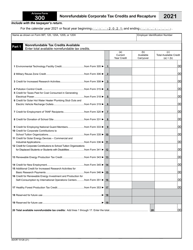

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 341 (ADOR10751) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.