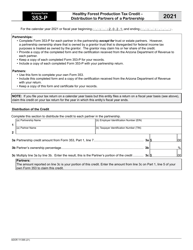

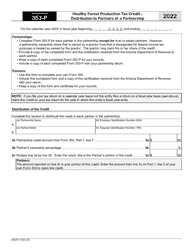

This version of the form is not currently in use and is provided for reference only. Download this version of

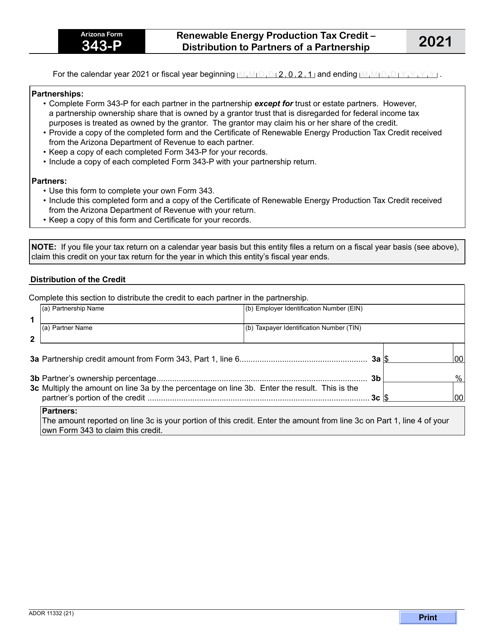

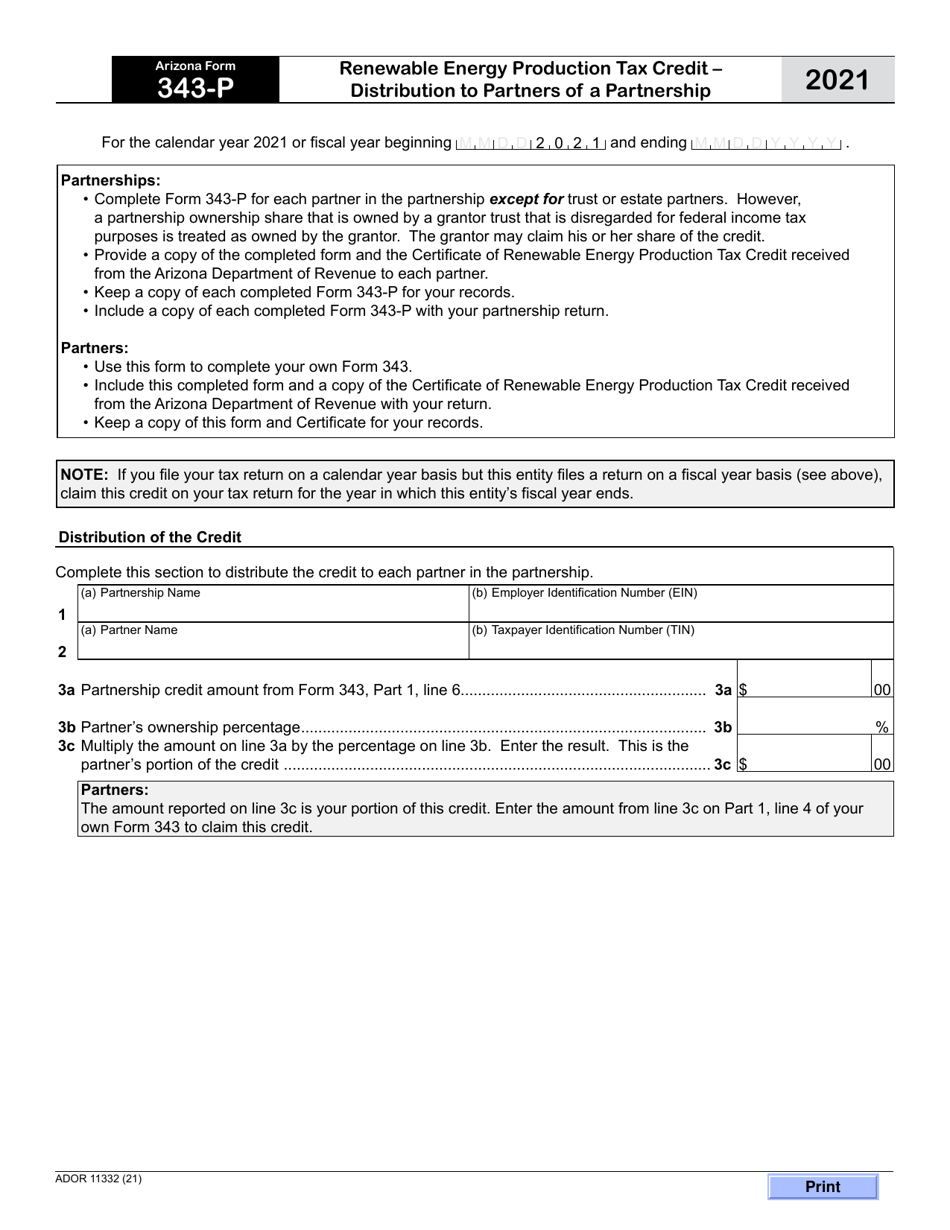

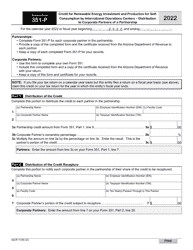

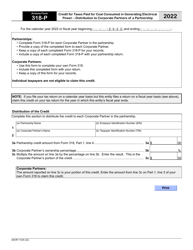

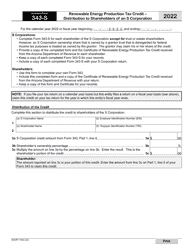

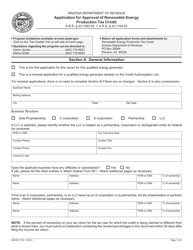

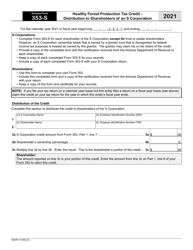

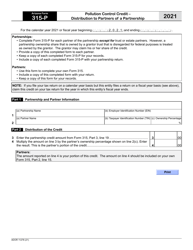

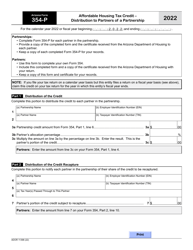

Arizona Form 343-P (ADOR11332)

for the current year.

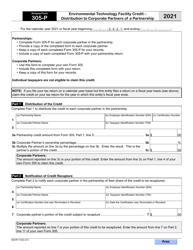

Arizona Form 343-P (ADOR11332) Renewable Energy Production Tax Credit - Distribution to Partners of a Partnership - Arizona

What Is Arizona Form 343-P (ADOR11332)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 343-P?

A: Arizona Form 343-P is a form used to claim the Renewable Energy Production Tax Credit - Distribution to Partners of a Partnership in Arizona.

Q: What is the purpose of Arizona Form 343-P?

A: The purpose of Arizona Form 343-P is to claim the tax credit for renewable energy production and distribute it to partners of a partnership in Arizona.

Q: Who can use Arizona Form 343-P?

A: Arizona Form 343-P can be used by partners of a partnership who are eligible for the Renewable Energy Production Tax Credit.

Q: What information is required to complete Arizona Form 343-P?

A: To complete Arizona Form 343-P, you will need information about the partnership, the renewable energy project, and the allocated tax credit for each partner.

Q: When is the deadline to file Arizona Form 343-P?

A: The deadline to file Arizona Form 343-P is typically April 15th of the following year, unless an extension has been granted.

Q: Is Arizona Form 343-P for individuals or businesses?

A: Arizona Form 343-P is primarily for businesses, specifically partnerships that qualify for the Renewable Energy Production Tax Credit.

Q: Are there any other forms related to Arizona Form 343-P?

A: Yes, there are additional forms that may be required to support the information provided on Arizona Form 343-P, such as Form 300, Form 340, and Form 305.

Q: Can I e-file Arizona Form 343-P?

A: No, Arizona Form 343-P cannot be e-filed and must be submitted by mail to the Arizona Department of Revenue.

Q: What should I do if I have questions or need assistance with Arizona Form 343-P?

A: If you have questions or need assistance with Arizona Form 343-P, you can contact the Arizona Department of Revenue directly for guidance.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 343-P (ADOR11332) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.