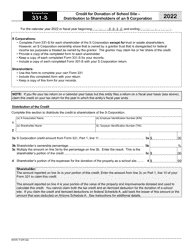

This version of the form is not currently in use and is provided for reference only. Download this version of

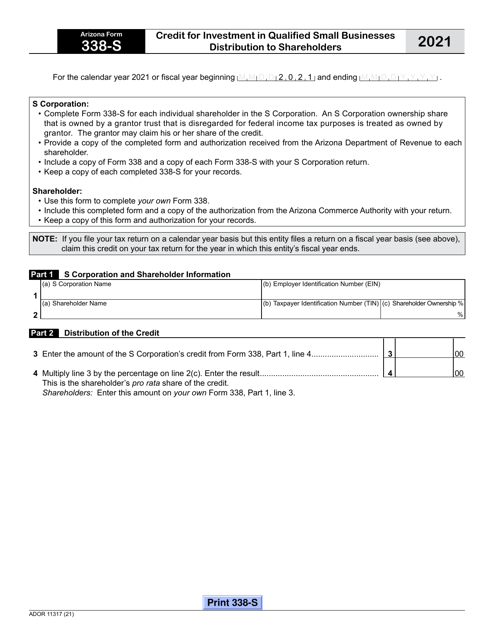

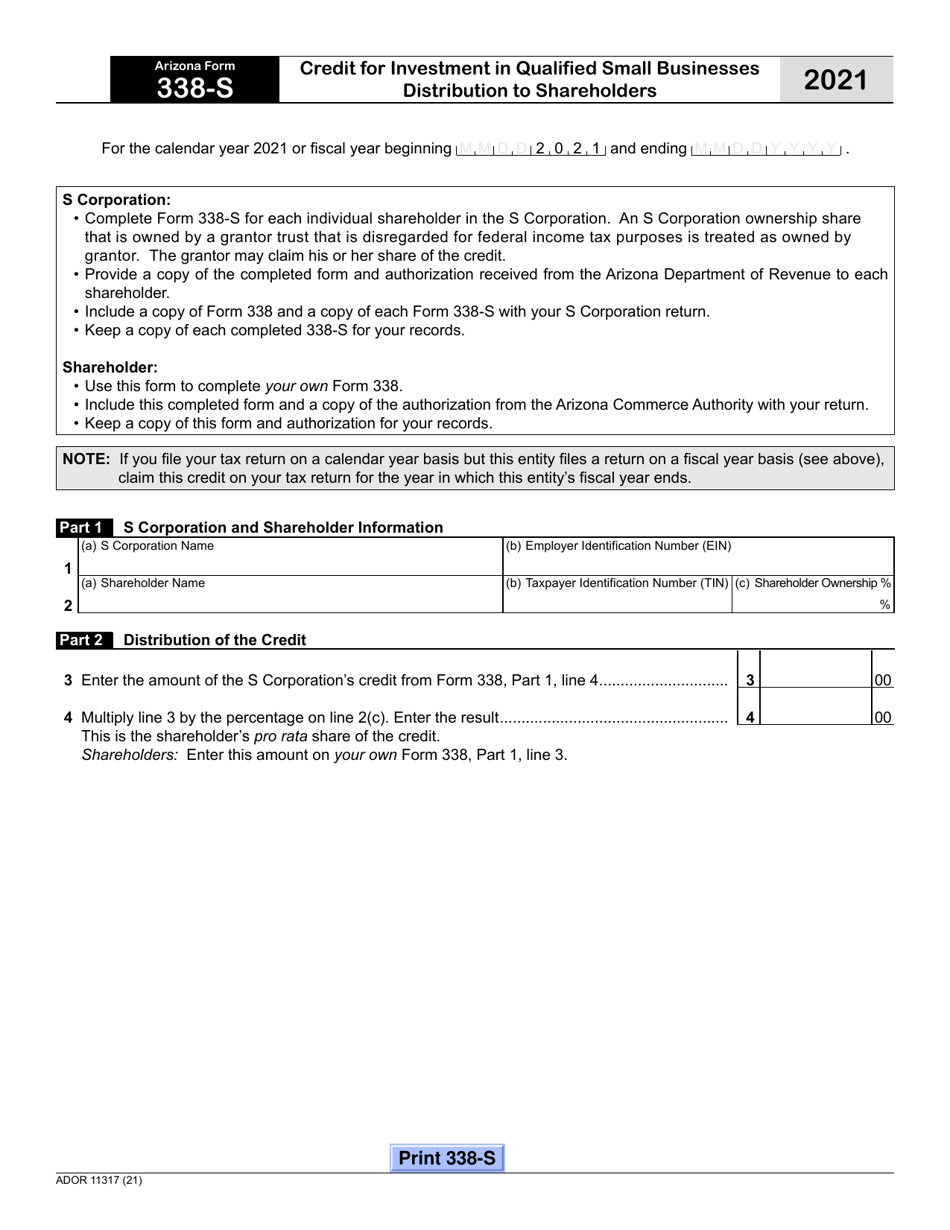

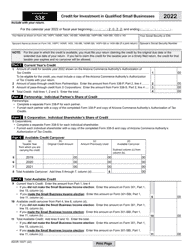

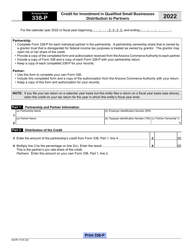

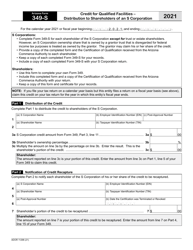

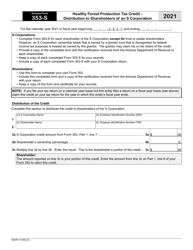

Arizona Form 338-S (ADOR11317)

for the current year.

Arizona Form 338-S (ADOR11317) Credit for Investment in Qualified Small Businesses Distribution to Shareholders - Arizona

What Is Arizona Form 338-S (ADOR11317)?

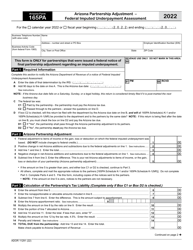

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 338-S?

A: Arizona Form 338-S is a tax form used to claim a Credit for Investment in Qualified Small Businesses Distribution to Shareholders in the state of Arizona.

Q: What is the purpose of Arizona Form 338-S?

A: The purpose of Arizona Form 338-S is to allow shareholders of qualified small businesses to claim a tax credit for their investment in those businesses.

Q: Who can use Arizona Form 338-S?

A: Shareholders of qualified small businesses in Arizona can use Arizona Form 338-S.

Q: What is the tax credit for investment in qualified small businesses?

A: The tax credit for investment in qualified small businesses allows shareholders to receive a credit against their Arizona state income tax liability.

Q: What is a qualified small business?

A: A qualified small business is a business that meets certain criteria specified by the state of Arizona, such as being a corporation or limited liability company engaged in specific industries.

Q: How much is the tax credit?

A: The tax credit for investment in qualified small businesses can be up to 10% of the investment made by the shareholder in the business.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the tax credit, such as a maximum credit amount and a maximum credit limit per taxpayer.

Q: What is the deadline for filing Arizona Form 338-S?

A: The deadline for filing Arizona Form 338-S is the same as the deadline for filing your Arizona state income tax return, typically April 15th.

Q: Is the tax credit refundable?

A: No, the tax credit for investment in qualified small businesses is non-refundable, meaning it can only be used to offset your Arizona state income tax liability and cannot result in a refund if the credit exceeds the tax liability.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 338-S (ADOR11317) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.