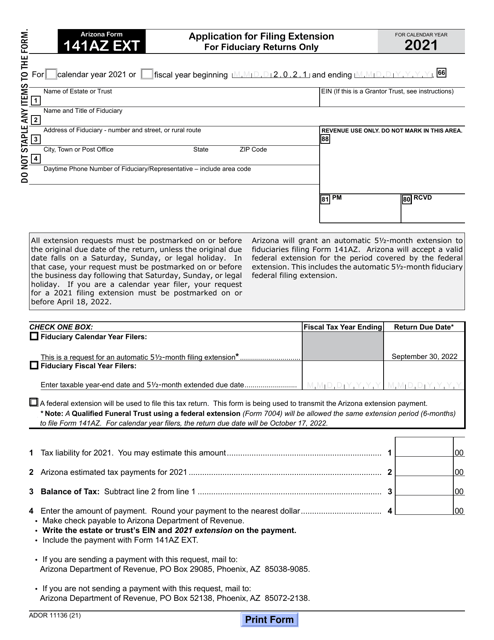

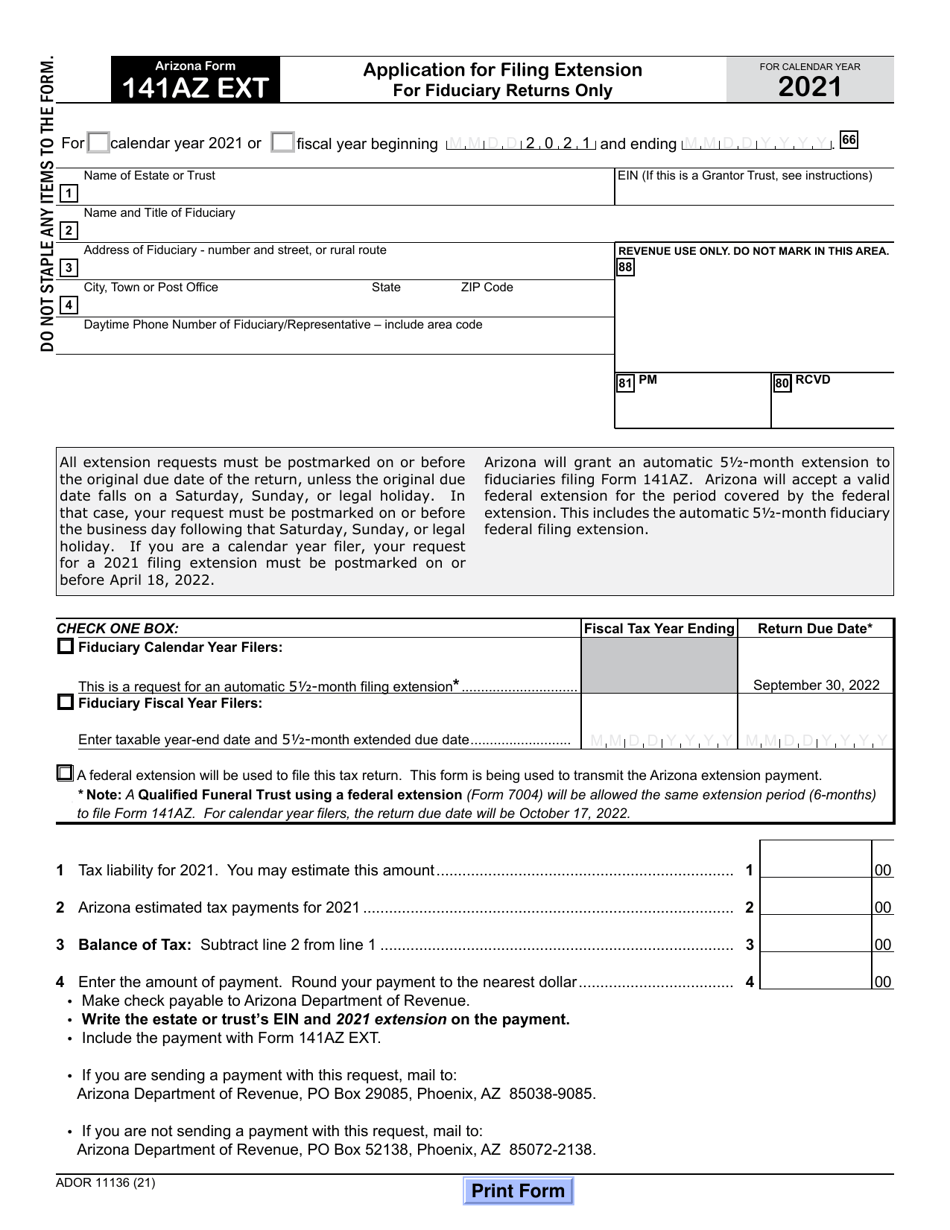

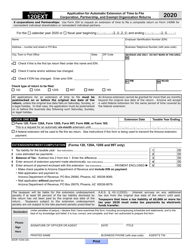

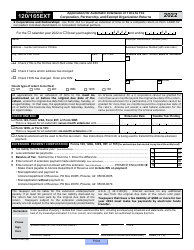

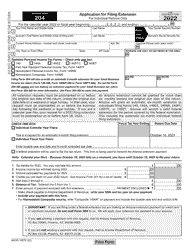

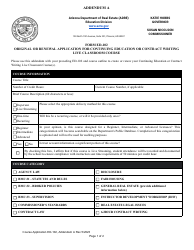

Arizona Form 141AZ EXT (ADOR11136) Application for Filing Extension for Fiduciary Returns Only - Arizona

What Is Arizona Form 141AZ EXT (ADOR11136)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 141AZ EXT?

A: Arizona Form 141AZ EXT is an Application for Filing Extension for Fiduciary Returns Only in Arizona.

Q: Who is eligible to use Arizona Form 141AZ EXT?

A: This form is specifically for fiduciary returns in Arizona.

Q: What is the purpose of Arizona Form 141AZ EXT?

A: The purpose of this form is to request an extension for filing fiduciary returns in Arizona.

Q: Is Arizona Form 141AZ EXT only for residents of Arizona?

A: No, this form can be used by both residents and non-residents of Arizona who need an extension for filing fiduciary returns.

Q: Is there a fee for filing Arizona Form 141AZ EXT?

A: No, there is no fee for filing this form.

Q: What is the deadline for filing Arizona Form 141AZ EXT?

A: The deadline for filing this form is the same as the deadline for filing the fiduciary return, which is generally April 15th.

Q: Can I get multiple extensions using Arizona Form 141AZ EXT?

A: No, Arizona Form 141AZ EXT only allows for a single extension of time.

Q: What if my fiduciary return is already overdue?

A: If your fiduciary return is already overdue, you may still file Arizona Form 141AZ EXT to request an additional extension.

Q: What should I do after filing Arizona Form 141AZ EXT?

A: After filing the form, you should continue to gather the necessary information and complete your fiduciary return as soon as possible.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 141AZ EXT (ADOR11136) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.