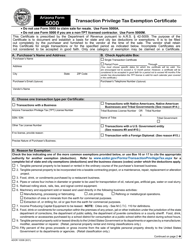

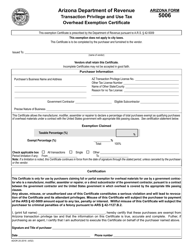

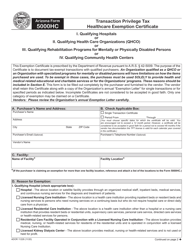

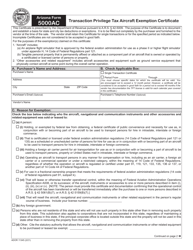

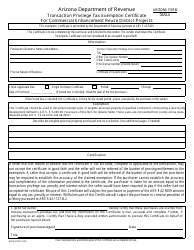

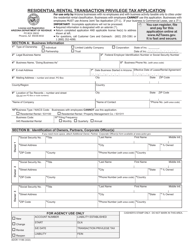

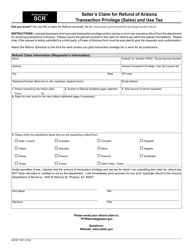

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 51T, ADOR10150

for the current year.

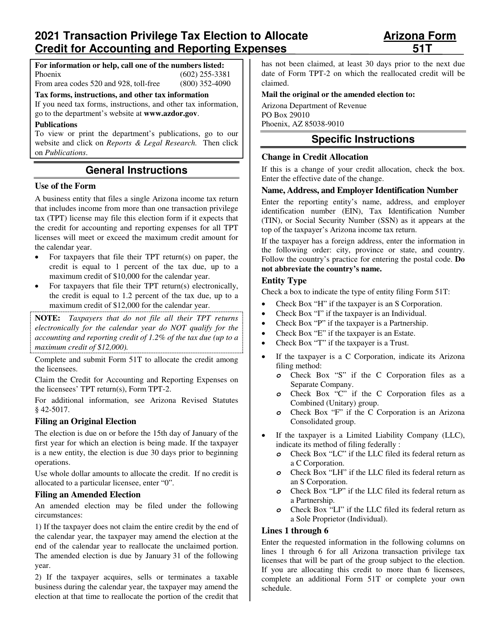

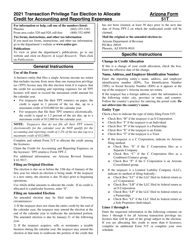

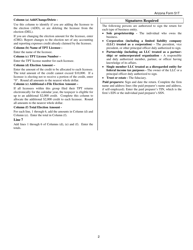

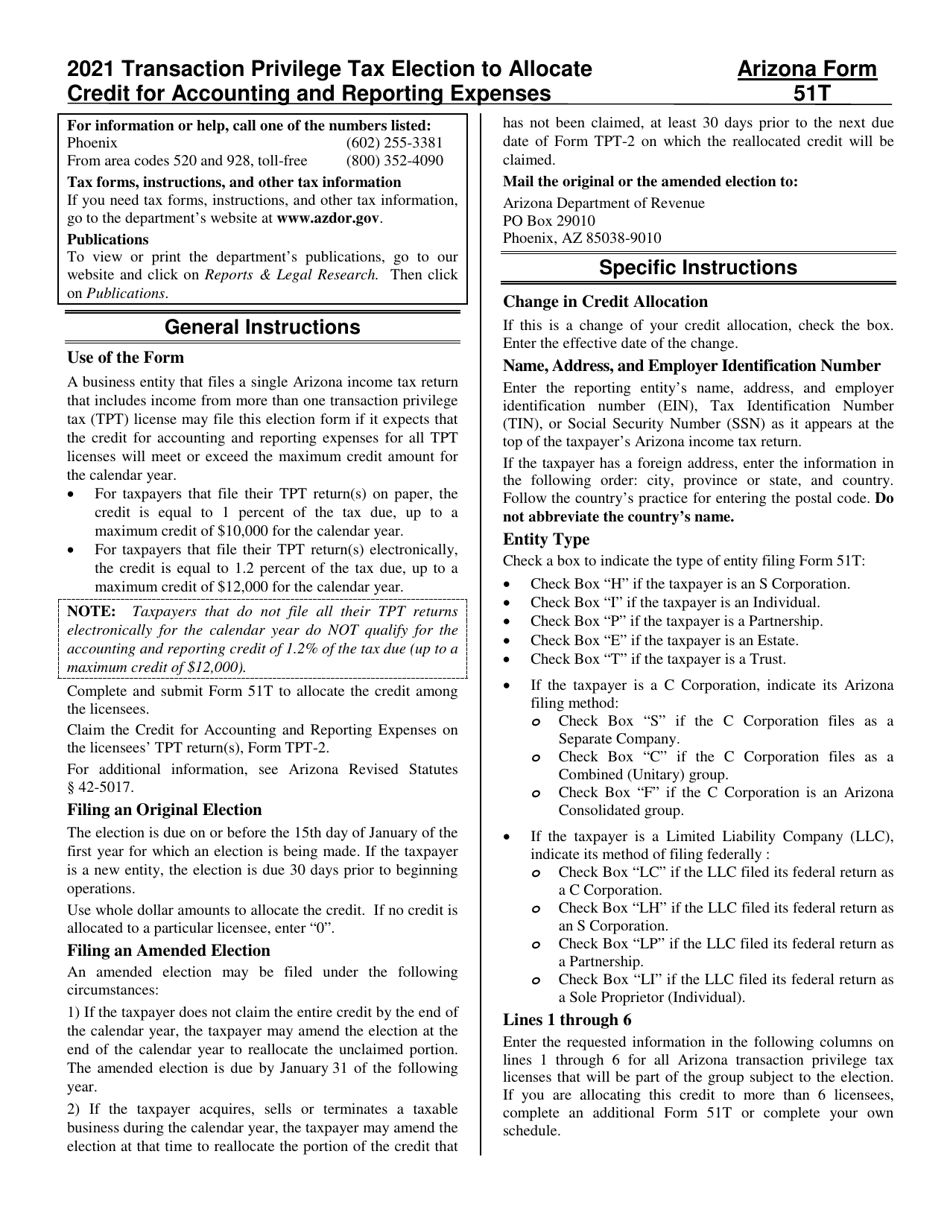

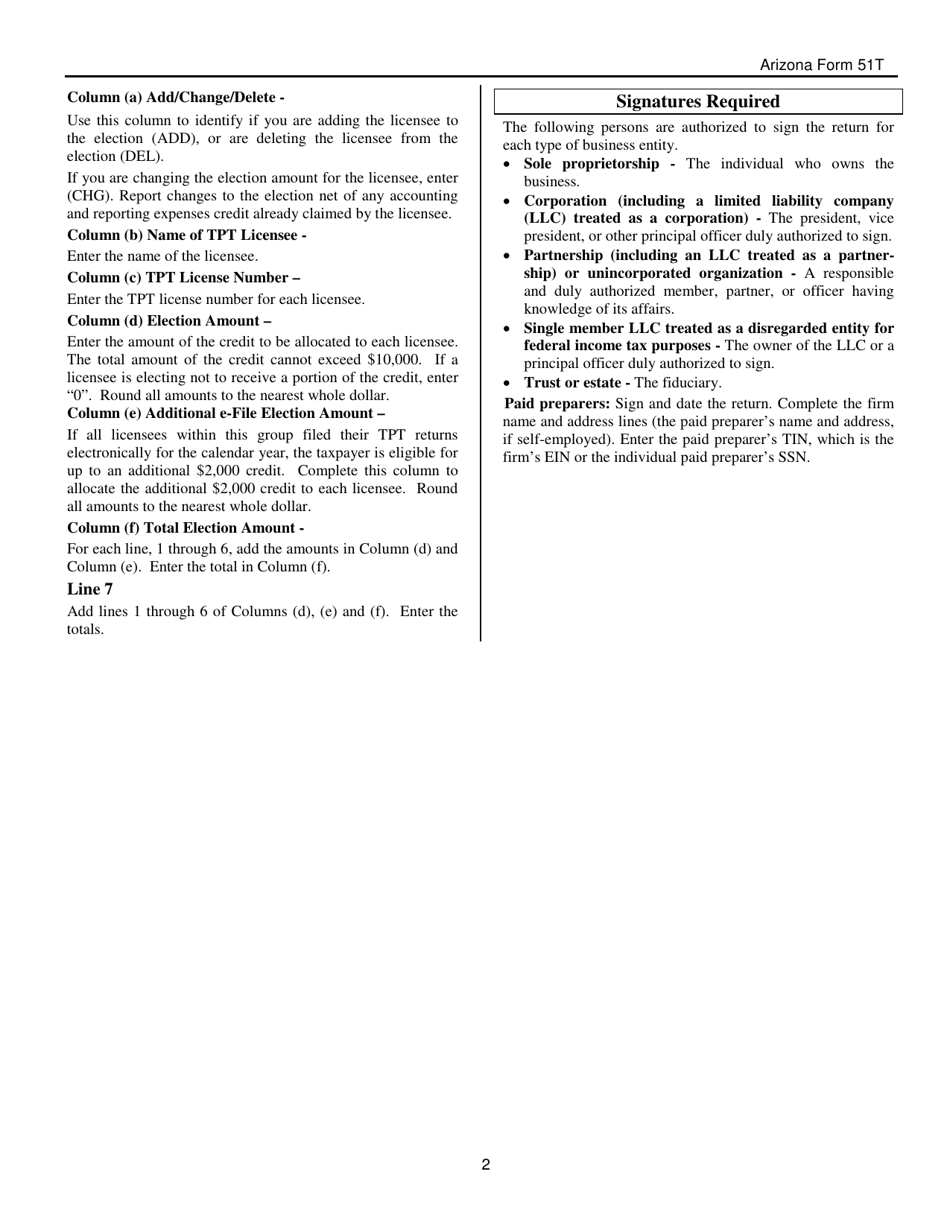

Instructions for Arizona Form 51T, ADOR10150 Transaction Privilege Tax Electionto Allocate Credit for Accounting and Reporting Expenses - Arizona

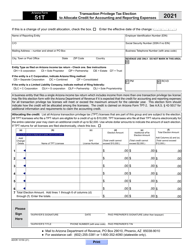

This document contains official instructions for Arizona Form 51T , and Form ADOR10150 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 51T (ADOR10150) is available for download through this link.

FAQ

Q: What is Arizona Form 51T?

A: Arizona Form 51T is a form used to make an election to allocate credits for accounting and reporting expenses related to transaction privilege tax.

Q: What is the purpose of Arizona Form 51T?

A: The purpose of Arizona Form 51T is to allow businesses to allocate credits for accounting and reporting expenses related to transaction privilege tax.

Q: Who needs to file Arizona Form 51T?

A: Businesses that want to allocate credits for accounting and reporting expenses related to transaction privilege tax need to file Arizona Form 51T.

Q: What are the requirements for filing Arizona Form 51T?

A: To file Arizona Form 51T, you need to provide your business information, details of the credits being allocated, and any applicable attachments or supporting documentation.

Q: Are there any deadlines for filing Arizona Form 51T?

A: Yes, Arizona Form 51T must be filed on or before the due date of the original transaction privilege tax return for the period the credits are being allocated.

Q: Can I amend Arizona Form 51T?

A: Yes, you can file an amended Arizona Form 51T within four years from the original due date of the return to make changes or correct any errors.

Q: What should I do if I have questions about Arizona Form 51T?

A: If you have questions about Arizona Form 51T, you can contact the Arizona Department of Revenue for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.