This version of the form is not currently in use and is provided for reference only. Download this version of

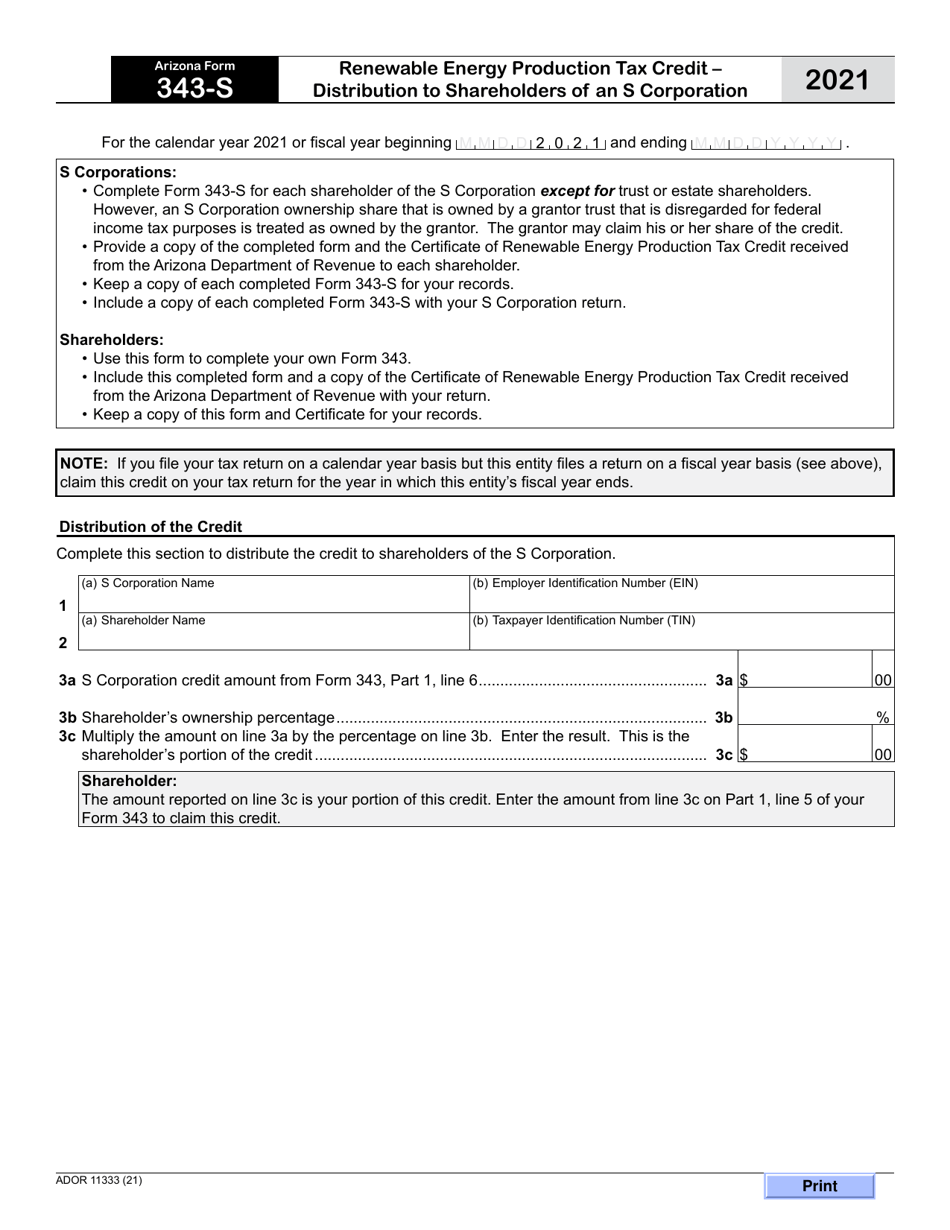

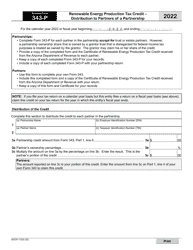

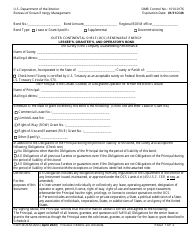

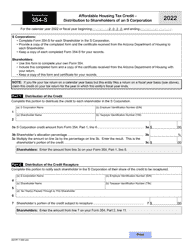

Arizona Form 343-S (ADOR11333)

for the current year.

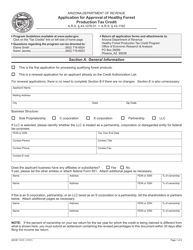

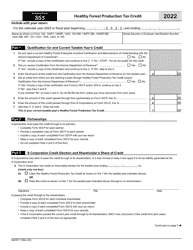

Arizona Form 343-S (ADOR11333) Renewable Energy Production Tax Credit - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 343-S (ADOR11333)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 343-S?

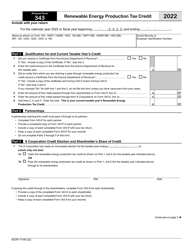

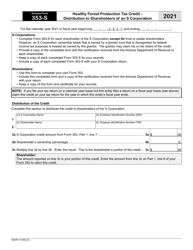

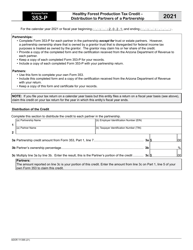

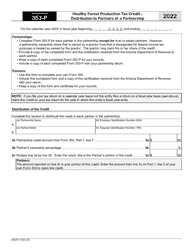

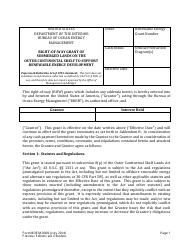

A: Arizona Form 343-S is a tax form used to claim the Renewable Energy Production Tax Credit for shareholders of an S Corporation in Arizona.

Q: What is the Renewable Energy Production Tax Credit?

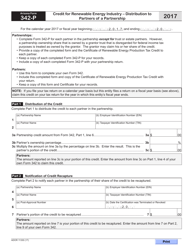

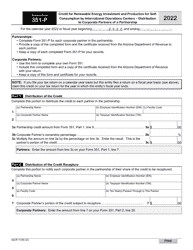

A: The Renewable Energy Production Tax Credit is a tax credit offered by the state of Arizona to encourage and incentivize the production of renewable energy.

Q: Who can use Arizona Form 343-S?

A: Shareholders of an S Corporation in Arizona who are eligible for the Renewable Energy Production Tax Credit can use Arizona Form 343-S.

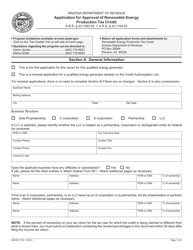

Q: What information does Arizona Form 343-S require?

A: Arizona Form 343-S requires information about the S Corporation and its shareholders, as well as details about the renewable energy production activities and credits.

Q: How do I file Arizona Form 343-S?

A: Arizona Form 343-S can be filed electronically or by mail. The instructions provided with the form will guide you on how to complete and submit it.

Q: What is the deadline for filing Arizona Form 343-S?

A: The deadline for filing Arizona Form 343-S is generally the same as the deadline for filing the S Corporation tax return in Arizona, which is April 15th.

Q: Are there any limitations or restrictions on claiming the Renewable Energy Production Tax Credit?

A: Yes, there are limitations and restrictions on claiming the credit. It's important to review the instructions and consult a tax professional to ensure eligibility and compliance.

Q: What is the purpose of the Renewable Energy Production Tax Credit?

A: The purpose of the Renewable Energy Production Tax Credit is to encourage the use and development of renewable energy sources, such as solar, wind, and geothermal power, in Arizona.

Q: Are there any other forms or documents related to the Renewable Energy Production Tax Credit in Arizona?

A: Yes, besides Arizona Form 343-S, there may be additional forms or documents required to claim the Renewable Energy Production Tax Credit, depending on the specific circumstances. Consult the Arizona Department of Revenue for more information.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 343-S (ADOR11333) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.