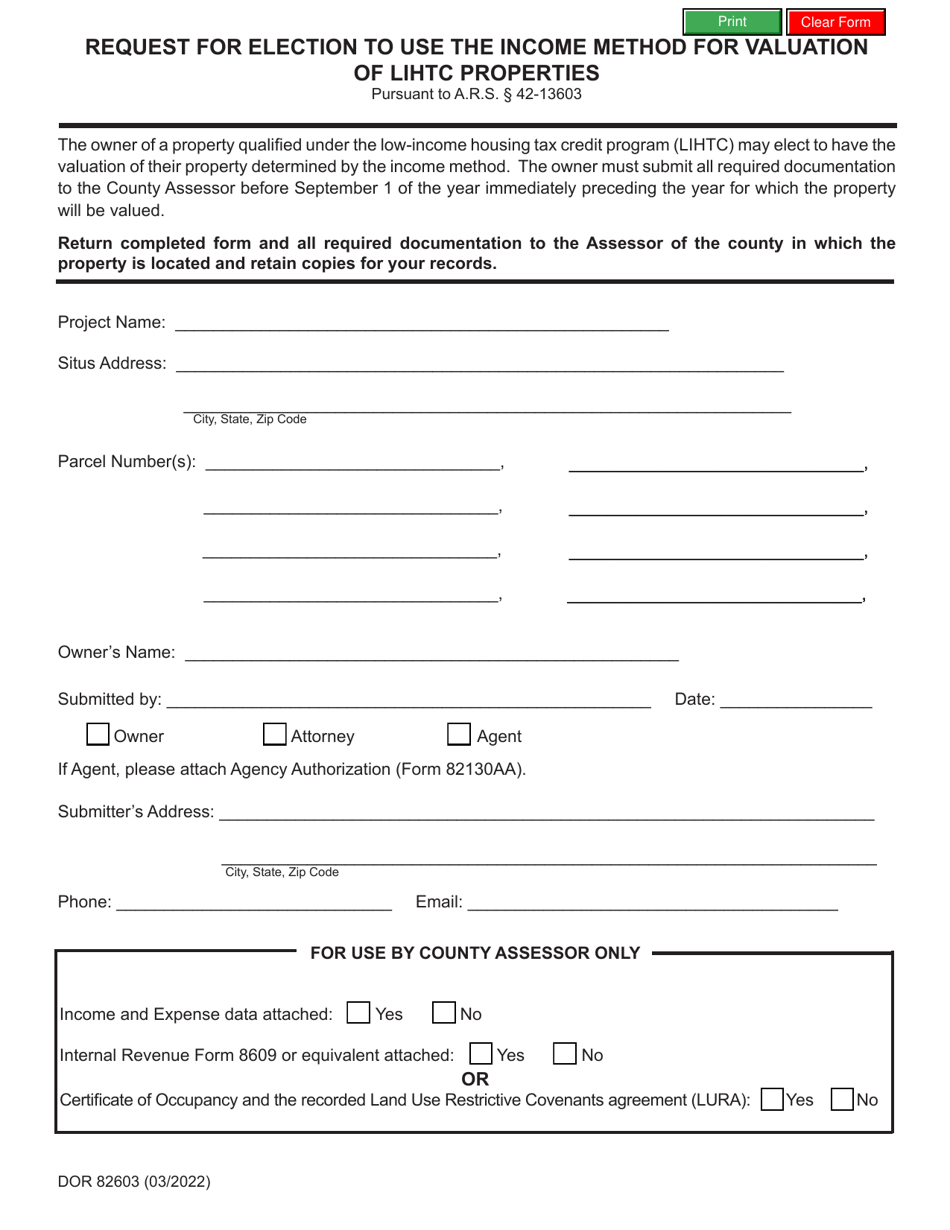

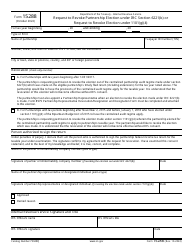

Form DOR82603 Request for Election to Use the Income Method for Valuation of LIHTC Properties - Arizona

What Is Form DOR82603?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

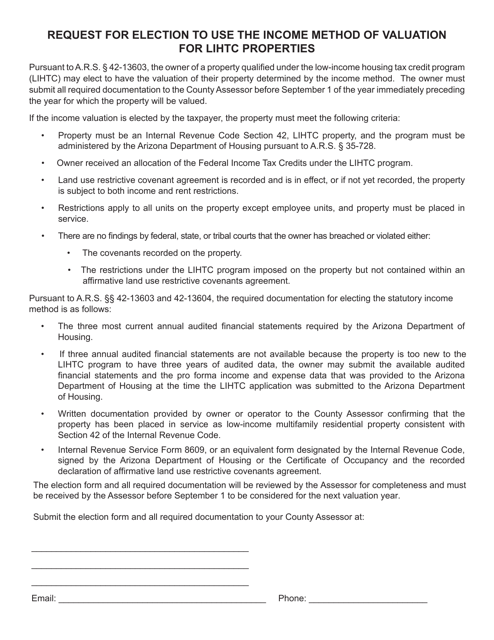

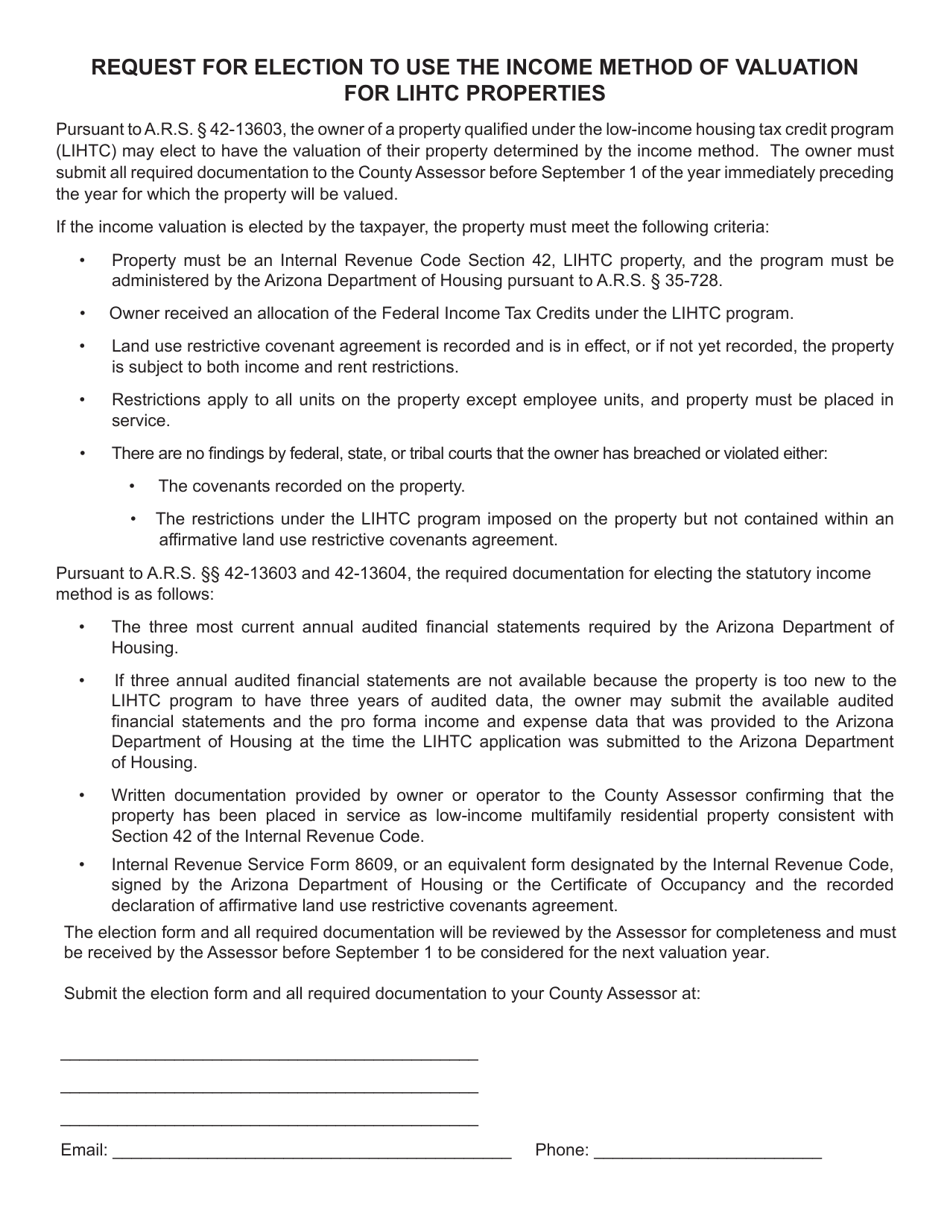

Q: What is Form DOR82603?

A: Form DOR82603 is a request form used for the election to use the income method for valuation of LIHTC (Low-Income Housing Tax Credit) properties in Arizona.

Q: What is the income method for valuation of LIHTC properties?

A: The income method is a valuation approach used for determining the value of LIHTC properties based on their income-generating potential.

Q: Why would someone elect to use the income method for valuation of LIHTC properties?

A: Using the income method allows property owners to take advantage of the tax benefits associated with LIHTC properties.

Q: Who needs to complete Form DOR82603?

A: Property owners or individuals involved in the management of LIHTC properties in Arizona may need to complete Form DOR82603.

Q: Are there any filing fees for Form DOR82603?

A: There are no filing fees associated with Form DOR82603.

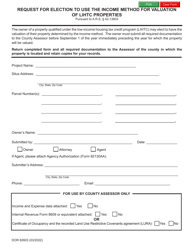

Q: What information is needed to complete Form DOR82603?

A: Form DOR82603 requires information such as the property address, property type, income information, and the election to use the income method.

Q: Is Form DOR82603 specific to LIHTC properties in Arizona?

A: Yes, Form DOR82603 is specifically used for LIHTC properties in Arizona.

Q: What is the deadline for submitting Form DOR82603?

A: The deadline for submitting Form DOR82603 may vary depending on the specific requirements and timelines set by the Arizona Department of Revenue.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82603 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.