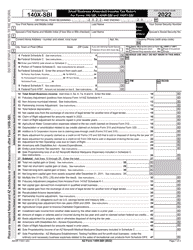

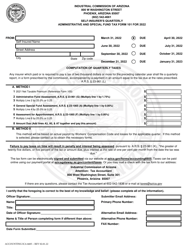

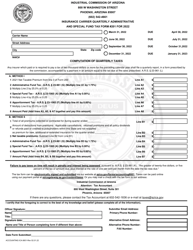

This version of the form is not currently in use and is provided for reference only. Download this version of

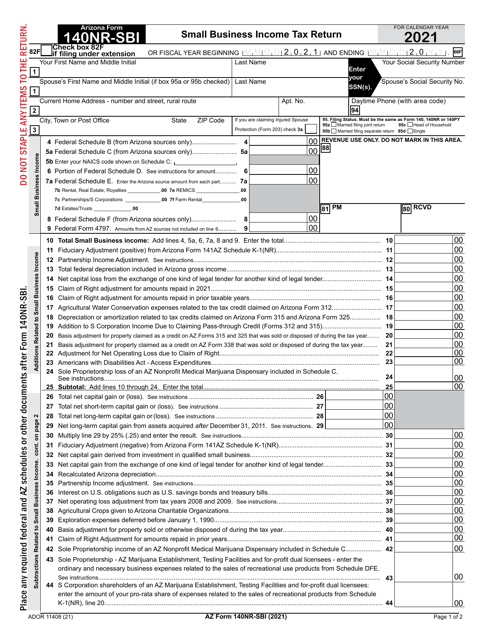

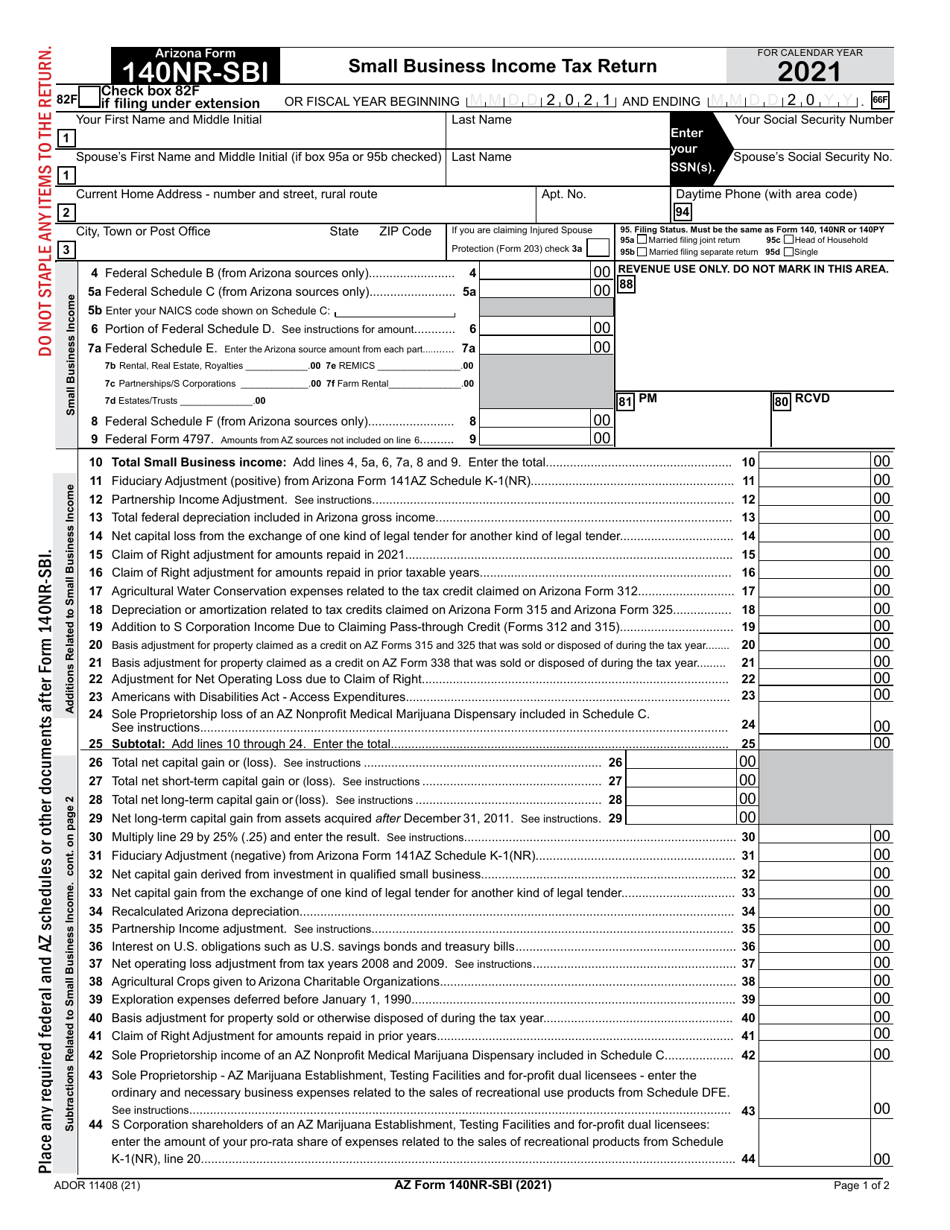

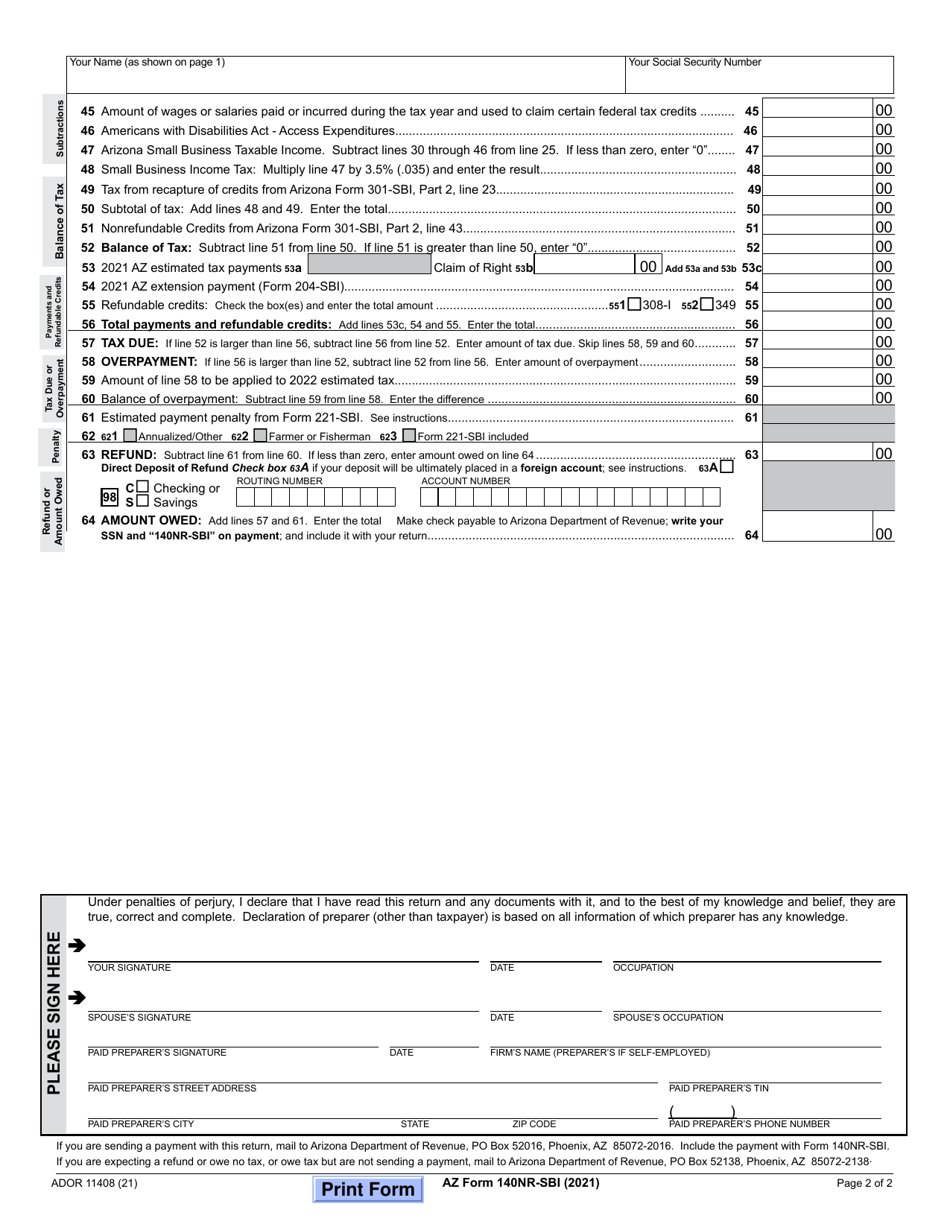

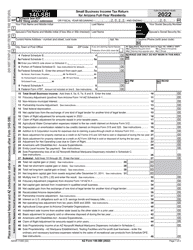

Arizona Form 140NR-SBI (ADOR11408)

for the current year.

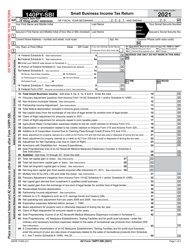

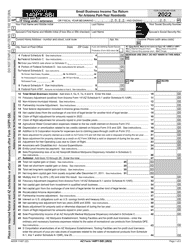

Arizona Form 140NR-SBI (ADOR11408) Small Business Income Tax Return - Arizona

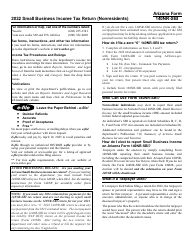

What Is Arizona Form 140NR-SBI (ADOR11408)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 140NR-SBI?

A: Arizona Form 140NR-SBI is the Small Business Income Tax Return for Arizona.

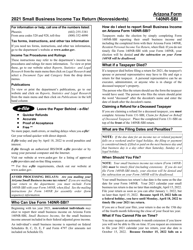

Q: Who needs to file Arizona Form 140NR-SBI?

A: Individuals who have small business income in Arizona and are non-residents for tax purposes may need to file Arizona Form 140NR-SBI.

Q: What is the purpose of Arizona Form 140NR-SBI?

A: The purpose of Arizona Form 140NR-SBI is to report small business income earned in Arizona.

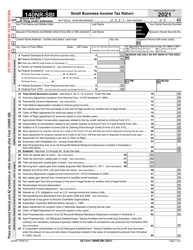

Q: What information do I need to complete Arizona Form 140NR-SBI?

A: You will need information about your small business income earned in Arizona, as well as any expenses and deductions related to your business.

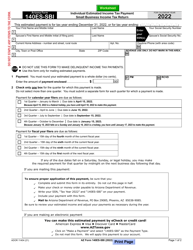

Q: When is the due date for filing Arizona Form 140NR-SBI?

A: The due date for filing Arizona Form 140NR-SBI is typically April 15th, or the same date as the federal income tax return deadline.

Q: Can I e-file Arizona Form 140NR-SBI?

A: Yes, you can e-file Arizona Form 140NR-SBI if you meet the requirements and use an approved tax software or service.

Q: What should I do if I have questions about Arizona Form 140NR-SBI?

A: If you have questions about Arizona Form 140NR-SBI, you can contact the Arizona Department of Revenue or consult a tax professional.

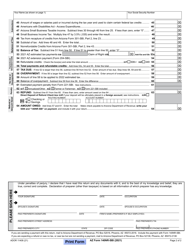

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 140NR-SBI (ADOR11408) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.