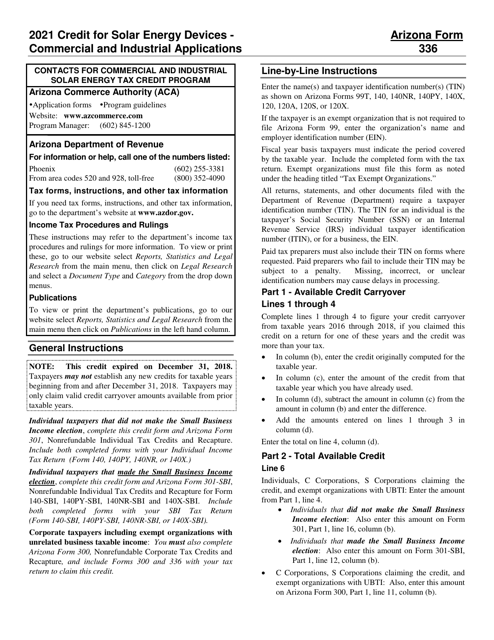

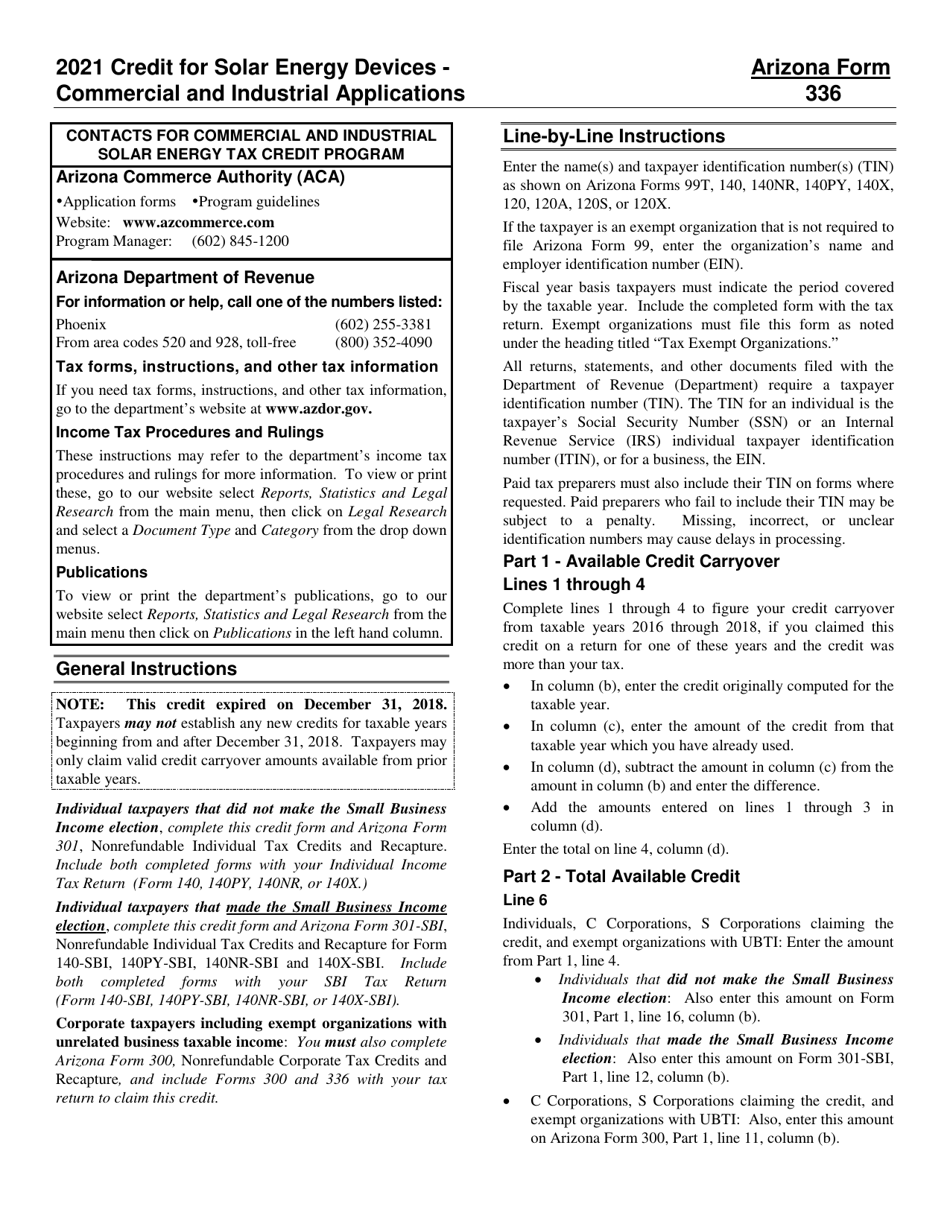

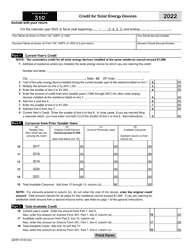

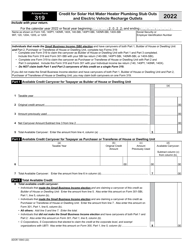

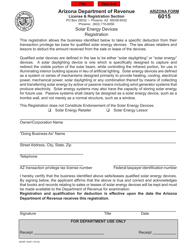

Instructions for Arizona Form 336, ADOR10722 Credit for Solar Energy Devices - Commercial and Industrial Applications - Arizona

This document contains official instructions for Arizona Form 336 , and Form ADOR10722 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 336 (ADOR10722) is available for download through this link.

FAQ

Q: What is Arizona Form 336?

A: Arizona Form 336 is a form used for claiming the Credit for Solar Energy Devices for Commercial and Industrial Applications in Arizona.

Q: What is the purpose of Arizona Form 336?

A: The purpose of Arizona Form 336 is to claim the credit for installing qualifying solar energy devices in commercial and industrial properties in Arizona.

Q: What is the ADOR10722?

A: ADOR10722 is the form number for Arizona Form 336.

Q: Who is eligible to use Arizona Form 336?

A: Commercial and industrial property owners in Arizona who have installed qualifying solar energy devices are eligible to use Arizona Form 336.

Q: What is the credit for solar energy devices?

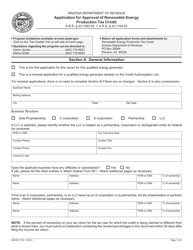

A: The credit for solar energy devices is a tax incentive provided by the Arizona government to encourage the use of renewable energy.

Q: How can I claim the credit for solar energy devices?

A: To claim the credit for solar energy devices, you need to complete Arizona Form 336 and submit it to the Arizona Department of Revenue.

Q: What are qualifying solar energy devices?

A: Qualifying solar energy devices include solar water heating systems, solar space heating systems, and photovoltaic systems.

Q: Are there any limitations on the credit?

A: Yes, there are limitations on the credit for solar energy devices. Please refer to the instructions provided with Arizona Form 336 for more information.

Q: Can I claim the credit if I installed solar energy devices in my residential property?

A: No, the credit is only available for commercial and industrial properties in Arizona.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.