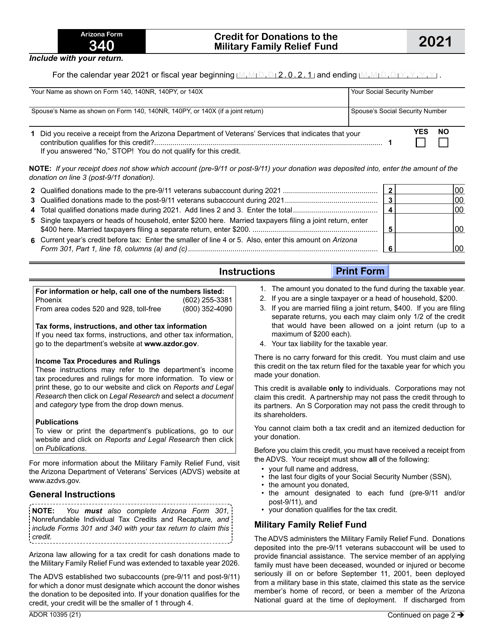

Arizona Form 340 (ADOR10395) Credit for Donations to the Military Family Relief Fund - Arizona

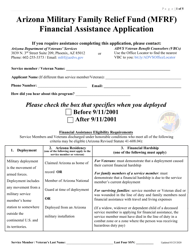

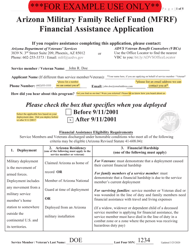

What Is Arizona Form 340 (ADOR10395)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 340?

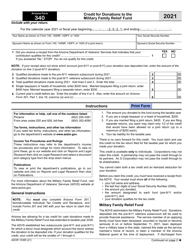

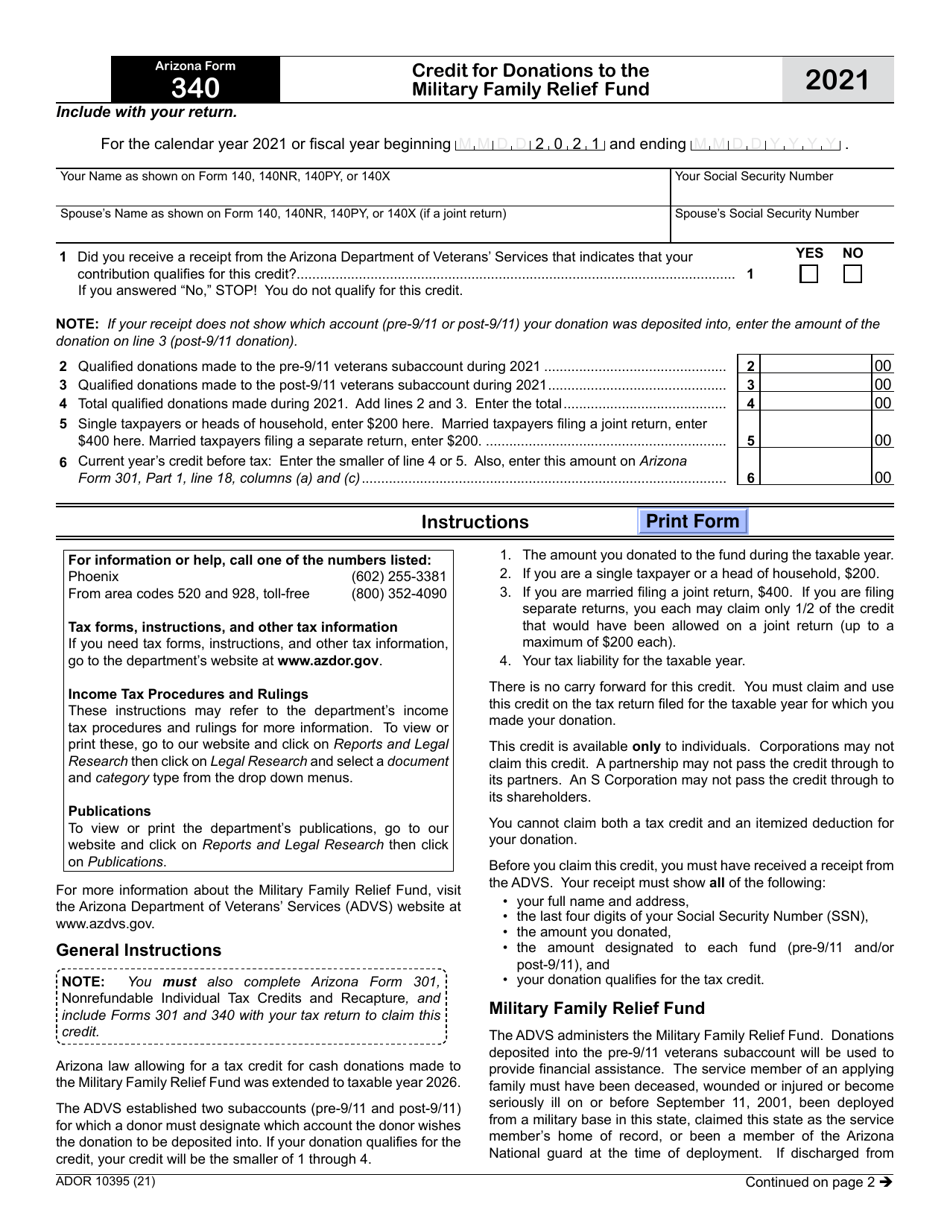

A: Arizona Form 340 is a state tax form used to claim the Credit for Donations to the Military Family Relief Fund.

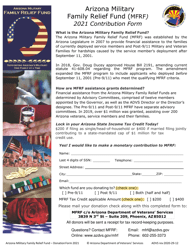

Q: What is the Military Family Relief Fund?

A: The Military Family Relief Fund is a fund in Arizona that provides financial assistance to military families facing financial hardships.

Q: Who is eligible to claim the Credit for Donations to the Military Family Relief Fund?

A: Any individual or corporation that made a cash donation to the Military Family Relief Fund is eligible to claim this credit.

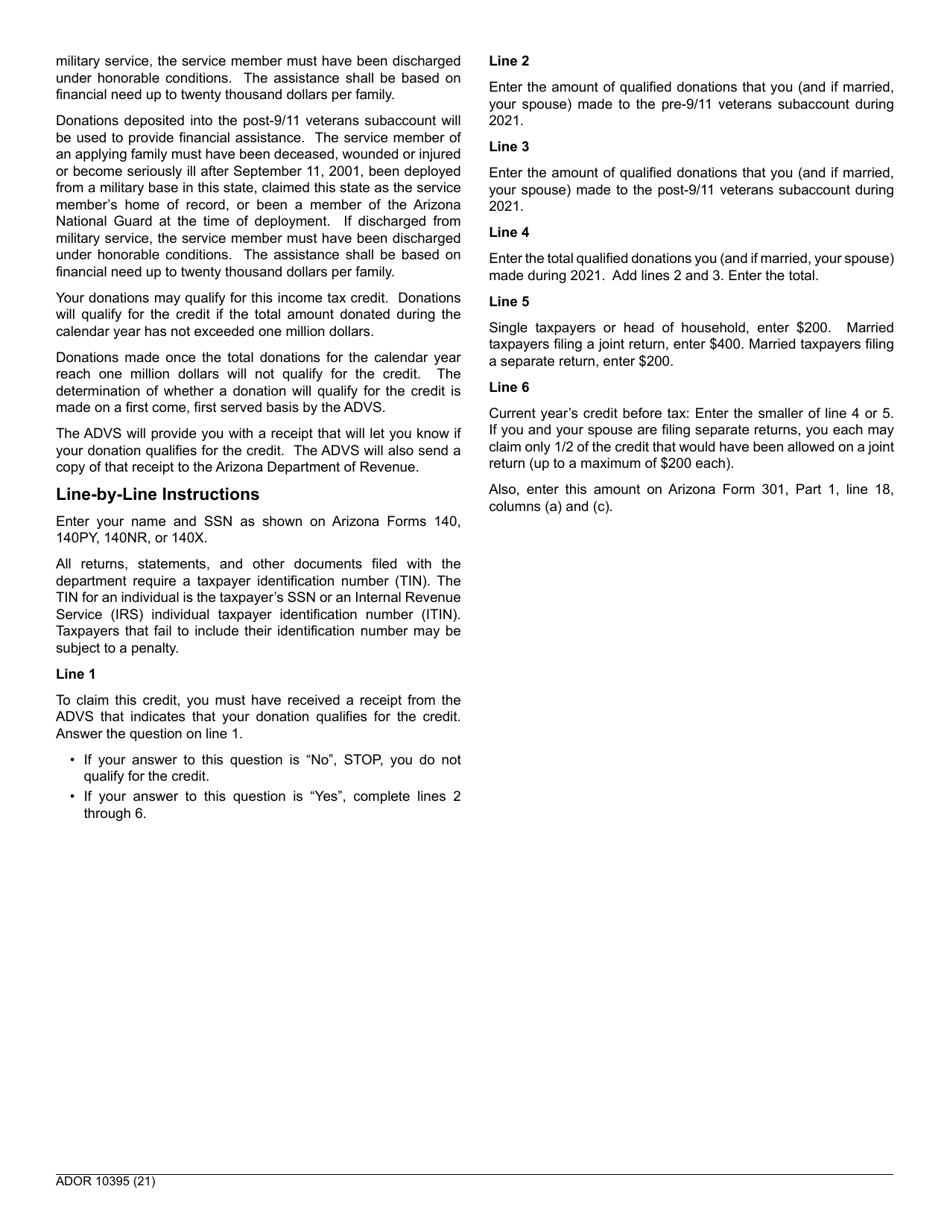

Q: How much is the credit?

A: The credit is equal to 100% of the donation amount, up to a maximum of $200 for individuals and $400 for married couples filing jointly.

Q: How do I claim this credit?

A: To claim this credit, you need to complete Arizona Form 340 and include it when filing your state income tax return.

Q: Is there a deadline to claim this credit?

A: Yes, the deadline to claim this credit is the same as the deadline to file your state income tax return.

Q: Can I claim this credit if I have already claimed other tax credits?

A: Yes, you can still claim this credit even if you have claimed other tax credits.

Q: Can I carry forward any excess credit amount?

A: No, any excess credit amount cannot be carried forward to future years.

Q: Can I e-file Arizona Form 340?

A: Yes, you can e-file Arizona Form 340 if you are filing your state income tax return electronically.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 340 (ADOR10395) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.