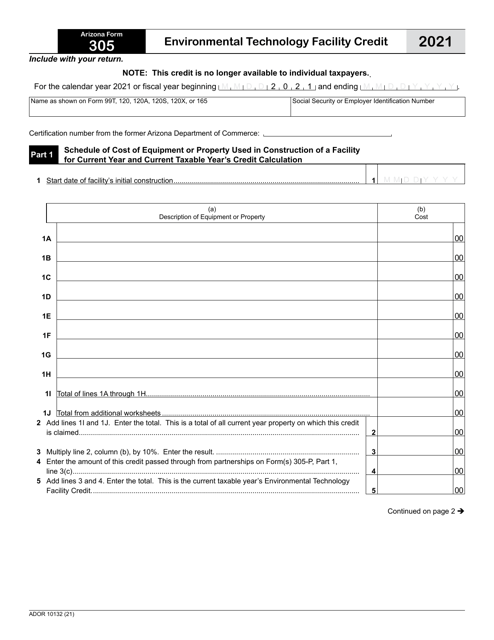

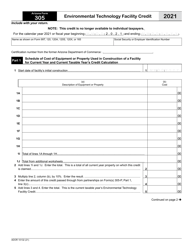

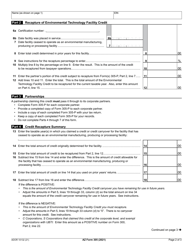

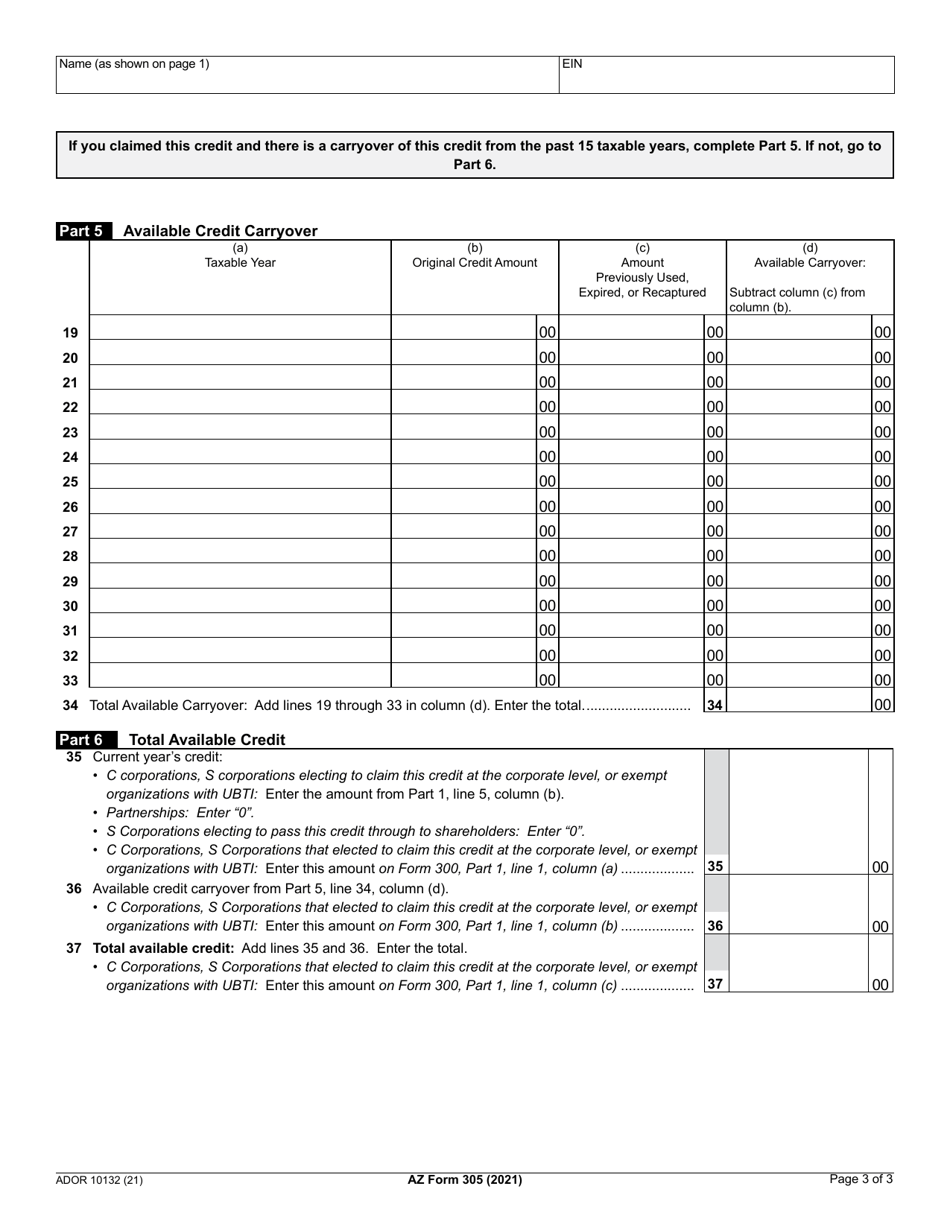

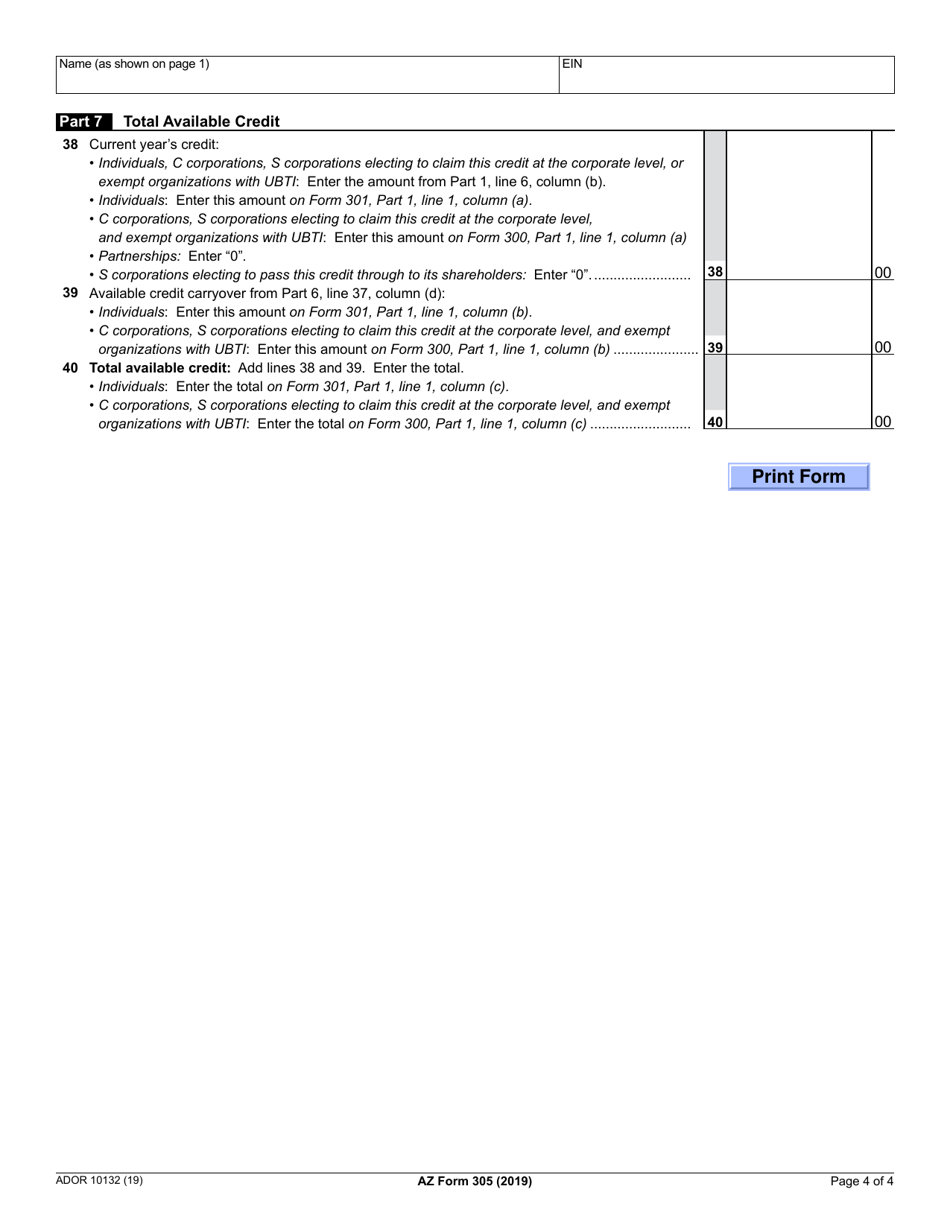

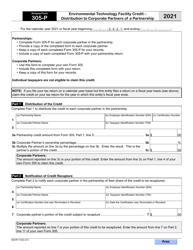

Arizona Form 305 (ADOR10132) Environmental Technology Facility Credit - Arizona

What Is Arizona Form 305 (ADOR10132)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 305?

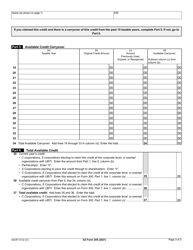

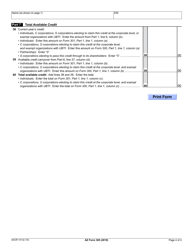

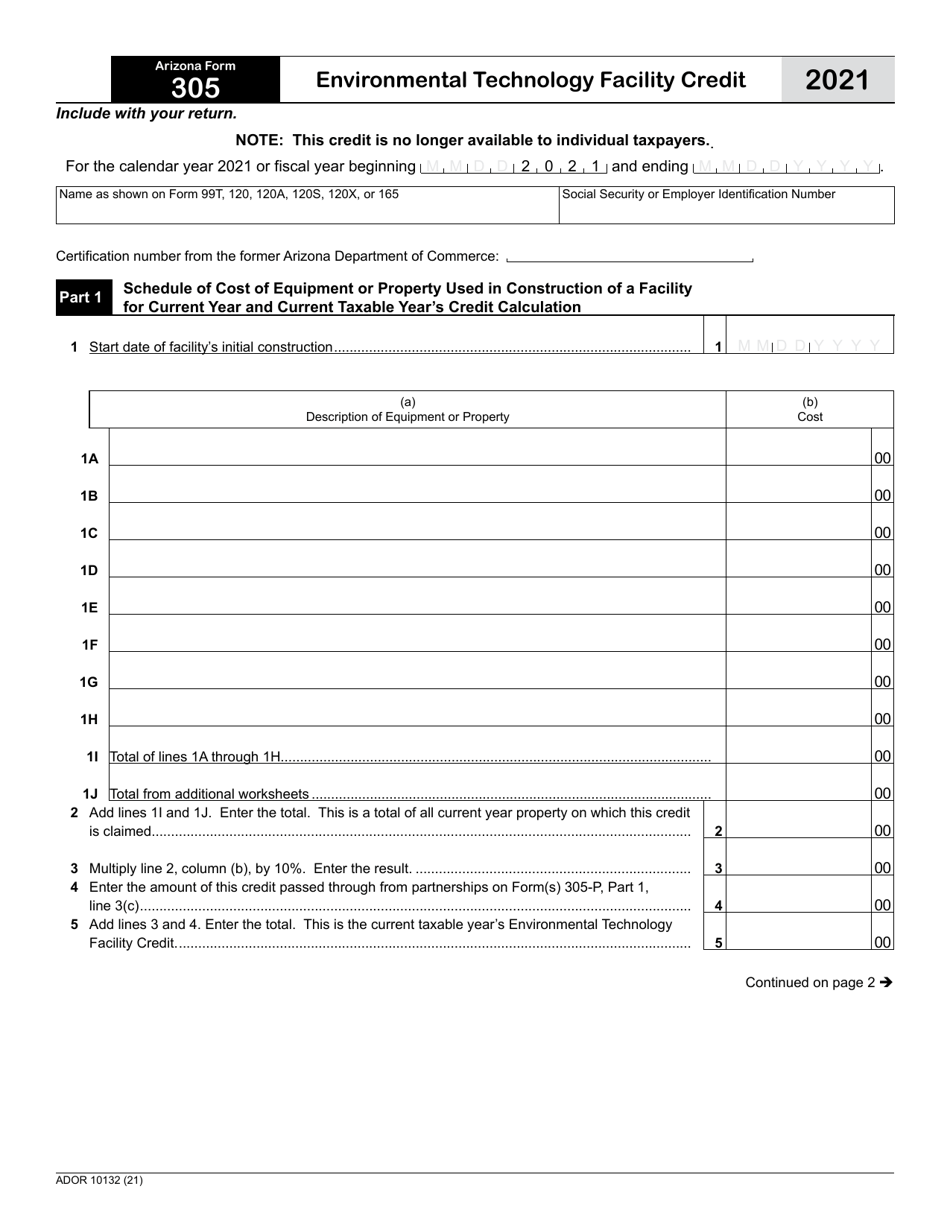

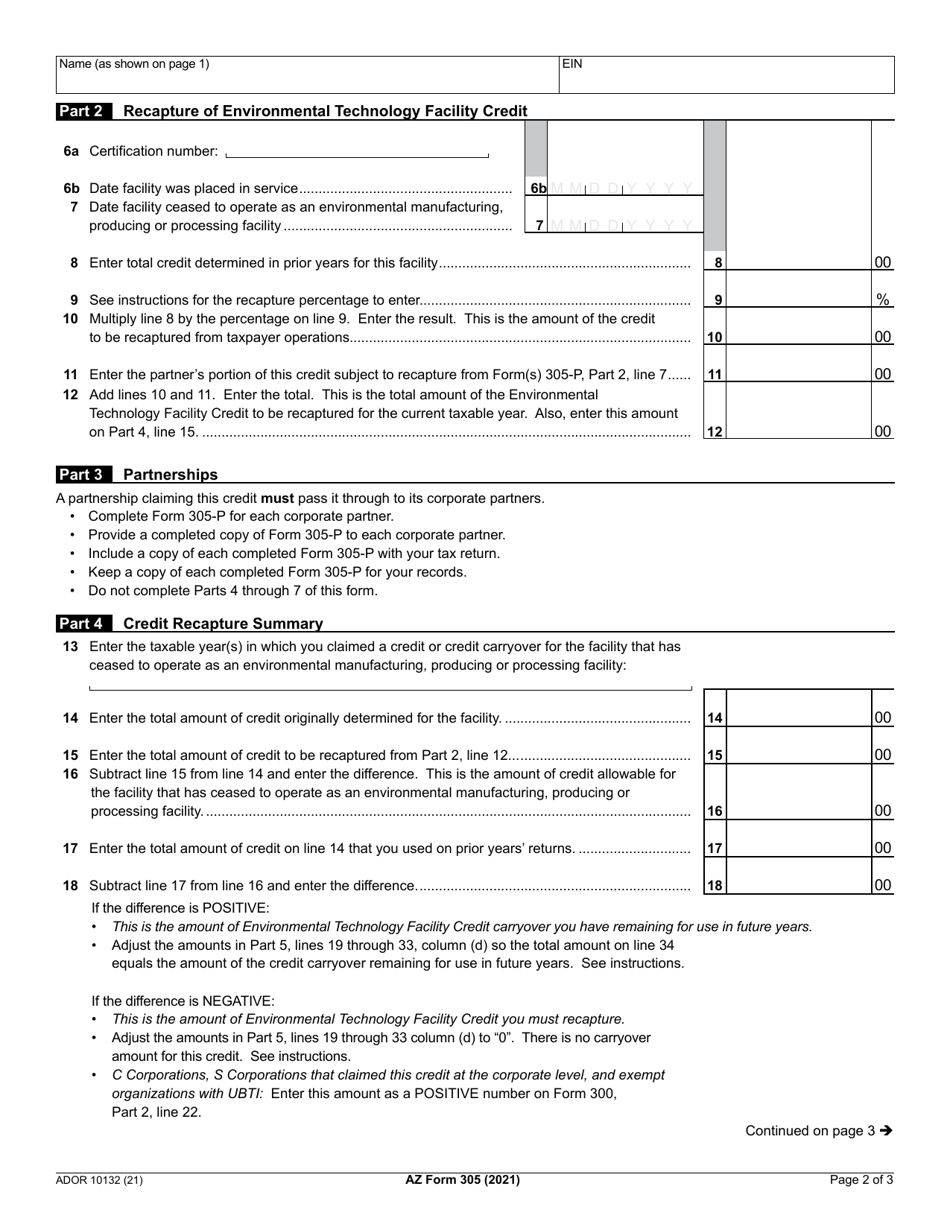

A: Arizona form 305 is a tax form used to claim the Environmental Technology Facility Credit in Arizona.

Q: What is the ADOR10132 form?

A: The ADOR10132 form is the official form number for Arizona Form 305.

Q: What is the Environmental Technology Facility Credit?

A: The Environmental Technology Facility Credit is a tax credit offered in Arizona for investments made in eligible environmental technology facilities.

Q: How do I claim the Environmental Technology Facility Credit?

A: To claim the credit, you need to complete and file Arizona Form 305 with the Arizona Department of Revenue.

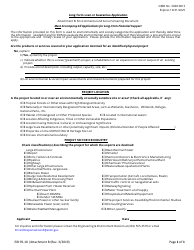

Q: What is an eligible environmental technology facility?

A: An eligible environmental technology facility is a facility that uses technology to prevent, control, or reduce pollution, or to remove contaminants from air, water, or soil.

Q: Are there any requirements or limitations for claiming the credit?

A: Yes, there are requirements and limitations for claiming the credit. You can find more information on this in the instructions for Arizona Form 305.

Q: Is the Environmental Technology Facility Credit available in other states?

A: No, the Environmental Technology Facility Credit is specific to the state of Arizona.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 305 (ADOR10132) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.