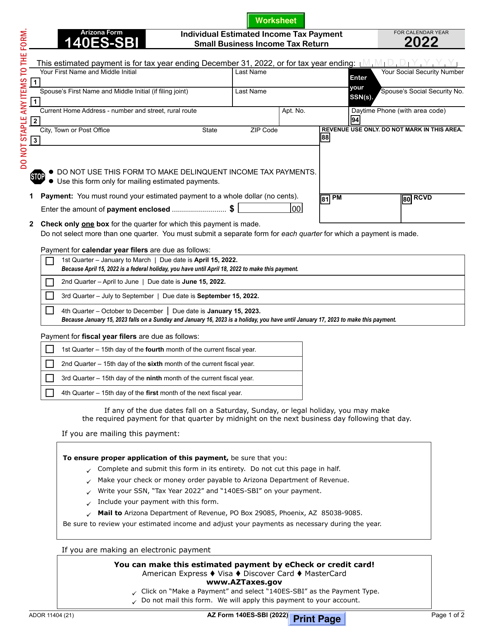

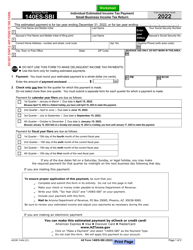

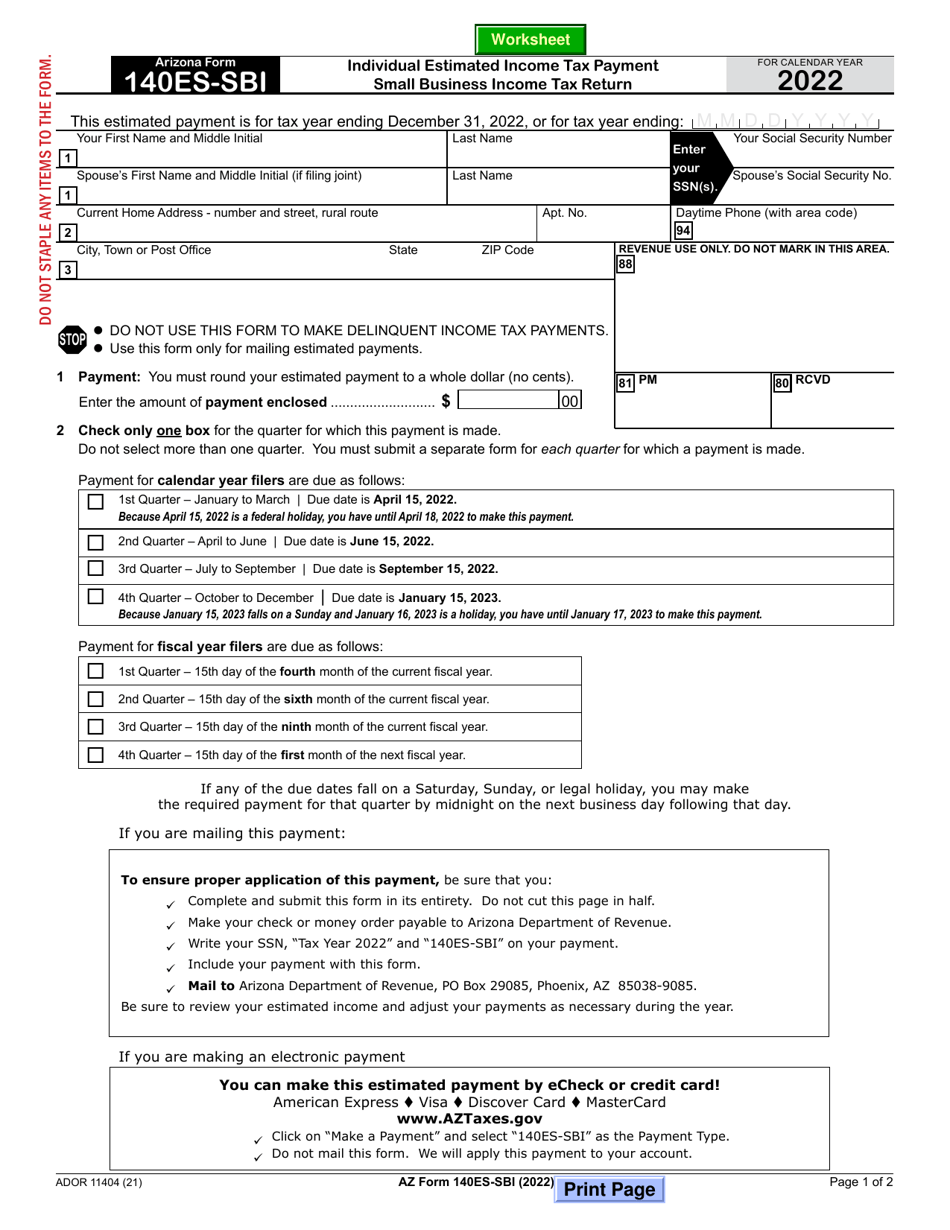

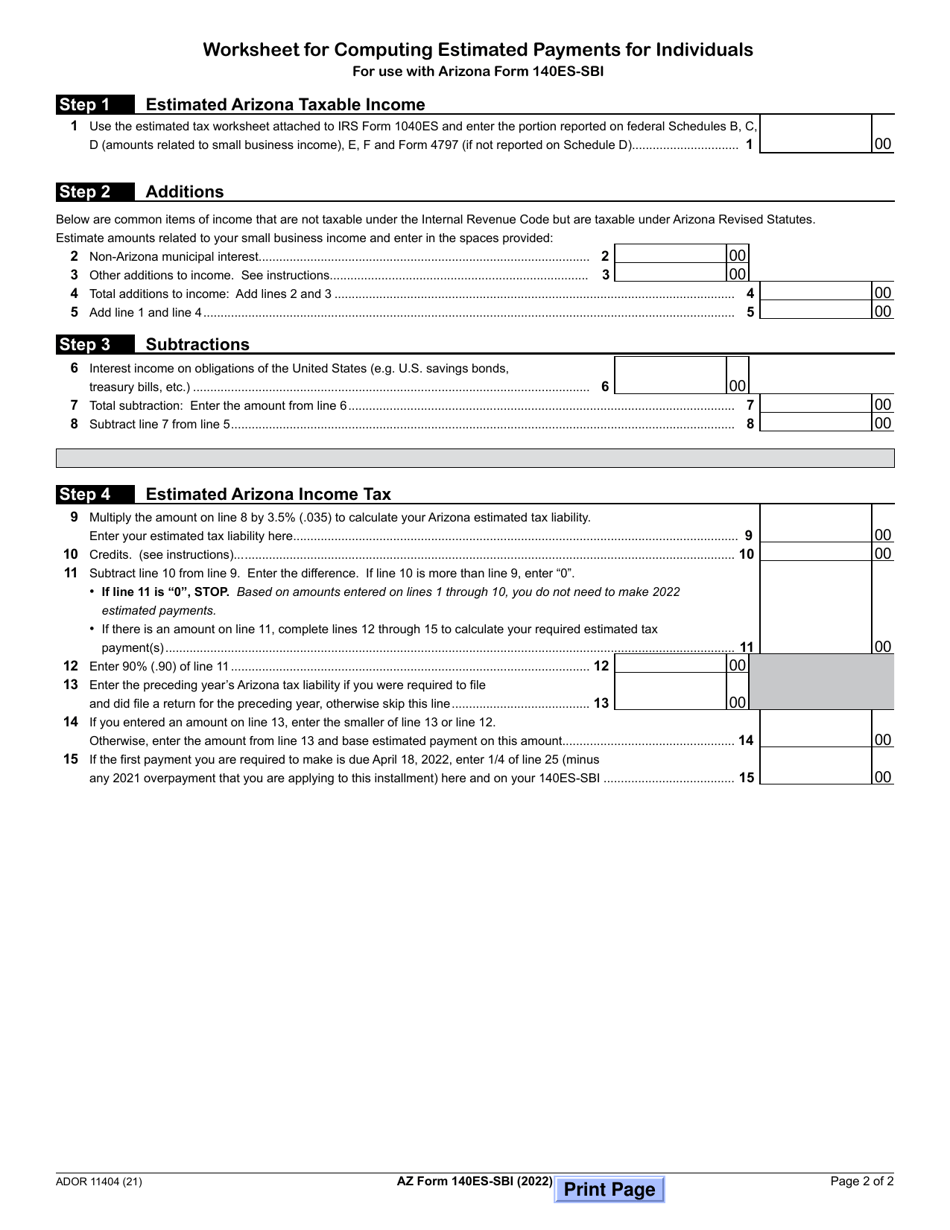

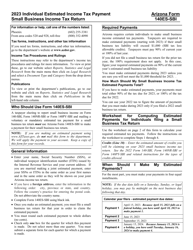

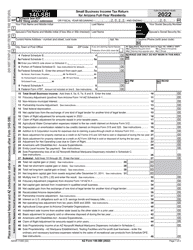

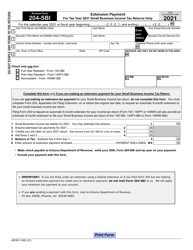

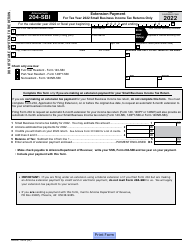

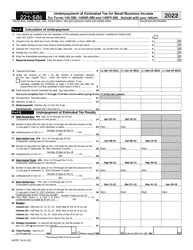

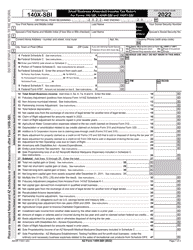

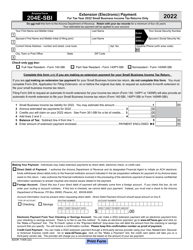

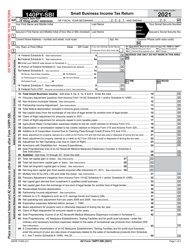

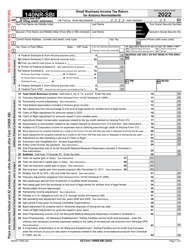

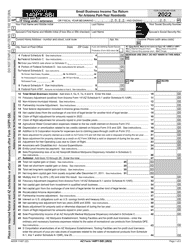

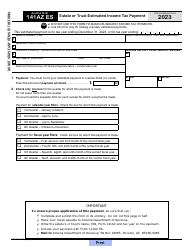

Arizona Form 140ES-SBI (ADOR11404) Individual Estimated Income Tax Payment Small Business Income Tax Return - Arizona

What Is Arizona Form 140ES-SBI (ADOR11404)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 140ES-SBI?

A: Arizona Form 140ES-SBI is the Individual Estimated Income Tax Payment Small Business Income Tax Return for Arizona.

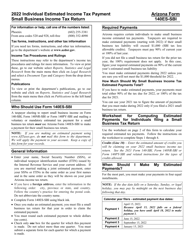

Q: Who needs to file Arizona Form 140ES-SBI?

A: Individuals who have small business income and need to make estimated income tax payments in Arizona.

Q: What is the purpose of Arizona Form 140ES-SBI?

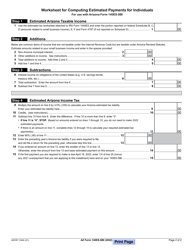

A: The purpose of Arizona Form 140ES-SBI is to report and pay estimated income tax for individuals with small business income.

Q: When is Arizona Form 140ES-SBI due?

A: Arizona Form 140ES-SBI is due on April 15th of each year.

Q: Are there any penalties for not filing Arizona Form 140ES-SBI?

A: Failure to file Arizona Form 140ES-SBI and pay the required estimated tax payments may result in penalties and interest being assessed by the Arizona Department of Revenue.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 140ES-SBI (ADOR11404) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.