This version of the form is not currently in use and is provided for reference only. Download this version of

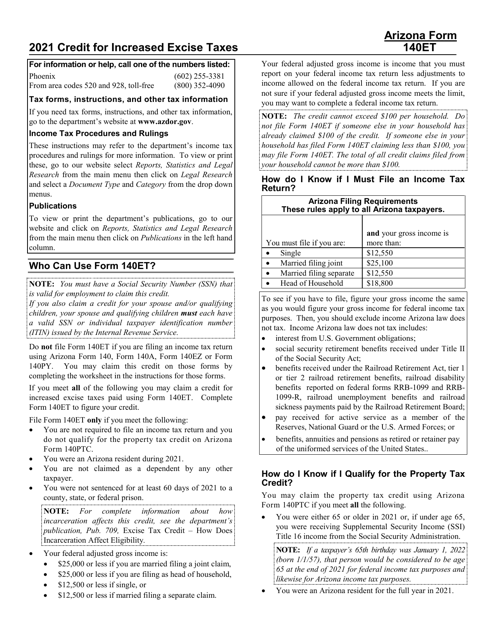

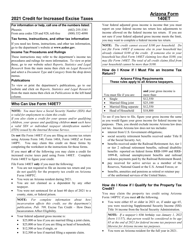

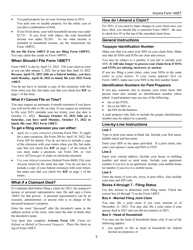

Instructions for Arizona Form 140ET, ADOR10532

for the current year.

Instructions for Arizona Form 140ET, ADOR10532 Credit for Increased Excise Taxes - Arizona

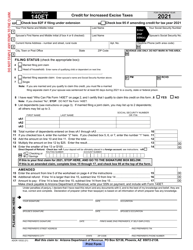

This document contains official instructions for Arizona Form 140ET , and Form ADOR10532 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 140ET (ADOR10532) is available for download through this link.

FAQ

Q: What is Arizona Form 140ET?

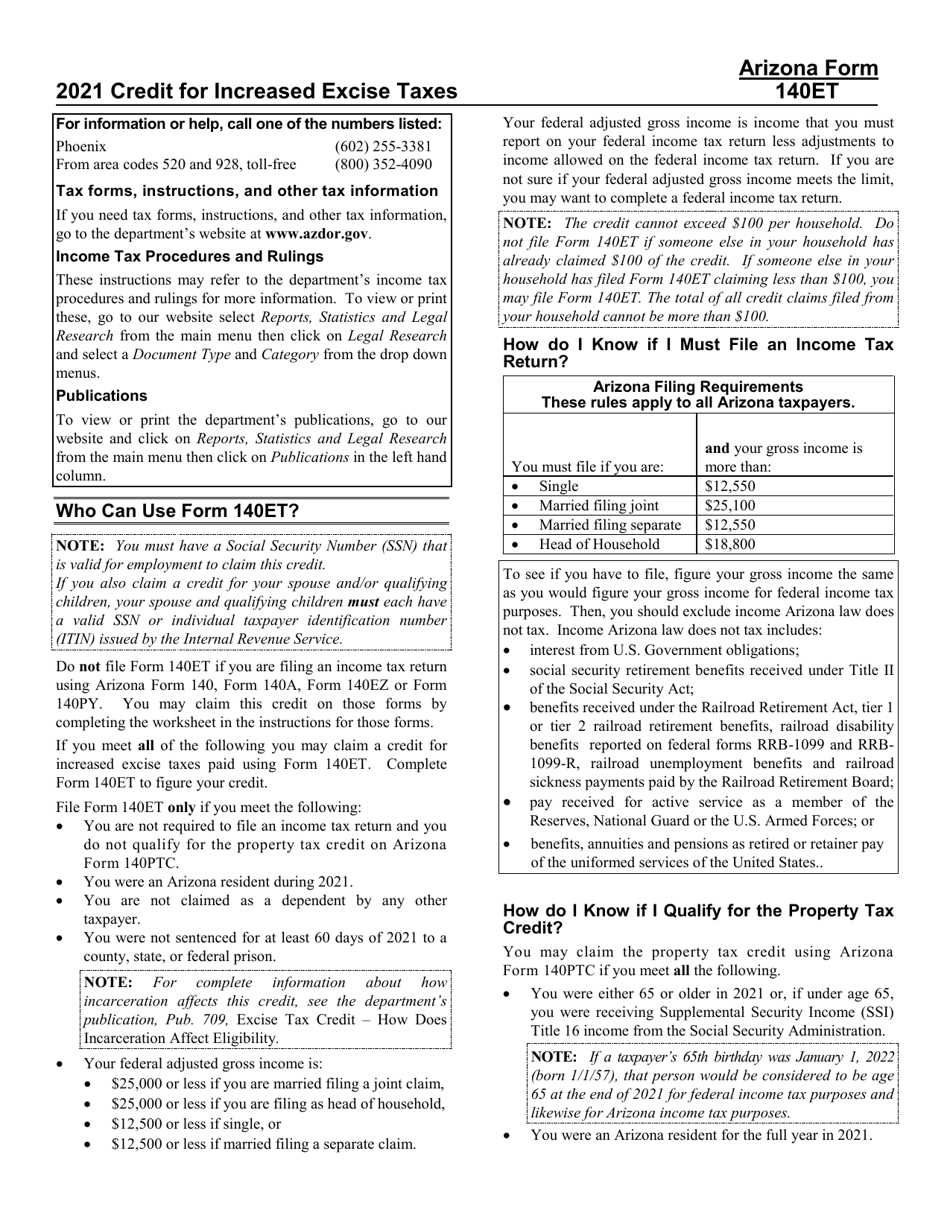

A: Arizona Form 140ET is a tax form used to claim the Credit for Increased Excise Taxes in Arizona.

Q: What is the ADOR10532 Credit for Increased Excise Taxes?

A: ADOR10532 is a tax credit provided by the Arizona Department of Revenue for taxpayers who have paid increased excise taxes.

Q: Who can use Arizona Form 140ET?

A: Any taxpayer who has paid increased excise taxes in Arizona can use Arizona Form 140ET to claim the tax credit.

Q: What are excise taxes?

A: Excise taxes are taxes imposed on certain goods or activities, such as cigarettes, alcohol, or fuel.

Q: How do I complete Arizona Form 140ET?

A: To complete Arizona Form 140ET, you will need to fill out the required information regarding your increased excise taxes paid and compute the credit amount.

Q: When is the deadline to file Arizona Form 140ET?

A: The deadline to file Arizona Form 140ET is the same as the deadline for filing your Arizona state income tax return, which is typically April 15th.

Q: Is the ADOR10532 Credit for Increased Excise Taxes refundable?

A: No, the ADOR10532 Credit for Increased Excise Taxes is non-refundable, meaning it can only be used to offset your Arizona state tax liability.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.