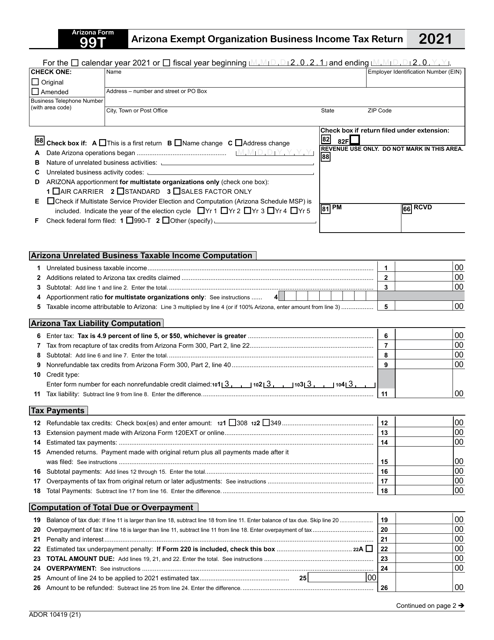

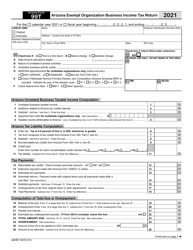

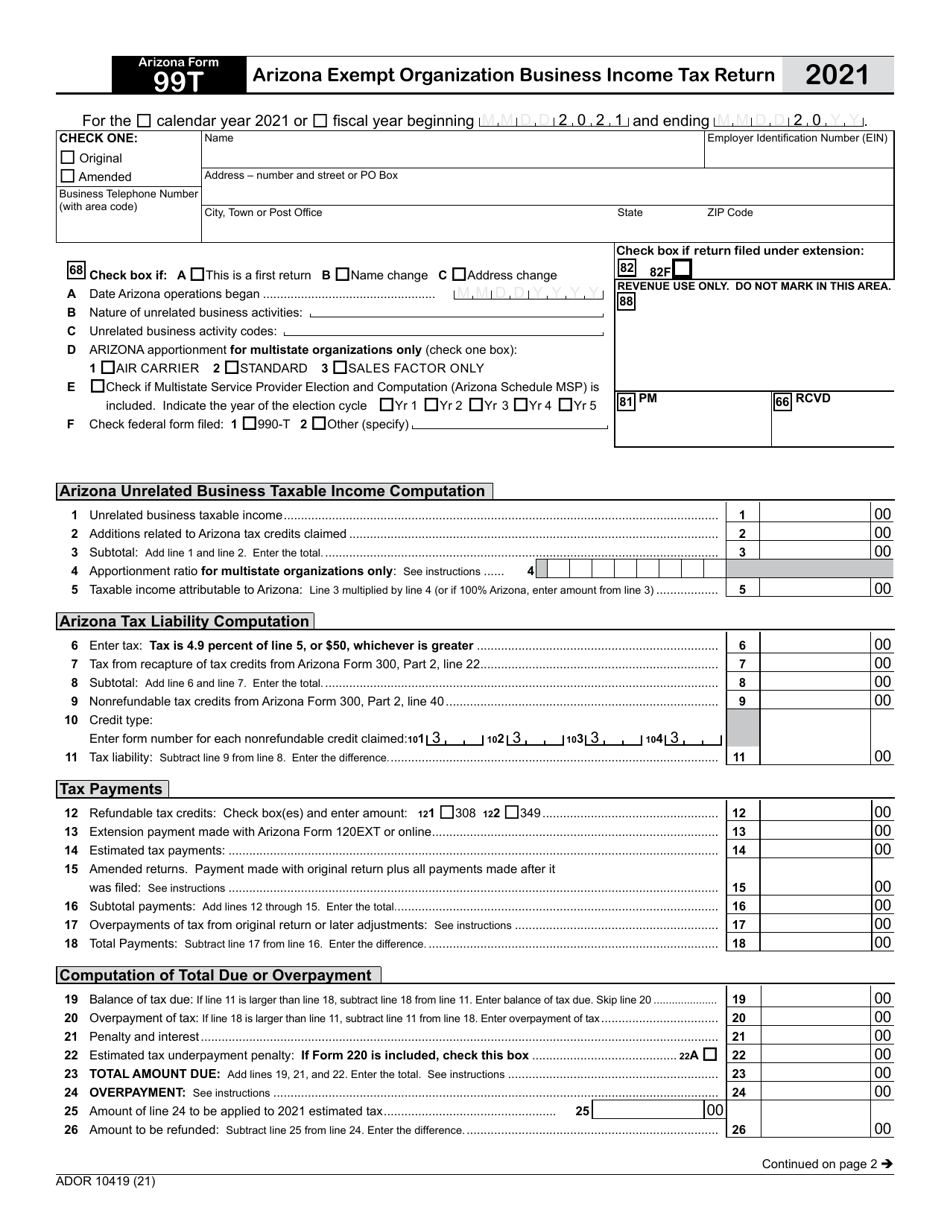

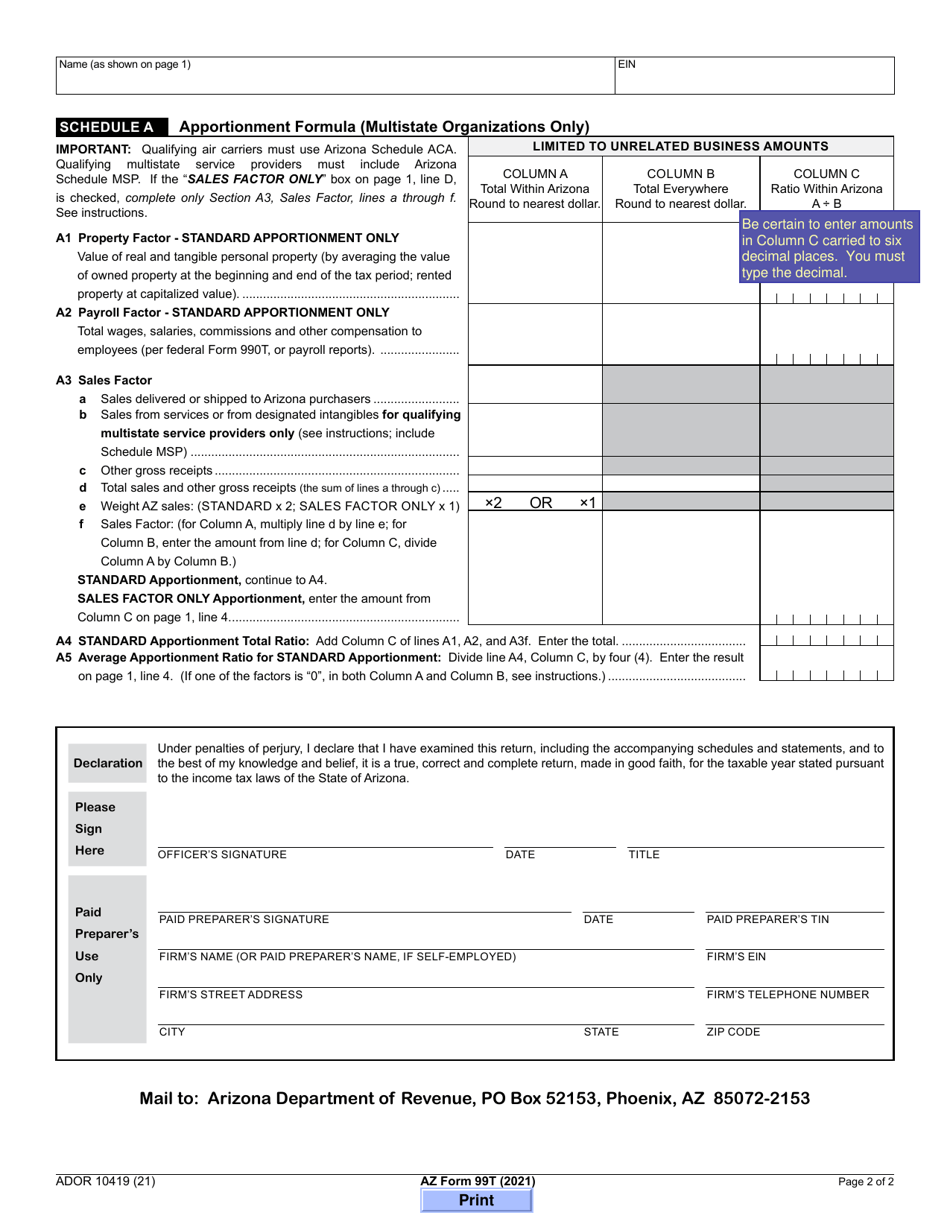

Arizona Form 99T (ADOR10419) Arizona Exempt Organization Business Income Tax Return - Arizona

What Is Arizona Form 99T (ADOR10419)?

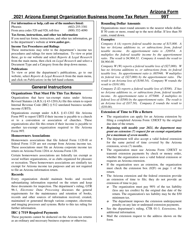

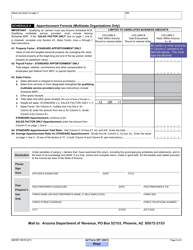

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 99T?

A: Arizona Form 99T is the Exempt Organization Business Income Tax Return for Arizona.

Q: Who needs to file Arizona Form 99T?

A: Exempt organizations that have business income in Arizona need to file Arizona Form 99T.

Q: What is the purpose of Arizona Form 99T?

A: The purpose of Arizona Form 99T is to report business income and calculate the tax liability of exempt organizations in Arizona.

Q: Is Arizona Form 99T for individuals or businesses?

A: Arizona Form 99T is specifically for exempt organizations that have business income in Arizona. It is not for individuals or regular businesses.

Q: What is the deadline to file Arizona Form 99T?

A: The deadline to file Arizona Form 99T is the same as the federal tax deadline, which is generally April 15th.

Q: Is there a filing fee for Arizona Form 99T?

A: No, there is no filing fee for Arizona Form 99T.

Q: Are there any penalties for late filing of Arizona Form 99T?

A: Yes, there can be penalties for late filing of Arizona Form 99T. It is important to file the return on time to avoid any penalties.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 99T (ADOR10419) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.