This version of the form is not currently in use and is provided for reference only. Download this version of

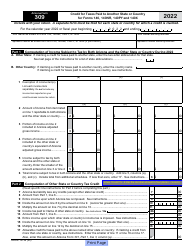

Arizona Form 318 (ADOR10942)

for the current year.

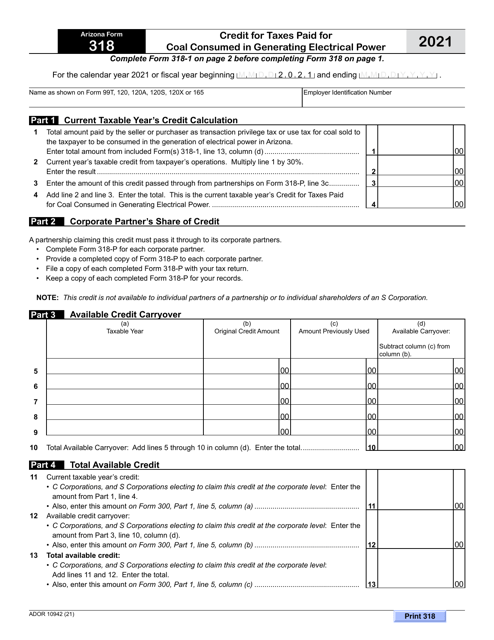

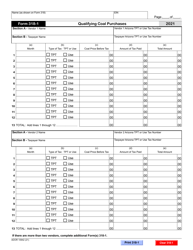

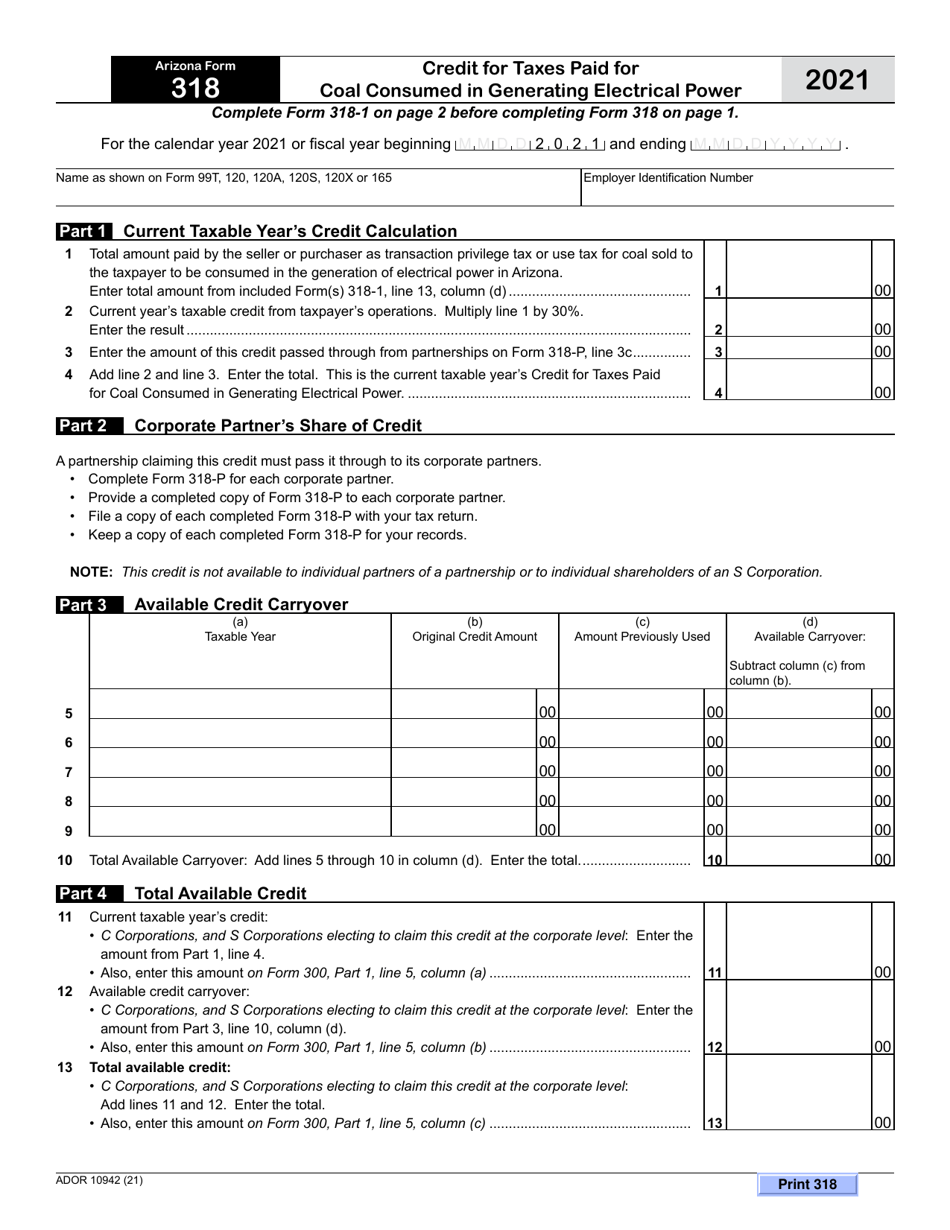

Arizona Form 318 (ADOR10942) Credit for Taxes Paid for Coal Consumed in Generating Electrical Power - Arizona

What Is Arizona Form 318 (ADOR10942)?

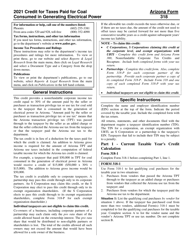

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 318?

A: Arizona Form 318 is a tax form used to claim a credit for taxes paid for coal consumed in generating electrical power in Arizona.

Q: Who can use Arizona Form 318?

A: Arizona taxpayers who paid taxes for coal consumed in generating electrical power in Arizona can use this form to claim a tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is intended to incentivize the use of coal in generating electrical power in Arizona.

Q: How do I submit Arizona Form 318?

A: Arizona Form 318 should be attached to your state income tax return when you file it.

Q: Is there a deadline to submit Arizona Form 318?

A: Yes, Arizona Form 318 must be submitted by the filing deadline for your state income tax return, typically April 15th.

Q: Can I claim the tax credit if I didn't consume coal in generating electrical power?

A: No, you can only claim the tax credit if you paid taxes for coal consumed in generating electrical power in Arizona.

Q: What supporting documentation do I need to submit with Arizona Form 318?

A: You may be required to submit documentation such as receipts or invoices showing the taxes paid on coal consumed.

Q: Is the tax credit refundable?

A: No, the tax credit is nonrefundable and can only be used to offset your Arizona state income tax liability.

Q: Can I carry forward any unused tax credit?

A: Yes, if you have excess tax credit that you cannot use in the current tax year, you may carry it forward to future years.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 318 (ADOR10942) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.