This version of the form is not currently in use and is provided for reference only. Download this version of

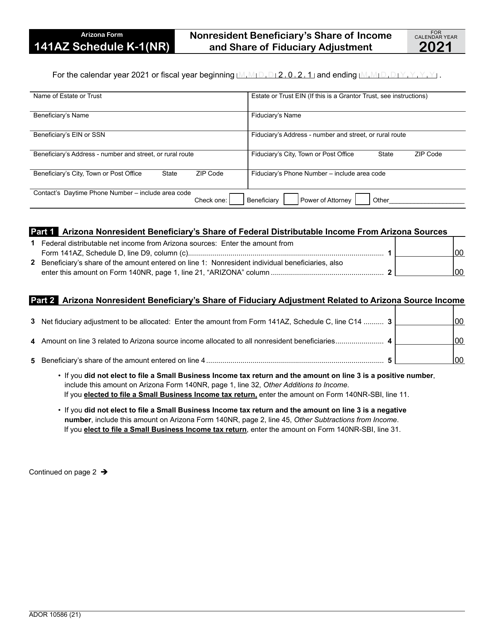

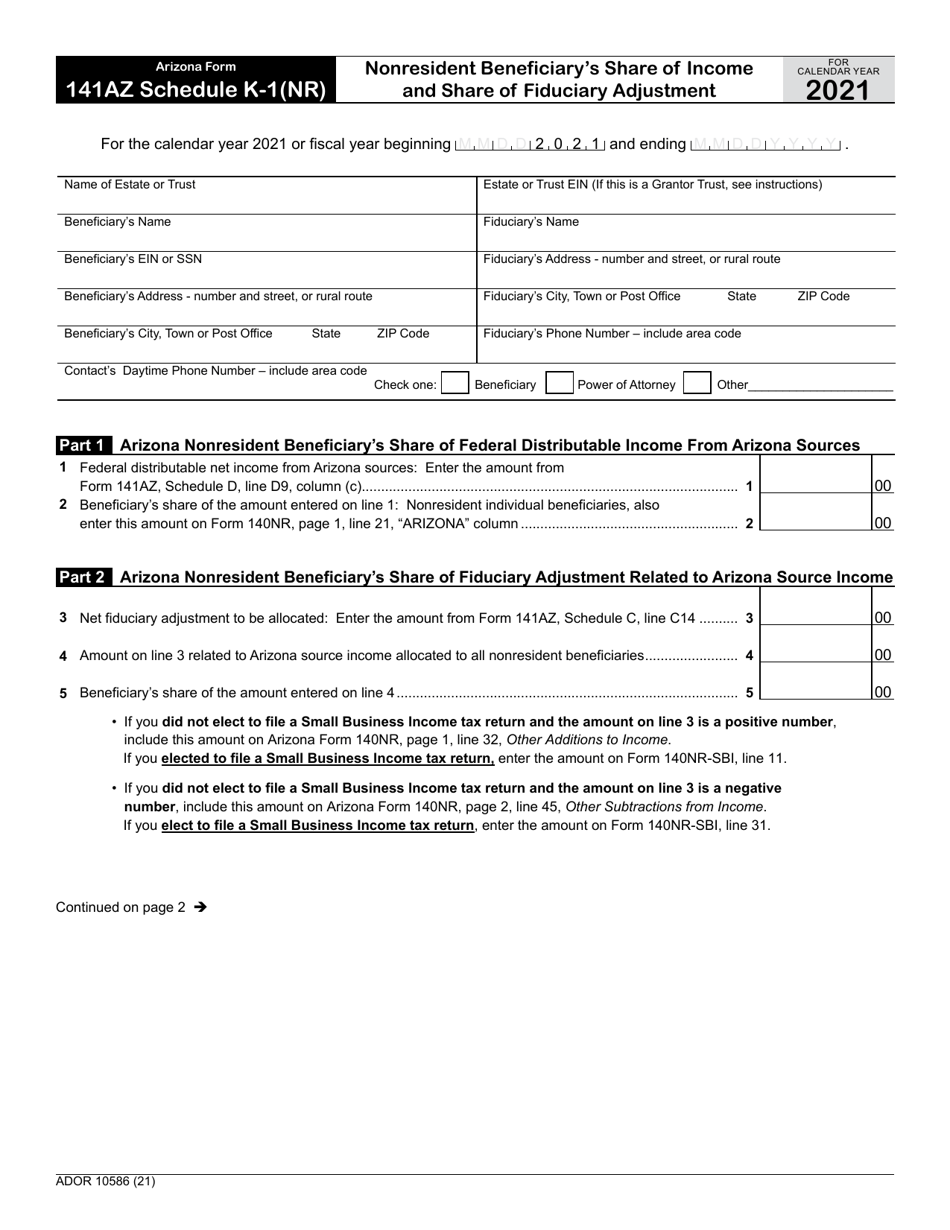

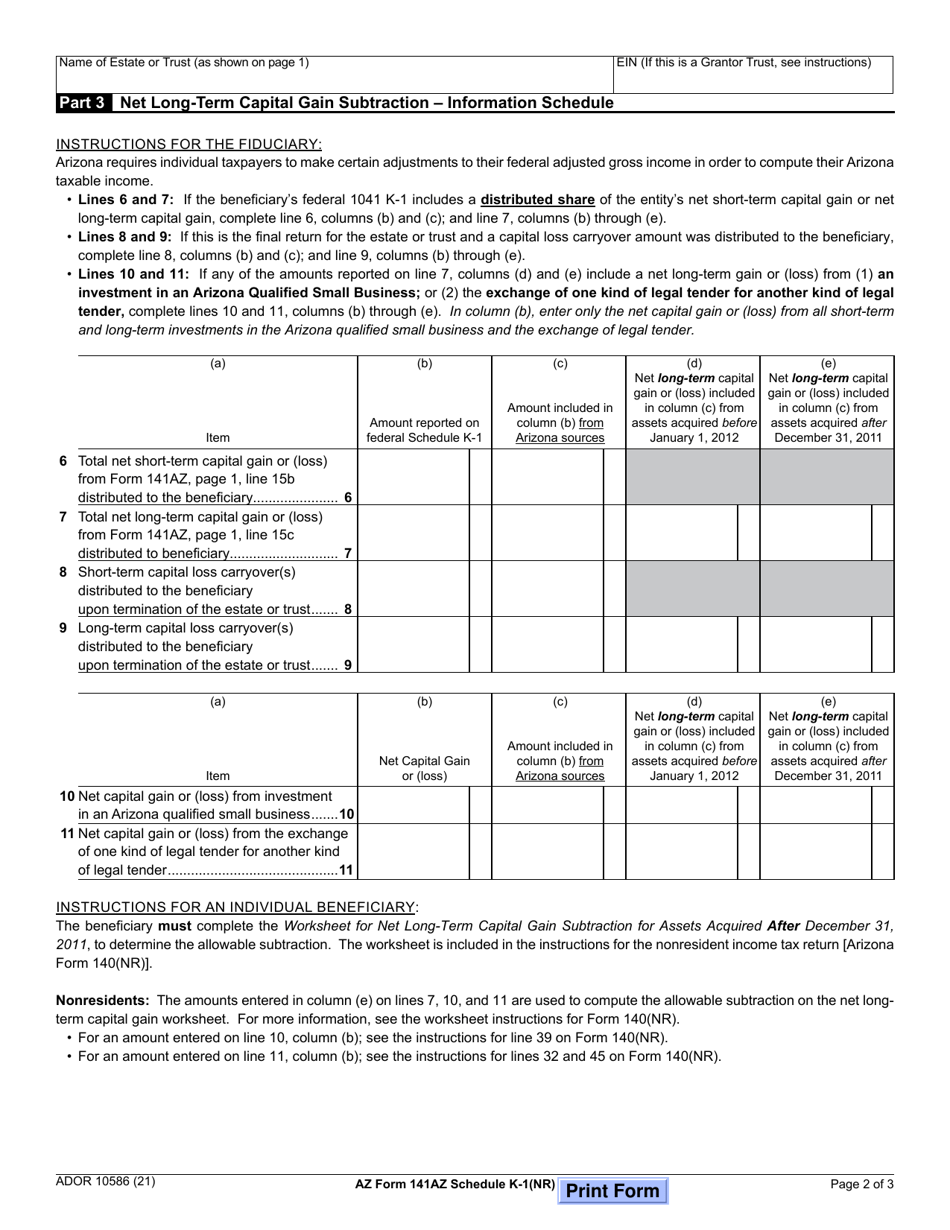

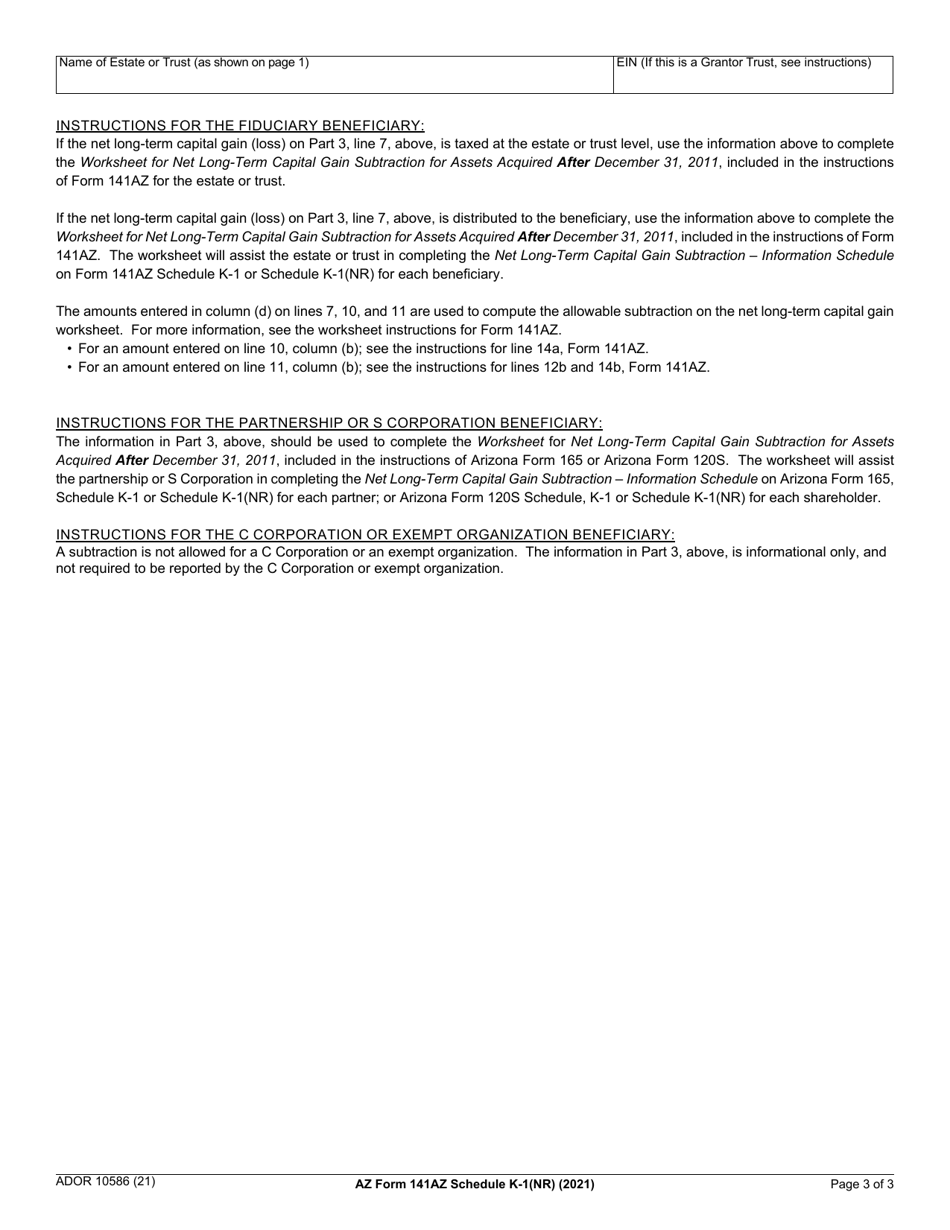

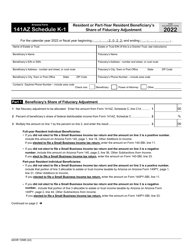

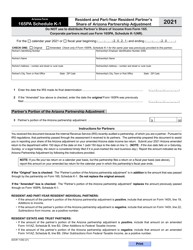

Arizona Form 141AZ (ADOR10586) Schedule K-1(NR)

for the current year.

Arizona Form 141AZ (ADOR10586) Schedule K-1(NR) Nonresident Beneficiary's Share of Income and Share of Fiduciary Adjustment - Arizona

What Is Arizona Form 141AZ (ADOR10586) Schedule K-1(NR)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 141AZ?

A: Arizona Form 141AZ is a tax form used by nonresident beneficiaries to report their share of income and fiduciary adjustment in Arizona.

Q: Who needs to file Arizona Form 141AZ?

A: Nonresident beneficiaries who have income and fiduciary adjustment in Arizona need to file Arizona Form 141AZ.

Q: What is Schedule K-1(NR)?

A: Schedule K-1(NR) is a part of Arizona Form 141AZ where nonresident beneficiaries report their share of income and fiduciary adjustment.

Q: What is a fiduciary adjustment?

A: A fiduciary adjustment is an adjustment made by a fiduciary on behalf of a beneficiary to reflect the beneficiary's share of income or deductions.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 141AZ (ADOR10586) Schedule K-1(NR) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.