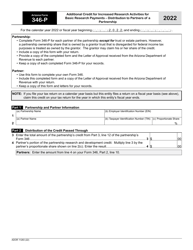

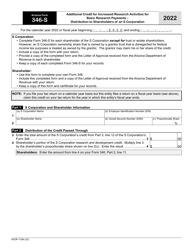

This version of the form is not currently in use and is provided for reference only. Download this version of

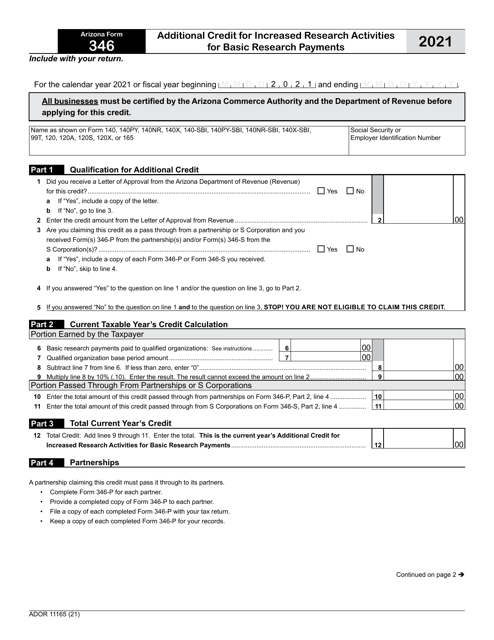

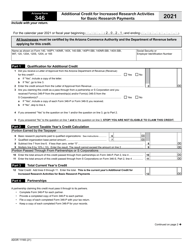

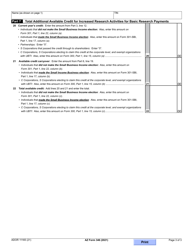

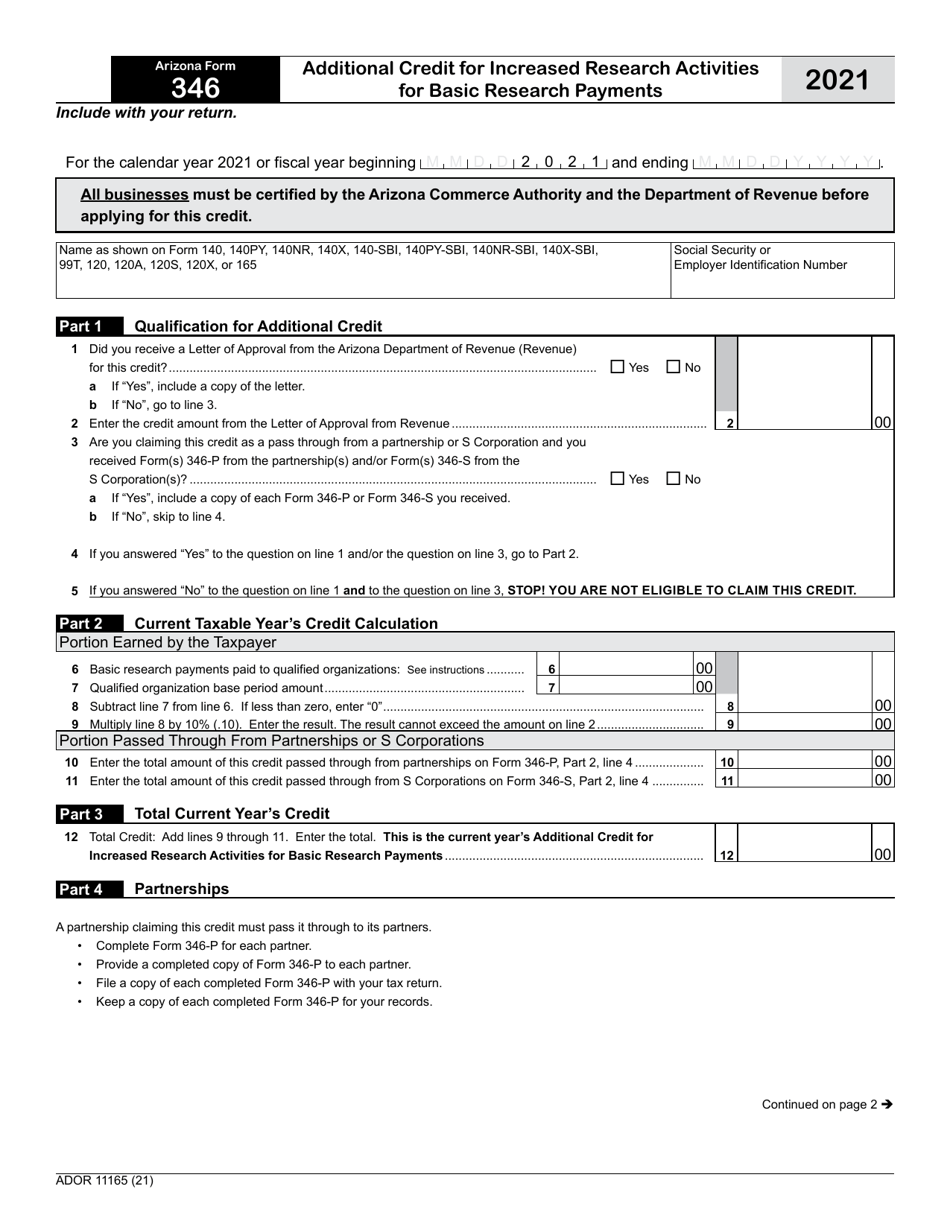

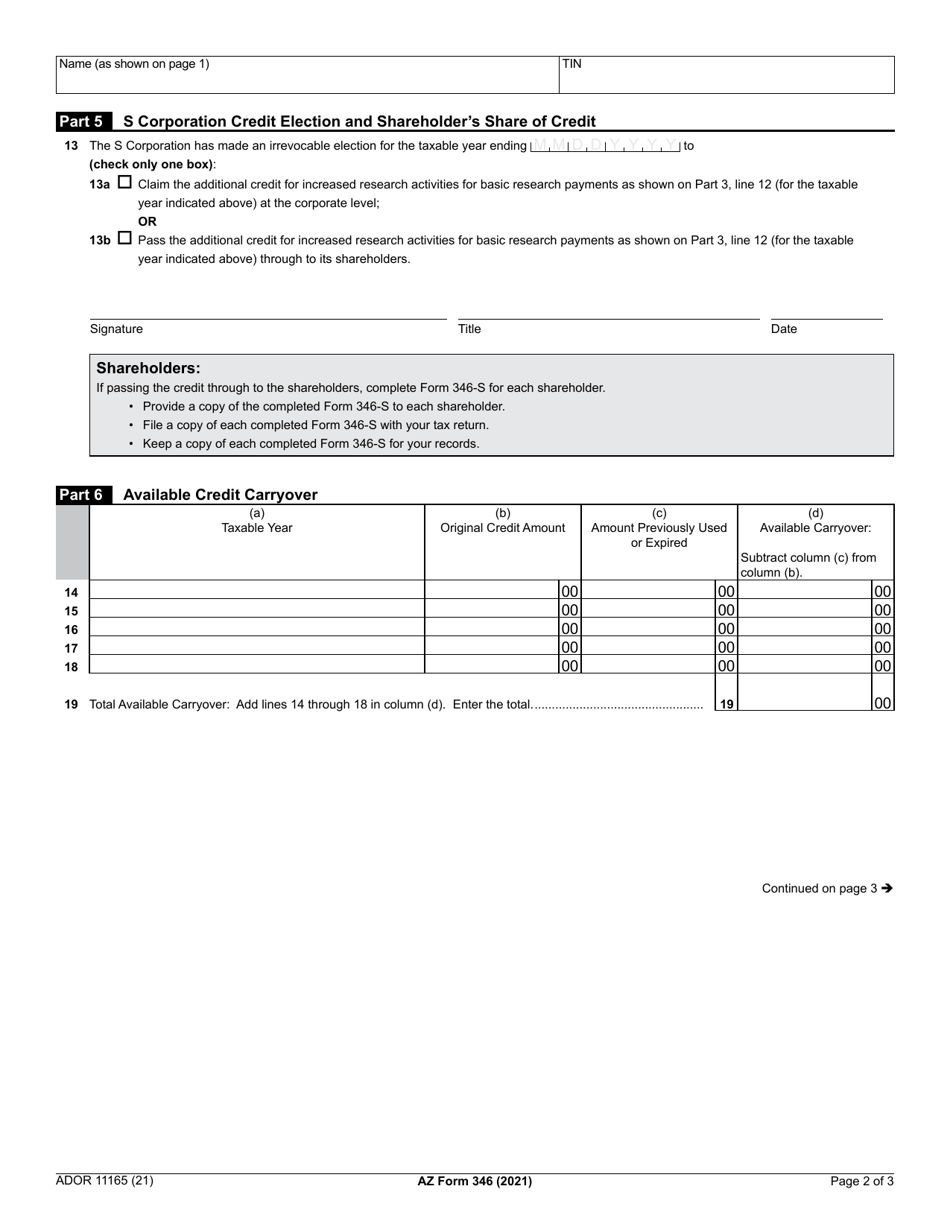

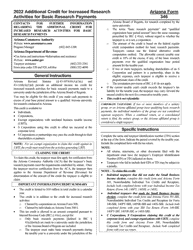

Arizona Form 346 (ADOR11165)

for the current year.

Arizona Form 346 (ADOR11165) Additional Credit for Increased Research Activities for Basic Research Payments - Arizona

What Is Arizona Form 346 (ADOR11165)?

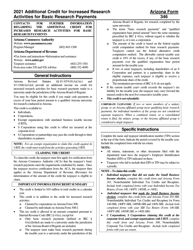

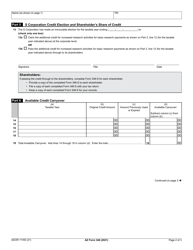

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 346?

A: Arizona Form 346 is a form that allows taxpayers in Arizona to claim an additional credit for increased research activities for basic research payments.

Q: What is the purpose of Arizona Form 346?

A: The purpose of Arizona Form 346 is to provide taxpayers with a way to claim a tax credit for their increased research activities in the state of Arizona.

Q: Who can use Arizona Form 346?

A: Taxpayers in Arizona who have made basic research payments and have increased their research activities can use Arizona Form 346 to claim an additional credit.

Q: What are basic research payments?

A: Basic research payments are payments made by taxpayers in Arizona for research activities that are intended to be useful in the development of a new or improved business component.

Q: How do I claim the additional credit using Arizona Form 346?

A: To claim the additional credit for increased research activities, taxpayers must complete Arizona Form 346 and include it with their state tax return.

Q: Is there a deadline for filing Arizona Form 346?

A: Yes, Arizona Form 346 must be filed by the due date of the taxpayer's Arizona tax return, including extension periods.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 346 (ADOR11165) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.