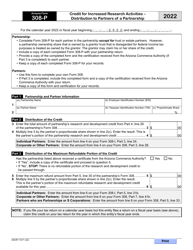

This version of the form is not currently in use and is provided for reference only. Download this version of

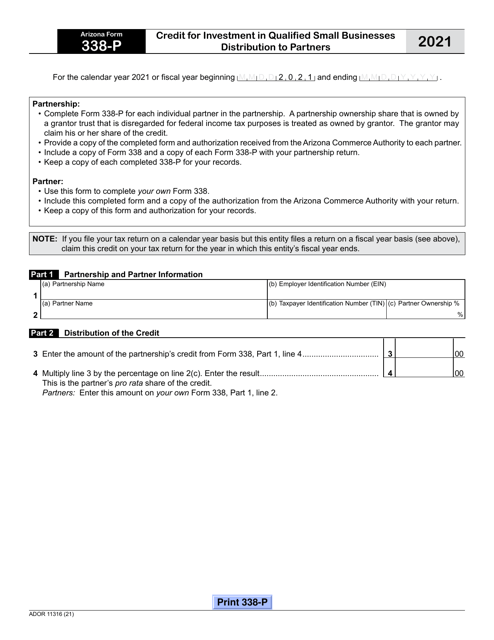

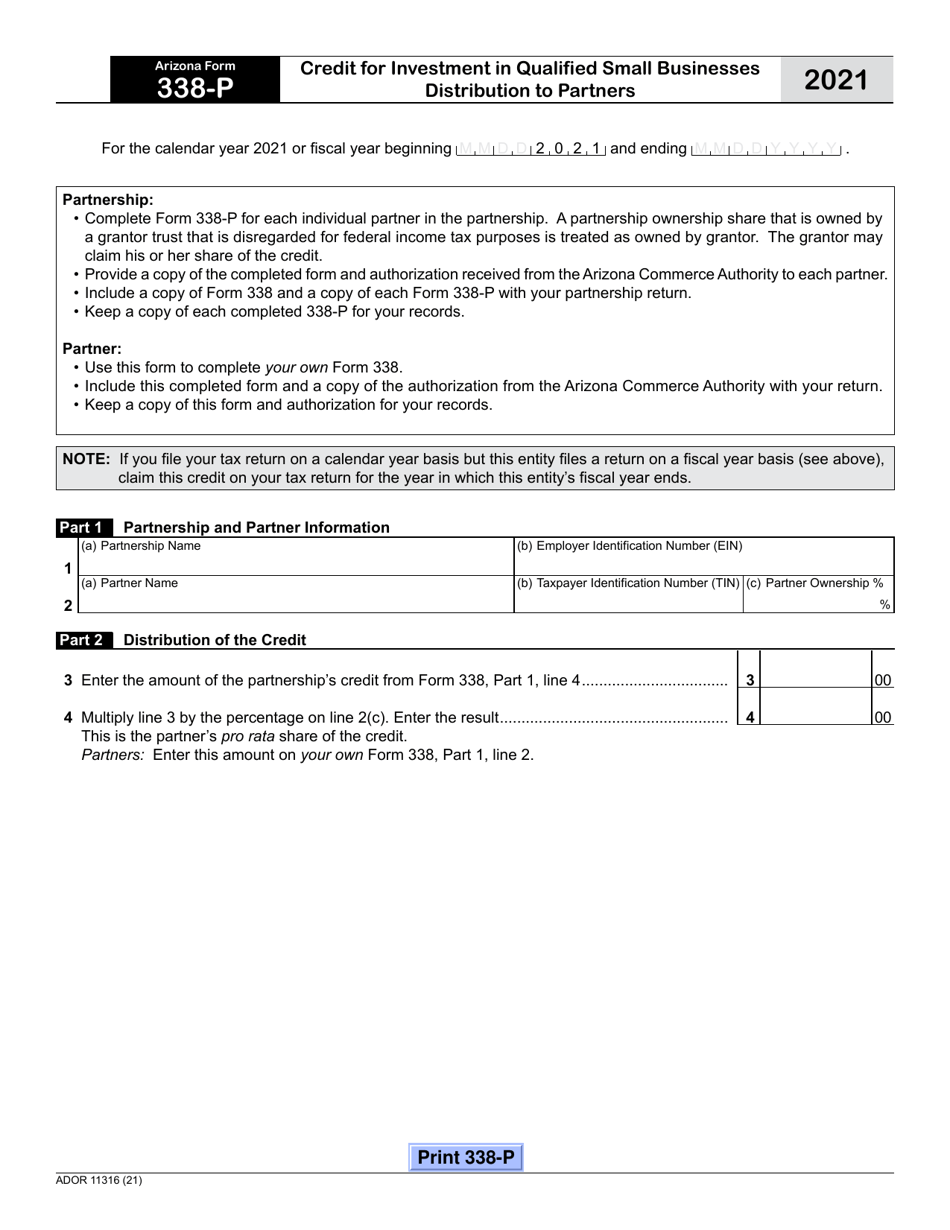

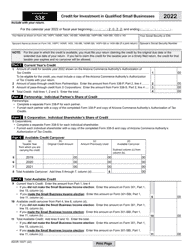

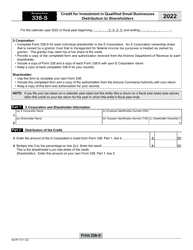

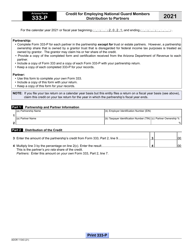

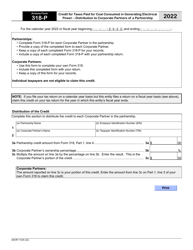

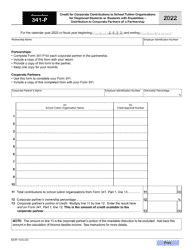

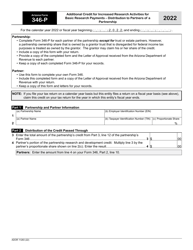

Arizona Form 338-P (ADOR11316)

for the current year.

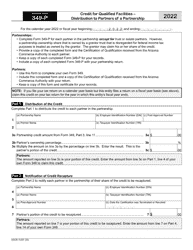

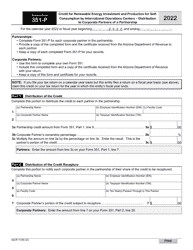

Arizona Form 338-P (ADOR11316) Credit for Investment in Qualified Small Businesses Distribution to Partners - Arizona

What Is Arizona Form 338-P (ADOR11316)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 338-P?

A: Arizona Form 338-P is a tax form used to claim the Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona.

Q: Who can use Arizona Form 338-P?

A: Arizona Form 338-P can be used by individuals or entities who have made qualified investments in small businesses in Arizona.

Q: What is the purpose of Arizona Form 338-P?

A: The purpose of Arizona Form 338-P is to calculate and claim the Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona.

Q: What is the Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona?

A: The Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona is a tax credit offered by the state of Arizona to individuals or entities who invest in qualified small businesses.

Q: How do I qualify for the Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona?

A: To qualify for the credit, you must have made a qualified investment in a small business in Arizona and meet the other eligibility criteria set by the Arizona Department of Revenue.

Q: When is the deadline to file Arizona Form 338-P?

A: The deadline to file Arizona Form 338-P is usually April 15th, unless an extension has been granted by the Arizona Department of Revenue.

Q: Is the Credit for Investment in Qualified Small Businesses Distribution to Partners refundable?

A: No, the Credit for Investment in Qualified Small Businesses Distribution to Partners in Arizona is not refundable. However, any unused credit can be carried forward for up to 5 years.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 338-P (ADOR11316) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.