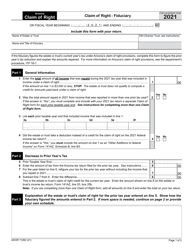

Instructions for Form ADOR11273 Claim of Right - Individual - Arizona

This document contains official instructions for Form ADOR11273 , Claim of Right - Individual - a form released and collected by the Arizona Department of Revenue. An up-to-date fillable Form ADOR11273 is available for download through this link.

FAQ

Q: What is Form ADOR11273?

A: Form ADOR11273 is a claim of right form for individuals in Arizona.

Q: Who should use Form ADOR11273?

A: Individuals in Arizona who are claiming a refund or credit for taxes paid on income that is later determined not to be taxable should use Form ADOR11273.

Q: What is the purpose of Form ADOR11273?

A: The purpose of Form ADOR11273 is to provide individuals with a way to claim a refund or credit for taxes paid on income that is later determined not to be taxable.

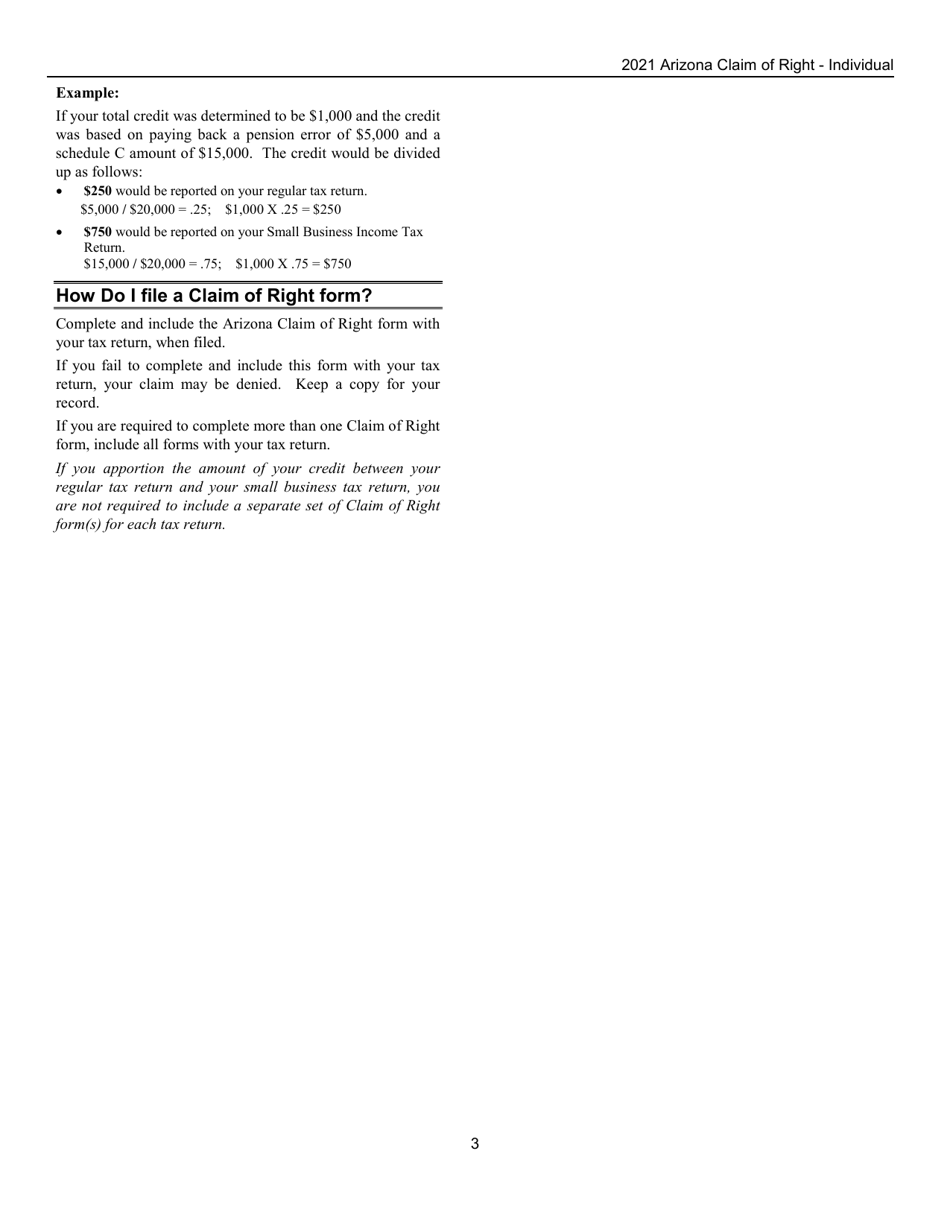

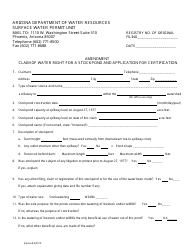

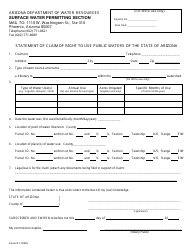

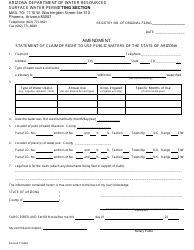

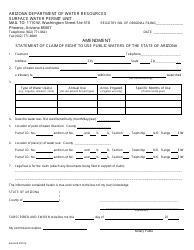

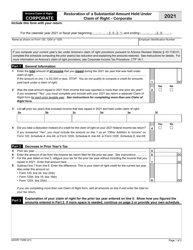

Q: How do I fill out Form ADOR11273?

A: Form ADOR11273 requires you to provide your personal information, details of the income, and the reason why you believe the income is not taxable.

Q: When should I submit Form ADOR11273?

A: You should submit Form ADOR11273 as soon as possible after you determine that the income is not taxable.

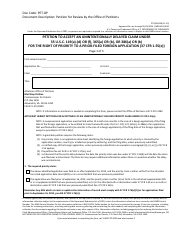

Q: What should I do after submitting Form ADOR11273?

A: After submitting Form ADOR11273, you should keep a copy for your records and wait for the Arizona Department of Revenue to process your claim.

Q: How long does it take to process Form ADOR11273?

A: The processing time for Form ADOR11273 varies, but it generally takes several weeks to a few months.

Q: What happens if my claim is approved?

A: If your claim is approved, you will receive a refund or credit for the taxes paid on the income.

Q: What happens if my claim is denied?

A: If your claim is denied, you have the option to appeal the decision with the Arizona Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.