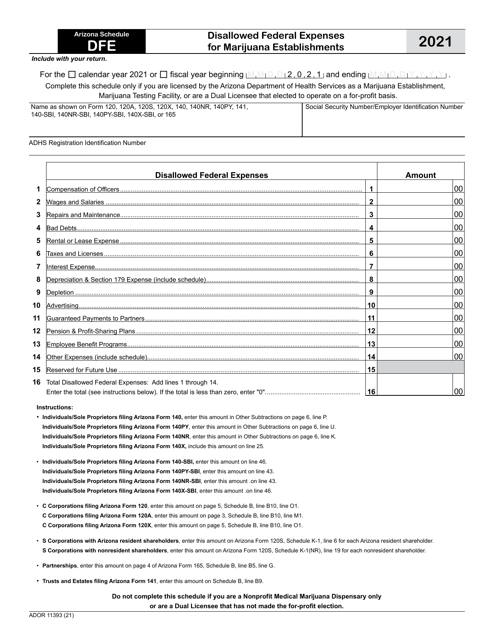

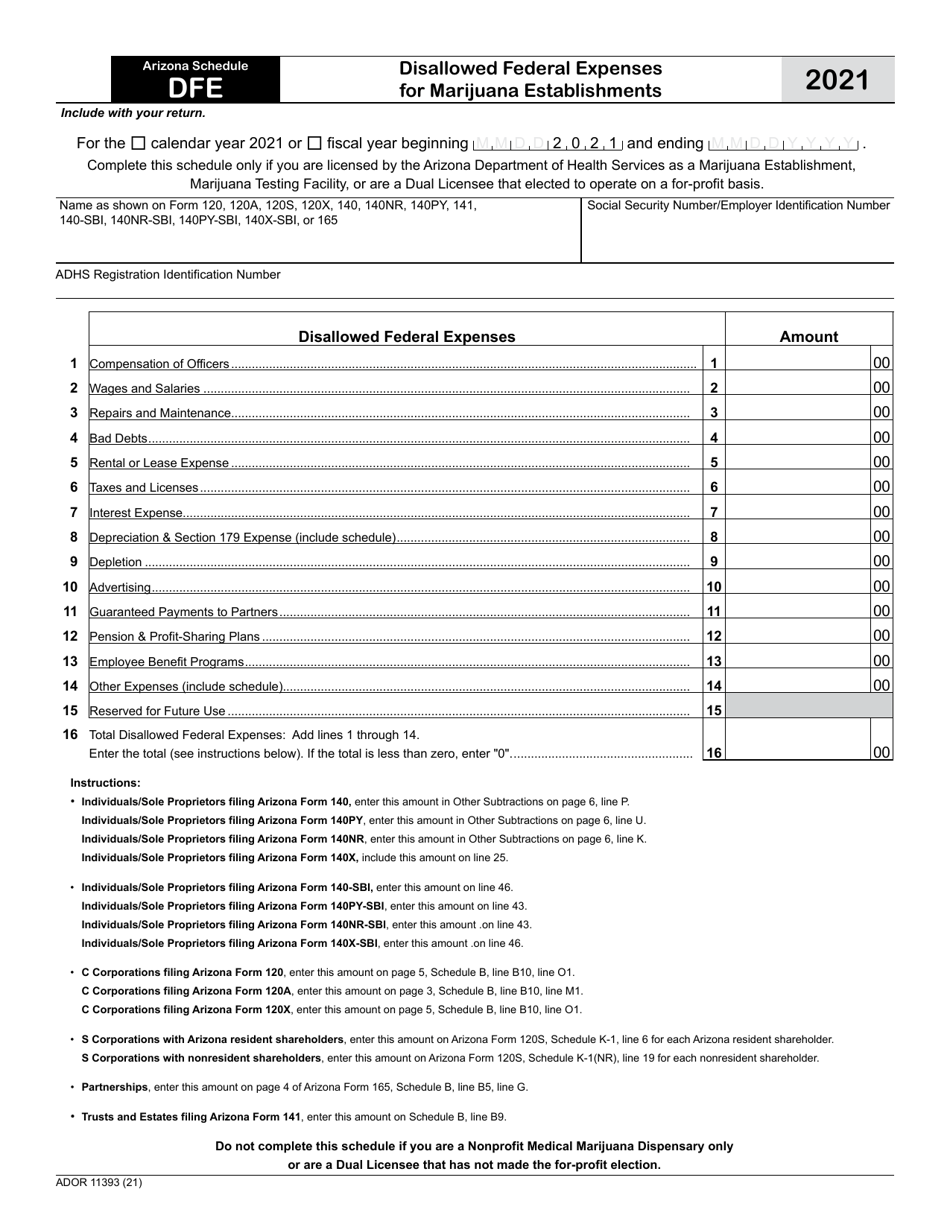

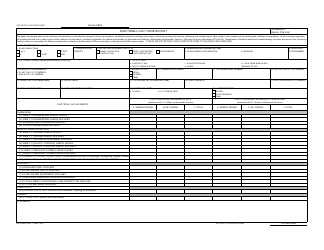

Form ADOR11393 Schedule DFE Disallowed Federal Expenses for Marijuana Establishments - Arizona

What Is Form ADOR11393 Schedule DFE?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ADOR11393?

A: Form ADOR11393 is a Schedule DFE form for reporting disallowed federal expenses for marijuana establishments in Arizona.

Q: What does Schedule DFE stand for?

A: Schedule DFE stands for Disallowed Federal Expenses.

Q: Who needs to file Form ADOR11393?

A: Marijuana establishments in Arizona need to file Form ADOR11393.

Q: What are disallowed federal expenses?

A: Disallowed federal expenses are expenses related to marijuana businesses that are not allowed as deductions for federal tax purposes.

Q: Why are federal expenses disallowed for marijuana establishments?

A: Federal law classifies marijuana as a controlled substance, and therefore businesses involved in marijuana activities are not allowed to deduct their ordinary and necessary business expenses for federal tax purposes.

Q: Is Form ADOR11393 for federal or state taxes?

A: Form ADOR11393 is for state taxes, specifically for reporting disallowed federal expenses related to marijuana establishments in Arizona.

Q: When is the deadline to file Form ADOR11393?

A: The deadline for filing Form ADOR11393 is usually the same as the deadline for filing Arizona state taxes, which is typically April 15th, or the next business day if it falls on a weekend or holiday.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11393 Schedule DFE by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.