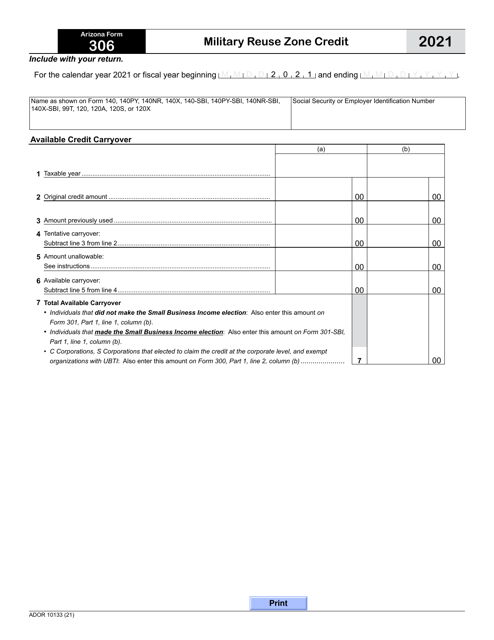

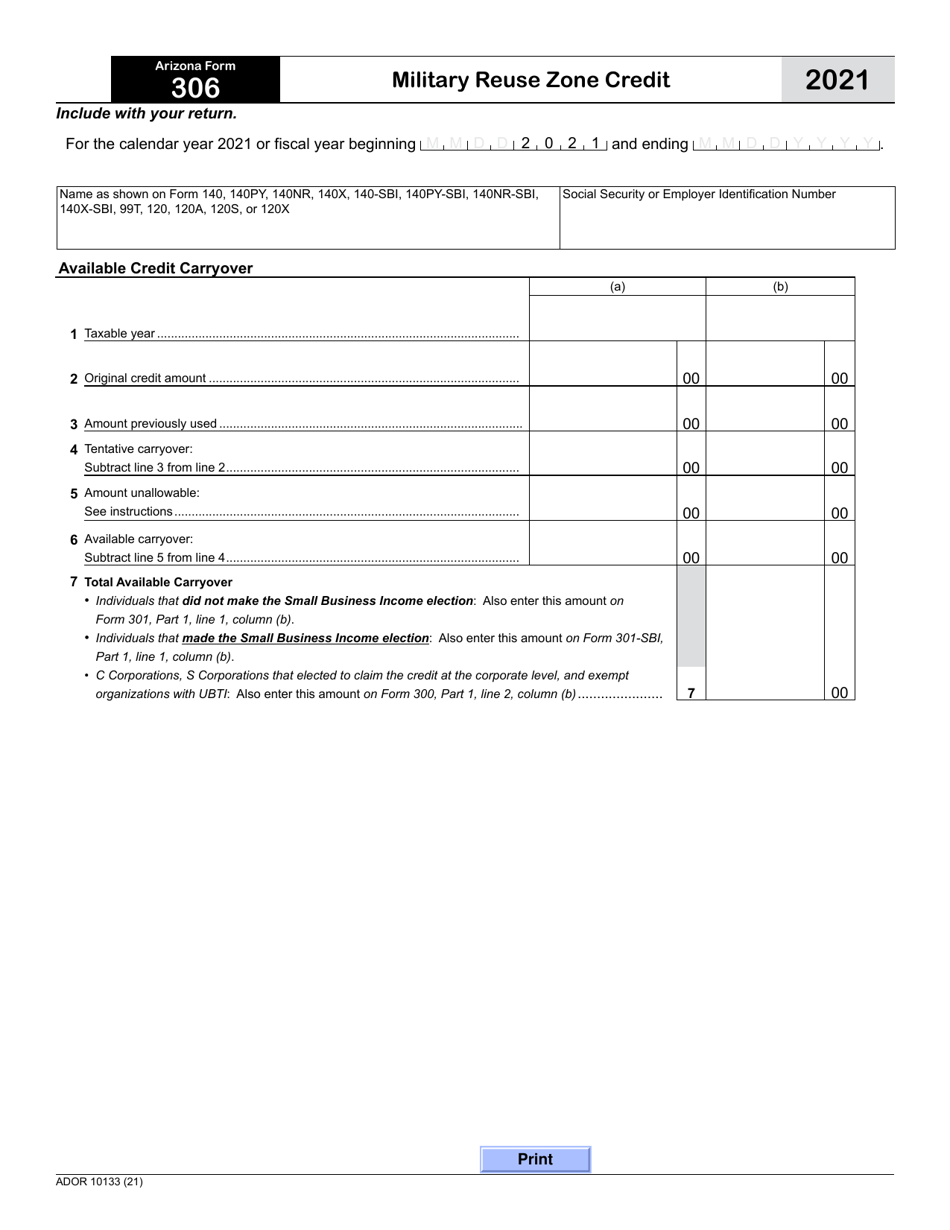

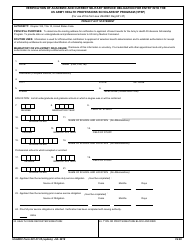

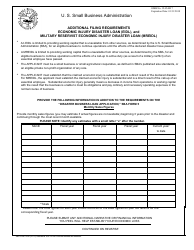

Arizona Form 306 (ADOR10133) Military Reuse Zone Credit - Arizona

What Is Arizona Form 306 (ADOR10133)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 306?

A: Arizona Form 306 is a tax form specifically for claiming the Military Reuse Zone Credit in Arizona.

Q: What is the Military Reuse Zone Credit?

A: The Military Reuse Zone Credit is a tax credit available to businesses located in designated Military Reuse Zones in Arizona.

Q: Who is eligible to claim the Military Reuse Zone Credit?

A: Businesses that are located in designated Military Reuse Zones in Arizona are eligible to claim this tax credit.

Q: What is the purpose of the Military Reuse Zones?

A: The Military Reuse Zones are designated areas where former military facilities have been repurposed for economic development and job creation.

Q: What expenses can be included for the Military Reuse Zone Credit?

A: Expenses such as qualified wages and salaries, electric power costs, and certain research and development expenses can be included for this tax credit.

Q: Are there any restrictions or limitations for claiming the Military Reuse Zone Credit?

A: Yes, there are certain restrictions and limitations on the amount of credit that can be claimed based on the size of the business and the amount of qualified expenses.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 306 (ADOR10133) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.