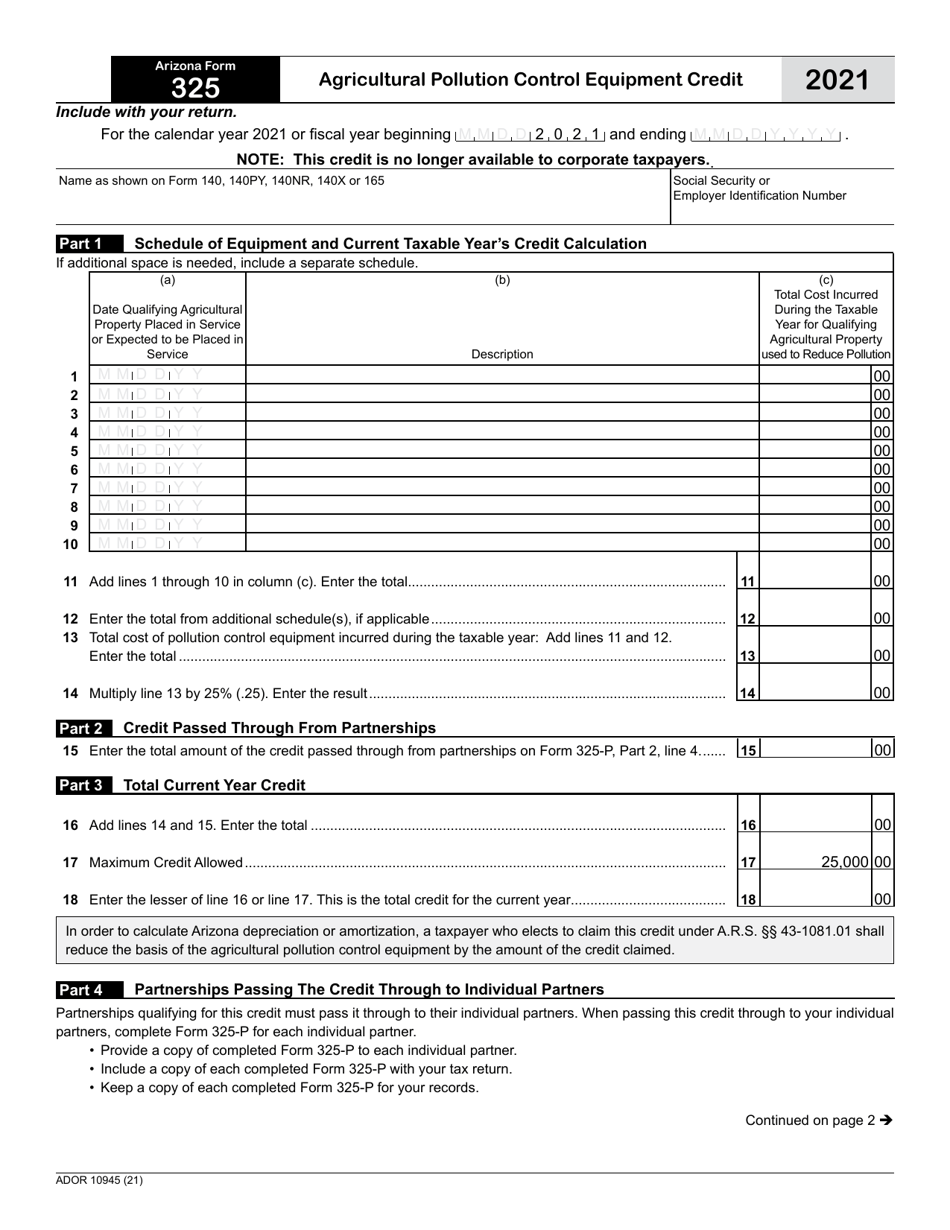

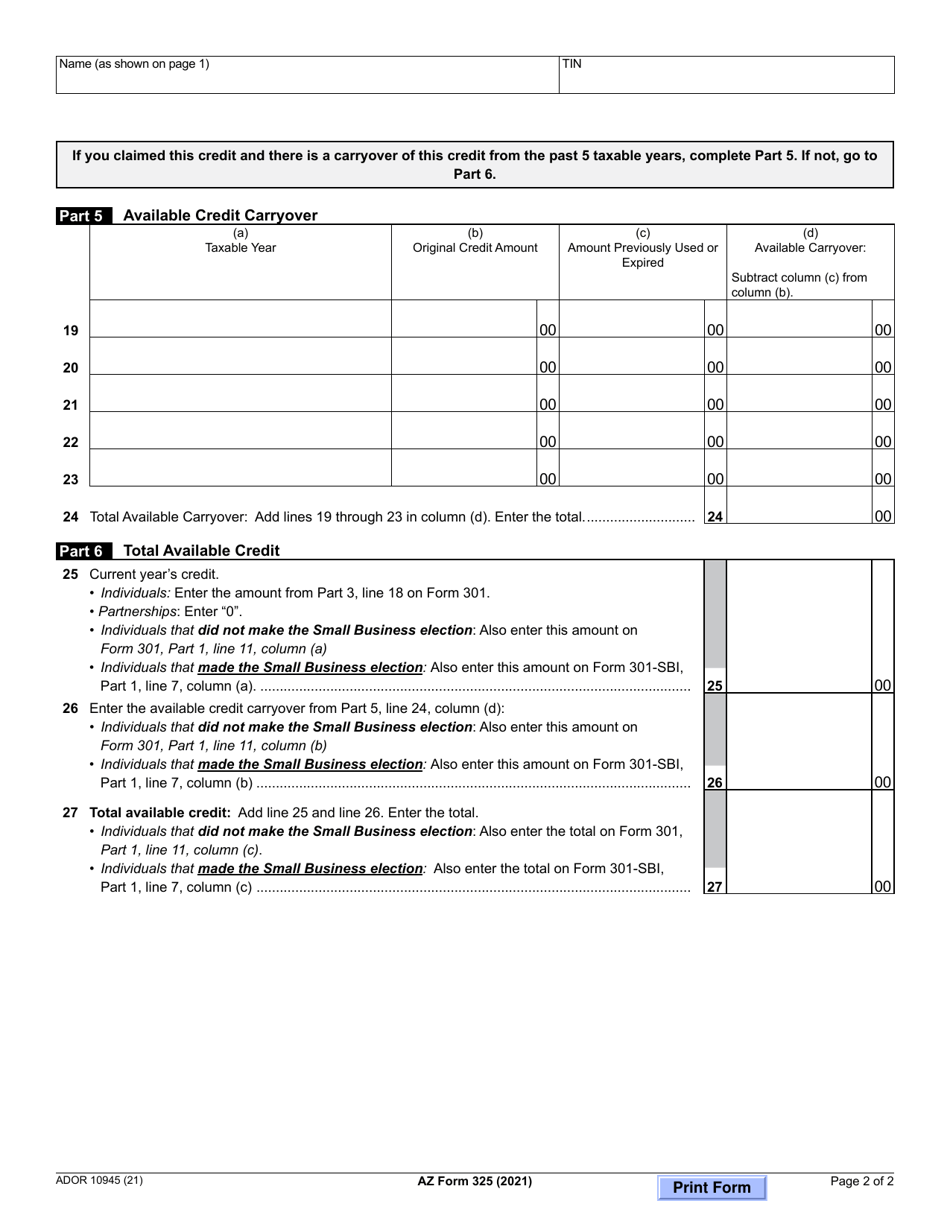

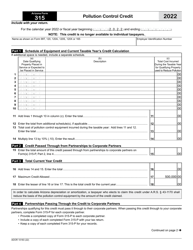

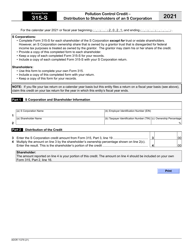

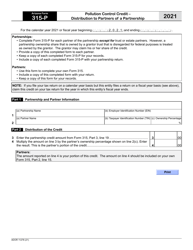

This version of the form is not currently in use and is provided for reference only. Download this version of

Arizona Form 325 (ADOR10945)

for the current year.

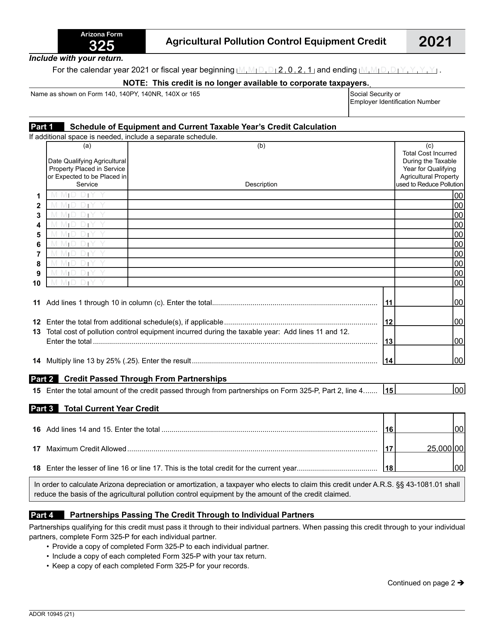

Arizona Form 325 (ADOR10945) Agricultural Pollution Control Equipment Credit - Arizona

What Is Arizona Form 325 (ADOR10945)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 325?

A: Arizona Form 325 is a tax form used to claim the Agricultural Pollution ControlEquipment Credit in Arizona.

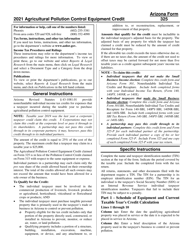

Q: What is the Agricultural Pollution Control Equipment Credit?

A: The Agricultural Pollution Control Equipment Credit is a tax credit available to eligible Arizona farmers who purchase and install qualifying pollution control equipment.

Q: Who is eligible for the Agricultural Pollution Control Equipment Credit?

A: Eligible individuals, partnerships, corporations, or limited liability companies engaged in farming operations in Arizona are eligible for the credit.

Q: What is considered qualifying pollution control equipment?

A: Qualifying pollution control equipment includes equipment used to control or abate agricultural pollution, such as waste management systems or air or water pollution control equipment.

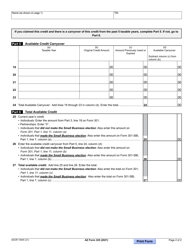

Q: How much is the tax credit?

A: The tax credit is equal to 10% of the cost of qualifying pollution control equipment, up to a maximum credit of $20,000 per taxpayer.

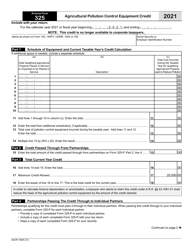

Q: How do I claim the Agricultural Pollution Control Equipment Credit?

A: To claim the credit, you must complete and file Arizona Form 325 with your state tax return.

Q: Are there any limitations or conditions for claiming the credit?

A: Yes, there are limitations and conditions for claiming the credit. It's advised to review the official instructions provided with the form for detailed information.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 325 (ADOR10945) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.