This version of the form is not currently in use and is provided for reference only. Download this version of

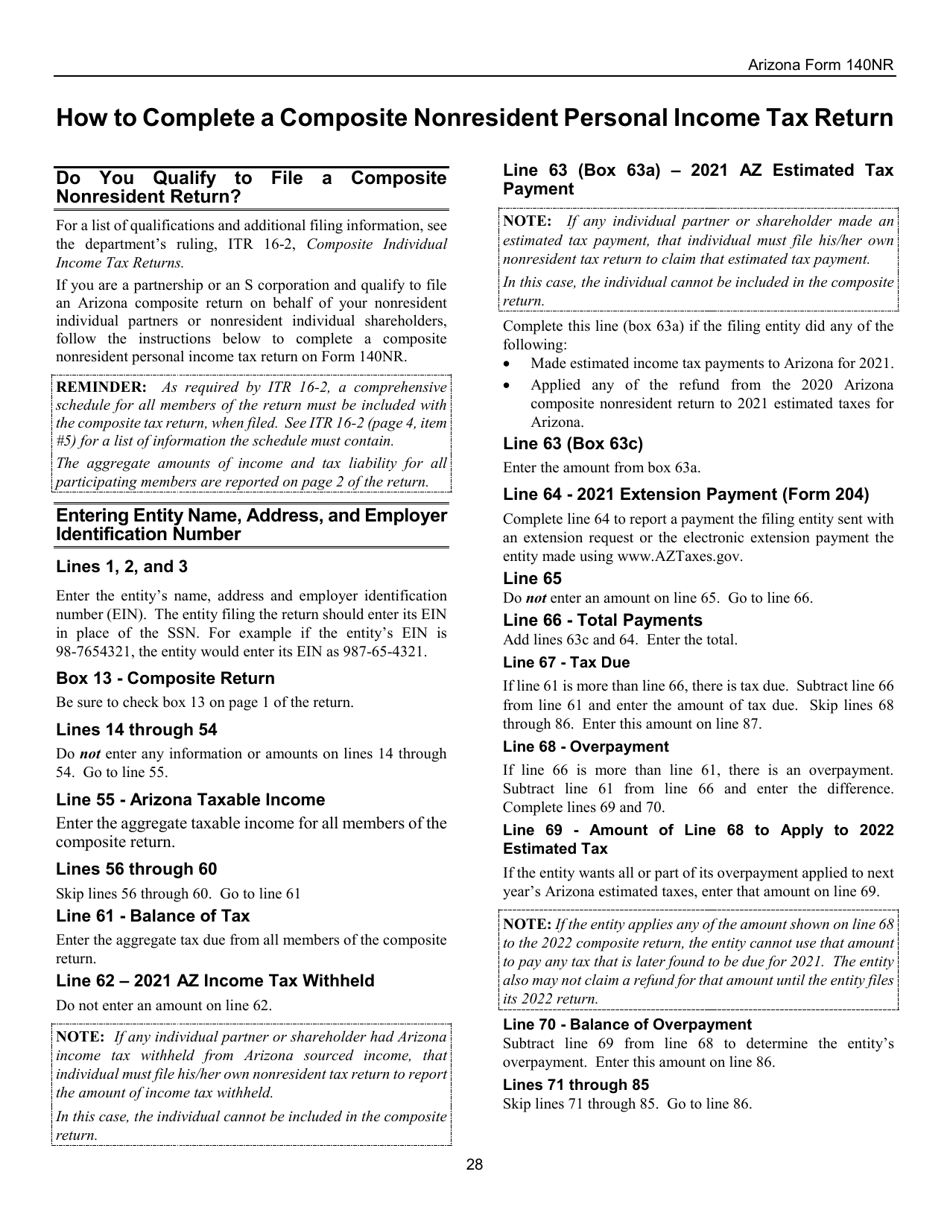

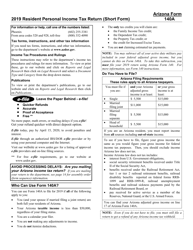

Instructions for Arizona Form 140NR, ADOR10413

for the current year.

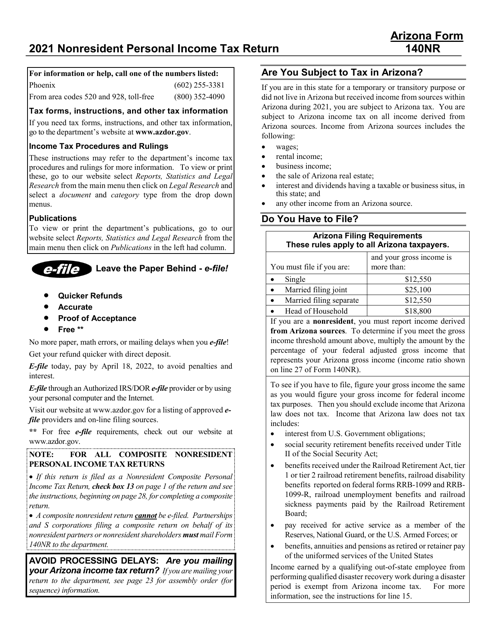

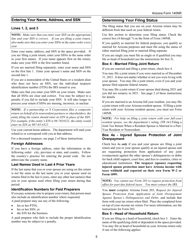

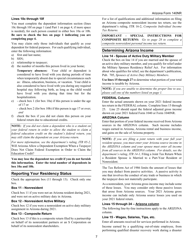

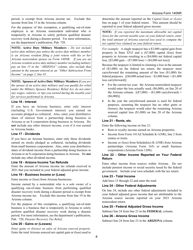

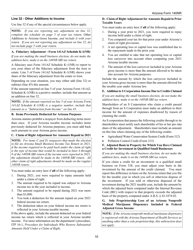

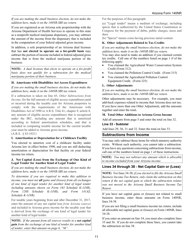

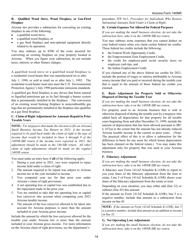

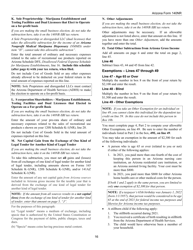

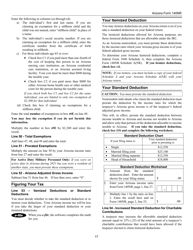

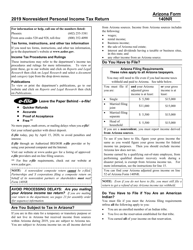

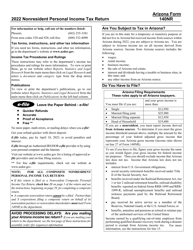

Instructions for Arizona Form 140NR, ADOR10413 Nonresident Personal Income Tax - Arizona

This document contains official instructions for Arizona Form 140NR , and Form ADOR10413 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 140NR?

A: Arizona Form 140NR is a tax form used by nonresidents of Arizona to report and pay personal income tax.

Q: Who needs to file Arizona Form 140NR?

A: Nonresidents of Arizona who have taxable income from Arizona sources need to file Arizona Form 140NR.

Q: What is considered taxable income from Arizona sources?

A: Taxable income from Arizona sources includes income earned in Arizona, rental income from Arizona property, and income from an Arizona business.

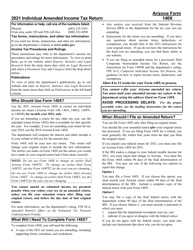

Q: When is the deadline to file Arizona Form 140NR?

A: The deadline to file Arizona Form 140NR is April 15th, or the following business day if April 15th falls on a weekend or holiday.

Q: Are there any extensions available for filing Arizona Form 140NR?

A: Yes, you can request an extension to file Arizona Form 140NR, but any taxes owed must still be paid by the original due date.

Q: What if I have questions or need assistance with Arizona Form 140NR?

A: You can contact the Arizona Department of Revenue for assistance with Arizona Form 140NR.

Instruction Details:

- This 29-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.