This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 319, ADOR10943

for the current year.

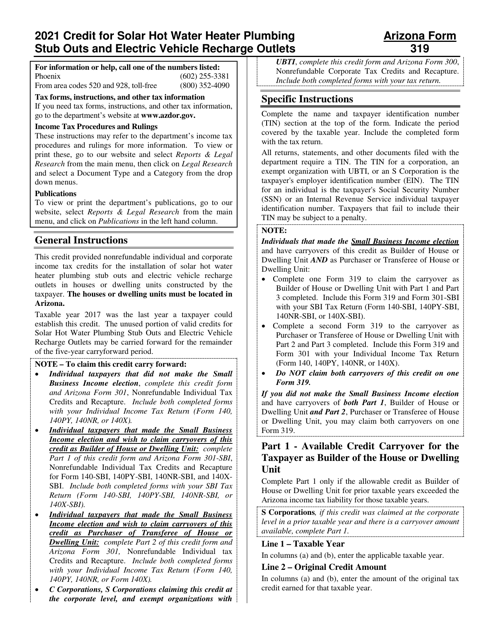

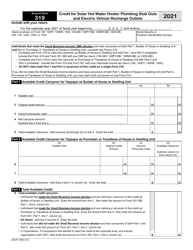

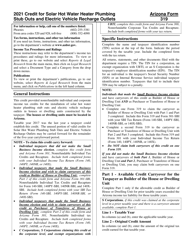

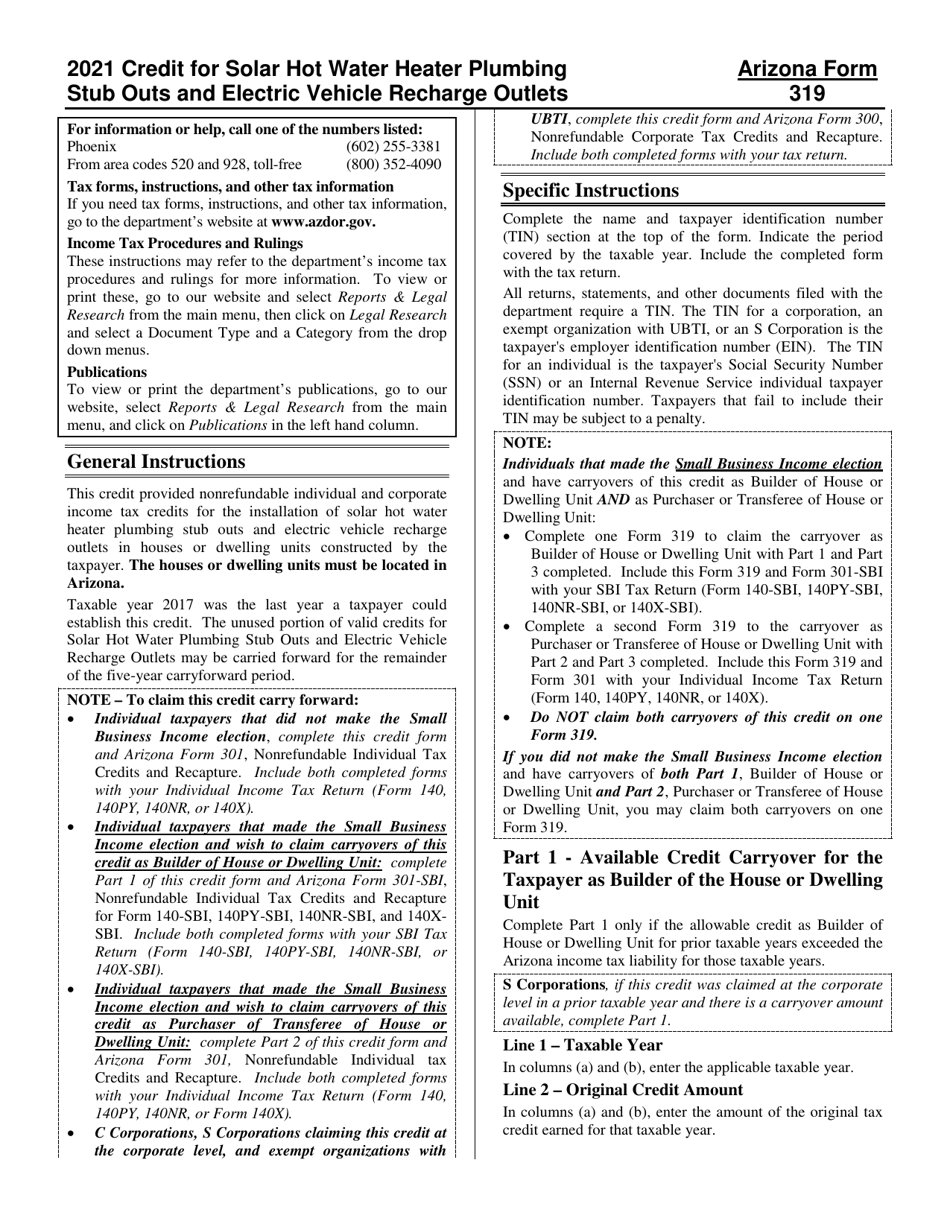

Instructions for Arizona Form 319, ADOR10943 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge Outlets - Arizona

This document contains official instructions for Arizona Form 319 , and Form ADOR10943 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 319 (ADOR10943) is available for download through this link.

FAQ

Q: What is Arizona Form 319?

A: Arizona Form 319 is a tax form.

Q: What is ADOR10943?

A: ADOR10943 is the form number for Arizona Form 319.

Q: What is the purpose of Arizona Form 319?

A: Arizona Form 319 is used to claim a tax credit for installing solar hot water heater plumbing stub outs and electric vehicle recharge outlets in Arizona.

Q: Who can use Arizona Form 319?

A: Individuals or businesses who have installed solar hot water heater plumbing stub outs and/or electric vehicle recharge outlets in Arizona may use this form.

Q: What is the tax credit for?

A: The tax credit is for the expenses incurred in installing solar hot water heater plumbing stub outs and electric vehicle recharge outlets.

Q: How do I fill out Arizona Form 319?

A: You will need to provide your personal and contact information, details about the installation, and any supporting documentation.

Q: Is there a deadline for submitting Arizona Form 319?

A: Yes, you must submit the form by the designated tax deadline for the applicable tax year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.