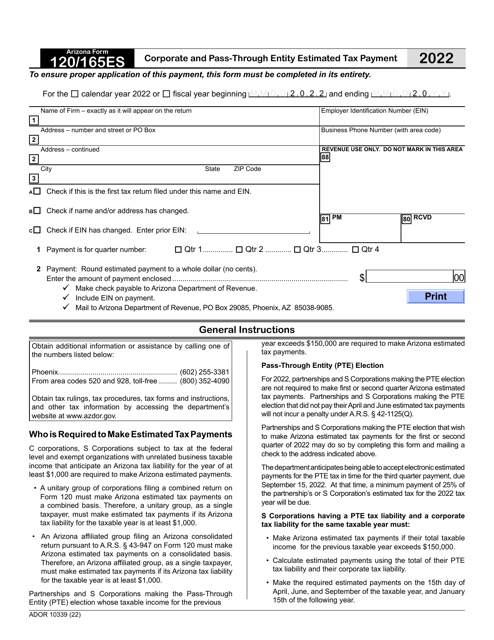

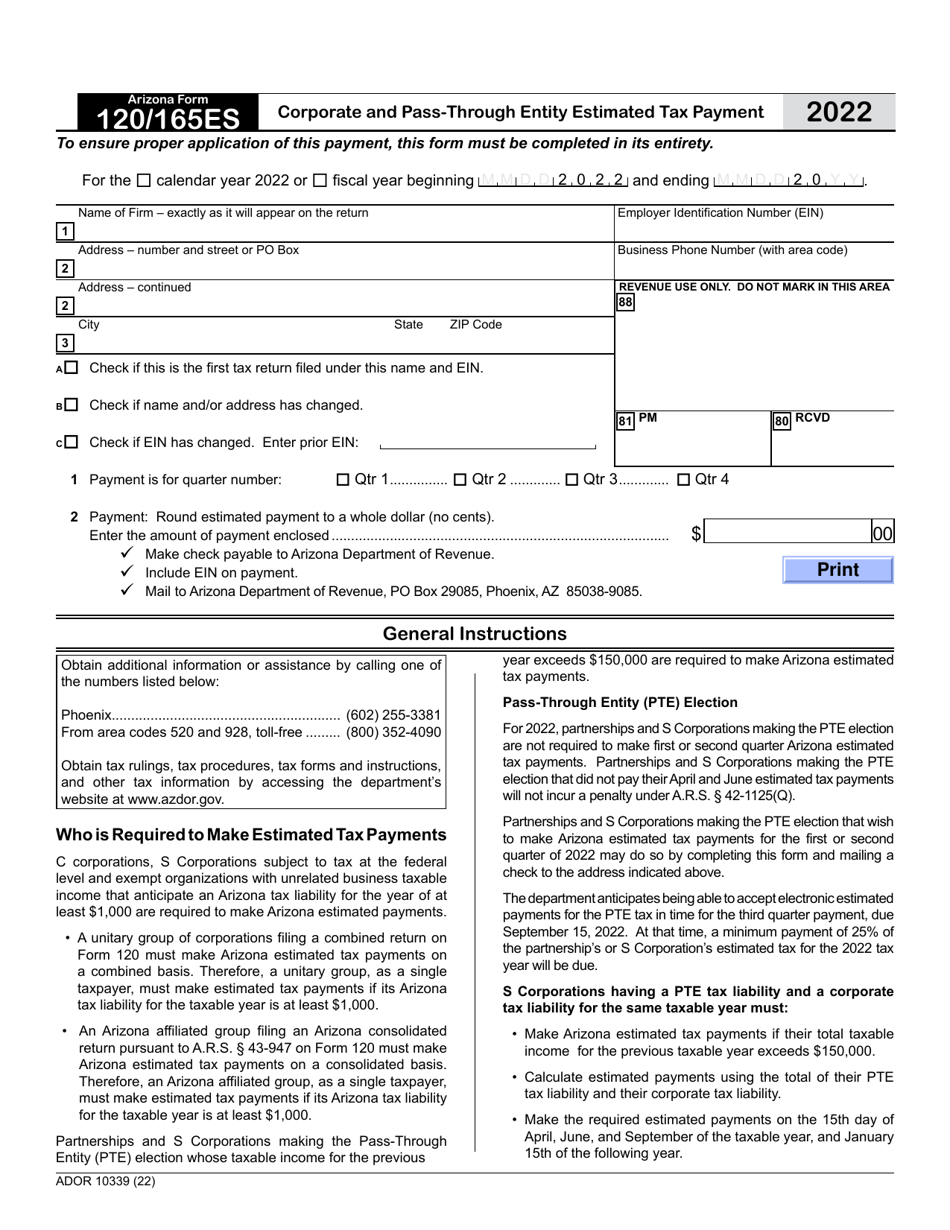

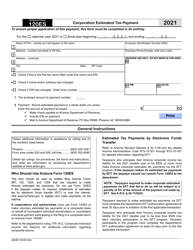

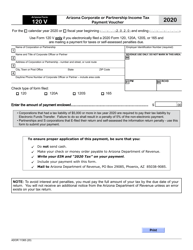

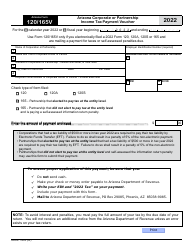

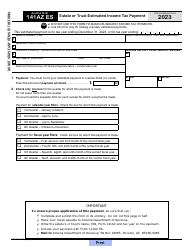

Arizona Form 120 / 165ES (ADOR10339) Corporate and Pass-Through Entity Estimated Tax Payment - Arizona

What Is Arizona Form 120/165ES (ADOR10339)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 120/165ES?

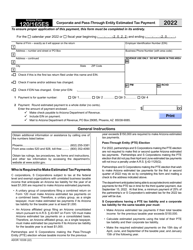

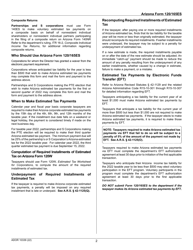

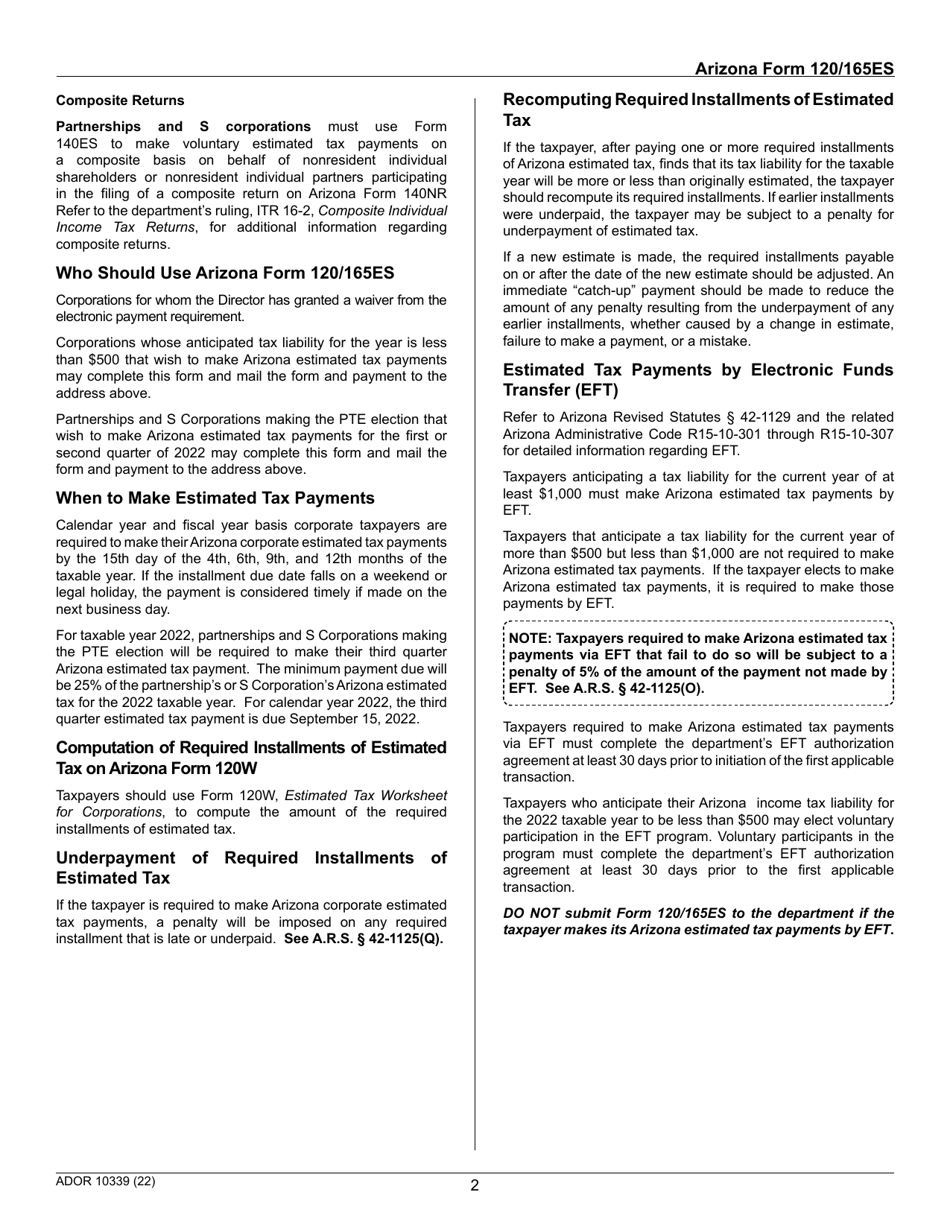

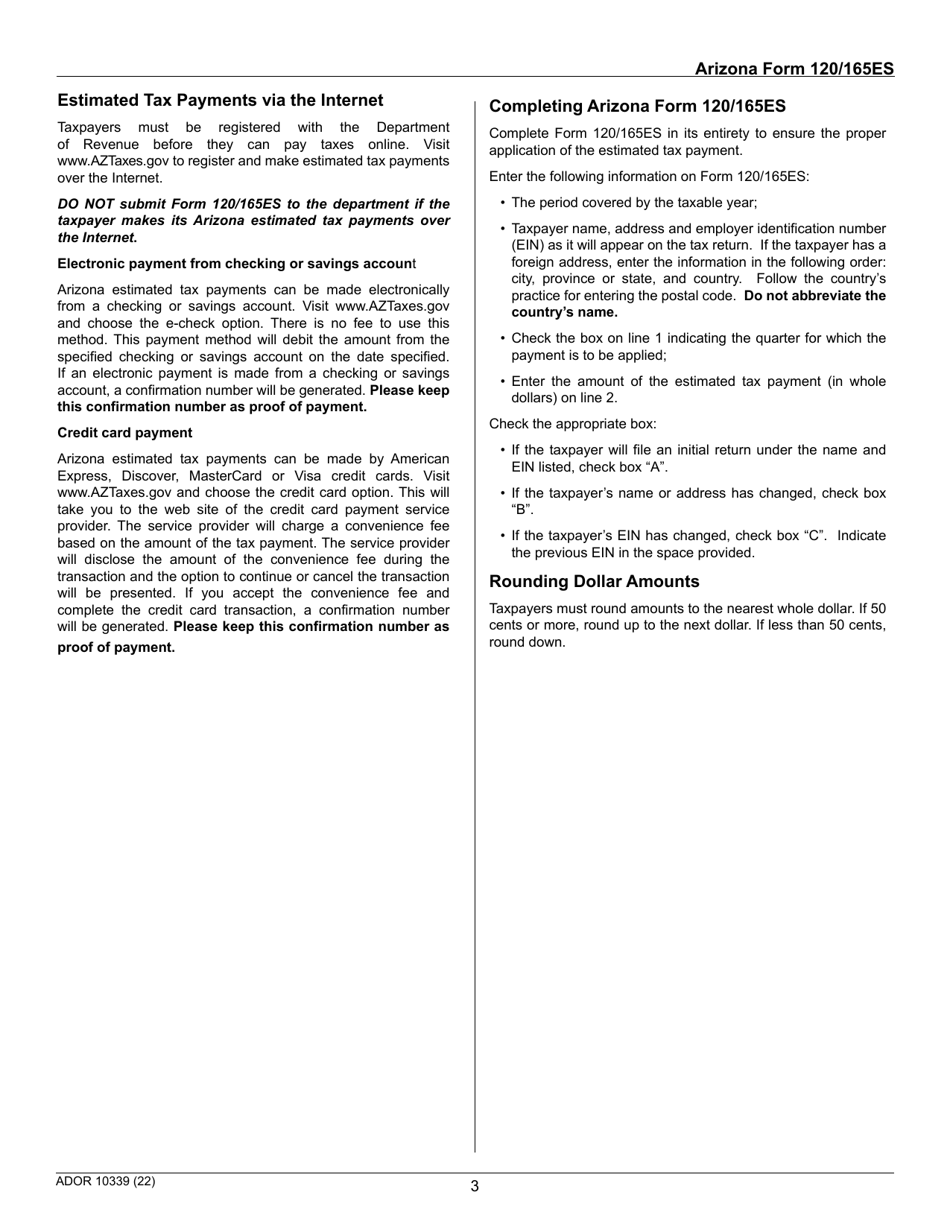

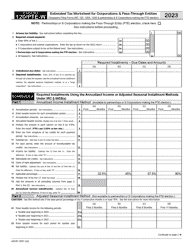

A: Arizona Form 120/165ES is a form used to make estimated tax payments for corporate and pass-through entities in Arizona.

Q: Who needs to use Arizona Form 120/165ES?

A: Corporate and pass-through entities in Arizona who are required to make estimated tax payments need to use Arizona Form 120/165ES.

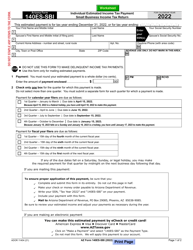

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made by taxpayers to cover their expected tax liability for the year, when the full amount cannot be paid through withholding.

Q: How often are estimated tax payments made?

A: Estimated tax payments for Arizona Form 120/165ES are generally made on a quarterly basis.

Q: Are there any penalties for not making estimated tax payments?

A: Yes, failure to make estimated tax payments or underpaying estimated taxes may result in penalties and interest.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

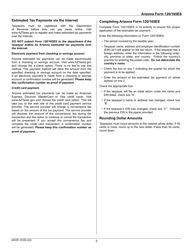

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120/165ES (ADOR10339) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.