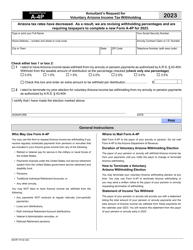

This version of the form is not currently in use and is provided for reference only. Download this version of

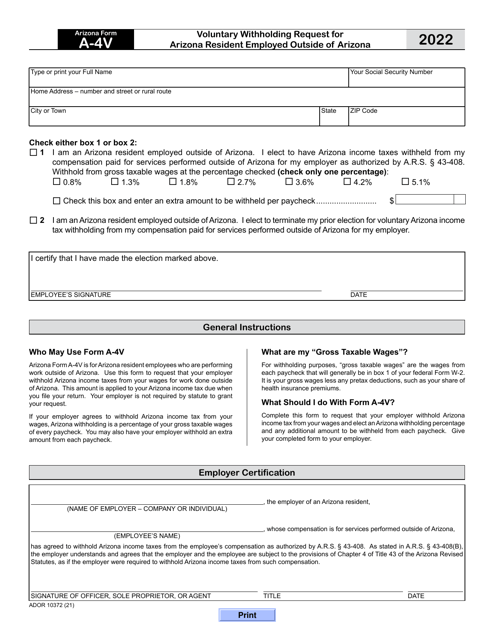

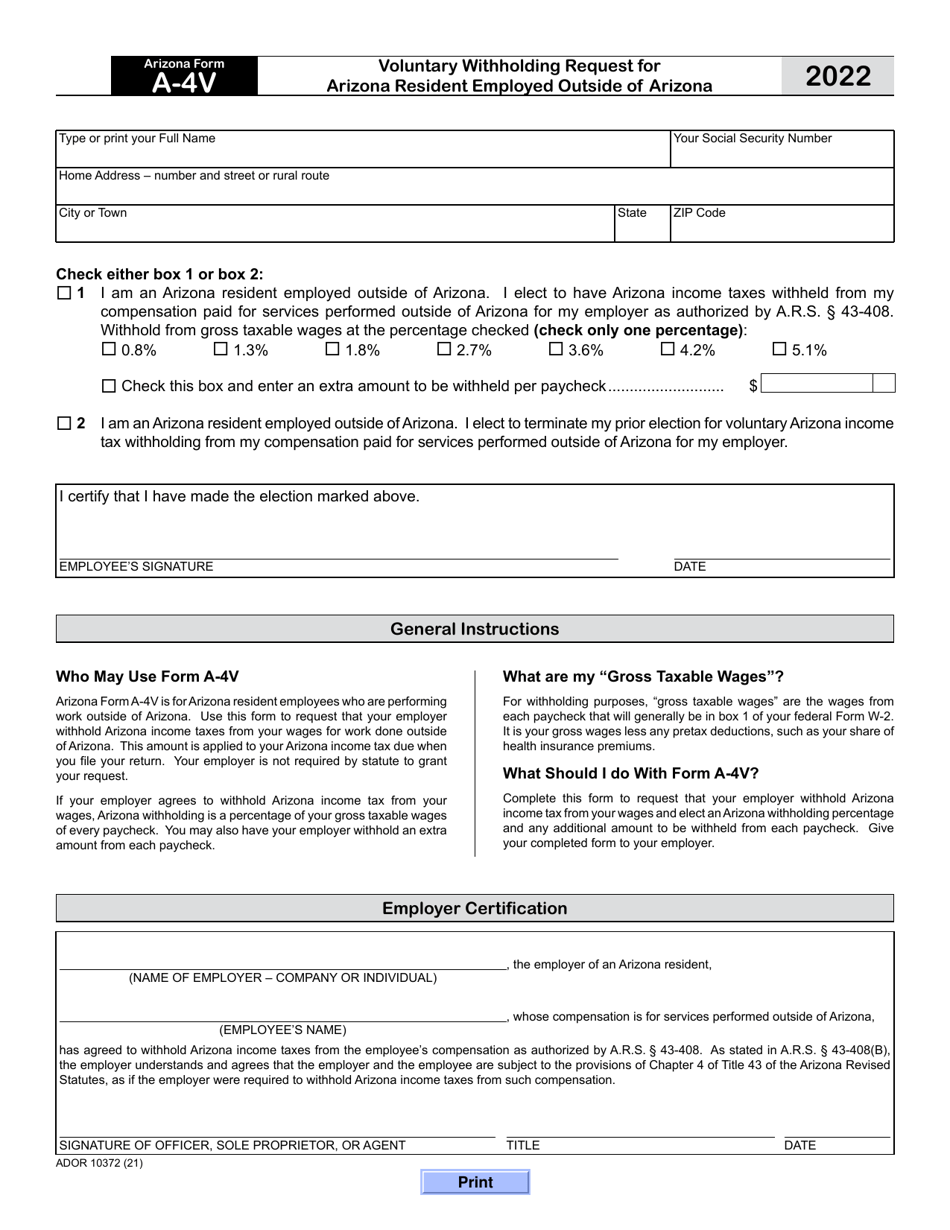

Arizona Form A-4V (ADOR10372)

for the current year.

Arizona Form A-4V (ADOR10372) Voluntary Withholding Request for Arizona Resident Employed Outside of Arizona - Arizona

What Is Arizona Form A-4V (ADOR10372)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form A-4V?

A: Arizona Form A-4V is a voluntary withholding request for Arizona residents who are employed outside of Arizona.

Q: Who can use Arizona Form A-4V?

A: Arizona residents who work outside of Arizona can use Arizona Form A-4V.

Q: What is the purpose of Arizona Form A-4V?

A: The purpose of Arizona Form A-4V is to request voluntary withholding of Arizona state taxes for Arizona residents employed outside of Arizona.

Q: Is Arizona Form A-4V mandatory?

A: No, Arizona Form A-4V is voluntary and only needs to be filled out if you want to request voluntary withholding of Arizona state taxes.

Q: Can I use Arizona Form A-4V if I work in Arizona?

A: No, Arizona Form A-4V is specifically for Arizona residents who are employed outside of Arizona.

Q: Do I need to file Arizona Form A-4V every year?

A: No, you only need to file Arizona Form A-4V once unless you want to change your withholding status or exemption status.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A-4V (ADOR10372) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.