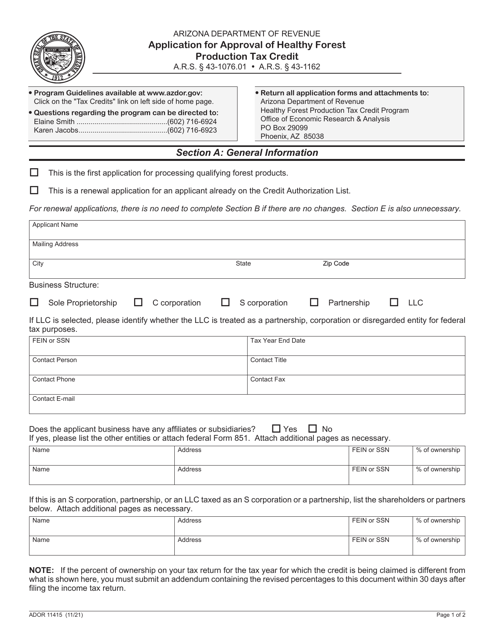

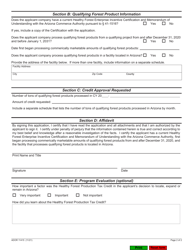

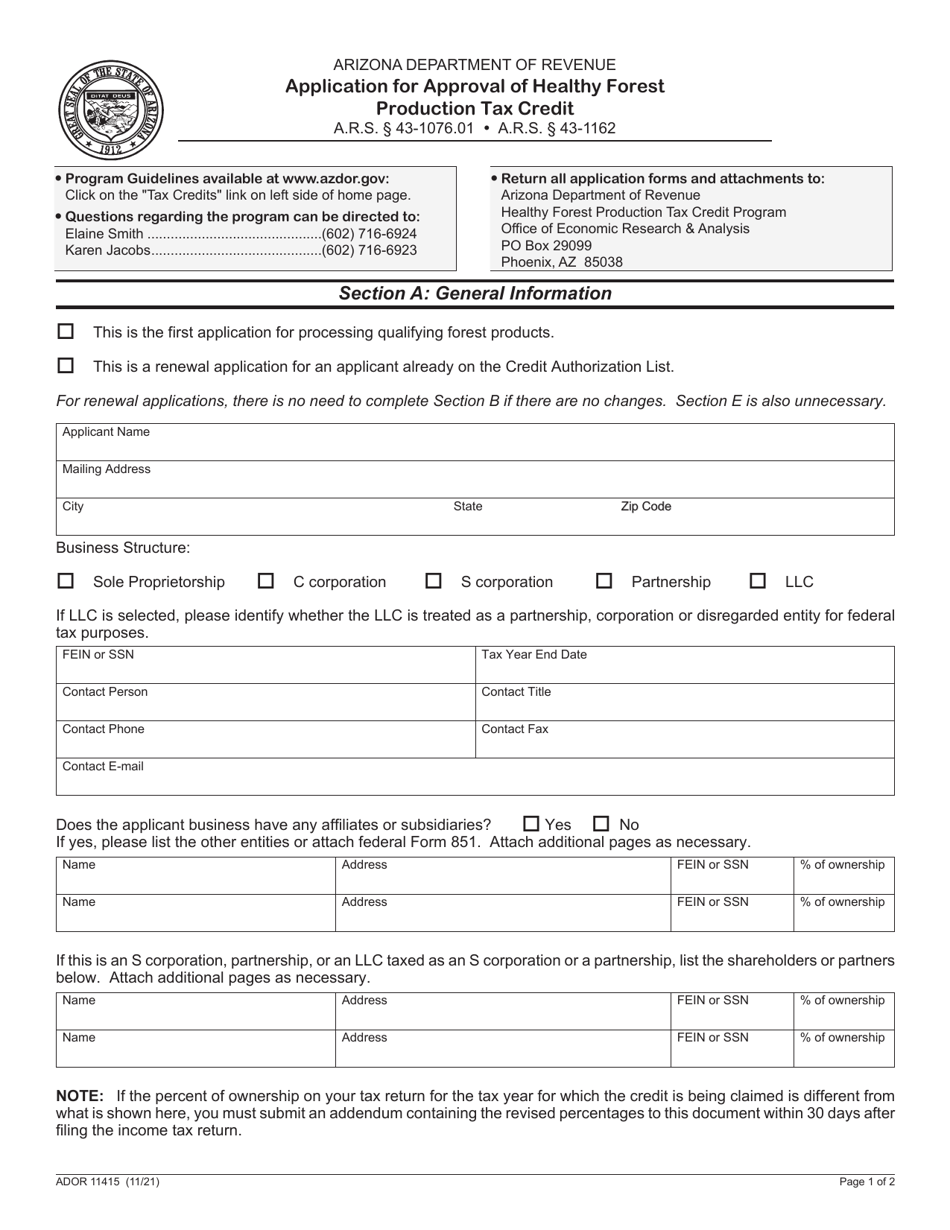

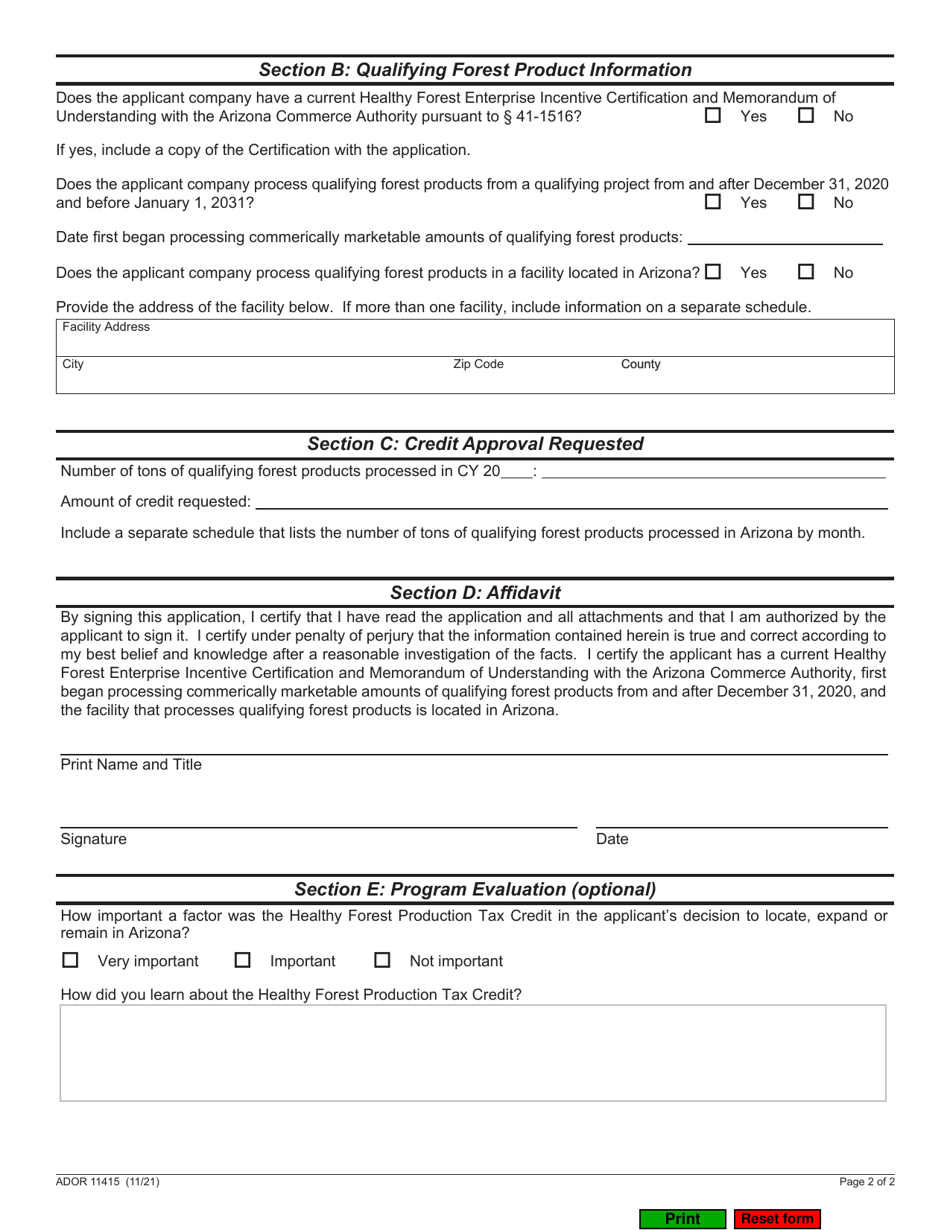

Form ADOR11415 Application for Approval of Healthy Forest Production Tax Credit - Arizona

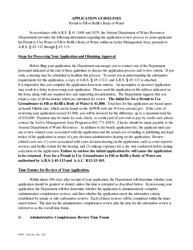

What Is Form ADOR11415?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ADOR11415 Application?

A: The ADOR11415 Application is a form used to apply for Approval of the Healthy Forest Production Tax Credit in Arizona.

Q: What is the Healthy Forest Production Tax Credit?

A: The Healthy Forest Production Tax Credit is a tax credit offered in Arizona to encourage the sustainable production of forest products.

Q: Who is eligible to apply for the Healthy Forest Production Tax Credit?

A: Forest landowners and operators who engage in sustainable forest production activities in Arizona may be eligible to apply.

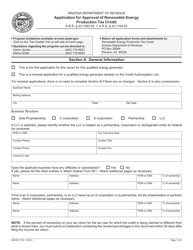

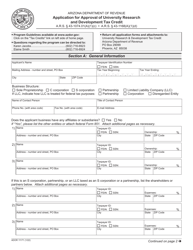

Q: What information is required on the ADOR11415 Application?

A: The application requires information about the applicant, such as their contact details and tax identification number, as well as details about the forest land and production activities.

Q: Is there a deadline for submitting the ADOR11415 Application?

A: Yes, the application must be submitted by the specified deadline, which is usually mentioned on the application form or provided by the Arizona Department of Revenue.

Q: Are there any fees associated with the ADOR11415 Application?

A: There may be fees associated with the application process, such as an application fee or a fee for processing the tax credit.

Q: How long does it take to receive approval for the Healthy Forest Production Tax Credit?

A: The processing time for the application can vary, but it is advisable to submit the application well in advance to allow for sufficient processing time.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11415 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.