This version of the form is not currently in use and is provided for reference only. Download this version of

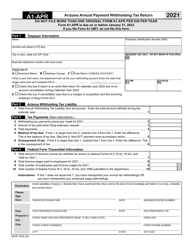

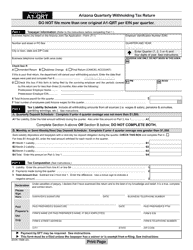

Arizona Form A1-QTC (ADOR10762)

for the current year.

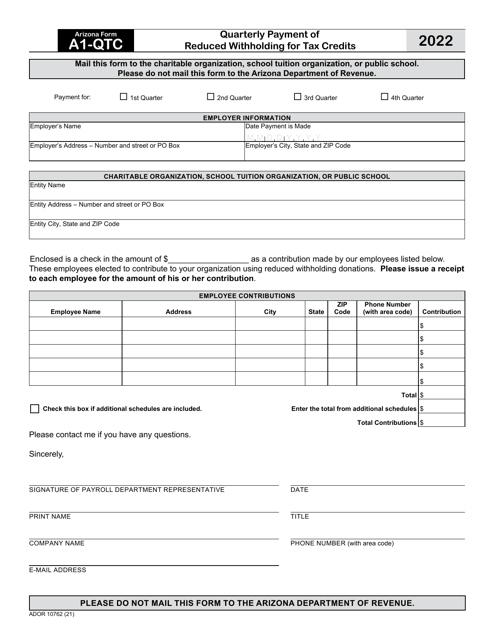

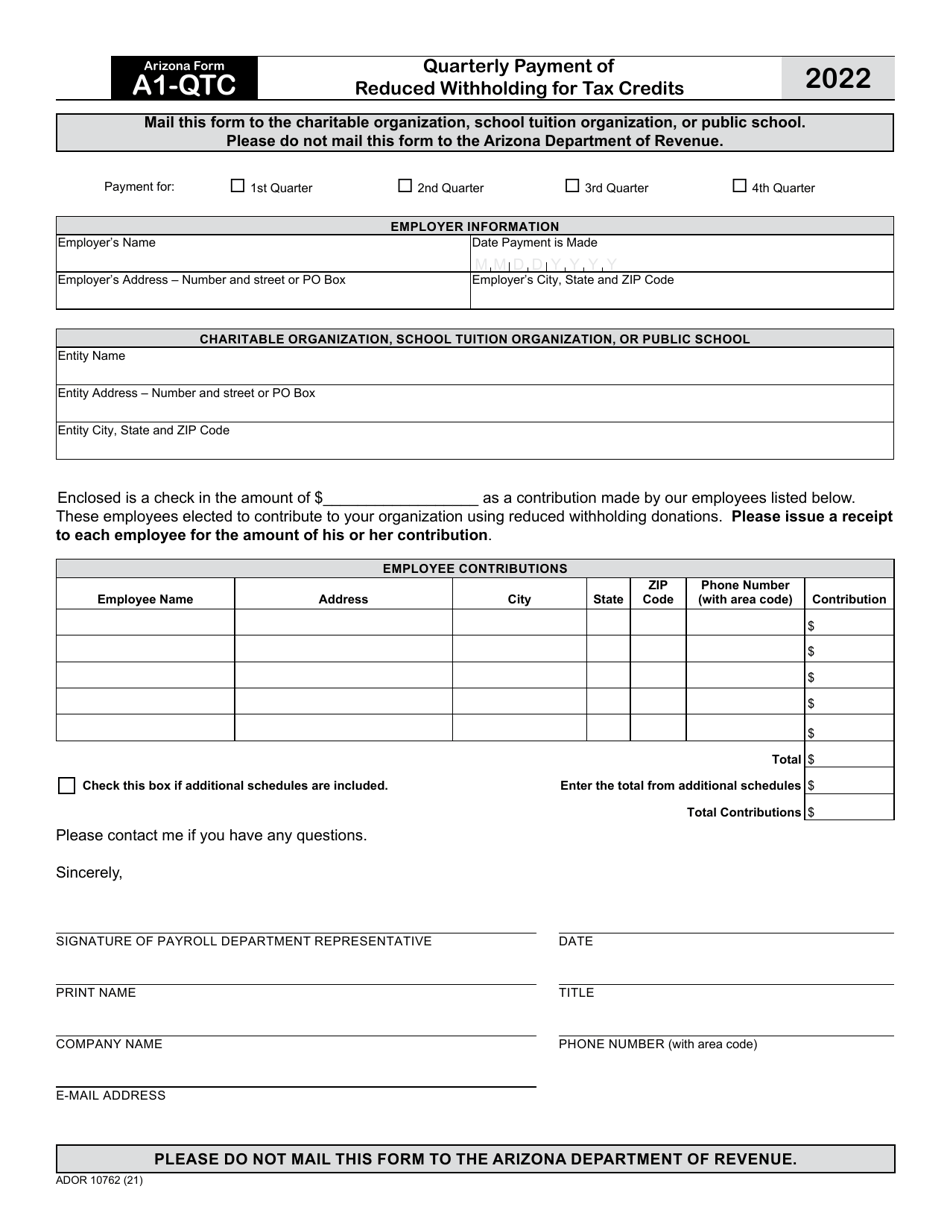

Arizona Form A1-QTC (ADOR10762) Quarterly Payment of Reduced Withholding for Tax Credits - Arizona

What Is Arizona Form A1-QTC (ADOR10762)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form A1-QTC?

A: Arizona Form A1-QTC is a form used to make quarterly payments for reduced withholding for tax credits in Arizona.

Q: Who needs to use Arizona Form A1-QTC?

A: Employers who are claiming tax credits and have reduced withholding for their employees in Arizona need to use Arizona Form A1-QTC.

Q: What is the purpose of Arizona Form A1-QTC?

A: The purpose of Arizona Form A1-QTC is to report and pay the reduced withholding amount for tax credits claimed by an employer.

Q: How often should Arizona Form A1-QTC be filed?

A: Arizona Form A1-QTC should be filed on a quarterly basis, with payments being made by the last day of the month following the end of each quarter.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-QTC (ADOR10762) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.