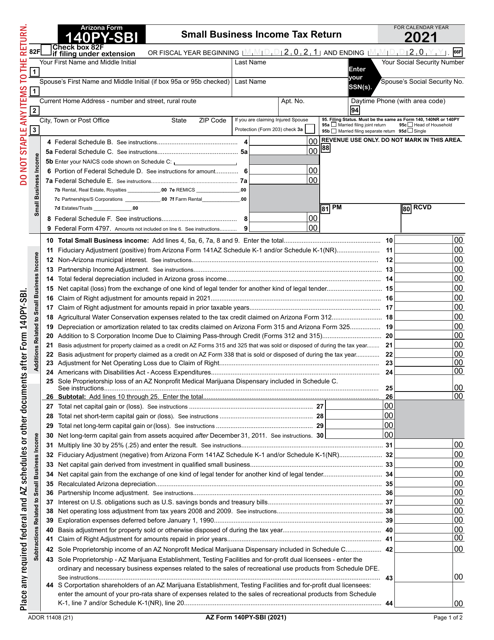

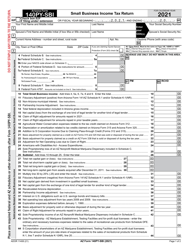

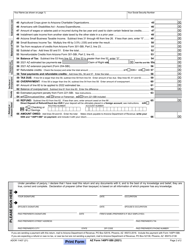

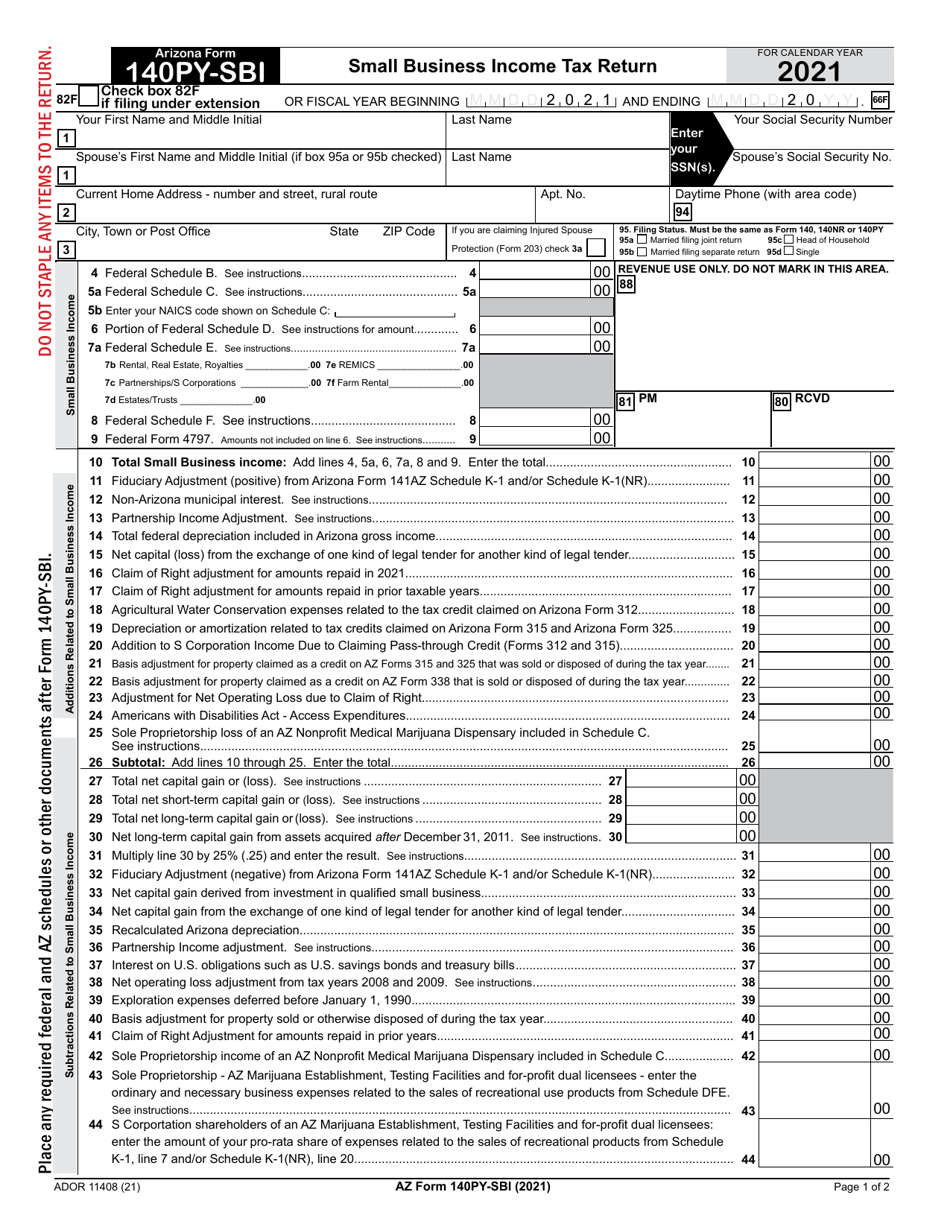

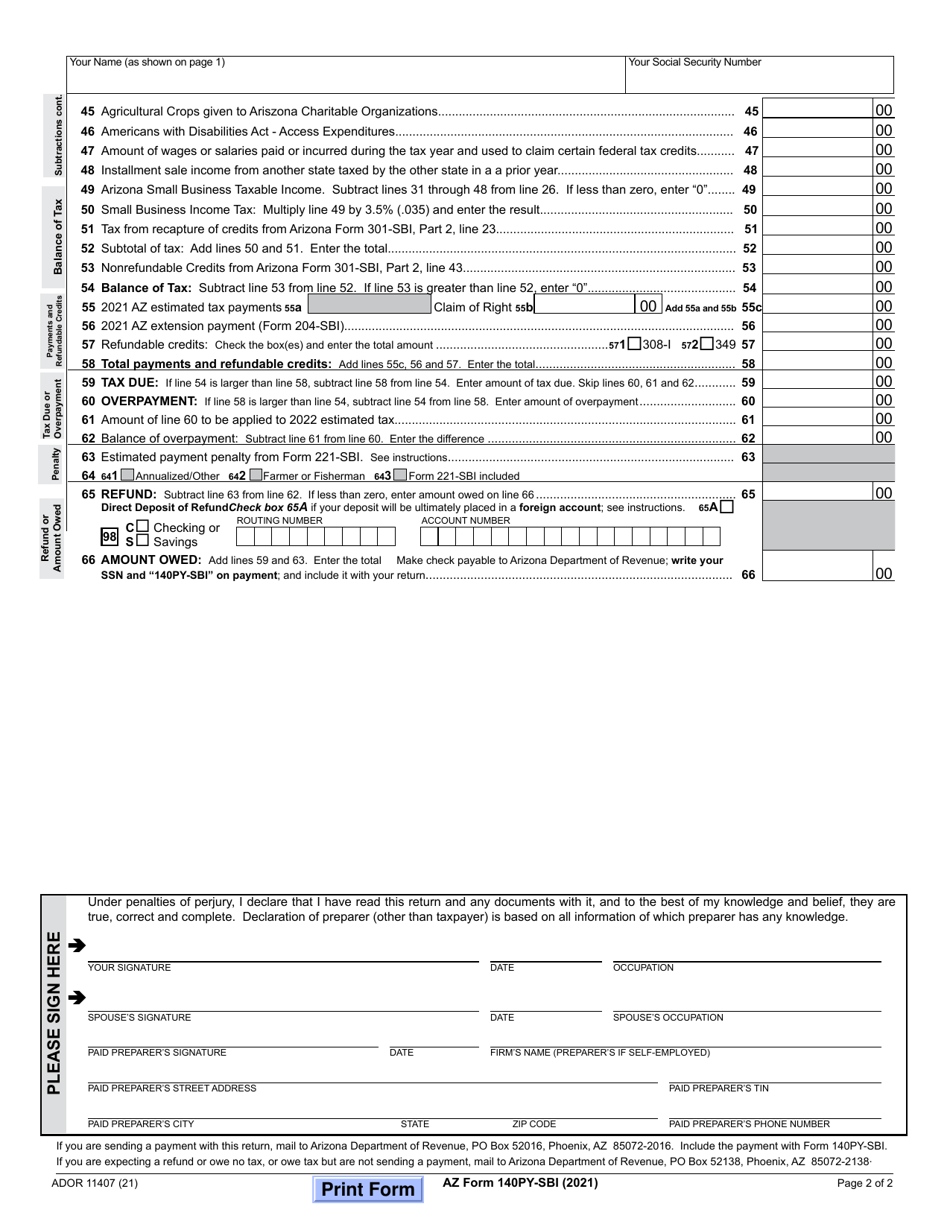

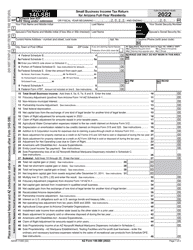

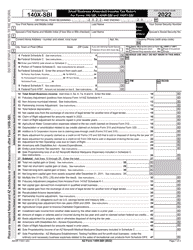

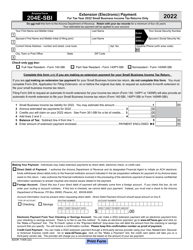

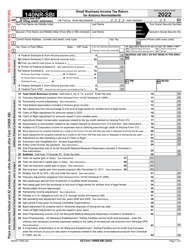

Arizona Form 140PY-SBI (ADOR11408) Small Business Income Tax Return - Arizona

What Is Arizona Form 140PY-SBI (ADOR11408)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 140PY-SBI?

A: Arizona Form 140PY-SBI is the Small Business Income Tax Return for individuals in Arizona.

Q: Who needs to file Arizona Form 140PY-SBI?

A: Individuals in Arizona who have small businesses need to file Arizona Form 140PY-SBI.

Q: What is the purpose of Arizona Form 140PY-SBI?

A: The purpose of Arizona Form 140PY-SBI is to report small business income for individuals in Arizona.

Q: Is Arizona Form 140PY-SBI only for residents of Arizona?

A: Yes, Arizona Form 140PY-SBI is specifically for residents of Arizona.

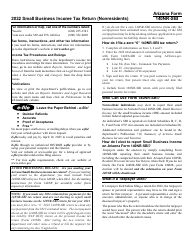

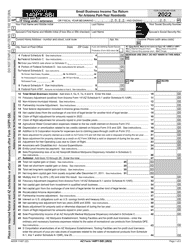

Q: Are there any filing requirements or deadlines for Arizona Form 140PY-SBI?

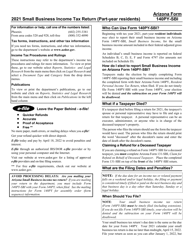

A: Yes, there are specific filing requirements and deadlines for Arizona Form 140PY-SBI. You should check with the Arizona Department of Revenue for the latest information.

Q: Are there any specific instructions or guidelines for filling out Arizona Form 140PY-SBI?

A: Yes, there are specific instructions and guidelines provided with Arizona Form 140PY-SBI. You should carefully read and follow them.

Q: What should I do if I have questions or need assistance with Arizona Form 140PY-SBI?

A: If you have questions or need assistance with Arizona Form 140PY-SBI, you can contact the Arizona Department of Revenue for help.

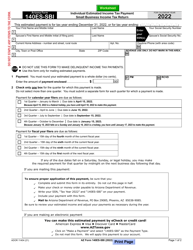

Q: Is there a fee for filing Arizona Form 140PY-SBI?

A: There may be fees associated with filing Arizona Form 140PY-SBI. You should check with the Arizona Department of Revenue for more information.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 140PY-SBI (ADOR11408) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.