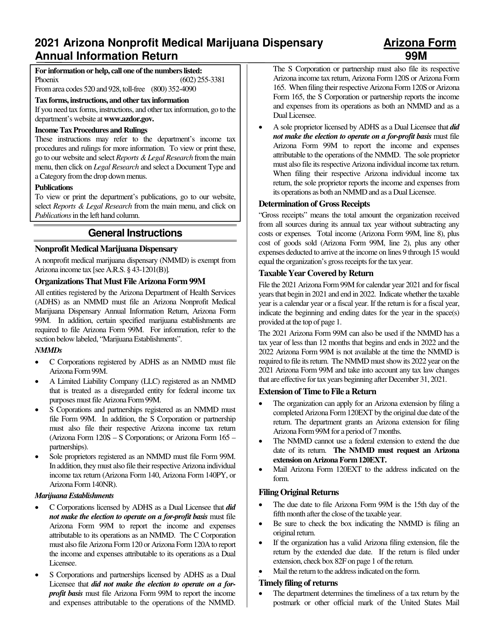

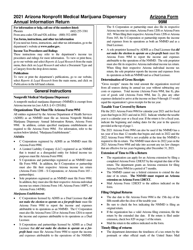

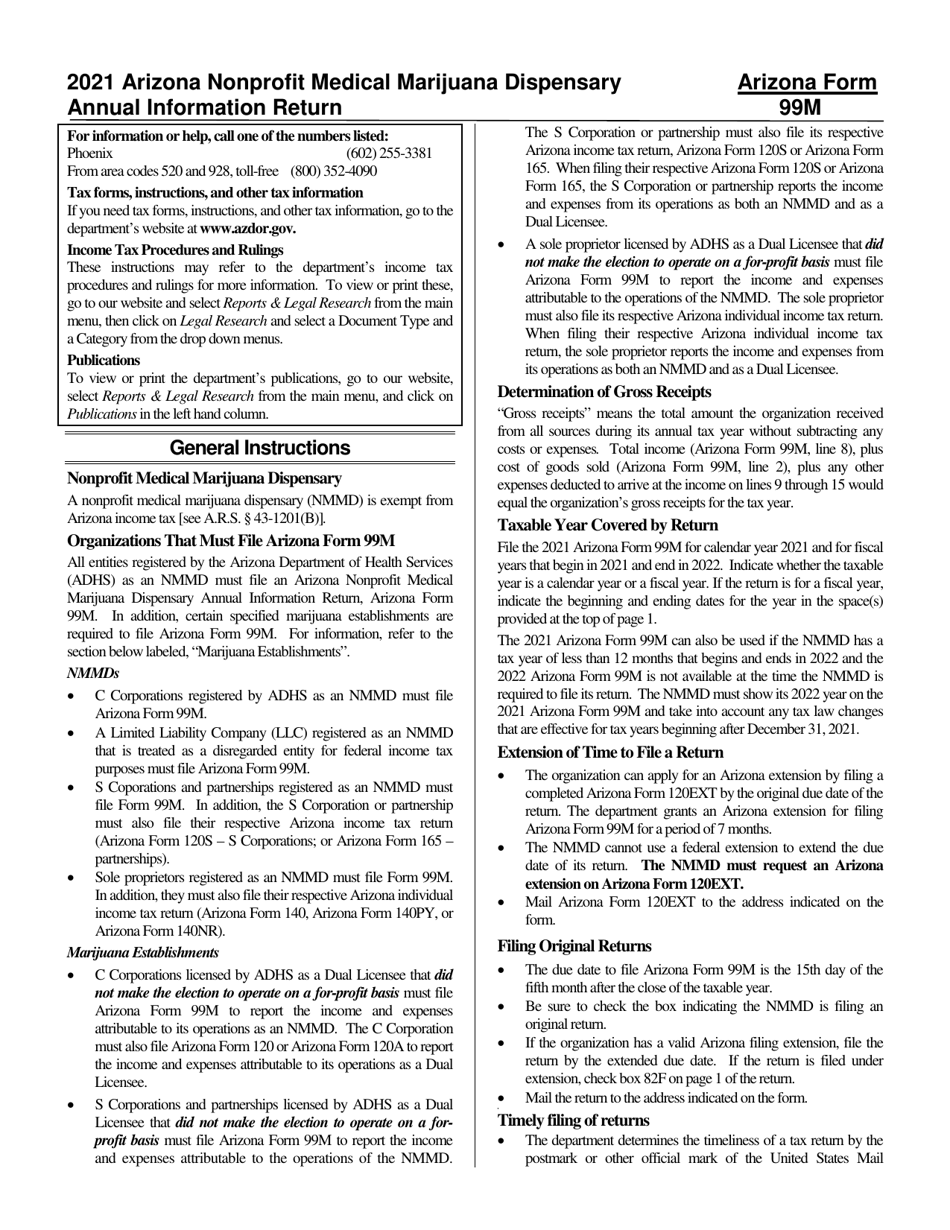

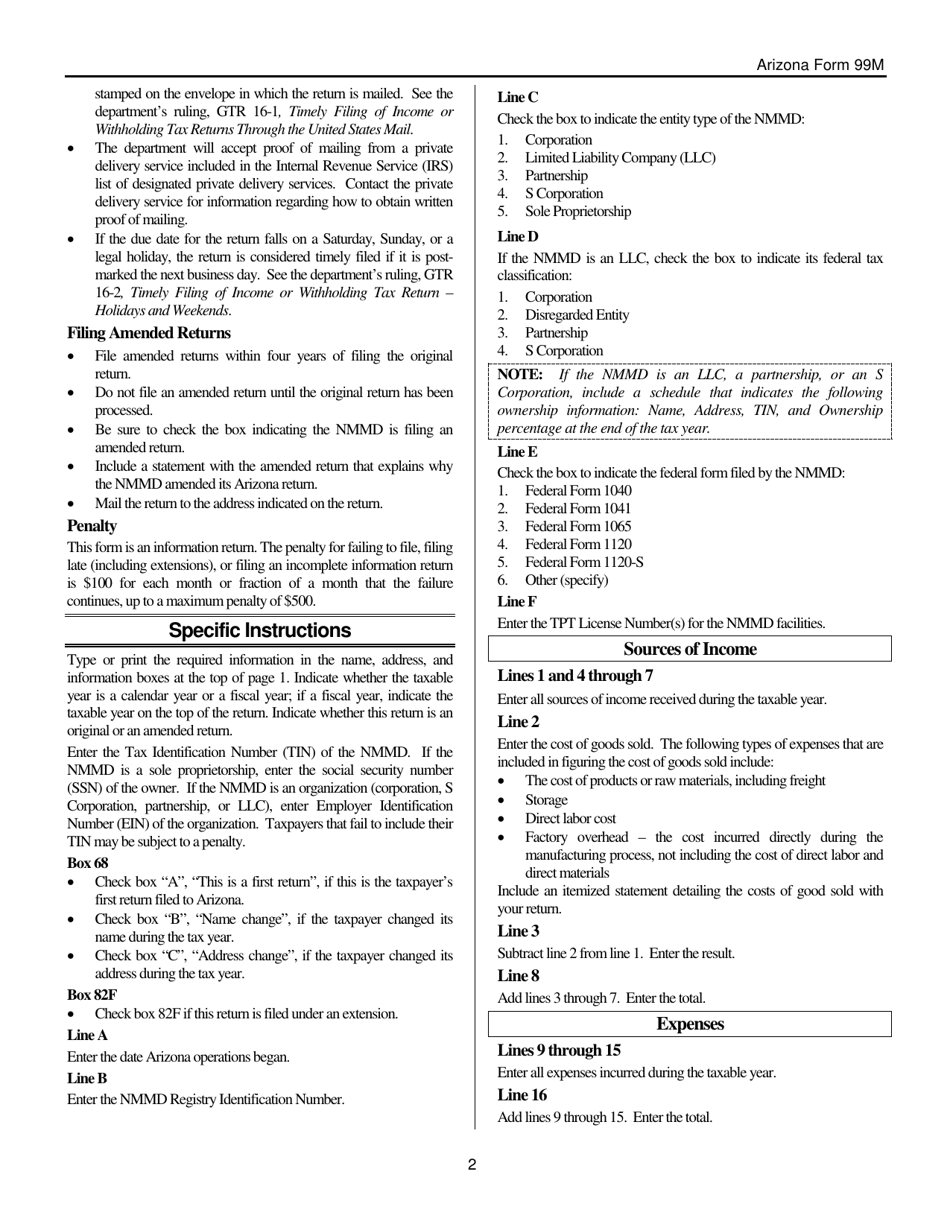

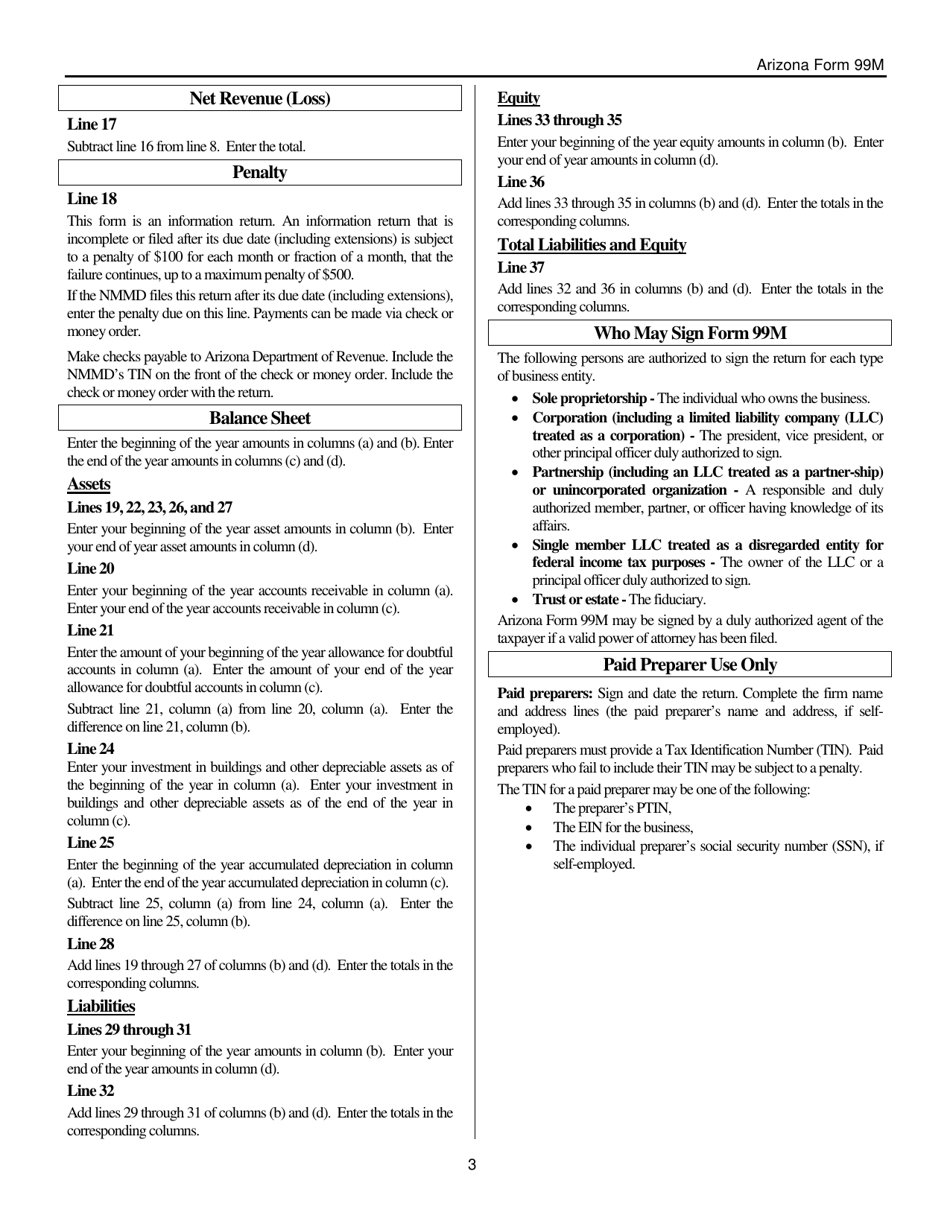

Instructions for Arizona Form 99M, ADOR11362 Arizona Nonprofit Medical Marijuana Dispensary Annual Information Return - Arizona

This document contains official instructions for Arizona Form 99M , and Form ADOR11362 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 99M (ADOR11362) is available for download through this link.

FAQ

Q: What is Arizona Form 99M?

A: Arizona Form 99M is the ADOR11362 Arizona Nonprofit Medical Marijuana Dispensary Annual Information Return.

Q: Who needs to file Arizona Form 99M?

A: Nonprofit medical marijuana dispensaries in Arizona need to file Arizona Form 99M.

Q: What is the purpose of Arizona Form 99M?

A: Arizona Form 99M is used to report annual information for nonprofit medical marijuana dispensaries in Arizona.

Q: Is Arizona Form 99M specific to medical marijuana dispensaries?

A: Yes, Arizona Form 99M is specifically for nonprofit medical marijuana dispensaries in Arizona.

Q: Is Arizona Form 99M required every year?

A: Yes, nonprofit medical marijuana dispensaries in Arizona are required to file Arizona Form 99M annually.

Q: What information is required on Arizona Form 99M?

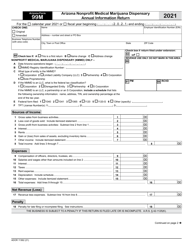

A: Arizona Form 99M requires information related to the nonprofit medical marijuana dispensary's operations and financials.

Q: Are there any deadlines for filing Arizona Form 99M?

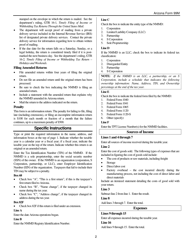

A: Yes, the deadline for filing Arizona Form 99M is determined by the Arizona Department of Revenue (ADOR) and may vary each year.

Q: Are there any penalties for late filing of Arizona Form 99M?

A: Penalties for late filing of Arizona Form 99M may apply as determined by the Arizona Department of Revenue (ADOR).

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.